Fill Your Adp Pay Stub Form

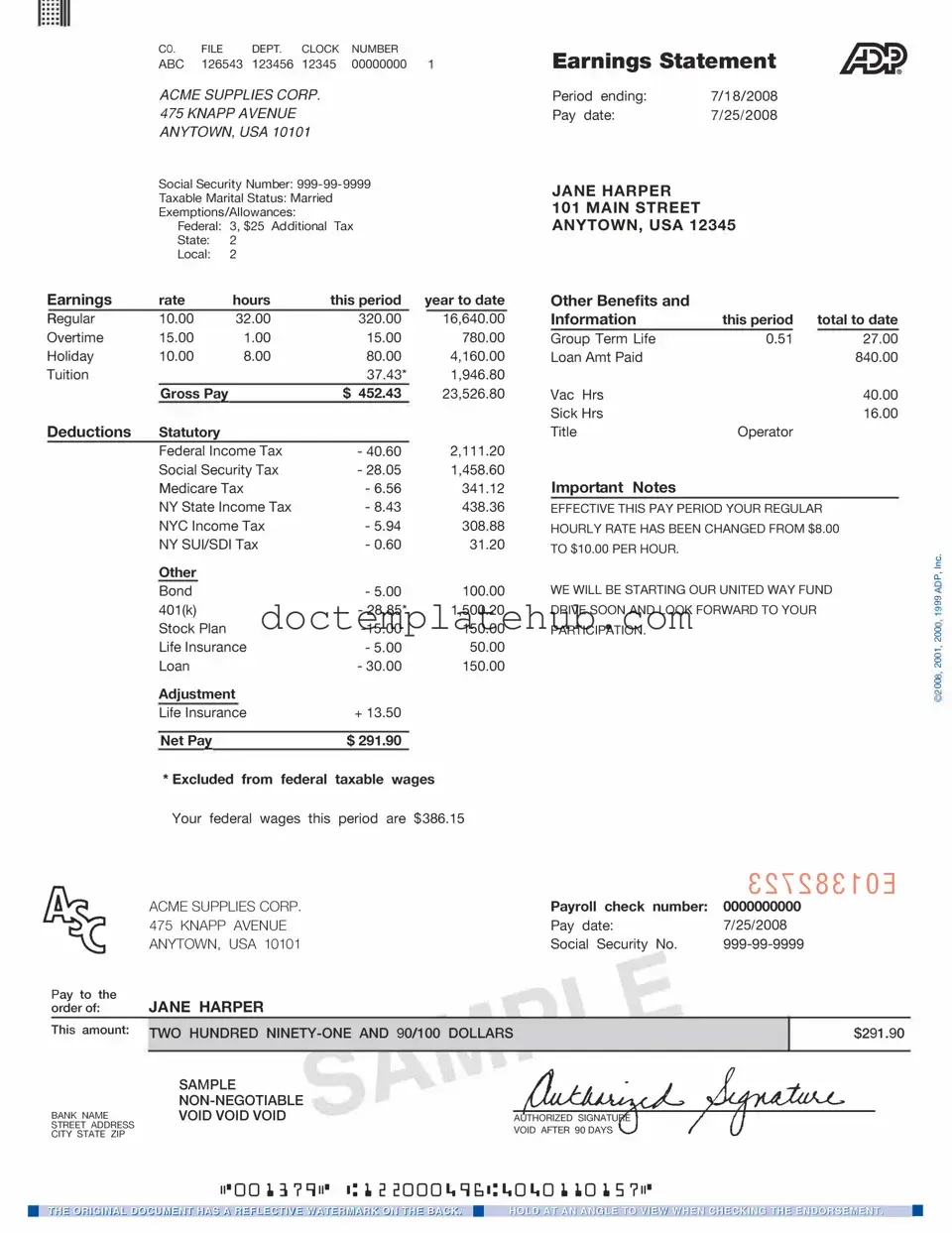

The ADP Pay Stub form serves as a crucial document for employees, providing a comprehensive breakdown of their earnings and deductions. This form details various components, including gross pay, net pay, and the specific deductions taken from each paycheck, such as taxes, health insurance, and retirement contributions. Employees can find information about hours worked, overtime, and any bonuses or commissions earned during the pay period. Additionally, the form often includes year-to-date totals, which help employees track their earnings and tax withholdings over the course of the year. Understanding the ADP Pay Stub is essential for employees to ensure accuracy in their paychecks and to facilitate personal financial planning. By reviewing this document regularly, employees can identify discrepancies and address them promptly, ensuring they receive the compensation they deserve. This form not only serves as a record of payment but also plays a vital role in fostering transparency between employers and employees regarding compensation practices.

Similar forms

The W-2 form is a key document for employees in the United States. It summarizes an employee's annual earnings and the taxes withheld from their paychecks throughout the year. Like the ADP Pay Stub, the W-2 provides crucial financial information, but it is issued at the end of the year rather than per pay period. Both documents serve to inform employees about their earnings and tax liabilities, making them essential for personal financial planning and tax preparation.

