Fillable Transfer-on-Death Deed Template for Arizona State

In the realm of estate planning, the Arizona Transfer-on-Death Deed (TOD) offers a streamlined approach to transferring real property upon the death of the owner. This legal tool allows property owners to designate beneficiaries who will automatically receive the property without the need for probate, simplifying the transition and reducing potential legal complications. The form itself requires specific information, including the names of the property owner and the beneficiaries, as well as a clear description of the property being transferred. Importantly, the deed must be signed and recorded with the county recorder's office to be valid. Arizona law provides flexibility, allowing property owners to revoke or amend the deed at any time during their lifetime, ensuring that their estate planning remains adaptable to changing circumstances. By utilizing the Transfer-on-Death Deed, individuals can maintain control over their property while providing peace of mind to their loved ones, making it a valuable option for many Arizona residents.

Similar forms

The Arizona Transfer-on-Death Deed (TOD) form is similar to a Last Will and Testament in that both documents allow individuals to specify how their assets will be distributed after their death. However, while a will goes through probate—a legal process that can be time-consuming and costly—the TOD deed allows for a more straightforward transfer of property directly to the designated beneficiaries without the need for probate. This can provide a more efficient and less burdensome way for heirs to receive their inheritance.

Another document akin to the TOD deed is the Revocable Living Trust. Like the TOD, a revocable living trust allows property to be transferred outside of probate. The key difference lies in the management of the assets during the grantor's lifetime. A living trust can hold a variety of assets and allows the grantor to maintain control over them while they are alive. Upon the grantor's death, the assets in the trust are distributed according to the terms set forth in the trust document, making it a flexible option for estate planning.

The Beneficiary Designation form is another document that shares similarities with the TOD deed. This form is often used for financial accounts, retirement plans, and insurance policies, allowing individuals to name beneficiaries who will receive the assets upon their death. Like the TOD deed, this form bypasses probate, ensuring that the assets are transferred directly to the named beneficiaries. This streamlined process can be beneficial for individuals looking to simplify their estate management.

A Payable-on-Death (POD) account is also similar to the TOD deed. A POD account allows individuals to designate a beneficiary who will receive the funds in the account upon the account holder's death. This arrangement avoids probate, enabling the beneficiary to access the funds quickly and easily. Both the POD account and the TOD deed serve to facilitate direct transfers of assets to heirs, enhancing efficiency in estate planning.

The Joint Tenancy with Right of Survivorship agreement shares characteristics with the TOD deed as well. In this arrangement, two or more individuals hold title to property together, and upon the death of one owner, the surviving owner automatically inherits the deceased owner's share. This mechanism allows for a seamless transfer of ownership, similar to how a TOD deed operates, ensuring that the property does not enter probate.

For those looking to rent a property, understanding the intricacies of the rental process is key. A crucial resource in this endeavor is the comprehensive New York Rental Application form, which gathers vital information required by landlords to evaluate potential tenants effectively.

The Life Estate Deed is another document that functions similarly to the TOD deed. This deed allows a property owner to transfer ownership to another person while retaining the right to live in the property during their lifetime. Upon the death of the life tenant, the property automatically passes to the remainderman without going through probate. This arrangement ensures that the property is managed according to the owner's wishes while providing a clear path for transfer after death.

The Durable Power of Attorney for Healthcare is related in that it allows individuals to designate someone to make healthcare decisions on their behalf if they become incapacitated. While it does not directly deal with property transfer, it ensures that an individual's wishes regarding medical treatment are honored, similar to how a TOD deed ensures that property is transferred according to the owner's wishes. Both documents empower individuals to make decisions about their future and provide clarity to their loved ones.

The Durable Power of Attorney for Finances also resembles the TOD deed in that it allows individuals to appoint someone to manage their financial affairs if they become unable to do so themselves. While the TOD deed focuses on property transfer after death, the Durable Power of Attorney ensures that financial matters are handled according to the individual's preferences during their lifetime. Both documents aim to simplify complex situations and provide peace of mind to individuals and their families.

Lastly, the Community Property Agreement is similar to the TOD deed in that it addresses the distribution of property between spouses. This agreement allows couples to opt for community property status, meaning that upon the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share of the community property. Like the TOD deed, this arrangement bypasses probate, ensuring a smoother transition of ownership and minimizing potential disputes.

Other Common State-specific Transfer-on-Death Deed Templates

Transfer on Death Deed Georgia - As life circumstances change, property owners can update this deed to reflect current relationships and wishes.

When completing the USCIS I-134 form, it is essential to have the necessary information and resources at hand to ensure accuracy and compliance. For those looking for guidance on filling out this important document, resources like smarttemplates.net provide valuable templates and support to help sponsors navigate the process effectively.

Tod in California - This option is available in many states, making it widely accessible.

More About Arizona Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TOD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon their death. This deed enables property owners to bypass the probate process, making the transfer of property more straightforward and efficient. It is important to note that the property owner retains full control of the property during their lifetime, and they can revoke or change the deed at any time before their death.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Arizona can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it is essential that the property is solely owned or that all co-owners agree to the transfer. Additionally, the beneficiary must be a person or an entity that can legally hold property, such as a family member, friend, or trust.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which is available through the Arizona Secretary of State’s website or local county recorder’s office. The form requires the property owner's name, the description of the property, and the beneficiary's name. Once completed, the deed must be signed in front of a notary public and recorded with the county recorder’s office where the property is located. Recording the deed is crucial, as it ensures the transfer is legally recognized.

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time before your death. To do so, you must create a new deed that explicitly revokes the previous one or file a revocation form with the county recorder’s office. It is advisable to keep all documents organized and to inform your beneficiaries of any changes to avoid confusion in the future.

