Fill Your 14653 Form

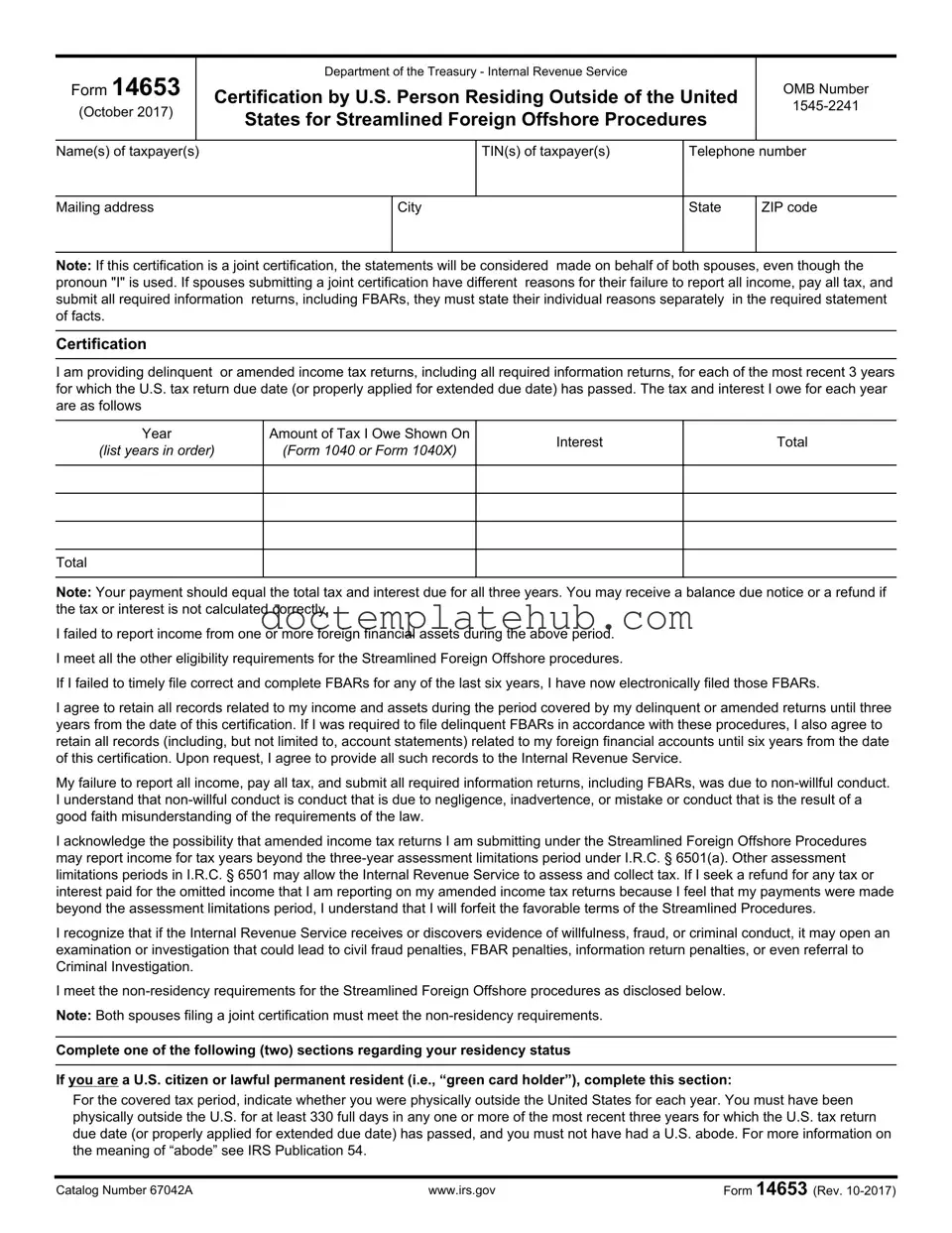

The Form 14653, officially titled "Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures," serves as a crucial document for U.S. citizens and lawful permanent residents who have not complied with their tax obligations while living abroad. This form, issued by the Department of the Treasury's Internal Revenue Service (IRS), is designed to facilitate the streamlined filing compliance program, which aims to assist individuals in rectifying past tax reporting failures without incurring severe penalties. Key aspects of the form include the requirement for taxpayers to provide delinquent or amended income tax returns for the past three years, as well as a detailed account of any foreign financial assets that were not reported. Taxpayers must also affirm their eligibility for the streamlined procedures by certifying that their failure to report was non-willful, which encompasses mistakes, inadvertence, or misunderstandings of the law. Furthermore, the form mandates that individuals retain records related to their income and foreign accounts for specified periods, ensuring that they remain compliant with IRS requests for documentation. The complexities of this form highlight the importance of accurate reporting and the potential consequences of non-compliance, including the risk of civil penalties or criminal investigations if evidence of willfulness is discovered.

Similar forms

Form 8854, also known as the Initial and Annual Expatriation Statement, is similar to Form 14653 in that it addresses U.S. citizens or long-term residents who have moved abroad. Both forms require individuals to report their tax obligations and provide information about their residency status. Form 8854 focuses specifically on individuals who have expatriated from the U.S., requiring them to certify that they have complied with their tax responsibilities for the five years preceding their expatriation. This form emphasizes the importance of tax compliance while transitioning to a new country, much like the streamlined procedures outlined in Form 14653.

Form 1040, the U.S. Individual Income Tax Return, is another document that shares similarities with Form 14653. Both forms are essential for U.S. taxpayers, as they involve reporting income and tax obligations to the IRS. While Form 1040 is the standard tax return for U.S. residents, Form 14653 is specifically for those living abroad who may have missed filing deadlines. Both require detailed information about income, deductions, and credits, reinforcing the importance of accurate reporting regardless of residency status.

