Fill Your Alabama Mvt 20 1 Form

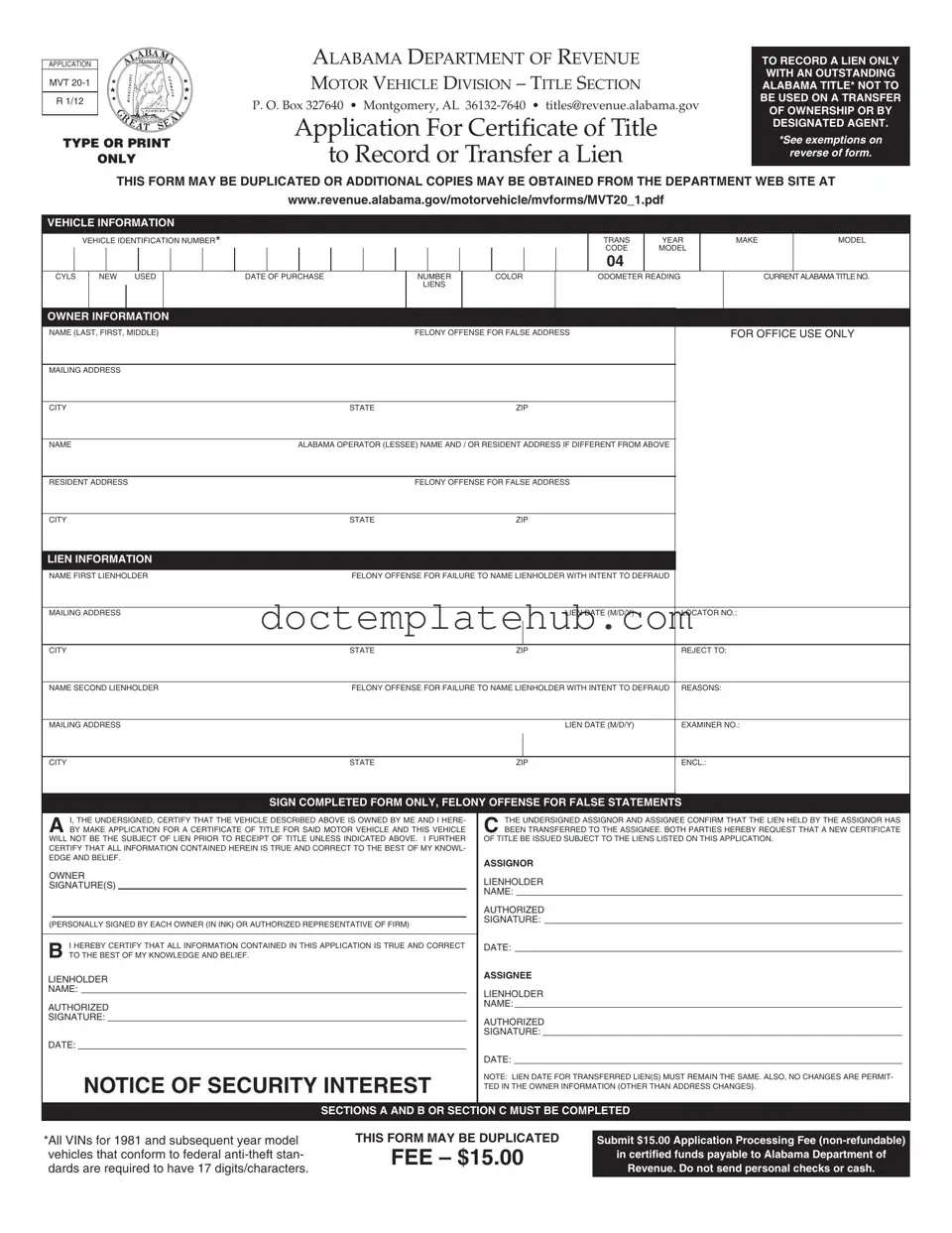

The Alabama Mvt 20 1 form is a crucial document designed specifically for recording or transferring liens on motor vehicles in the state of Alabama. This form is utilized exclusively when there is an outstanding Alabama title, and it is not applicable for ownership transfers or by designated agents. Individuals must complete the form accurately, providing essential vehicle information such as the Vehicle Identification Number (VIN), make, model, year, and odometer reading. Owner details, including names and addresses, are also required, along with information about the lienholders involved. The form mandates that all parties involved certify the accuracy of the information provided, emphasizing the importance of honesty in the process. A non-refundable application processing fee of $15 must accompany the submission, and the form must be printed or typed legibly to avoid rejection. Notably, there are exemptions to the titling requirements for certain vehicles, including those older than specific model years. Understanding these nuances is vital for anyone looking to navigate the complexities of vehicle lien recording in Alabama.

