Official Articles of Incorporation Form

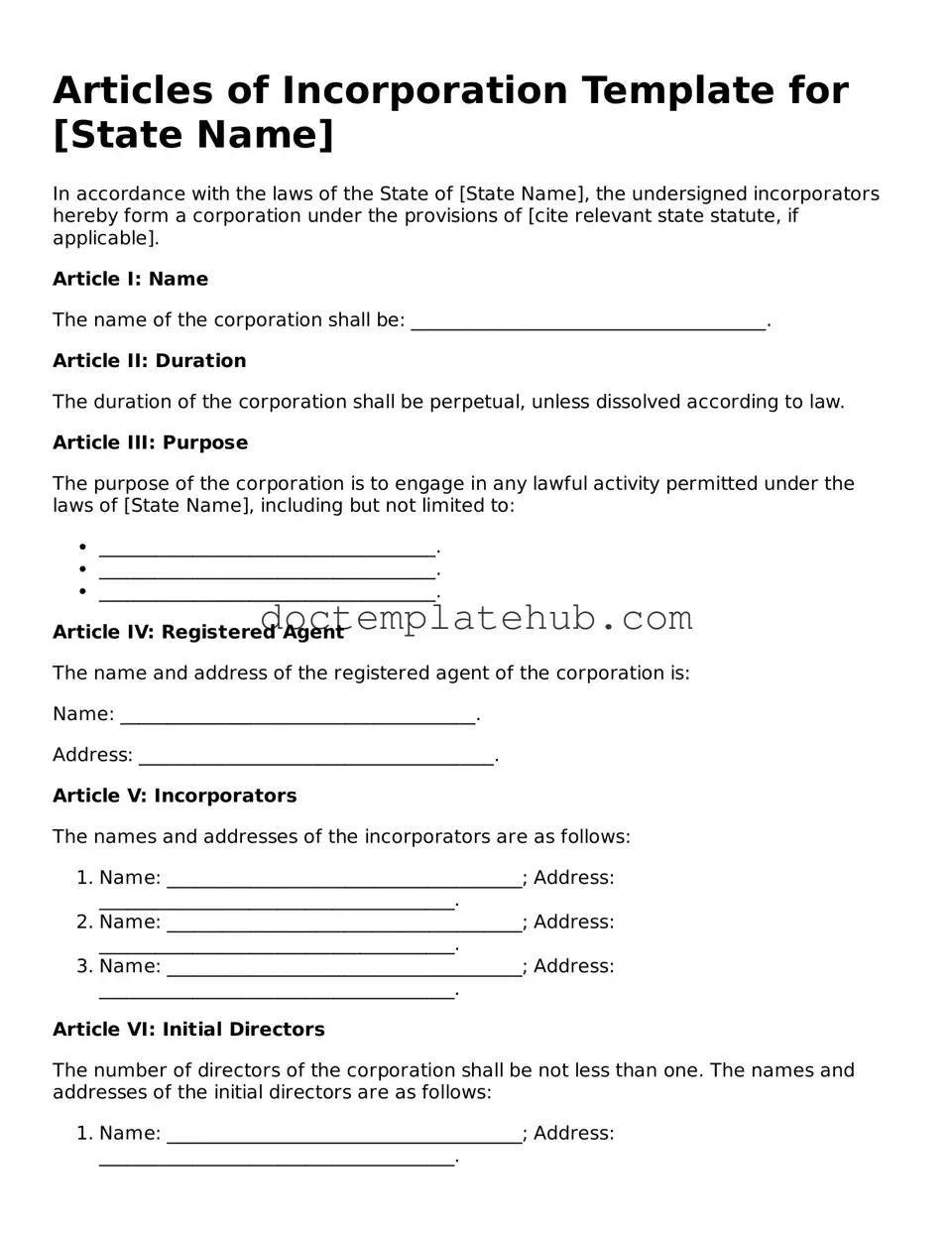

The Articles of Incorporation form serves as a crucial document for anyone looking to establish a corporation in the United States. This form lays the groundwork for the business entity by outlining essential details such as the corporation's name, its purpose, and the address of its principal office. Additionally, it specifies the number of shares the corporation is authorized to issue, which is vital for potential investors and stakeholders. The form also requires information about the registered agent, who will act as the point of contact for legal matters. By providing a clear structure, the Articles of Incorporation help ensure compliance with state laws and regulations, paving the way for the corporation to operate legally. Understanding the components of this form is essential for business owners, as it not only reflects the organization's identity but also influences its governance and operational framework.

Similar forms

The Articles of Incorporation form is often compared to a business plan, which outlines a company’s goals, strategies, and the means to achieve them. While the Articles serve as a formal declaration to establish a corporation, the business plan provides a roadmap for its operations and future growth. Both documents are essential in guiding the company’s direction, but they differ in their purpose and level of detail. The Articles of Incorporation are required for legal recognition, whereas a business plan is typically used for internal planning or securing financing.

Another document similar to the Articles of Incorporation is the Operating Agreement. This document is crucial for limited liability companies (LLCs) and outlines the management structure, roles, and responsibilities of members. Like the Articles, the Operating Agreement is foundational for establishing the entity’s legal framework, but it focuses more on internal governance rather than external recognition. Both documents help clarify the organization’s structure and can prevent future disputes among members or shareholders.

The Bylaws of a corporation also share similarities with the Articles of Incorporation. Bylaws detail the rules and procedures for managing the corporation, including how meetings are conducted and how decisions are made. While the Articles provide the basic information needed to form the corporation, the Bylaws serve as an internal manual for its operation. Both documents are vital for ensuring that the corporation functions smoothly and adheres to legal requirements.

