Fill Your Aoa 100A Form

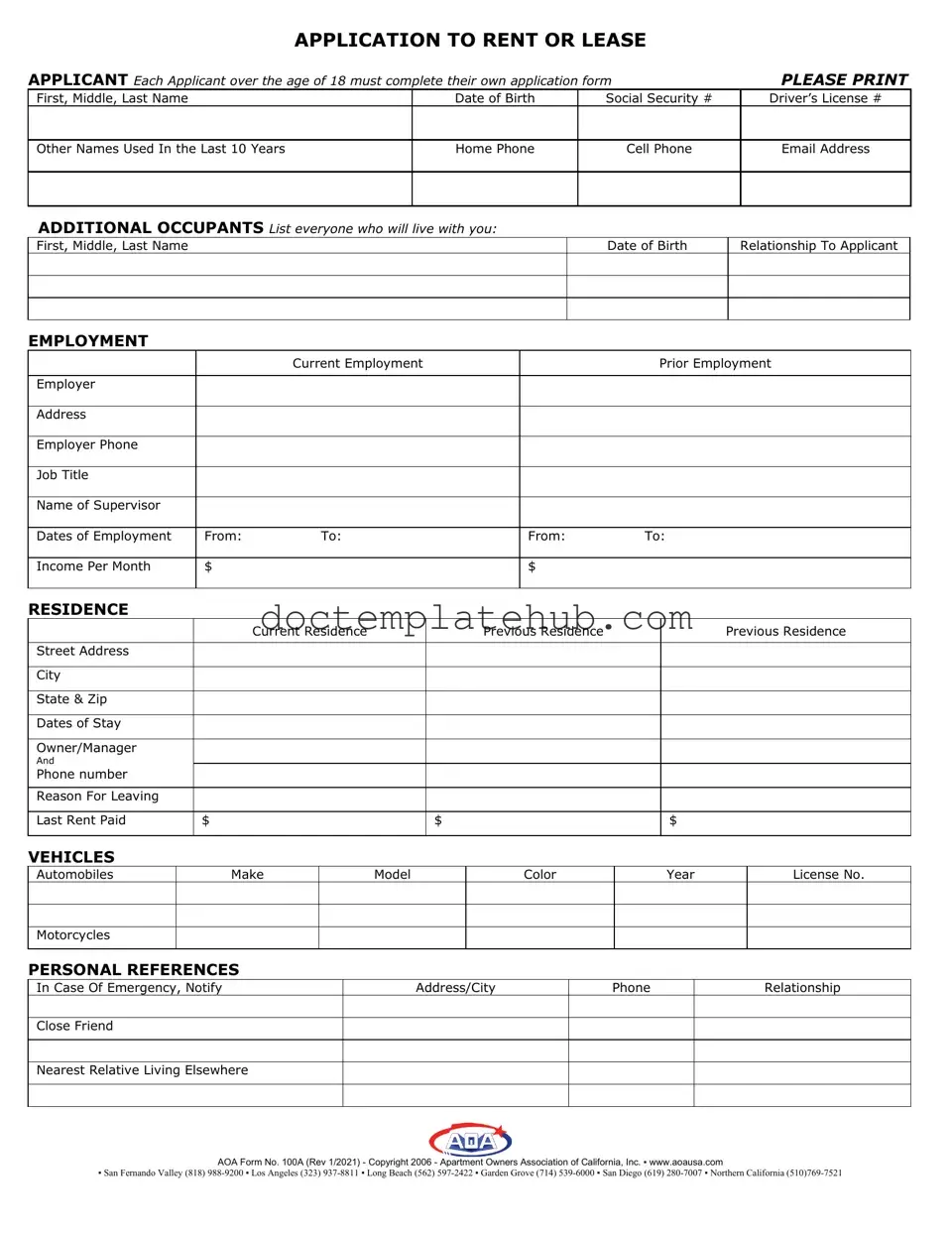

The AOA 100A form is an essential document for individuals seeking to rent or lease an apartment. It serves as a comprehensive application that collects vital information about the applicant, ensuring that landlords can make informed decisions. Each applicant over the age of 18 must fill out their own form, which includes personal details such as name, date of birth, and contact information. The form also requires the disclosure of additional occupants, employment history, and previous residences. This information allows landlords to assess the applicant's stability and reliability. Furthermore, the form delves into financial obligations, including banking details and credit accounts, which are crucial for evaluating the applicant's financial responsibility. Applicants are also prompted to answer questions regarding smoking, pets, and any past legal issues, providing a fuller picture of their lifestyle and potential fit for the rental property. Additionally, the AOA 100A form includes a section for personal references and emergency contacts, further enhancing the landlord's ability to verify the applicant's background. By signing the form, applicants authorize the verification of their provided information and acknowledge the importance of accuracy in their application. This proactive approach helps prevent any delays in processing and mitigates the risk of misrepresentation, which could lead to serious consequences, including eviction. Overall, the AOA 100A form is a crucial step in the rental process, ensuring that both landlords and applicants are well-informed and prepared for a successful leasing experience.

Similar forms

The Aoa 100A form, which serves as an application to rent or lease a property, shares similarities with the Rental Application form commonly used across various states. Like the Aoa 100A, the Rental Application requires personal information from the applicant, including their name, contact details, and employment history. This form also typically includes questions regarding current and previous residences, financial obligations, and references. The purpose of both documents is to assess the suitability of the applicant for tenancy, ensuring that landlords can make informed decisions based on the applicant's background and financial stability.

Another document that resembles the Aoa 100A is the Tenant Background Check Authorization form. This form is often used by landlords to obtain permission from applicants to conduct background checks, including credit history and criminal records. Similar to the Aoa 100A, this document emphasizes the importance of transparency and trust in the rental process. Both forms require applicants to provide consent for the verification of their personal information, ensuring that landlords can verify the accuracy of the details provided in the application.

In addition to these documents, it's important to recognize the value of having an informative resource like an Employee Handbook, which can be a vital tool for both employers and employees to align on expectations and responsibilities. For more insights on creating an effective handbook, you can visit TopTemplates.info.