Similar forms

The Alabama Mvt 20 1 form serves a specific purpose in the context of vehicle ownership and lien recording. One document that is similar to it is the Application for Title (Form MVT 5-1E). This form is used by designated agents to record liens, making it essential for those who are not the vehicle owners but have a legal claim to the vehicle. Both forms require detailed vehicle information and the identification of lienholders, ensuring that all parties involved are recognized in the transaction. However, while the MVT 20 1 is strictly for lien recording, the MVT 5-1E allows for the inclusion of additional agents in the title process, highlighting the different roles that can exist in vehicle ownership and financing.

Another comparable document is the Bill of Sale for Motor Vehicles. This document serves as proof of the transfer of ownership from the seller to the buyer. While the Mvt 20 1 focuses on recording liens, the Bill of Sale is primarily concerned with the ownership aspect of a vehicle. Both documents require information about the vehicle, such as the Vehicle Identification Number (VIN) and purchase details. However, the Bill of Sale is often used as a standalone document for ownership transfer, whereas the Mvt 20 1 is part of a broader process involving lienholders and existing titles.

The Lien Release form is also similar in function to the Mvt 20 1. This document is utilized when a lien on a vehicle is satisfied and needs to be officially released. Both forms deal with the concept of liens; however, the Lien Release is focused on removing a lien, while the Mvt 20 1 is about recording a new lien. Both require the identification of the vehicle and the lienholder, ensuring that all legal claims are accurately reflected in public records.

The Affidavit of Heirship for Motor Vehicles shares similarities with the Mvt 20 1 in that it deals with the transfer of interest in a vehicle. This affidavit is often used when a vehicle owner passes away, and heirs need to establish their right to the vehicle. Both documents require detailed information about the vehicle and the parties involved. However, the Affidavit of Heirship is more focused on establishing ownership through inheritance, while the Mvt 20 1 is specifically for recording liens, emphasizing the financial obligations associated with the vehicle.

The Application for Duplicate Title is another document that aligns with the Mvt 20 1. This form is used when a vehicle owner needs to obtain a replacement title due to loss or damage. Both documents require information about the vehicle and the owner, ensuring that the state has accurate records. However, the Application for Duplicate Title is concerned with replacing an existing title, whereas the Mvt 20 1 is focused on recording a lien against a vehicle that already has a title.

The Vehicle Registration Application is also similar in that it involves the documentation of a vehicle's status. This form is used to register a vehicle with the state, providing information about ownership and the vehicle itself. Both the Vehicle Registration Application and the Mvt 20 1 require detailed vehicle information and the identification of the owner. However, the primary purpose of registration is to ensure that a vehicle is legally allowed to operate on the roads, while the Mvt 20 1 specifically addresses the financial interests associated with the vehicle.

The Notice of Security Interest is another document that shares similarities with the Mvt 20 1. This notice is filed to inform others that a security interest exists in a vehicle. Both documents serve to protect the rights of lienholders and require detailed information about the vehicle and the lienholder. However, the Notice of Security Interest is often more general and can be used in various contexts, while the Mvt 20 1 is specifically tailored for the state of Alabama's lien recording process.

The Title Application for Non-Title Vehicles is also relevant to the discussion. This form is used for vehicles that do not require a title, such as certain trailers or older vehicles. Both documents involve the recording of ownership and lien information, but the Title Application for Non-Title Vehicles is used in cases where traditional titling does not apply. This highlights the nuances in vehicle documentation and the specific requirements based on the vehicle type.

For those looking to navigate the specifics of this process, a useful resource is a guide on the essential Boat Bill of Sale form, which details the legal aspects of ownership transfer for boats, ensuring all necessary information is effectively documented.

Finally, the Vehicle Transfer Notification form is similar in that it communicates changes in vehicle ownership. This form is used to notify the state when a vehicle is sold or transferred. While both the Vehicle Transfer Notification and the Mvt 20 1 involve the transfer of interests in a vehicle, the former is focused on ownership changes, while the latter is specifically for lien recording. This distinction is crucial for understanding the different processes involved in vehicle transactions.

