Fillable Quitclaim Deed Template for Arizona State

In Arizona, the Quitclaim Deed form serves as a vital legal instrument for transferring property rights between parties. It allows an individual, known as the grantor, to convey whatever interest they may have in a property to another party, referred to as the grantee, without making any guarantees about the title. This means that the grantor does not have to assure the grantee that the title is free from liens or encumbrances. Consequently, the Quitclaim Deed is often used in situations like transferring property between family members, settling divorce agreements, or clearing up title issues. To execute this form properly, both parties must sign it, and it typically requires notarization to ensure its validity. Once completed, the deed must be recorded with the county recorder's office to provide public notice of the ownership change. This process not only protects the interests of the grantee but also helps maintain an accurate public record of property ownership in Arizona.

Similar forms

A Warranty Deed serves a similar purpose to a Quitclaim Deed, as both are used to transfer property ownership. However, a Warranty Deed provides guarantees about the title. The grantor assures the grantee that they hold clear title to the property and have the right to sell it. This document also protects the buyer against future claims on the property, which is not a feature of a Quitclaim Deed.

Understanding various types of property deeds is essential for anyone involved in real estate transactions, as it helps clarify the rights and responsibilities of buyers and sellers. For instance, the smarttemplates.net resource can provide insights into how estate planning documents like the Texas Last Will and Testament play a critical role in the disposition of assets, similar to how different deeds operate within property transfers.

A Grant Deed is another document that shares similarities with a Quitclaim Deed. Like a Quitclaim Deed, a Grant Deed transfers ownership of real estate. However, a Grant Deed includes implied warranties that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This added protection makes it distinct from a Quitclaim Deed, which does not provide such assurances.

A Bargain and Sale Deed is also comparable to a Quitclaim Deed in that it transfers property ownership. However, it typically implies that the grantor has some interest in the property, even if it does not guarantee a clear title. This type of deed is often used in transactions where the seller may not be able to provide a warranty but still wants to convey their interest in the property.

An Executor’s Deed is similar to a Quitclaim Deed in that it transfers ownership of property, but it is specifically used in the context of estate administration. When a person passes away, the executor may use this deed to transfer property from the deceased’s estate to the heirs or beneficiaries. Unlike a Quitclaim Deed, an Executor’s Deed may carry certain legal implications regarding the estate’s liabilities.

A Trustee’s Deed is used when a property is held in a trust. This deed transfers property from the trust to a beneficiary or another party. While it serves a similar function to a Quitclaim Deed in terms of transferring ownership, a Trustee’s Deed may involve more complex legal considerations, particularly regarding the terms of the trust and the authority of the trustee.

A Deed of Trust is not a transfer of ownership like a Quitclaim Deed, but it is related to property transactions. It secures a loan by placing a lien on the property. In this document, the borrower conveys the property to a trustee, who holds it as security for the lender. This arrangement is distinct from a Quitclaim Deed, which does not involve any borrowing or securing of loans.

A Leasehold Deed conveys rights to use and occupy a property for a specific period. While it does not transfer ownership, it shares similarities with a Quitclaim Deed in that it can be used to transfer interests in real property. A Leasehold Deed may grant rights to tenants or lessees, whereas a Quitclaim Deed transfers ownership rights without any guarantees.

A Mineral Deed specifically transfers ownership of mineral rights associated with a property. While it is focused on a specific type of interest, it is similar to a Quitclaim Deed in that it can convey rights without warranties. This type of deed may be used when a seller wants to transfer rights to extract minerals from the land without transferring the surface ownership.

An Assignment of Lease is another document that shares some characteristics with a Quitclaim Deed. It transfers the lessee's interest in a lease to another party. While a Quitclaim Deed transfers ownership of real property, an Assignment of Lease allows the original lessee to relinquish their rights to the property temporarily or permanently, depending on the lease terms.

A Bill of Sale is similar in function to a Quitclaim Deed but is used for the transfer of personal property instead of real estate. This document provides a record of the transaction and can serve as proof of ownership. While both documents facilitate the transfer of rights, a Bill of Sale is specifically for movable items, whereas a Quitclaim Deed pertains to immovable property.