The Lease Application form is also comparable to the Aoa 100A. This document is often utilized by landlords to gather detailed information from prospective tenants before entering into a lease agreement. Like the Aoa 100A, the Lease Application typically includes sections for personal details, employment history, and references. The main objective of both forms is to gather comprehensive information that allows landlords to evaluate the applicant's reliability and ability to fulfill lease obligations.

Similarly, the Credit Application form is closely aligned with the Aoa 100A. This document focuses specifically on the financial background of the applicant, requesting information about credit history, income, and existing debts. While the Aoa 100A encompasses a broader range of information, both forms aim to assess the financial responsibility of the applicant. This evaluation is crucial for landlords to determine whether the applicant can afford the rent and manage their financial commitments.

The Employment Verification form is another document that bears similarities to the Aoa 100A. This form is often used by landlords to confirm the employment status and income of potential tenants. Like the Aoa 100A, it requires information about the applicant's current and previous employers, job titles, and income levels. Both forms are essential for verifying the applicant's financial stability, which is a critical factor in the rental decision-making process.

The Rental History Verification form also shares commonalities with the Aoa 100A. This document is used to gather information about an applicant's past rental experiences, including previous landlords' contact details and rental payment history. The Aoa 100A includes similar inquiries, allowing landlords to assess the applicant's reliability as a tenant. Both forms aim to provide landlords with a comprehensive view of the applicant's rental history, which can significantly influence their decision.

Lastly, the Guarantor Application form is akin to the Aoa 100A, especially when an applicant may require a co-signer for their lease. This document collects information about the guarantor's financial background and relationship to the applicant. Just as the Aoa 100A evaluates the applicant's qualifications, the Guarantor Application assesses the financial reliability of the individual willing to support the applicant's lease. Both forms serve to ensure that landlords have adequate security in the rental agreement, protecting their interests while providing opportunities for applicants who may need additional support.

Other PDF Templates

Gf Application Form - Hoping to find a supportive partner who encourages growth and ambition.

California Immunization Record Form - Parents must safeguard this document as it may be required for various health and educational purposes.

Understanding the importance of a Power of Attorney is vital, especially when considering resources that can aid in the process. For those interested in preparing this document, smarttemplates.net offers useful templates and guidance to ensure that your choices are clearly communicated and legally binding.

How to Make a Timesheet in Excel - Understanding how to complete a time card is a valuable workplace skill.

More About Aoa 100A

What is the Aoa 100A form used for?