Other PDF Templates

Name the Certifying Body for Your Health Occupation - This form supports the credentialing process for healthcare professionals in the VA system.

In order to ensure comprehensive protection during various activities in Texas, it is essential to utilize a Hold Harmless Agreement form. This legally binding document serves to clarify responsibilities and prevent liability for injuries or damages that may arise. For those looking to create or understand more about these agreements, resources like smarttemplates.net can provide valuable assistance in drafting an effective form.

Affidavit of Death of Joint Tenant California - It is particularly useful in preventing potential challenges during estate distribution.

More About Alabama Mvt 20 1

What is the purpose of the Alabama MVT 20 1 form?

The Alabama MVT 20 1 form is specifically designed for lienholders to record or transfer a lien on a vehicle that already has an outstanding Alabama title. This form should not be used for transferring ownership of the vehicle or by designated agents. It ensures that the lien is officially recognized and recorded by the Alabama Department of Revenue, providing legal protection for the lienholder's interest in the vehicle.

Who needs to fill out the MVT 20 1 form?

This form must be completed by lienholders who wish to record a lien against a vehicle owned by someone else. The owner of the vehicle must also be involved in the process, as both parties need to certify the accuracy of the information provided. If you are a designated agent or looking to transfer ownership, you will need to use a different form, specifically the MVT 5-1E.

What information is required on the MVT 20 1 form?

The form requires detailed vehicle information, including the Vehicle Identification Number (VIN), year, make, model, and current Alabama title number. Additionally, you will need to provide information about the vehicle owner, including their name and mailing address. If there are any liens, the lienholder's information must also be included. It is crucial that all information matches what is on the existing Alabama title, except for any changes to mailing or resident addresses.

Is there a fee associated with submitting the MVT 20 1 form?

Yes, there is a non-refundable application processing fee of $15. This fee must be submitted in certified funds made payable to the Alabama Department of Revenue. Personal checks and cash are not accepted, so it's important to ensure that the payment method is correct to avoid delays in processing your application.

Are there any exemptions related to the MVT 20 1 form?

Yes, there are specific exemptions. For example, no certificate of title will be issued for manufactured homes, trailers, or motor vehicles that are more than 20 or 35 model years old, respectively. Additionally, low-speed vehicles are also exempt from titling. It's essential to check if your vehicle falls under these exemptions before completing the form, as this could affect your ability to record a lien.

Dos and Don'ts

When filling out the Alabama MVT 20 1 form, consider these important dos and don'ts to ensure a smooth application process.

- Do type or print the application legibly to avoid delays.

- Do ensure that the vehicle and owner information matches the current Alabama title.

- Do include the correct application processing fee of $15 in certified funds.

- Do submit the current Alabama title along with your application.

- Do double-check for any required signatures before submission.

- Don't use this form for transferring ownership or if you are a designated agent.

- Don't send personal checks or cash as payment; only certified funds are accepted.

- Don't leave any sections blank; complete all required parts of the form.

- Don't attempt to change owner information other than address changes.

- Don't forget to check for any exemptions that may apply to your vehicle.

Alabama Mvt 20 1 - Usage Steps

Completing the Alabama MVT 20 1 form is a straightforward process that requires attention to detail. Once the form is filled out correctly and submitted along with the necessary fee, it will be processed by the Alabama Department of Revenue. Ensure that all information is accurate to avoid any delays.

- Obtain the Alabama MVT 20 1 form from the Alabama Department of Revenue website or a physical copy.

- Type or print the application legibly. Illegible forms will be returned.

- Fill in the vehicle information section:

- Vehicle Identification Number (VIN)

- Year, make, model, and color of the vehicle

- Odometer reading

- Current Alabama title number

- Provide the owner's information:

- Full name (last, first, middle)

- Mailing address, city, state, and ZIP code

- Alabama operator name and/or resident address if different

- Complete the lien information section:

- First lienholder's name and mailing address

- Liens date

- If applicable, include the second lienholder's information

- Sign and date the completed form. Each owner or authorized representative must sign in ink.

- Prepare a certified check or money order for the $15 application processing fee, made payable to the Alabama Department of Revenue. Do not send personal checks or cash.

- Attach the current Alabama title for the vehicle to the application.

- Submit the completed form, the title, and the fee to the address provided on the form:

- P. O. Box 327640

- Montgomery, AL 36132-7640