Fill Your Advance Beneficiary Notice of Non-coverage Form

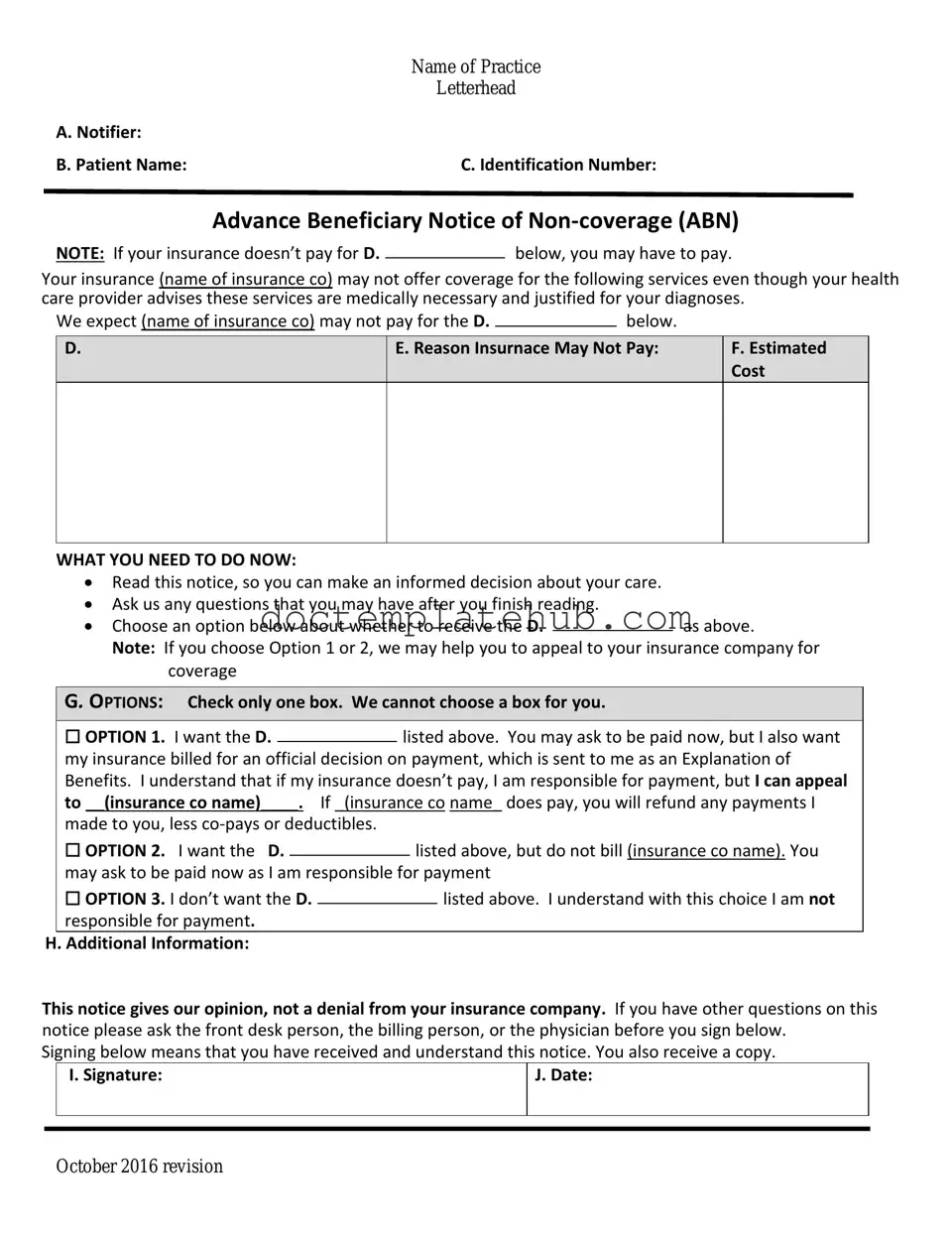

The Advance Beneficiary Notice of Non-coverage (ABN) is a crucial document in the landscape of Medicare services, providing beneficiaries with essential information regarding their potential out-of-pocket costs for certain medical services or items. This form serves as a notice from healthcare providers, indicating that Medicare may not cover a specific service, test, or procedure. By receiving an ABN, beneficiaries gain a clearer understanding of their financial responsibilities before undergoing treatment, allowing them to make informed decisions about their healthcare. The form not only outlines the reasons why Medicare might deny coverage but also offers patients the opportunity to accept or decline the service in question. This proactive communication is designed to protect beneficiaries from unexpected bills and ensure they are aware of their options. Understanding the ABN is vital for anyone navigating the Medicare system, as it empowers patients to take control of their healthcare choices while minimizing the risk of surprise expenses.

Similar forms

The Advance Beneficiary Notice of Non-coverage (ABN) form is similar to the Informed Consent form. Both documents require patients to acknowledge understanding of potential risks and benefits associated with medical services. Informed Consent ensures that patients are aware of what they are agreeing to before undergoing treatment, just as the ABN informs them that certain services may not be covered by Medicare, allowing for informed decision-making regarding their care options.

Another document akin to the ABN is the Notice of Privacy Practices (NPP). While the ABN focuses on coverage, the NPP addresses patient rights regarding their personal health information. Both documents emphasize transparency and patient autonomy, ensuring that individuals are informed about their rights and the implications of their healthcare decisions.

The Medicare Summary Notice (MSN) also shares similarities with the ABN. The MSN provides a summary of services received and indicates which services were covered or denied by Medicare. Like the ABN, the MSN aims to keep patients informed about their healthcare costs and the status of their claims, fostering an understanding of their financial responsibilities.

The Employee Handbook form is essential in shaping a clear understanding of policies and responsibilities within a workplace environment. It serves as a valuable resource for employees, outlining expectations and providing key insights into workplace behavior, benefits, and legal compliance. To explore a comprehensive template for your company's handbook, you can refer to documentonline.org/blank-employee-handbook, which can aid in creating a document that effectively communicates these crucial elements.

