Fill Your Acord 130 Form

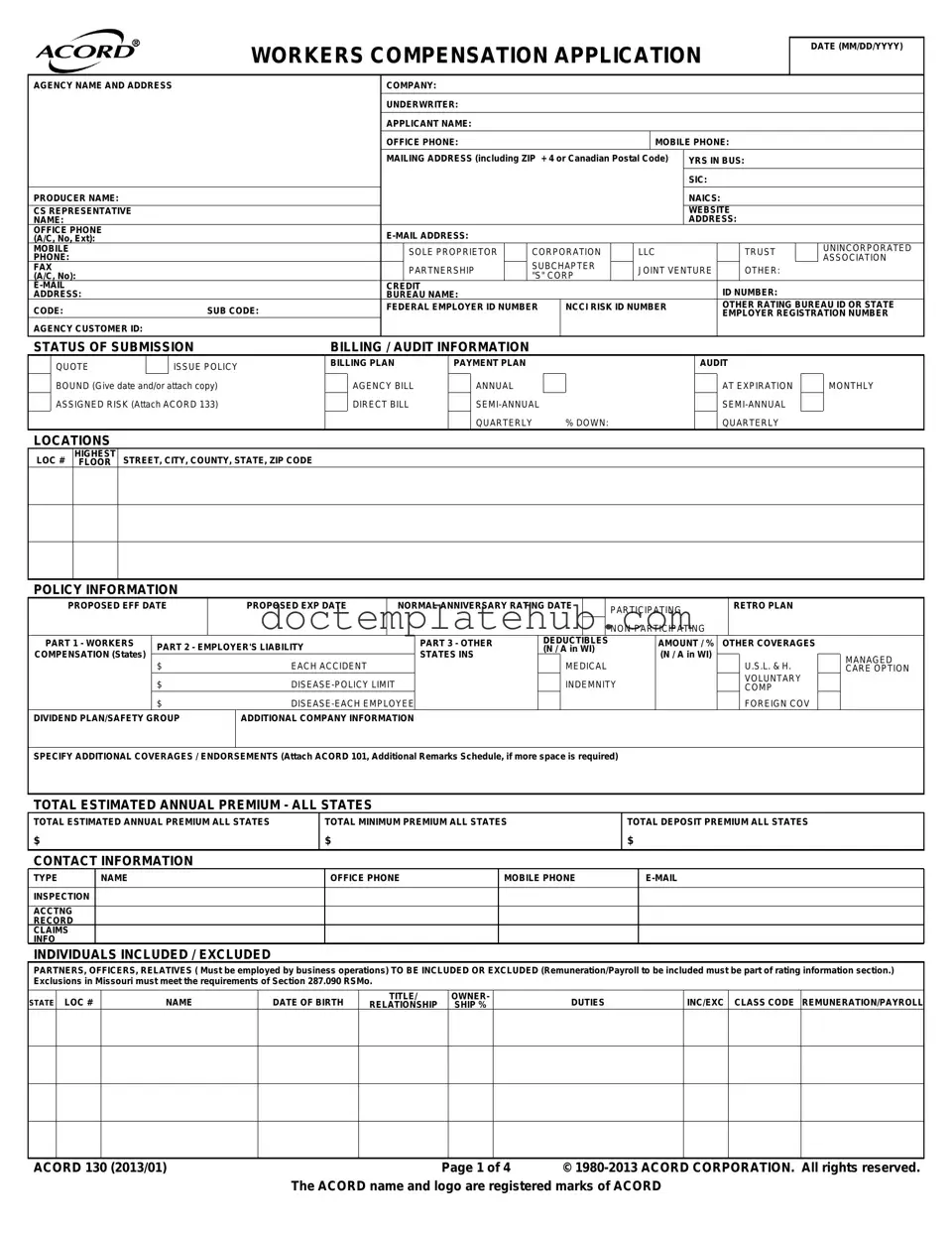

The ACORD 130 form serves as a critical document for businesses seeking workers' compensation insurance. It collects essential information about the applicant, including the agency's name, contact details, and the nature of the business. Applicants must provide their years in business, the Standard Industrial Classification (SIC) code, and the North American Industry Classification System (NAICS) code, which help insurers assess risk. The form also requires information about the proposed coverage, including the effective and expiration dates, and the estimated annual premium. Additionally, it includes sections for detailing employee classifications, remuneration, and any prior loss history, which can impact premium rates. By accurately completing the ACORD 130, applicants can facilitate a smoother underwriting process and ensure they receive appropriate coverage tailored to their specific business needs.

