Fillable Deed in Lieu of Foreclosure Template for Arizona State

The Arizona Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows property owners to voluntarily transfer their property title back to the lender, thereby avoiding the lengthy and often distressing foreclosure process. By executing this deed, homeowners can mitigate the negative impact on their credit scores and alleviate the burden of mortgage debt. The form outlines essential elements, including the identification of the parties involved, a clear description of the property, and the acknowledgment of any existing liens. Additionally, it may include provisions regarding the release of personal liability for the mortgage debt, offering a sense of relief to struggling homeowners. Understanding the implications and requirements of this form is vital for anyone considering this option, as it can provide a pathway to financial recovery and a fresh start.

Similar forms

A short sale agreement is often considered similar to a deed in lieu of foreclosure. In a short sale, the homeowner sells their property for less than the amount owed on the mortgage, with the lender’s approval. This allows the homeowner to avoid foreclosure while the lender recovers some of their losses. Both processes aim to provide a solution for financially distressed homeowners, but a short sale involves a sale transaction, whereas a deed in lieu transfers ownership directly to the lender without a sale.

A mortgage modification agreement is another document that shares similarities with a deed in lieu of foreclosure. This agreement involves changing the terms of an existing mortgage to make it more manageable for the borrower. It may include lower interest rates, extended loan terms, or reduced principal balances. While both options aim to assist homeowners facing financial difficulties, a mortgage modification allows the homeowner to retain ownership of the property, whereas a deed in lieu involves relinquishing ownership to the lender.

A foreclosure notice is also related to a deed in lieu of foreclosure. This document is issued by the lender when a borrower falls behind on mortgage payments and serves as a formal notification of the lender's intent to initiate foreclosure proceedings. Both documents reflect the homeowner’s financial struggles, but a foreclosure notice signals the beginning of the legal process to reclaim the property, while a deed in lieu is a voluntary agreement to transfer ownership before foreclosure occurs.

Understanding the nuances of various legal documents related to property ownership is essential for homeowners facing financial difficulties. As they navigate options like the Deed in Lieu of Foreclosure, it’s crucial to consider all available agreements that can aid in achieving financial resolution. For comprehensive templates and guidance on these documents, check out smarttemplates.net, which offers valuable resources and fillable forms tailored to your needs.

A forbearance agreement is similar in that it provides temporary relief to homeowners facing financial hardship. In this document, the lender agrees to pause or reduce mortgage payments for a specified period, allowing the borrower time to recover financially. While both a forbearance agreement and a deed in lieu aim to help homeowners avoid foreclosure, the former allows the homeowner to stay in their home temporarily, while the latter involves surrendering the property to the lender.

Lastly, a bankruptcy filing can also be compared to a deed in lieu of foreclosure. When a homeowner files for bankruptcy, it may provide an opportunity to restructure debts or even eliminate them altogether. In some cases, homeowners may choose to surrender their property through bankruptcy, similar to a deed in lieu. Both documents serve as mechanisms to address overwhelming debt, but bankruptcy involves a legal process that can affect the homeowner's credit for years, while a deed in lieu is a more straightforward transfer of property ownership.

Other Common State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Foreclosure Form - Participants can often negotiate terms of the Deed in Lieu, making it a flexible option for both parties involved.

California Property Surrender Deed - Documenting the transfer protects both parties and ensures legal clarity moving forward.

Completing the CDC U.S. Standard Certificate of Live Birth form is an important step for new parents, and more information can be found at documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth/, which provides guidance on how to fill out this essential document accurately.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This option may provide homeowners with an easier exit strategy in challenging financial conditions.

More About Arizona Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in exchange for the cancellation of the mortgage debt. This option can help avoid the lengthy and costly process of foreclosure.

How does a Deed in Lieu of Foreclosure work?

When a homeowner decides to pursue a Deed in Lieu of Foreclosure, they must first negotiate with their lender. If both parties agree, the homeowner signs the deed, transferring ownership of the property to the lender. In return, the lender typically forgives the remaining mortgage balance, relieving the homeowner of the debt.

What are the benefits of a Deed in Lieu of Foreclosure?

This option can provide several advantages. It can help homeowners avoid foreclosure, which can severely impact their credit score. Additionally, the process is usually quicker and less expensive than foreclosure. Homeowners may also find it easier to negotiate terms with the lender compared to a foreclosure situation.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides. Homeowners may still face a negative impact on their credit score, although typically less severe than a foreclosure. Furthermore, lenders may require the homeowner to prove financial hardship, and some may not agree to a Deed in Lieu of Foreclosure if the property has other liens or issues.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners facing financial difficulties who can no longer afford their mortgage payments may qualify. It’s essential to demonstrate that you have exhausted other options, such as loan modifications or short sales, before pursuing this route.

What is the process for obtaining a Deed in Lieu of Foreclosure?

The process typically begins with contacting your lender to discuss your situation. If the lender is open to the idea, you will need to provide documentation of your financial hardship. After negotiations, if both parties reach an agreement, you will sign the deed and transfer ownership. Make sure to keep copies of all documents for your records.

Can a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure can impact your credit score. While it is generally less damaging than a full foreclosure, it still signifies that you were unable to meet your mortgage obligations. The exact effect on your score will depend on your overall credit history and the scoring model used.

What happens to my mortgage payments after a Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is completed, you are no longer responsible for making mortgage payments on that property. The lender will assume ownership, and your obligation to pay the mortgage will be canceled, assuming all terms of the agreement are met.

Can I buy another home after a Deed in Lieu of Foreclosure?

Yes, you can buy another home after a Deed in Lieu of Foreclosure, but it may take some time. Most lenders will require a waiting period before you can qualify for a new mortgage. This period can vary, often ranging from two to four years, depending on the lender’s policies and your overall credit situation.