Other Common State-specific Quitclaim Deed Templates

What Is a Quit Claim Deed in Florida - A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another.

Knowing the significance of a well-drafted Prenuptial Agreement guide for couples can be pivotal in safeguarding individual interests in marriage. This legal document serves to delineate financial responsibilities and personal rights, thereby fostering transparency and mutual understanding before entering into the marriage commitment.

Georgia Deed Transfer Forms - The Quitclaim Deed is often used to add or remove a name from a title.

More About Arizona Quitclaim Deed

What is a Quitclaim Deed in Arizona?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties. In Arizona, this type of deed is commonly used between family members or in situations where the parties know each other well. The grantor (the person transferring the property) relinquishes any claim they have to the property, but does not guarantee that the title is clear or free of liens. This means the grantee (the person receiving the property) takes on the risk associated with the property’s title.

How do I complete an Arizona Quitclaim Deed?

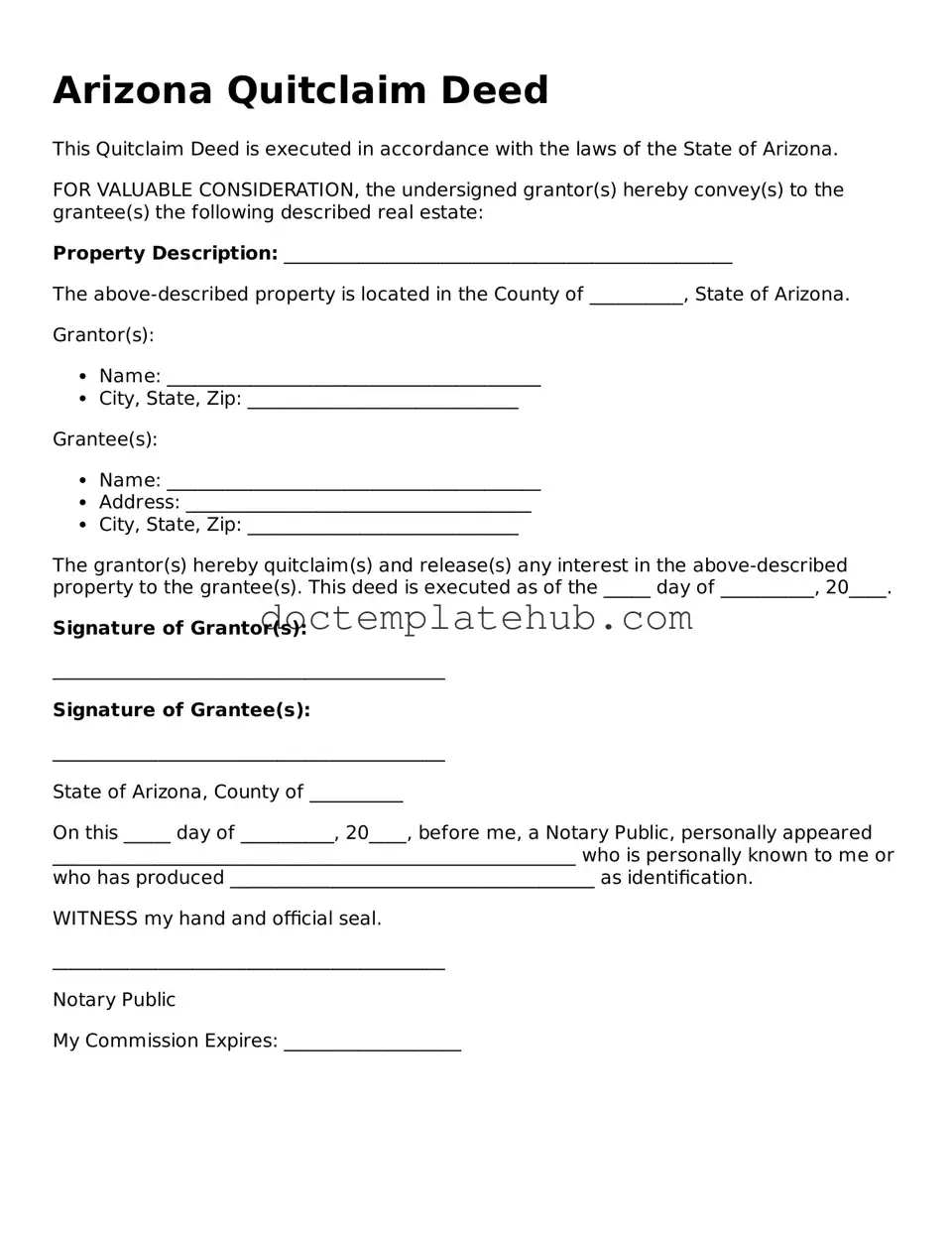

To complete a Quitclaim Deed in Arizona, you need to provide specific information. Start with the names and addresses of both the grantor and the grantee. Next, include a legal description of the property being transferred, which can usually be found on the property’s tax records. After filling out the form, both parties should sign it in front of a notary public. Finally, the deed must be recorded with the county recorder’s office where the property is located to make the transfer official.

Do I need an attorney to prepare a Quitclaim Deed in Arizona?

While it is not legally required to have an attorney prepare a Quitclaim Deed in Arizona, seeking legal advice can be beneficial. An attorney can ensure that the document is completed correctly and that all necessary information is included. They can also help clarify any potential issues related to the property’s title or any implications of the transfer. If the transaction is complex or involves significant value, consulting with a legal professional is advisable.

Are there any fees associated with filing a Quitclaim Deed in Arizona?

Yes, there are fees associated with filing a Quitclaim Deed in Arizona. The specific fee varies by county, but it typically ranges from $10 to $50. Additionally, if there are any taxes owed on the property or if the property is subject to transfer tax, those costs may apply as well. It’s important to check with the local county recorder’s office for the exact fee structure and any additional costs that may arise during the process.

What happens after I file a Quitclaim Deed?

