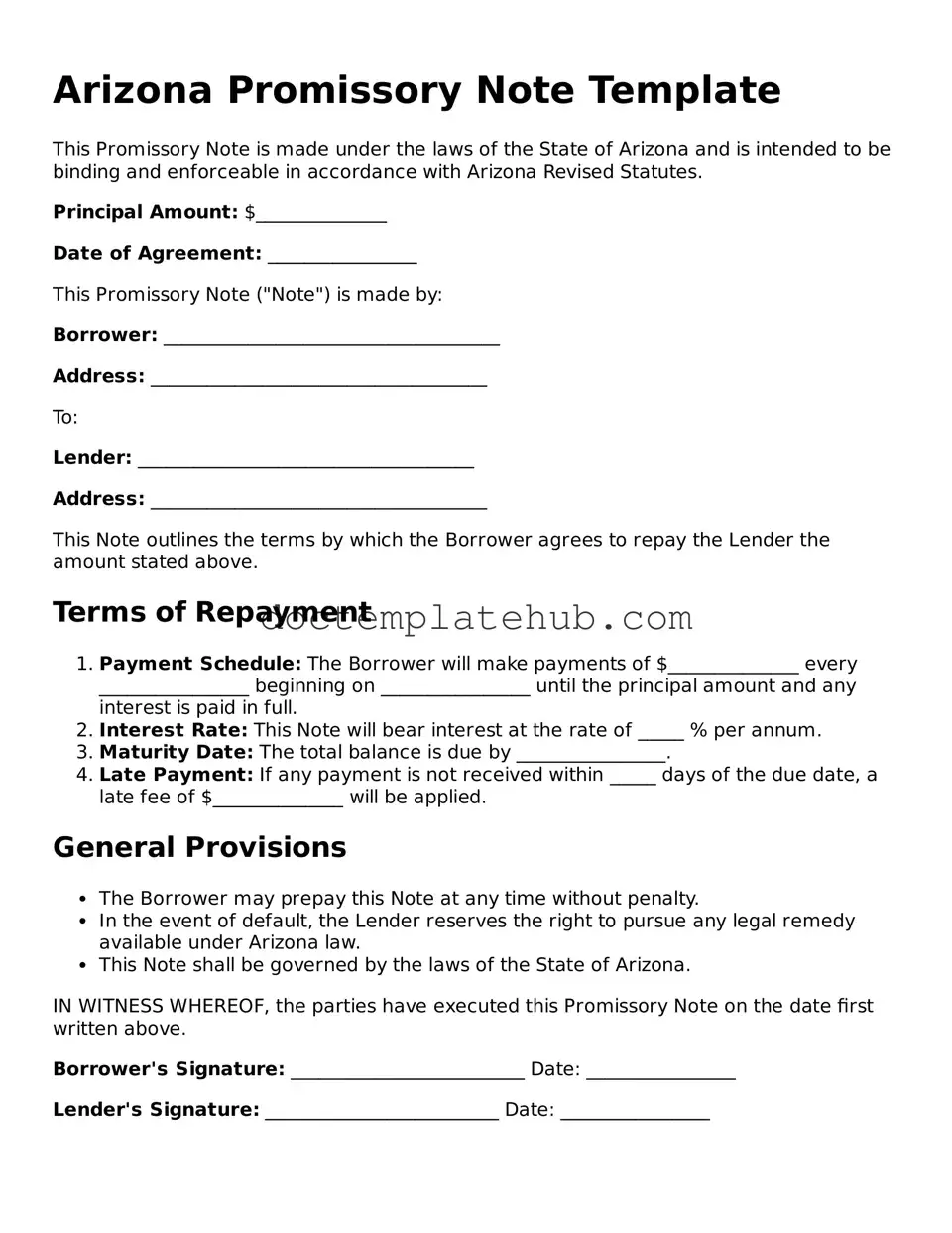

Fillable Promissory Note Template for Arizona State

The Arizona Promissory Note form serves as a crucial legal document for individuals or businesses that wish to formalize a loan agreement. This document outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. It provides clarity and protection for both the lender and borrower by detailing the obligations and rights of each party. By specifying whether the note is secured or unsecured, it helps to establish the level of risk involved. Additionally, the form may include provisions for late fees, default conditions, and any applicable state laws governing the agreement. Understanding the elements of this form is essential for anyone looking to engage in a lending transaction in Arizona, ensuring that all parties are aware of their responsibilities and the legal implications of their agreement.

Similar forms

The Arizona Promissory Note is similar to a Loan Agreement. Both documents serve as formal agreements between a lender and a borrower regarding the terms of a loan. A Loan Agreement outlines the amount borrowed, interest rates, repayment schedule, and other conditions. While a Promissory Note is often simpler and focuses primarily on the borrower's promise to repay, a Loan Agreement may include more detailed provisions and protections for both parties. This makes the Loan Agreement a more comprehensive document for larger or more complex loans.

Another document comparable to the Arizona Promissory Note is the Mortgage. A Mortgage secures a loan with real property, providing the lender with a legal claim to the property if the borrower defaults. While a Promissory Note indicates the borrower's commitment to repay the loan, the Mortgage provides the lender with collateral. This relationship between the two documents is crucial in real estate transactions, as the Promissory Note reflects the debt, and the Mortgage secures it.

The Arizona Promissory Note also bears similarities to an IOU. An IOU is a simple acknowledgment of a debt, often less formal than a Promissory Note. While an IOU may not include specific repayment terms, the Promissory Note details the obligations of the borrower, including payment amounts and due dates. Both documents signify that money is owed, but the Promissory Note offers more structure and legal enforceability, making it a stronger choice for formal lending situations.

