Fillable Articles of Incorporation Template for Arizona State

In the dynamic landscape of business formation, understanding the Arizona Articles of Incorporation form is crucial for entrepreneurs looking to establish a corporation in the state. This essential document serves as the foundation for your corporation, detailing critical information that outlines its existence and structure. Key aspects of the form include the corporation's name, which must be unique and distinguishable from other registered entities, ensuring clarity in business identity. Additionally, the form requires the listing of the corporation's purpose, which should reflect the nature of the business activities intended to be conducted. The registered agent, a designated individual or business entity responsible for receiving legal documents, must also be identified, as this ensures proper communication with state authorities. Furthermore, the form mandates the inclusion of the number of shares the corporation is authorized to issue, which can significantly impact future financing and ownership structure. Completing the Arizona Articles of Incorporation accurately is not just a formality; it is a vital step that can influence the success and legal standing of your business. Thus, understanding each component of this form is imperative for anyone ready to embark on the journey of corporate formation in Arizona.

Similar forms

The Articles of Organization is a document used primarily for limited liability companies (LLCs) in Arizona. Much like the Articles of Incorporation, this form officially establishes a business entity with the state. It includes essential information such as the name of the LLC, its purpose, and the registered agent. Both documents serve to formalize a business's existence, but while Articles of Incorporation are for corporations, Articles of Organization cater specifically to LLCs. This distinction is crucial for business owners when deciding on the structure that best suits their needs.

The importance of understanding various legal documents cannot be overstated, particularly when it comes to establishing and maintaining a business. For example, the EDD DE 2501 form is crucial for those seeking disability benefits in California, and one can find more information about it at https://documentonline.org/blank-edd-de-2501/. This form, along with the Articles of Incorporation and other regulatory documents, highlights the necessity of being well-informed about legal requirements to ensure a smooth operation and compliance in business affairs.

The Certificate of Formation is another document that resembles the Articles of Incorporation, particularly in the context of forming a nonprofit organization. This certificate outlines the nonprofit’s name, purpose, and the details of its board of directors. Just as the Articles of Incorporation lay the groundwork for a corporation, the Certificate of Formation does the same for nonprofits. Both documents are filed with the state to gain legal recognition and enable the organization to operate within the law.

The Bylaws of a corporation are internal documents that outline how the company will be governed. While the Articles of Incorporation provide the basic framework for the corporation's existence, the Bylaws delve into operational details. They cover aspects such as how meetings are conducted, the roles of officers, and voting procedures. Both documents are essential for the effective management of the corporation, but they serve different purposes: one establishes the entity, while the other guides its internal operations.

The Operating Agreement is similar to Bylaws but is specifically for LLCs. This document outlines the management structure and operational guidelines for the LLC. Like the Articles of Organization, the Operating Agreement is crucial for defining the roles and responsibilities of members. Both documents work together to ensure clarity and prevent misunderstandings among the owners, making it easier to run the business smoothly.

The Statement of Information is a document that some states require corporations to file periodically after incorporation. This statement provides updated information about the company, including its address and the names of its officers. It is similar to the Articles of Incorporation in that it serves to keep the state informed about the corporation's status. However, while the Articles of Incorporation establish the corporation, the Statement of Information maintains its compliance with state regulations.

The Certificate of Good Standing is another important document that can be compared to the Articles of Incorporation. This certificate confirms that a corporation has complied with all necessary state regulations and is authorized to conduct business. While the Articles of Incorporation are the initial step to forming a corporation, the Certificate of Good Standing serves as proof of its legitimacy and ongoing compliance. This document can be crucial for business dealings, as it reassures partners and clients of the corporation's legal standing.

Finally, the Business License is a document that businesses may need to operate legally within a specific jurisdiction. While the Articles of Incorporation establish the business entity, a Business License grants permission to conduct business activities in a particular area. Both documents are essential for legal compliance, but they serve different functions: one forms the business, while the other permits its operation within local regulations.

Other Common State-specific Articles of Incorporation Templates

Biz Online - The form may ask for the corporation's fiscal year end date.

Creating a comprehensive estate plan is essential for every individual, and utilizing the Texas Last Will and Testament form available at smarttemplates.net can greatly simplify this process, ensuring that your intentions are clearly communicated and legally recognized.

Texas Llc Annual Fees - Establishing the corporation does not provide immediate tax-exempt status.

More About Arizona Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in Arizona. They outline the basic information about your business, such as its name, purpose, and structure. Filing these documents with the Arizona Corporation Commission is a crucial step in forming a corporation.

What information do I need to provide in the Articles of Incorporation?

You will need to include several key details, including the name of your corporation, the principal office address, the name and address of the statutory agent, the purpose of the corporation, and the number of shares the corporation is authorized to issue. Additionally, you may need to provide the names and addresses of the initial directors.

How do I file the Articles of Incorporation in Arizona?

To file the Articles of Incorporation, you can submit your documents online through the Arizona Corporation Commission's website, or you can mail a paper form. Ensure that you include the required filing fee, which varies based on the type of corporation you are forming.

What is the filing fee for the Articles of Incorporation?

The filing fee for Articles of Incorporation in Arizona typically starts at $60 for a corporation. Additional fees may apply depending on the type of corporation and any optional services you choose, such as expedited processing.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation after they have been filed. If you need to make changes, such as altering the corporation's name or the number of shares authorized, you will need to file an amendment form with the Arizona Corporation Commission and pay the associated fee.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online submissions are processed faster than paper filings. You can expect a turnaround time of about 3 to 5 business days for online submissions, while paper filings may take longer, possibly up to 10 business days or more.