Once a Quitclaim Deed is filed with the county recorder’s office, the transfer of ownership becomes public record. The grantee is now recognized as the new owner of the property. It is advisable for the grantee to obtain a copy of the recorded deed for their records. This document serves as proof of ownership and may be necessary for future transactions, such as selling the property or obtaining financing.

Can a Quitclaim Deed be revoked in Arizona?

In general, a Quitclaim Deed cannot be revoked once it has been executed and recorded. The transfer of ownership is considered final. However, if there are extenuating circumstances, such as fraud or undue influence, legal recourse may be available. In such cases, it is important to consult with a legal professional to explore options for challenging the deed or seeking remedies.

Dos and Don'ts

When filling out the Arizona Quitclaim Deed form, it is essential to approach the task with care. Here are some important things to do and avoid:

- Do ensure all names are spelled correctly. Accurate spelling is crucial to prevent any future legal issues.

- Do provide a complete legal description of the property. This description should be clear and specific to avoid confusion.

- Do sign the document in front of a notary. A notary's acknowledgment is necessary for the deed to be legally valid.

- Do keep a copy of the completed form for your records. This serves as proof of the transfer and can be important for future reference.

- Don’t leave any sections blank. Every part of the form must be filled out to ensure it is complete.

- Don’t use unclear or vague language. Be precise in your descriptions to avoid misunderstandings.

- Don’t forget to check local recording requirements. Each county may have specific rules regarding the submission of the deed.

- Don’t rush through the process. Take your time to ensure everything is accurate and properly executed.

Arizona Quitclaim Deed - Usage Steps

Once you have the Arizona Quitclaim Deed form, it’s important to fill it out accurately to ensure a smooth transfer of property. After completing the form, you will need to have it signed in front of a notary public before filing it with the county recorder's office.

- Begin by entering the name of the current owner (the grantor) at the top of the form.

- Next, provide the name of the person receiving the property (the grantee).

- Include the address of the property being transferred. This should be as detailed as possible, including the street number, street name, city, and ZIP code.

- Describe the property by providing the legal description. This information can usually be found on the current deed or property tax records.

- Fill in the date of the transfer. This is the date when the deed is being executed.

- Sign the form in the designated area. The grantor must sign the deed.

- Have the signature notarized. A notary public will verify the identity of the grantor and witness the signing.

- Once notarized, make copies of the completed deed for your records.

- Finally, file the original Quitclaim Deed with the county recorder's office in the county where the property is located.