The Explanation of Benefits (EOB) is another document that parallels the ABN. An EOB outlines the services provided, the amount billed, and what the insurance company covers. Patients receive both the ABN and the EOB to understand their financial obligations and the potential for out-of-pocket expenses, promoting transparency in healthcare billing.

The Patient Responsibility Agreement (PRA) is similar to the ABN in that it outlines the financial responsibilities of the patient for services rendered. This agreement clarifies what the patient will owe if certain services are not covered by insurance, paralleling the ABN's purpose of informing patients about potential non-coverage.

The Financial Consent form also relates closely to the ABN. This document requires patients to consent to the costs associated with their care, ensuring they understand their financial obligations. Both forms aim to promote informed consent regarding financial aspects of healthcare, emphasizing the importance of patient awareness.

The Release of Information form is another document that bears resemblance to the ABN. This form allows healthcare providers to share a patient’s information with third parties, similar to how the ABN informs patients about potential non-coverage. Both documents prioritize patient awareness and consent in the context of healthcare services.

The Notice of Non-Coverage (NNC) is closely related to the ABN as it explicitly informs patients when a service will not be covered by Medicare. While the ABN is a proactive measure taken before services are rendered, the NNC serves as a notification after a service has been deemed non-covered, ensuring that patients remain informed about their healthcare costs.

The Consent to Treat form also has similarities with the ABN. Both documents require patient acknowledgment and agreement before proceeding with care. While the Consent to Treat focuses on the acceptance of treatment, the ABN emphasizes the financial implications of that treatment, ensuring patients are fully informed before making decisions.

Finally, the Out-of-Pocket Expense Agreement (OPEA) shares characteristics with the ABN. This document outlines potential out-of-pocket costs for services that may not be covered by insurance. Both the OPEA and the ABN aim to ensure that patients are aware of their financial responsibilities, fostering informed decision-making regarding their healthcare options.

