Fillable Operating Agreement Template for Arizona State

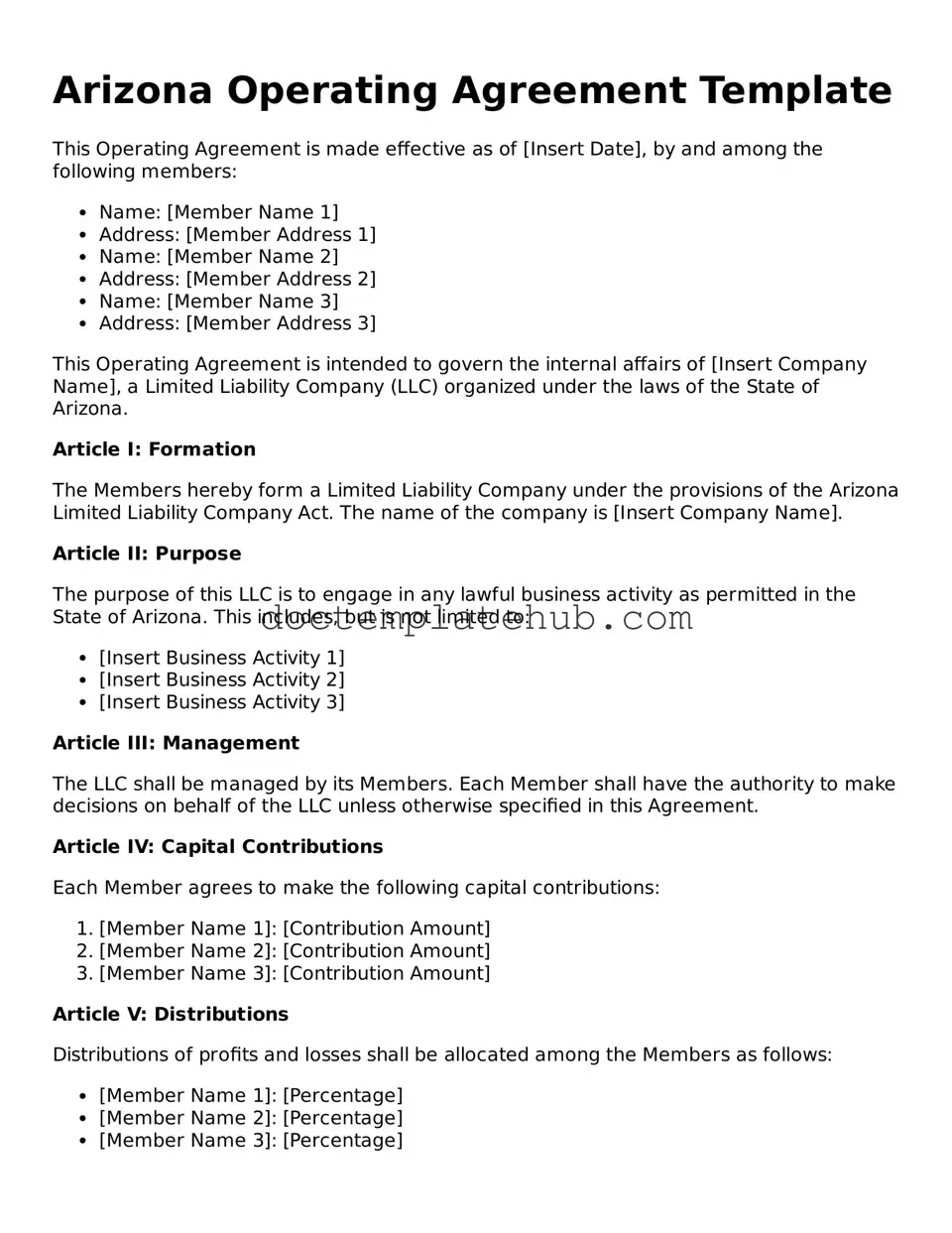

In the realm of business formation, particularly for Limited Liability Companies (LLCs) in Arizona, the Operating Agreement form serves as a crucial document that outlines the internal workings of the company. This agreement not only defines the roles and responsibilities of members but also establishes the procedures for decision-making, profit distribution, and dispute resolution. By clearly delineating these aspects, the Operating Agreement fosters transparency and helps prevent misunderstandings among members. Additionally, it addresses the management structure, whether the company will be member-managed or manager-managed, ensuring that everyone is on the same page regarding who has authority over day-to-day operations. The form also includes provisions for adding new members or handling the departure of existing ones, which is essential for maintaining the stability and continuity of the business. Overall, the Arizona Operating Agreement form is an indispensable tool that provides a solid foundation for any LLC, promoting clarity and cooperation among its members.

Similar forms

The Arizona Operating Agreement is similar to a Partnership Agreement. Both documents outline the roles, responsibilities, and rights of the parties involved. A Partnership Agreement is specifically designed for partnerships, detailing how profits and losses are shared among partners. In contrast, the Operating Agreement is tailored for limited liability companies (LLCs), but both serve to clarify expectations and prevent disputes among members or partners.

Another document comparable to the Arizona Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing how decisions are made, how meetings are conducted, and the rights of shareholders. Like an Operating Agreement, Bylaws establish clear guidelines for governance, ensuring that all parties understand their roles and the procedures that must be followed.

The Arizona Operating Agreement also resembles a Shareholders' Agreement. This document is used in corporations to outline the rights and obligations of shareholders. It addresses issues such as share transfers, voting rights, and dividend distribution. Similar to an Operating Agreement, it aims to protect the interests of all parties involved and provide a framework for resolving conflicts.