A Credit Agreement is another document that shares features with the Arizona Promissory Note. A Credit Agreement typically outlines the terms under which a borrower can access a line of credit, including interest rates, fees, and repayment terms. Like a Promissory Note, it establishes the borrower's obligation to repay borrowed funds. However, a Credit Agreement often provides more flexibility, allowing borrowers to draw funds as needed, while a Promissory Note usually involves a fixed loan amount.

In the realm of business transactions, safeguarding sensitive information is paramount, and one effective tool is the New York Non-disclosure Agreement form, which operates similarly to various financial instruments. Just as they formalize relationships and responsibilities, this agreement fortifies the confidentiality of vital business data, highlighting the significance of protection in competitive markets. For those seeking to create such an agreement, resources such as smarttemplates.net provide invaluable assistance.

Lastly, a Secured Note is similar to the Arizona Promissory Note in that it involves a promise to repay a loan. However, a Secured Note is backed by collateral, which can be seized by the lender in case of default. This provides an additional layer of security for the lender compared to an unsecured Promissory Note. Both documents outline the borrower's commitment to repay, but the Secured Note offers protection for the lender through the collateral involved.

Other Common State-specific Promissory Note Templates

Promissory Note Template Florida Pdf - May include a clause for resolving disputes through mediation.

Promissory Note Georgia - It's important for borrowers to read and understand all terms before signing the note.

Obtaining the CDC U.S. Standard Certificate of Live Birth form is an important step for new parents, as it serves not only to document the details of their child's birth but also to facilitate access to essential services and benefits. For more information and to download the necessary form, you can visit documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth/.

Promissory Note Form California - Clear terms in the promissory note can enhance clarity in financial transactions.

Ohio Promissory Note Requirements - The terms of the note can be customized to meet the needs of both lender and borrower.

More About Arizona Promissory Note

What is a promissory note in Arizona?

A promissory note is a written promise to pay a specified amount of money to a designated party at a predetermined time or on demand. In Arizona, this document serves as a legal instrument that outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any penalties for late payments. It is essential for both lenders and borrowers, as it provides clarity and protection for both parties involved in a financial transaction.

What are the key components of an Arizona promissory note?

Every promissory note in Arizona should include several crucial elements. First, it must clearly identify the borrower and lender, including their names and addresses. Second, the note should specify the loan amount and the interest rate, if applicable. Additionally, it should outline the repayment terms, such as the payment schedule and due dates. Lastly, any provisions for default, prepayment, or late fees should be included to ensure that both parties understand their rights and obligations.

Do I need a lawyer to create a promissory note in Arizona?

While it is not legally required to have a lawyer draft a promissory note, consulting with one can be beneficial. A legal professional can ensure that the document complies with Arizona laws and adequately protects your interests. If the loan amount is significant or if the terms are complex, seeking legal advice can help prevent future disputes and ensure that all necessary provisions are included.

Can a promissory note be modified after it is signed?

Yes, a promissory note can be modified after it has been signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and the lender. This ensures that there is a clear record of the new terms and helps avoid misunderstandings down the line. Verbal agreements regarding modifications are generally not enforceable, so it is crucial to put any changes in writing.

What happens if a borrower defaults on a promissory note?

If a borrower defaults on a promissory note, the lender has several options. Typically, the lender may attempt to contact the borrower to discuss the situation and seek a resolution. If the borrower fails to respond or rectify the default, the lender may pursue legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. It is important for both parties to understand the consequences of default and to communicate openly to avoid escalation.

Is a promissory note enforceable in Arizona?

Yes, a properly executed promissory note is generally enforceable in Arizona. As long as the note meets the legal requirements and both parties have signed it, it can be upheld in a court of law. However, if there are issues such as fraud, duress, or a lack of capacity, the enforceability may be challenged. To strengthen the enforceability of a promissory note, it is advisable to keep thorough records of all communications and payments related to the loan.

Dos and Don'ts

When filling out the Arizona Promissory Note form, it is important to adhere to specific guidelines to ensure the document is valid and enforceable. Below is a list of things to do and avoid during this process.

- Do: Clearly state the loan amount in both numerical and written form.

- Do: Include the names and addresses of both the borrower and the lender.

- Do: Specify the interest rate and payment schedule in detail.

- Do: Sign and date the document in the presence of a witness or notary, if required.

- Don't: Leave any sections blank; fill out all required fields completely.

- Don't: Use ambiguous language; be clear and precise in your wording.

- Don't: Forget to keep a copy of the signed document for your records.

Following these guidelines will help ensure that the Promissory Note is properly executed and legally binding.

Arizona Promissory Note - Usage Steps

Once you have the Arizona Promissory Note form in hand, it’s time to fill it out accurately. Completing this form correctly is essential for establishing a clear agreement between the parties involved. Follow the steps below to ensure you fill out the form properly.

- Start by entering the date at the top of the form. This should be the date when the note is being signed.

- Next, fill in the name of the borrower. This is the person or entity who is receiving the loan.

- In the following section, enter the name of the lender. This is the individual or organization providing the loan.

- Specify the principal amount being borrowed. This is the total sum of money that the borrower will repay.

- Indicate the interest rate. Make sure to clearly state whether it is a fixed or variable rate.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Provide any additional terms or conditions that apply to the loan. This might include late fees or prepayment penalties.

- Both the borrower and lender should sign and date the form at the bottom. This confirms their agreement to the terms outlined in the note.

After completing the form, review it carefully to ensure all information is accurate. Both parties should keep a signed copy for their records. If any questions arise, consider consulting with a legal professional for clarification.