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the Transfer-on-Death Deed will not automatically transfer to that beneficiary's heirs. Instead, the property will remain part of your estate and can be transferred to another beneficiary through a new deed. It is wise to consider naming an alternate beneficiary in the deed to ensure a smooth transition of ownership.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property is not considered a gift during your lifetime, so you do not incur gift taxes. However, the property may be subject to estate taxes upon your death, depending on the total value of your estate. It is advisable to consult with a tax professional to understand any potential tax consequences related to your specific situation.

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure accuracy and legality. Here are some key dos and don'ts to consider:

- Do ensure that you are eligible to use the Transfer-on-Death Deed by confirming that you own the property in question.

- Do provide clear and accurate information about the property, including the legal description and address.

- Do sign the form in the presence of a notary public to validate the document.

- Do keep a copy of the completed form for your records after filing it with the county recorder.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to check for any specific local requirements or additional documents needed when filing.

Arizona Transfer-on-Death Deed - Usage Steps

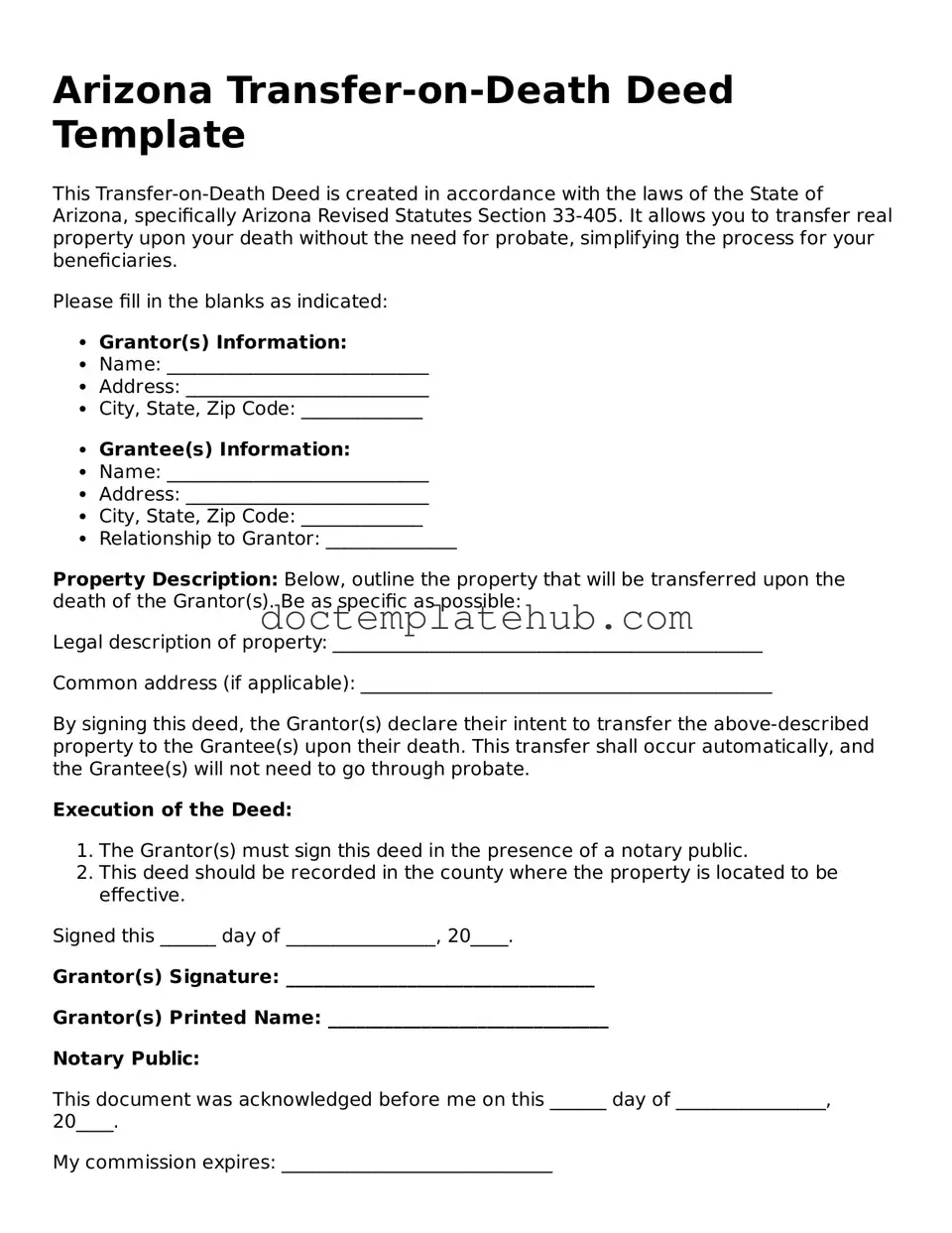

After obtaining the Arizona Transfer-on-Death Deed form, you will need to carefully complete it to ensure that your wishes regarding property transfer are clearly documented. Follow these steps to fill out the form accurately.

- Begin by entering the name of the property owner. This should be the person who currently holds the title to the property.

- Next, provide the address of the property. Make sure to include the complete street address, city, and ZIP code.

- Indicate the legal description of the property. This information can typically be found on your property deed or tax records.

- Designate the beneficiary or beneficiaries. Include their full names and, if applicable, their relationship to you.

- Specify whether the transfer is to be made to multiple beneficiaries. If so, clarify how the property will be divided among them.

- Sign the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document to validate it.

- Finally, file the completed form with the county recorder's office in the county where the property is located. This step is crucial for the deed to take effect.

Once the form is filed, it will be recorded in public records, making your intentions clear and legally binding. It's important to keep a copy for your own records as well.