Fillable Durable Power of Attorney Template for Arizona State

In the realm of personal and financial decision-making, the Arizona Durable Power of Attorney form serves as a crucial instrument for individuals seeking to ensure their wishes are honored when they can no longer communicate or make decisions for themselves. This legal document empowers a designated agent, often referred to as an attorney-in-fact, to act on behalf of the principal, the person who creates the document. The form encompasses a wide array of powers, allowing the agent to manage financial affairs, make healthcare decisions, and handle other important matters, depending on the specific provisions outlined within the document. It is designed to remain effective even if the principal becomes incapacitated, thus providing a safeguard against potential difficulties that may arise in times of crisis. Understanding the nuances of this form is essential, as it not only outlines the scope of authority granted but also addresses the responsibilities of the agent, ensuring that individuals can make informed choices about who will represent their interests. Furthermore, the Arizona Durable Power of Attorney form requires careful consideration of the principal's values and preferences, making it a deeply personal document that reflects one's desires for their future care and management of their affairs.

Similar forms

The Arizona Durable Power of Attorney (DPOA) is similar to a General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to appoint someone else, referred to as the agent, to make decisions on their behalf. The key difference lies in durability; while a GPOA becomes ineffective if the principal becomes incapacitated, a DPOA remains valid even in such circumstances. This durability makes the DPOA particularly useful for long-term planning and ensures that the agent can act when the principal can no longer do so.

A Health Care Power of Attorney (HCPOA) shares similarities with the DPOA in that both empower an agent to make decisions for the principal. However, the HCPOA specifically focuses on medical decisions. In the event of incapacity, the agent designated in the HCPOA can make choices regarding medical treatment, end-of-life care, and other health-related matters. This document is crucial for ensuring that the principal's healthcare preferences are honored when they cannot communicate them directly.

The Living Will is another document that aligns closely with the DPOA, particularly in the context of health care. While the DPOA allows an agent to make decisions, a Living Will outlines the principal’s wishes regarding medical treatment and interventions in situations where they are terminally ill or in a persistent vegetative state. This document serves as a guide for both the agent and healthcare providers, ensuring that the principal’s values and preferences are respected.

A Revocable Trust is similar to the DPOA in that both allow for the management of assets. A Revocable Trust enables the principal to place their assets into a trust, which can be managed by a trustee during their lifetime and distributed according to their wishes upon death. While the DPOA grants authority to an agent to handle financial matters during the principal’s lifetime, the Revocable Trust provides a structured approach to asset management and can help avoid probate.

The Advance Directive is akin to the DPOA in that it encompasses the principal’s wishes regarding medical care and decision-making. While it often includes a Health Care Power of Attorney, it may also contain specific instructions about medical treatment preferences. This document helps ensure that the principal's desires are honored, particularly in cases where they are unable to communicate their wishes due to illness or injury.

For those looking to ensure a smooth transaction during the sale of their mobile home, understanding the particulars of a comprehensive Mobile Home Bill of Sale is essential. This document serves not only as evidence of the sale but also outlines crucial details like the sale price and the identities of the involved parties.

Lastly, the Guardianship document is similar to the DPOA in that both deal with decision-making on behalf of an individual. However, a Guardianship is typically established through a court process and is used when an individual is deemed unable to make decisions for themselves due to incapacity. In contrast, the DPOA is a proactive measure that allows individuals to select their agents without court intervention, thereby streamlining the decision-making process in times of need.

Other Common State-specific Durable Power of Attorney Templates

Durable Power of Attorney Paperwork - This form can be beneficial for older adults or individuals with health concerns.

A Quitclaim Deed is a legal document used in Alabama to transfer ownership of real estate from one party to another without any warranties. This form is often utilized in situations where the seller is not guaranteeing clear title to the property. For those looking to facilitate this process, you can access the Quitclaim Deed form to ensure a smooth transfer.

How to Get Power of Attorney in Ohio for Elderly Parent - The form helps maintain continuity in financial matters during illness or injury.

More About Arizona Durable Power of Attorney

What is a Durable Power of Attorney in Arizona?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. In Arizona, the term "durable" means that the authority granted to your agent continues even if you become incapacitated. This can cover financial matters, medical decisions, or both, depending on how the document is drafted.

How do I create a Durable Power of Attorney in Arizona?

To create a DPOA in Arizona, you need to fill out a specific form that meets state requirements. This form must be signed by you, the principal, and notarized or witnessed by at least one person. It’s important to choose a trustworthy agent, as they will have significant authority over your affairs. Once completed, the document should be kept in a safe place, and copies should be provided to your agent and relevant institutions.

Can I revoke a Durable Power of Attorney in Arizona?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that may have relied on the original DPOA. It’s advisable to also destroy any copies of the original document to prevent confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy, costly, and may not align with your personal wishes. Having a DPOA in place allows you to choose someone you trust to manage your affairs without court intervention.

Can I specify what powers my agent has in the Durable Power of Attorney?

Absolutely. In your Durable Power of Attorney, you can specify the powers you wish to grant your agent. This can include managing your finances, making medical decisions, or handling real estate transactions. You can also limit their authority by stating what they cannot do. Clearly outlining these powers helps ensure that your wishes are respected.

Dos and Don'ts

When filling out the Arizona Durable Power of Attorney form, it is important to follow certain guidelines to ensure that the document is valid and meets your needs. Here is a list of things you should and shouldn't do:

- Do ensure you are of sound mind when completing the form.