The pay statement, often issued by employers, is another document similar to the ADP Pay Stub. It details an employee's earnings for a specific pay period, including hours worked, gross pay, deductions, and net pay. While the ADP Pay Stub is a specific format provided by ADP, the pay statement serves the same purpose of breaking down compensation, allowing employees to track their earnings and deductions effectively.

The 1099 form is used for independent contractors and freelancers. It reports income received outside of traditional employment. Similar to the ADP Pay Stub, it provides a breakdown of earnings, but it does not include tax withholdings. Both documents are essential for understanding income, but the 1099 is geared toward those who are not on a payroll system, highlighting the differences in employment status.

The direct deposit receipt serves as a confirmation of funds transferred to an employee's bank account. This document shares similarities with the ADP Pay Stub, as both confirm payment. However, the direct deposit receipt typically does not provide a detailed breakdown of hours worked or deductions. Instead, it focuses solely on the transaction, making it a simpler but related document in the payroll process.

The paycheck is another comparable document. It is a physical or digital representation of an employee's earnings for a specific pay period. Like the ADP Pay Stub, it includes details about gross pay, deductions, and net pay. However, the paycheck is a method of payment, while the ADP Pay Stub is a detailed record that provides insights into the earnings breakdown.

The payroll summary report is typically generated by an employer's payroll system. It consolidates payroll information for multiple employees over a given period. This document is similar to the ADP Pay Stub in that it provides financial details, but it encompasses a broader scope, summarizing data for all employees rather than focusing on an individual’s earnings.

The benefits statement outlines the benefits an employee receives, such as health insurance, retirement contributions, and other perks. While it does not directly relate to pay, it is similar to the ADP Pay Stub in that both documents provide important financial information that impacts an employee's overall compensation package. Understanding benefits is crucial for employees when evaluating their total earnings and job satisfaction.

Other PDF Templates

Financial Affidavit Short Form Florida - Consider preparing the form with all necessary supporting documents ready.

Da Form 31 - It’s not just a request; it’s a formal process for documenting military leave.

Roof Certification Form - Checking for changes in occupancy aids in understanding potential roof wear.

More About Adp Pay Stub

What is an ADP Pay Stub?

An ADP Pay Stub is a document that provides a detailed breakdown of an employee's earnings for a specific pay period. It includes information such as gross pay, deductions, and net pay. This document serves as a record of payment and is essential for employees to understand their compensation and tax contributions.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP employee portal. To do this, you will need to log in using your credentials. If you do not have an account, you may need to register by providing some personal information. Once logged in, you can view, download, or print your pay stubs for any pay period.

What information is included on my ADP Pay Stub?

Your ADP Pay Stub typically includes your name, employee ID, pay period dates, gross earnings, various deductions (such as taxes, health insurance, and retirement contributions), and your net pay. Some stubs may also show year-to-date totals for earnings and deductions, giving you a comprehensive view of your financial standing throughout the year.

Why is my net pay different from my gross pay?

The difference between your net pay and gross pay is due to deductions taken from your earnings. These deductions can include federal and state taxes, Social Security contributions, Medicare taxes, and other benefits you may have elected, such as health insurance or retirement savings plans. Understanding these deductions can help you better manage your finances.

What should I do if I find an error on my ADP Pay Stub?

If you notice any discrepancies on your pay stub, it is important to address them promptly. Start by reviewing the details carefully to ensure that the error is not a misunderstanding. If you still believe there is an error, contact your HR department or payroll administrator as soon as possible. They can assist you in resolving the issue and ensuring that any necessary corrections are made.

Can I receive my ADP Pay Stub via email?

Dos and Don'ts

When filling out the ADP Pay Stub form, attention to detail is crucial. Here’s a list of important dos and don’ts to ensure accuracy and compliance.

- Do double-check your personal information for accuracy.

- Do ensure your pay period dates are correct.

- Do confirm your hours worked are accurately recorded.

- Do review your deductions to make sure they reflect your current benefits.

- Do keep a copy of your completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any fields blank unless instructed.

- Don't ignore discrepancies; address them immediately.

- Don't forget to sign and date the form if required.

- Don't submit the form without reviewing it first.

Adp Pay Stub - Usage Steps

Filling out the ADP Pay Stub form requires attention to detail. Accurate information ensures that you receive the correct pay and helps in maintaining your records. Follow the steps below to complete the form efficiently.

- Begin by entering your employee information. This includes your name, employee ID, and any other required identifiers.

- Next, fill in your pay period dates. Clearly indicate the start and end dates for the pay period you are reporting.

- Enter your hours worked. Specify the total number of hours you worked during the pay period, including regular and overtime hours.

- Provide your pay rate. This is the amount you earn per hour or salary for the pay period.

- List any deductions. Include taxes, benefits, and other deductions that apply to your pay.

- Finally, review all entered information for accuracy. Ensure that all figures are correct and that there are no missing details.

Once completed, you can submit the form as required by your employer's payroll department. Keeping a copy for your records is advisable.