Other PDF Templates

Youth Baseball Player Evaluation Form - Evaluate infield skills and overall fundamentals.

Tst Meaning - A lot number and expiration date are essential for tracking the test materials.

In order to safeguard all parties involved, utilizing a Hold Harmless Agreement is imperative, particularly in environments where risk is prevalent. For those in Utah seeking to draft such a document, resources like smarttemplates.net provide essential templates that streamline the process, ensuring that all legal obligations and protections are clearly defined.

Hazardous Material Bill of Lading - All parties are encouraged to maintain open communication throughout the shipping process.

More About Advance Beneficiary Notice of Non-coverage

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly known as the ABN, is a notification that healthcare providers give to Medicare beneficiaries. It informs patients that a particular service or item may not be covered by Medicare. The ABN allows beneficiaries to make informed decisions about their healthcare and potential costs.

When should I receive an ABN?

You should receive an ABN before you receive a service or item that your healthcare provider believes may not be covered by Medicare. This typically happens when a provider anticipates that Medicare might deny payment based on medical necessity or other criteria. Receiving the ABN in advance helps you understand your financial responsibility.

What should I do if I receive an ABN?

If you receive an ABN, carefully review the information provided. It will outline the service in question, the reason for potential non-coverage, and your options. You can choose to either accept the service and agree to pay for it out-of-pocket or decline the service. Make sure to ask your provider any questions you may have about the notice.

What happens if I don’t sign the ABN?

If you choose not to sign the ABN, your healthcare provider may not provide the service or item in question. Additionally, if Medicare denies coverage for that service and you did not sign the ABN, you may be responsible for the full cost without any notice of potential charges.

Can I appeal a Medicare denial after signing an ABN?

Yes, you can appeal a Medicare denial even after signing an ABN. If Medicare denies payment for the service, you have the right to request a review. The appeal process allows you to present your case and provide any additional information that may support the necessity of the service.

Does signing the ABN mean I have to pay for the service?

Signing the ABN does not automatically mean you will be required to pay for the service. It simply indicates that you acknowledge the possibility of non-coverage. If Medicare does end up covering the service, you will not have to pay out-of-pocket. However, if Medicare denies coverage, you will be responsible for the payment.

Is there a specific format for the ABN?

Yes, there is a specific format that the ABN must follow. The Centers for Medicare & Medicaid Services (CMS) provides a standardized template that healthcare providers must use. This ensures that all necessary information is included and that beneficiaries understand their rights and responsibilities clearly.

Dos and Don'ts

When filling out the Advance Beneficiary Notice of Non-coverage (ABN) form, it’s important to approach the task with care. This form helps inform patients about services that may not be covered by Medicare. Here are some essential do's and don'ts to keep in mind:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information about the services you received or are about to receive.

- Do ensure that the form is signed and dated by both the provider and the patient.

- Do keep a copy of the completed form for your records.

- Do ask questions if you are unsure about any part of the form.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't provide false information, as this can lead to complications later.

- Don't ignore the notice; it is important for understanding potential costs.

- Don't forget to review the completed form for any errors before submission.

Advance Beneficiary Notice of Non-coverage - Usage Steps

After receiving the Advance Beneficiary Notice of Non-coverage form, you will need to complete it to acknowledge that certain services may not be covered by Medicare. This is an important step in understanding your potential financial responsibilities for those services. Follow the steps below to fill out the form accurately.

- Begin by entering the date at the top of the form. This is the date you are filling out the notice.

- Next, provide your name and Medicare number in the designated fields. This information is essential for identification purposes.

- In the section for the service or item, clearly describe the service you are being informed about. Be specific to avoid confusion.

- Indicate the reason for the non-coverage in the appropriate section. This helps clarify why Medicare may not pay for the service.

- Review the notice carefully to ensure all information is correct. Double-check names, numbers, and service descriptions.

- Sign and date the form at the bottom. Your signature indicates that you understand the information provided.

- Make a copy of the completed form for your records before submitting it to the provider.