Do I need a lawyer to file the Articles of Incorporation?

While you are not required to hire a lawyer to file your Articles of Incorporation, consulting with one can be beneficial. A legal expert can help ensure that your documents are completed correctly and can provide guidance on compliance with state laws.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After that, you will need to comply with ongoing requirements, such as filing annual reports and maintaining proper records.

Dos and Don'ts

When filling out the Arizona Articles of Incorporation form, attention to detail is crucial. Here is a list of things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Do use the correct legal name of your corporation as required.

- Do include the purpose of the corporation clearly.

- Do provide the registered agent's name and address.

- Do check for any specific requirements for your business type.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use abbreviations unless they are legally recognized.

- Don't forget to sign and date the form.

- Don't submit the form without paying the required filing fee.

- Don't overlook the importance of reviewing the form for errors before submission.

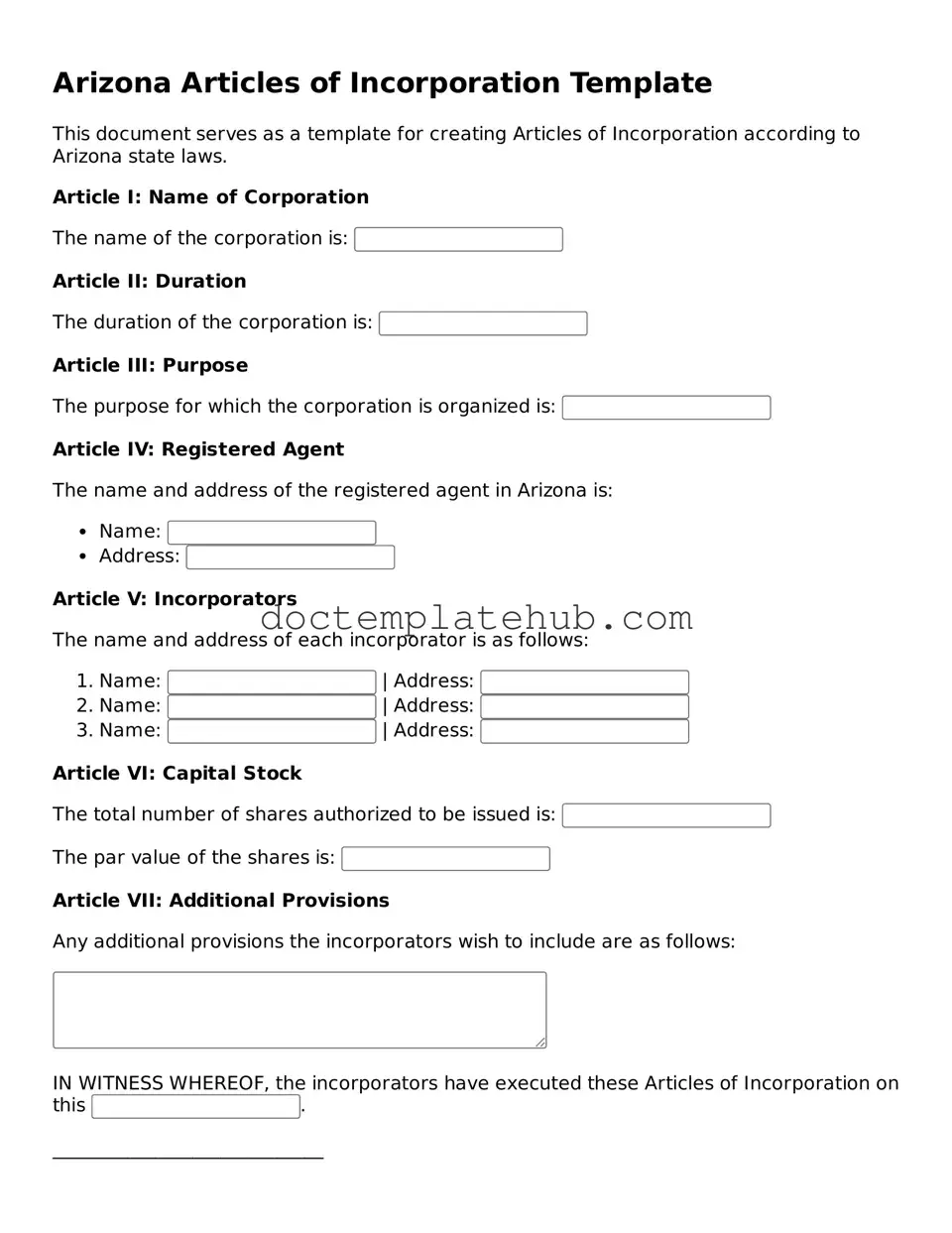

Arizona Articles of Incorporation - Usage Steps

Once you have your Arizona Articles of Incorporation form ready, you'll need to fill it out accurately. This process involves providing essential information about your new corporation. Follow these steps carefully to ensure everything is completed correctly.

- Begin by entering the name of your corporation. Ensure it complies with Arizona naming requirements.

- Next, provide the principal address of your corporation. This should be a physical address, not a P.O. Box.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- List the name and address of the statutory agent. This person or business will receive legal documents on behalf of your corporation.

- Include the number of shares your corporation is authorized to issue. Specify if there are different classes of shares.

- Provide the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that the person filling out the form is authorized to do so.

- Review all the information for accuracy. Double-check for any errors or omissions.

After completing the form, you will need to submit it to the Arizona Corporation Commission along with the required filing fee. Make sure to keep a copy for your records.