Similar forms

The ACORD 125 form is a standard application used in the insurance industry for commercial lines. Like the Acord 130, it collects essential information about the applicant, including business details and coverage needs. Both forms require the applicant to provide their agency information, contact details, and specific coverage requested. They serve a similar purpose in initiating the underwriting process for various types of insurance, ensuring that the insurer has a comprehensive understanding of the applicant’s business operations and risks.

The ACORD 126 form is another application form designed for commercial auto insurance. Similar to the Acord 130, it gathers critical information about the applicant's business, including vehicle details and driving history. Both forms aim to assess risk and determine appropriate coverage options. The ACORD 126 focuses specifically on vehicle usage and driver qualifications, while the Acord 130 addresses workers' compensation needs, making them complementary in the context of business insurance.

The ACORD 133 form is used for workers' compensation insurance in assigned risk markets. It is closely related to the Acord 130, as both forms are utilized to apply for workers' compensation coverage. The Acord 133 specifically addresses situations where businesses cannot obtain coverage through the standard market, while the Acord 130 is a more general application for workers' compensation. Both forms require detailed information about the business and its employees to facilitate accurate underwriting.

The ACORD 140 form is a commercial property application. Like the Acord 130, it collects information about the business and its operations. Both forms are essential for underwriting insurance policies, ensuring that insurers understand the risks associated with the applicant's business. The ACORD 140 focuses on property-related risks, while the Acord 130 centers on employee-related risks, highlighting the diverse needs of businesses seeking insurance coverage.

The ACORD 151 form is a general liability application. This document is similar to the Acord 130 in that it gathers crucial information about the applicant’s business operations and potential liabilities. Both forms are used to assess risk and determine coverage needs. While the Acord 130 specifically addresses workers' compensation, the ACORD 151 is tailored for general liability coverage, making them both vital in the broader context of business insurance.

The ACORD 160 form is a professional liability application. This form is akin to the Acord 130 as it also seeks to gather comprehensive information about the applicant's business and the risks involved. Both forms are essential for underwriting purposes, helping insurers to evaluate the applicant's exposure to claims. The ACORD 160 focuses on professional services, while the Acord 130 is centered on employee-related risks, showcasing the different areas of liability that businesses may face.

The ACORD 25 form is a certificate of insurance. While it serves a different purpose than the Acord 130, both documents play a role in the insurance process. The ACORD 25 provides proof of coverage, while the Acord 130 is an application for workers' compensation insurance. Both forms require accurate information about the business and its operations, ensuring that all parties involved understand the coverage in place.

The ACORD 27 form is a request for a cancellation of insurance policy. This document, while not an application like the Acord 130, is related in that it involves the management of an insurance policy. Both forms require specific details about the business and its insurance needs. The ACORD 27 focuses on the termination of coverage, while the Acord 130 is about initiating coverage, highlighting the lifecycle of an insurance policy.

For those looking to rent a property in Georgia, completing the Georgia rental application process is essential. This form not only streamlines the application phase but also equips landlords with pertinent information necessary for making informed decisions about potential tenants. By providing your details, you help ensure a smooth and efficient leasing experience.

The ACORD 29 form is a notice of cancellation for insurance policies. Similar to the Acord 130, it is part of the administrative process in insurance management. Both forms require detailed information about the insured business and its coverage. The ACORD 29 specifically deals with the cancellation process, whereas the Acord 130 is focused on the application for workers' compensation, illustrating the various stages of insurance policy management.

The ACORD 38 form is a personal lines application. This form is similar to the Acord 130 in that it collects information necessary for underwriting insurance policies. Both forms require the applicant to provide personal and business details. However, the ACORD 38 is geared towards personal insurance needs, while the Acord 130 focuses on workers' compensation, demonstrating the range of insurance applications available for different types of coverage.

Other PDF Templates

What Is a Progress Note in the Medical Record - Record of any surgical procedures performed.

For anyone navigating the complexities of legal documentation in New York, it's essential to comprehend the Durable Power of Attorney, a form that can be vital in safeguarding your interests. This legal tool, allowing another individual to manage your affairs should you become incapacitated, can be crucial for peace of mind. For further insights on filling out this important document, you can visit smarttemplates.net.

Alabama Lost Title - The application must be signed by all relevant parties involved in the lien.

More About Acord 130

What is the Acord 130 form?