Should I consult a lawyer before signing a Deed in Lieu of Foreclosure?

It is advisable to consult a lawyer before signing any legal documents, including a Deed in Lieu of Foreclosure. A legal professional can help you understand the implications, ensure that your rights are protected, and assist in negotiating terms with the lender.

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here’s a list of things you should and shouldn't do to ensure a smooth experience.

- Do read the entire form carefully before filling it out.

- Don't rush through the process; take your time to understand each section.

- Do provide accurate and complete information about the property.

- Don't leave any sections blank unless instructed; incomplete forms can cause delays.

- Do consult with a legal professional if you have questions about the form.

- Don't assume that all lenders accept a deed in lieu; check your lender’s policies first.

- Do sign the document in the presence of a notary public.

- Don't forget to keep a copy of the completed form for your records.

- Do submit the form to your lender as soon as possible after completion.

Following these guidelines can help you navigate the process more effectively and avoid potential pitfalls. Remember, taking the time to do it right can save you stress in the long run.

Arizona Deed in Lieu of Foreclosure - Usage Steps

After completing the Arizona Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties and ensuring that all necessary conditions are met for the transfer of property ownership. This may include notifying the lender and confirming the acceptance of the deed.

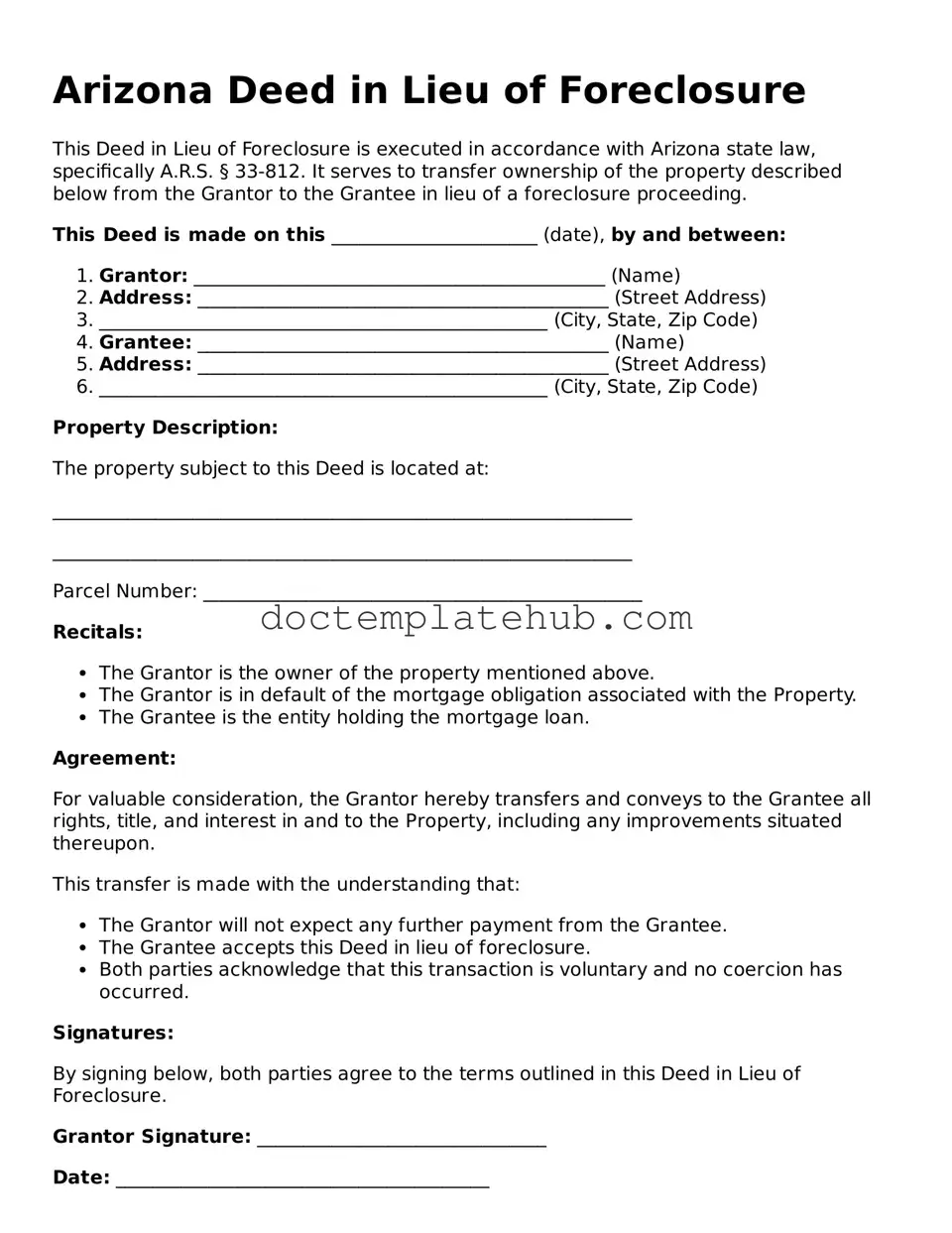

- Obtain the Arizona Deed in Lieu of Foreclosure form from a reliable source or legal website.

- Fill in the names of the grantor (the property owner) and the grantee (the lender) at the top of the form.

- Provide the property address and legal description of the property in the designated sections.

- Specify the date of the transfer in the appropriate field.

- Include any outstanding mortgage information, such as the loan number and the amount owed.

- Sign the form in the presence of a notary public to ensure that the signatures are valid.

- Ensure that all parties involved receive copies of the signed document for their records.

- Submit the completed form to the county recorder’s office to officially record the deed.