- Do clearly identify the agent you are appointing and their responsibilities.

- Do include specific powers you wish to grant to your agent.

- Do sign the document in the presence of a notary public.

- Don't leave any sections blank, as this may lead to confusion or misinterpretation.

- Don't use vague language that could create ambiguity about your intentions.

Following these guidelines will help ensure that your Durable Power of Attorney is effective and reflects your wishes accurately.

Arizona Durable Power of Attorney - Usage Steps

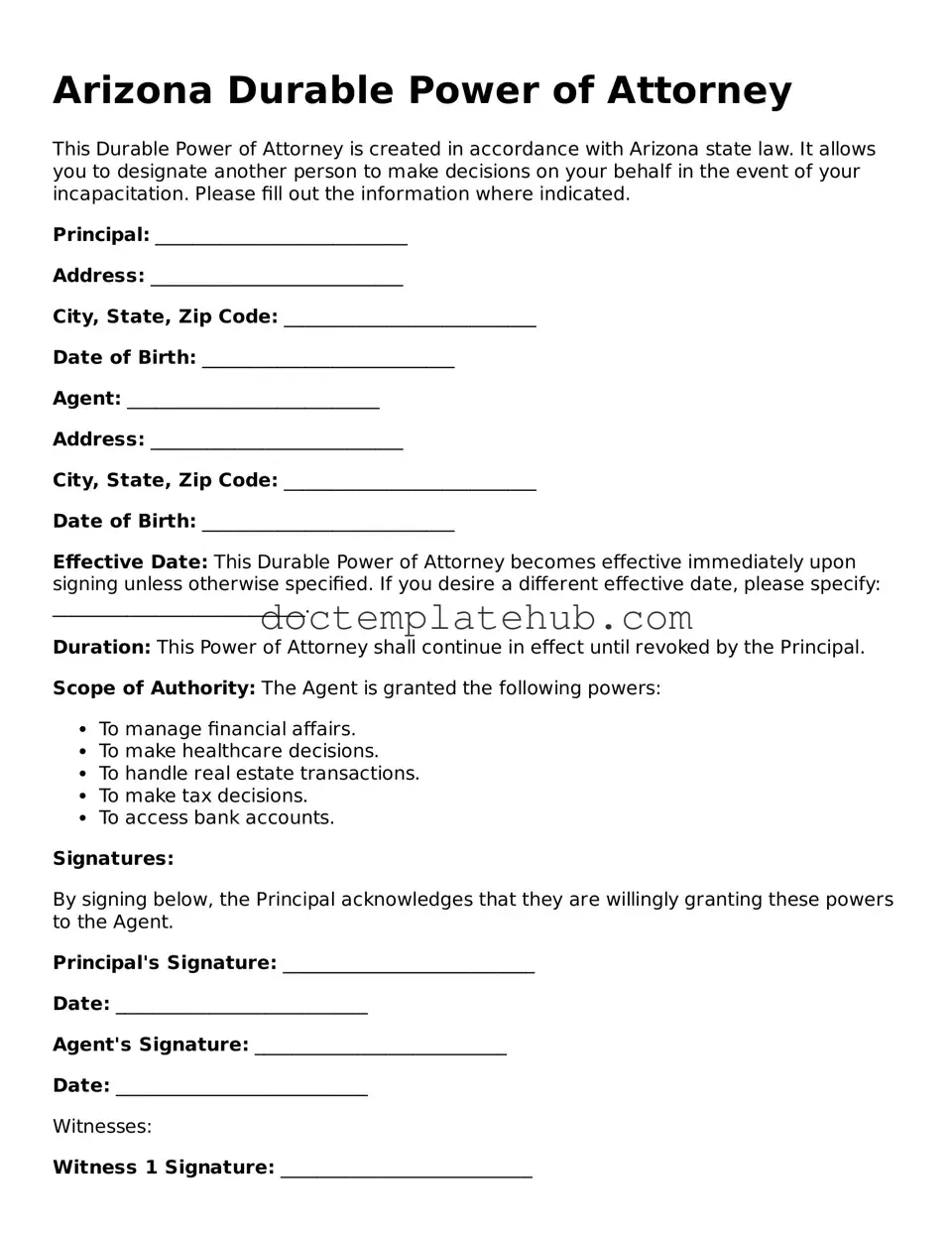

Filling out the Arizona Durable Power of Attorney form requires careful attention to detail. Once completed, this document will allow you to designate someone to make decisions on your behalf in case you become unable to do so. Follow these steps to ensure the form is filled out correctly.

- Obtain the Arizona Durable Power of Attorney form. You can find it online or at a local legal office.

- Read through the form carefully to understand all sections and requirements.

- In the first section, provide your full legal name and address. This identifies you as the principal.

- Next, designate your agent by writing their full legal name and address. This person will act on your behalf.

- Specify the powers you are granting to your agent. Be clear about what decisions they can make for you.

- If you wish to limit the duration of the power of attorney, indicate the specific time frame in the appropriate section.

- Sign and date the form in the designated area. Ensure your signature is consistent with your legal name.

- Have the form notarized. This step is essential for the document to be legally binding.

- Distribute copies of the completed form to your agent and any relevant parties, such as family members or healthcare providers.