Form 8938, the Statement of Specified Foreign Financial Assets, is closely related to Form 14653 in that it pertains to U.S. taxpayers with foreign financial assets. Similar to the requirements in Form 14653, Form 8938 mandates the reporting of foreign accounts and assets, ensuring compliance with U.S. tax laws. This form is particularly relevant for individuals living outside the U.S. who must disclose their foreign holdings to avoid penalties, highlighting the interconnectedness of U.S. tax obligations and foreign financial interests.

Form 5471, the Information Return of U.S. Persons With Respect to Certain Foreign Corporations, also parallels Form 14653. This form is required for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. Like Form 14653, it emphasizes the necessity of transparency and compliance with U.S. tax laws while dealing with foreign entities. Both forms aim to ensure that taxpayers are accountable for their international financial activities.

Form 8862, the Information to Claim Earned Income Credit After Disallowance, has a similar purpose in that it helps taxpayers clarify their eligibility for specific credits. While Form 14653 focuses on those who need to rectify past non-compliance, Form 8862 is used by individuals who previously had their earned income credit denied. Both forms require detailed explanations and supporting documentation to demonstrate compliance with tax laws, reinforcing the importance of accurate reporting and eligibility verification.

The EDD DE 2501 form is essential for individuals seeking disability benefits in California, as it details the process for requesting financial assistance during temporary disability. By familiarizing yourself with this form's components, you can navigate the application process more effectively. For more information, you can visit https://documentonline.org/blank-edd-de-2501.

Form 1040X, the Amended U.S. Individual Income Tax Return, shares a connection with Form 14653 as both allow taxpayers to correct previously filed returns. Form 1040X is used to amend errors on a standard tax return, while Form 14653 is specifically for those who are rectifying their status under the Streamlined Foreign Offshore Procedures. Both forms require taxpayers to provide detailed information about the changes being made and the reasons for those changes, emphasizing the importance of accuracy in tax reporting.

Lastly, the Foreign Bank Account Report (FBAR) is similar to Form 14653 in that it requires U.S. taxpayers to report foreign financial accounts. The FBAR is mandatory for individuals with foreign accounts exceeding certain thresholds, while Form 14653 addresses those who may have failed to file FBARs in the past. Both documents stress the importance of compliance with U.S. laws regarding foreign assets, highlighting the need for transparency in international financial dealings.