The Acord 130 form is a Workers Compensation Application used in the insurance industry. It collects essential information about a business, including its operations, employee details, and coverage needs. Insurers use this form to assess risk and determine premium rates for workers' compensation insurance policies.

Who needs to fill out the Acord 130 form?

Any business seeking workers' compensation insurance must complete the Acord 130 form. This includes sole proprietors, corporations, partnerships, and LLCs. If your business has employees, you are required to provide this information to ensure proper coverage.

What information is required on the Acord 130 form?

The form asks for various details, including the agency name, applicant name, contact information, business structure, years in business, and estimated annual payroll. Additionally, you'll need to provide information about your operations, employee classifications, and any previous insurance coverage.

How is the estimated annual premium calculated?

The estimated annual premium is determined based on several factors, including the type of business, employee classifications, and payroll estimates. Each classification has a specific rate that helps assess the risk associated with your business operations. The form includes sections to calculate these premiums based on your provided information.

What should I do if I have employees with physical handicaps?

If you employ individuals with physical handicaps, you must disclose this information on the Acord 130 form. This is important for accurately assessing risk and ensuring that your coverage meets the needs of all employees. Provide details about any accommodations made for these employees.

What happens if I don’t disclose prior insurance coverage or claims?

Failing to disclose prior insurance coverage or claims can lead to serious consequences. If an insurer discovers that you withheld information, they may deny your claim or cancel your policy. Transparency is crucial for maintaining a good standing with your insurer and ensuring you have the right coverage.

Can I submit the Acord 130 form electronically?

Yes, many insurance agencies allow electronic submission of the Acord 130 form. Check with your insurance provider for their specific submission process. Electronic submission can speed up the application process and help you get the coverage you need more efficiently.

What should I do if I have questions while filling out the form?

If you have questions while completing the Acord 130 form, it’s best to reach out to your insurance agent or broker. They can provide guidance and clarify any sections of the form that may be confusing. Don't hesitate to ask for help to ensure your application is accurate and complete.

Dos and Don'ts

When filling out the ACORD 130 form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

- Do provide complete and accurate information for each section, including names, addresses, and contact details.

- Do double-check the dates to ensure they are formatted correctly (MM/DD/YYYY).

- Do include all necessary supporting documents, such as loss runs or additional remarks.

- Do specify any exclusions or special conditions related to your business operations.

- Do have an authorized representative sign the application to validate the information provided.

- Don't leave any sections blank; incomplete forms may delay processing.

- Don't use abbreviations or shorthand that may confuse the reviewer.

- Don't provide false or misleading information, as this can lead to serious penalties.

- Don't forget to include all employees and their respective roles in the business.

- Don't submit the form without reviewing it thoroughly for errors or omissions.

Acord 130 - Usage Steps

Completing the Acord 130 form is a crucial step in your workers' compensation application process. This form collects essential information about your business and its operations. Follow these steps carefully to ensure that all necessary details are included.

- Enter the Date: Fill in the date of application in the format MM/DD/YYYY.

- Agency Information: Provide the name and address of your agency.

- Company and Underwriter: Write the name of the insurance company and the underwriter.

- Applicant Information: Fill in your name, office phone, and mobile phone.

- Mailing Address: Include your complete mailing address, ensuring to add the ZIP + 4 or Canadian Postal Code.

- Business Details: Indicate the years in business, the Standard Industrial Classification (SIC), and the North American Industry Classification System (NAICS) codes.

- Producer Name: Enter the name of the producer handling your application.

- Customer Information: Provide your agency customer ID, website name, and contact details for the customer service representative.

- Business Structure: Check the appropriate box for your business type (e.g., sole proprietor, corporation, LLC).

- Contact Information: Fill out the contact information for your inspection, accounting, and claims personnel.

- Employee Information: List individuals included or excluded from coverage, including their roles, duties, and payroll information.

- Policy Information: Fill in details about your proposed effective and expiration dates, as well as the rating date.

- Coverage Information: Specify the type of coverage you require, including workers' compensation and employer's liability.

- Estimated Premiums: Provide your total estimated annual premium and minimum premium for all states.

- Prior Carrier Information: Detail your insurance history for the past five years, including claims and amounts paid.

- General Information: Answer the questions regarding your business operations, safety programs, and employee conditions.

- Signature: Ensure that the authorized representative of the applicant signs and dates the form.

Once you have completed the form, review all entries for accuracy. A well-filled form can help streamline your application process. Make sure to keep a copy for your records before submission.