A Joint Venture Agreement is another document that shares similarities with the Arizona Operating Agreement. Both documents outline the terms of collaboration between parties for a specific project or purpose. A Joint Venture Agreement specifies how profits and losses will be shared, while an Operating Agreement focuses on the management structure and operational procedures of an LLC. Both agreements seek to establish clear expectations and responsibilities.

It is essential to understand that the procedures involved in filling out and submitting the Arizona Operating Agreement form can sometimes be complicated; therefore, resources such as documentonline.org/blank-edd-de-2501 can provide valuable guidance to ensure compliance and clarity in your business documentation process.

The LLC Membership Agreement is closely related to the Arizona Operating Agreement. This document serves to define the rights and obligations of LLC members. It typically includes provisions on capital contributions, profit sharing, and decision-making processes. Like the Operating Agreement, it is essential for establishing the operational framework of an LLC and ensuring all members are on the same page.

Another comparable document is the Operating Agreement for a Limited Partnership. This document governs limited partnerships, outlining the roles of general and limited partners. It details how profits are distributed and the management structure of the partnership. While the Arizona Operating Agreement is specific to LLCs, both documents serve to clarify the relationships and responsibilities of the parties involved.

The Franchise Agreement also shares some similarities with the Arizona Operating Agreement. This document outlines the relationship between a franchisor and a franchisee, detailing the rights and obligations of both parties. While the focus is different—franchising versus LLC management—the goal remains the same: to establish clear expectations and guidelines to prevent misunderstandings.

Finally, the Non-Disclosure Agreement (NDA) can be considered similar in purpose to the Arizona Operating Agreement, though it serves a different function. An NDA protects confidential information shared between parties. While the Operating Agreement focuses on governance and operational aspects, both documents aim to create a clear understanding between parties, thereby reducing the potential for disputes.

Other Common State-specific Operating Agreement Templates

Ohio Llc Operating Agreement Template - This document can set forth guidelines for managing the company's finances.

Creating a thorough and precise estate plan is essential, and utilizing the Texas Last Will and Testament form can greatly aid in this process. By clearly specifying the distribution of assets, this legal document helps prevent disputes among heirs and ensures the testator's wishes are respected. For additional resources and templates, you can visit smarttemplates.net, which provides valuable tools for preparing your will.

What Does an Operating Agreement Look Like for an Llc - This document can outline how to handle changes in membership due to death or incapacity.

More About Arizona Operating Agreement

What is an Arizona Operating Agreement?

An Arizona Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Arizona. This agreement is crucial for defining the roles and responsibilities of members, how profits and losses will be distributed, and the process for making decisions. While not required by law, having an Operating Agreement is highly recommended as it helps prevent misunderstandings and disputes among members.

Who should create an Operating Agreement?

Every LLC in Arizona, regardless of size or number of members, should create an Operating Agreement. This includes single-member LLCs. Even if you are the only owner, having a clear document can help establish your business as a separate legal entity and protect your personal assets. For multi-member LLCs, it is especially important to ensure that all members are on the same page regarding the management and operations of the business.

What key elements should be included in the Operating Agreement?

Your Arizona Operating Agreement should include several important elements. First, it should identify the members of the LLC and their ownership percentages. Next, it should outline the management structure, whether it is member-managed or manager-managed. Additionally, include provisions for how profits and losses will be allocated, how decisions will be made, and the process for adding or removing members. Lastly, consider including a section on dispute resolution to address any potential conflicts that may arise.

Can the Operating Agreement be changed after it is created?

Yes, the Operating Agreement can be amended after it is created. It is common for businesses to evolve, and changes may be necessary as the company grows. To make amendments, the process should be outlined in the original Operating Agreement. Typically, this involves obtaining the consent of all members or a specified percentage of members. Always document any changes in writing to maintain clarity and ensure that all members are aware of the new terms.

Dos and Don'ts

When filling out the Arizona Operating Agreement form, it's important to approach the process with care. Here are seven key dos and don'ts to consider:

- Do ensure that all members of the LLC are clearly identified.

- Do outline the management structure and decision-making processes.

- Do specify each member's ownership percentage.

- Do include provisions for resolving disputes among members.

- Don't leave any sections blank; provide information for every required field.

- Don't use ambiguous language that could lead to misunderstandings.

- Don't forget to review the agreement with all members before finalizing it.

Arizona Operating Agreement - Usage Steps

After obtaining the Arizona Operating Agreement form, you will need to complete it with specific details about your business and its members. This document outlines the management structure and operational procedures for your LLC. Follow the steps below to fill out the form accurately.

- Begin by entering the name of your LLC at the top of the form. Ensure it matches the name registered with the Arizona Corporation Commission.

- Provide the principal address of the LLC. This should be the main location where your business operates.

- List the names and addresses of all members involved in the LLC. Include their roles and any relevant contact information.

- Specify the purpose of the LLC. Describe the nature of the business and its intended activities.

- Outline the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail the financial contributions of each member. Include the amount of capital each member will contribute to the LLC.

- Include provisions for profit and loss distribution. Specify how profits and losses will be shared among members.

- Address any additional terms or conditions relevant to the operation of the LLC. This may include rules for meetings, voting rights, or procedures for adding new members.

- Review the document for accuracy and completeness. Ensure all necessary information has been provided.

- Have all members sign and date the agreement. Consider having it notarized for added legal validity.