Other PDF Templates

Florida Real Estate Forms - The lease specifies which rental unit is being leased, including any associated furniture and appliances.

Creating a comprehensive estate plan often begins with drafting a Texas Last Will and Testament, as it provides a clear guidance on the distribution of assets. For those looking to simplify this process, resources are available online, such as smarttemplates.net, which offer fillable forms that ensure compliance with Texas laws and make it easier for testators to articulate their final wishes.

Miscellaneous Information - Different types of payments, such as rent and royalties, are reported using this form.

More About 14653

What is Form 14653 used for?

Form 14653 is a certification for U.S. persons living outside the United States who want to participate in the Streamlined Foreign Offshore Procedures. This form helps individuals who may have failed to report income, pay taxes, or submit required information returns, including FBARs (Foreign Bank Account Reports). By completing this form, taxpayers can disclose their past non-compliance and seek to resolve their tax issues under more lenient terms.

Who needs to fill out Form 14653?

U.S. citizens and lawful permanent residents who have been living outside the U.S. and did not report all of their income, pay all taxes, or file required information returns may need to fill out this form. Both spouses must meet the eligibility requirements if they are filing jointly. Each spouse should state their individual reasons for any failures separately if they differ.

What information do I need to provide on Form 14653?

You will need to provide personal details, including your name, taxpayer identification number (TIN), and contact information. Additionally, you must list the tax years for which you are submitting delinquent or amended returns and specify the amounts of tax and interest owed. A detailed statement explaining your reasons for failing to report income and file returns is also required. This statement should include your personal and financial background, as well as any relevant details about your foreign financial accounts.

What happens if I don’t complete Form 14653 correctly?

If Form 14653 is not filled out correctly or is incomplete, the Internal Revenue Service (IRS) may reject your submission. This means you could miss out on the favorable terms of the Streamlined Foreign Offshore Procedures. It’s crucial to provide all requested information and a comprehensive narrative statement to ensure your application is processed successfully.

Dos and Don'ts

When filling out Form 14653, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below are five recommendations on what to do and what to avoid:

- Do provide accurate personal information, including your name, taxpayer identification number, and mailing address.

- Do ensure that all required information returns are included for the last three years.

- Do retain all records related to your income and foreign financial assets for the specified retention periods.

- Do clearly explain your reasons for failing to report income, including any relevant personal or financial background.

- Do sign and date the form, including any joint certifications from your spouse.

- Don't omit any required information or documentation, as this may lead to your submission being considered incomplete.

- Don't use vague language when explaining your reasons for non-compliance; provide specific facts and details.

- Don't attempt to file the form without verifying that you meet all eligibility requirements for the Streamlined Foreign Offshore Procedures.

- Don't forget to check for accuracy in your calculations of tax and interest owed.

- Don't ignore the importance of retaining copies of all submitted documents for your records.

14653 - Usage Steps

Completing Form 14653 is an essential step for U.S. persons residing outside the United States who wish to participate in the Streamlined Foreign Offshore Procedures. This form allows you to certify your eligibility and provide necessary information regarding your tax situation. After filling out the form, you will need to submit it along with any required documentation to the IRS.

- Gather Required Information: Collect your tax identification number (TIN), telephone number, mailing address, and details of your foreign financial accounts.

- Fill in Taxpayer Information: Write the name(s) of the taxpayer(s), TIN(s), telephone number, mailing address, city, state, and ZIP code in the designated sections.

- Certification Section: Indicate that you are providing delinquent or amended income tax returns for the last three years. List the years and the amount of tax owed for each year, including interest.

- Residency Status: Complete the appropriate section based on whether you are a U.S. citizen or lawful permanent resident. Answer whether you were physically outside the U.S. for at least 330 days in each of the last three years.

- Statement of Facts: Provide a detailed narrative explaining your failure to report all income, pay all tax, and submit required information returns. Include specific reasons, your personal and financial background, and the source of funds in your foreign accounts.

- Sign and Date: Ensure that you sign and date the certification. If it's a joint certification, both spouses must sign.

- Submit the Form: Send the completed form along with any additional required documents to the IRS as instructed.