The Aoa 100A form is an application used by individuals seeking to rent or lease an apartment. Each applicant over the age of 18 must complete their own form. This document collects essential information, including personal details, employment history, residence history, and credit information, to assist landlords in evaluating potential tenants.

What information do I need to provide on the Aoa 100A form?

Applicants must provide a range of personal information, including their full name, date of birth, Social Security number, and contact details. Additionally, you will need to list any additional occupants, current and previous employment details, residence history, vehicle information, and personal references. Financial obligations and general information about your habits, such as smoking or pet ownership, must also be disclosed.

How does the application process work after submitting the Aoa 100A form?

Once you submit the Aoa 100A form, the landlord or property manager will review your application. They will verify the information provided, which may include contacting previous landlords and employers. A credit check and background check may also be conducted. The processing time can vary, and incomplete applications may delay the process or result in denial of tenancy.

What happens if I provide false information on the Aoa 100A form?

Providing false information on the Aoa 100A form can have serious consequences. If a material misstatement is discovered after you have been accepted as a tenant, the landlord may consider it a breach of the lease agreement. This could lead to immediate eviction and rescission of the rental contract. It is crucial to ensure that all information is accurate and complete to avoid these issues.

Is there an application fee associated with the Aoa 100A form?

Yes, there is typically an application fee required when submitting the Aoa 100A form. This fee covers the cost of processing your application, which includes obtaining credit history and background information. The amount of the fee may vary by landlord or property management company, so it is advisable to confirm the specific fee before submitting your application.

Can I apply for an apartment if I have a poor credit history?

A poor credit history may affect your chances of being approved for an apartment, but it does not automatically disqualify you. Landlords often consider various factors, including income, rental history, and personal references. If you have concerns about your credit, it may be helpful to discuss them with the landlord and provide additional information that demonstrates your reliability as a tenant.

Dos and Don'ts

When filling out the Aoa 100A form, it's essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure a smooth application process.

- Do print clearly and legibly to avoid any confusion.

- Do provide accurate information about your employment and income.

- Do list all additional occupants who will be living with you.

- Do include all necessary personal references and their contact information.

- Do double-check your Social Security number and other identifying information.

- Don't leave any sections blank; incomplete applications can lead to delays.

- Don't provide false information; honesty is crucial for your application’s approval.

- Don't forget to sign and date the application; an unsigned form will not be processed.

- Don't rush through the application; take your time to ensure accuracy.

- Don't ignore any questions, especially those regarding past evictions or criminal history; transparency is vital.

Aoa 100A - Usage Steps

Completing the AOA 100A form is an essential step in the rental application process. This form collects necessary information about you and any additional occupants, employment, residence history, vehicles, personal references, and credit information. Following these steps will help ensure that your application is filled out correctly and submitted without delays.

- Applicant Information: Begin by filling out your personal details. Include your first, middle, and last name, date of birth, social security number, driver's license number, and any other names you have used in the last 10 years. Provide your home phone, cell phone, and email address.

- Additional Occupants: List everyone who will be living with you. For each person, include their full name, date of birth, and relationship to you.

- Employment History: Fill in your current employment details, including employer name, address, phone number, job title, supervisor's name, and dates of employment. Repeat this for any prior employment. Also, indicate your monthly income from each job.

- Residence History: Provide your current and previous addresses, including street address, city, state, zip code, dates of stay, and the owner or manager's contact information. State the reason for leaving each residence and the last rent paid.

- Vehicle Information: List any automobiles and motorcycles you own. Include the make, model, color, year, and license number for each vehicle.

- Personal References: In case of an emergency, provide the name, address, phone number, and relationship of a close friend and a nearest relative living elsewhere.

- Credit Information: Detail your financial obligations. List the name of your bank or savings and loan, branch address, account numbers, and current balances for checking and savings accounts. Include any credit accounts with their respective details.

- General Information: Answer the questions regarding smoking, pets, bankruptcy, musical instruments, water-filled furniture, criminal convictions, and eviction history. If you answer "yes" to any questions, provide explanations in the space provided.

- Rental Agreement: Indicate the apartment number and address you are applying for, along with the proposed monthly rent. Submit the application fee indicated on the form.

- Signature: Finally, sign and date the application to certify that all information provided is true and correct.