Corporate resolutions are another document that bears resemblance to the Articles of Incorporation. These resolutions are formal decisions made by the board of directors or shareholders regarding significant actions, such as approving contracts or appointing officers. While the Articles establish the corporation’s existence, resolutions guide its day-to-day operations and strategic decisions. Both documents reflect the governance of the entity and are essential for maintaining compliance with state laws.

The Certificate of Formation is closely related to the Articles of Incorporation, particularly in states that use this term. This document serves a similar purpose by formally creating a corporation and providing essential information about its structure. While the terminology may differ, the underlying function of establishing a legal entity is the same. Both documents must be filed with the appropriate state authority to achieve legal recognition.

Another comparable document is the Statement of Information, which is often required in addition to the Articles of Incorporation. This document provides updated information about the corporation, such as its address, officers, and registered agent. While the Articles are filed at the time of incorporation, the Statement of Information is typically submitted periodically to keep the state informed. Both documents play a crucial role in maintaining transparency and compliance with state regulations.

Understanding the various legal documents required for incorporation is essential for successfully establishing a business. Among these, the Durable Power of Attorney form can be critical in ensuring that decision-making authority is clearly defined, especially if the business owner becomes incapacitated. For more details on completing this important document, you can visit smarttemplates.net.

The Partnership Agreement shares some similarities with the Articles of Incorporation, particularly when comparing business structures. This agreement outlines the terms of a partnership, including the roles and responsibilities of each partner. While the Articles establish a corporation, the Partnership Agreement serves a similar purpose for partnerships by defining how the business will operate. Both documents are essential for preventing misunderstandings and ensuring that all parties are on the same page regarding their rights and obligations.

The Shareholder Agreement is another document that is akin to the Articles of Incorporation. This agreement outlines the rights and responsibilities of shareholders within a corporation. While the Articles define the corporation’s existence and structure, the Shareholder Agreement focuses on the relationships among shareholders. Both documents are integral to ensuring that the corporation operates smoothly and that shareholders understand their rights and obligations.

Finally, the Tax Identification Number (TIN) application, while not a formal incorporation document, is essential for a corporation’s operation. The TIN is required for tax purposes and must be obtained once the Articles of Incorporation are filed. While the Articles establish the corporation, the TIN enables it to conduct business legally and fulfill its tax obligations. Both documents are crucial for ensuring compliance with federal and state regulations.

Common Forms

Letter of Intent for Business - It can be an important step in formalizing business relationships.

The California Trailer Bill of Sale form serves as a legal document that records the sale and transfer of ownership of a trailer in California. This form is essential for both buyers and sellers, as it helps ensure a smooth transaction and provides proof of ownership. For more detailed information, you can refer to the https://documentonline.org/blank-california-trailer-bill-of-sale, which outlines the necessary components that can simplify the buying or selling process significantly.

Download D1 Form Pdf - Be mindful that random checks will occur to verify the accuracy of signatures on your photograph.

T47 Affidavit - Submitting a completed T-47 can provide peace of mind to both parties involved in a transaction.

More About Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the United States. They outline essential information about the corporation, including its name, purpose, and the number of shares it is authorized to issue. This document is filed with the state government to officially create the corporation.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is necessary to legally form a corporation. This process provides your business with a distinct legal identity, which can protect personal assets from business liabilities. Additionally, it may be required to obtain business licenses and permits, open a corporate bank account, and attract investors.

What information is typically included in the Articles of Incorporation?

Common information found in Articles of Incorporation includes the corporation's name, its principal office address, the purpose of the corporation, the number of shares authorized, and the names and addresses of the incorporators. Some states may require additional details, such as the registered agent's name and address.

How do I file Articles of Incorporation?

To file Articles of Incorporation, you must complete the appropriate form provided by your state’s Secretary of State or equivalent agency. After filling out the form, submit it along with the required filing fee. This can often be done online, by mail, or in person, depending on the state.

What is the cost associated with filing Articles of Incorporation?

The cost to file Articles of Incorporation varies by state. Fees can range from $50 to several hundred dollars. It's essential to check with your state’s Secretary of State website for the specific amount and any additional fees that may apply.

How long does it take for Articles of Incorporation to be processed?

Processing times for Articles of Incorporation can vary significantly. Some states offer expedited services that can process filings within a few days, while standard processing may take several weeks. Checking your state’s website will provide the most accurate timeframe.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation if changes are necessary. This process typically involves filing an amendment form with the state and paying a fee. Common reasons for amendments include changes in the corporation's name, purpose, or share structure.

Do I need a lawyer to file Articles of Incorporation?

While it is not legally required to have a lawyer, consulting with one can be beneficial. A legal professional can help ensure that the Articles of Incorporation are completed accurately and in compliance with state laws, which can prevent issues down the line.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation from the state. Following this, you should set up corporate bylaws, hold an initial board meeting, and obtain any necessary business licenses or permits.

Dos and Don'ts

When filling out the Articles of Incorporation form, it is essential to approach the task with care. Here are five important dos and don'ts to keep in mind:

- Do provide accurate and complete information. Ensure that all details, such as the business name and address, are correct.

- Do check the specific requirements for your state. Each state may have different rules regarding the Articles of Incorporation.

- Do include the purpose of your corporation. Clearly state what your business will do to avoid any confusion.

- Don't use a name that is already taken. Conduct a name search to ensure your chosen name is unique and complies with state regulations.

- Don't rush the process. Take your time to review the form thoroughly before submitting it to prevent mistakes.

Articles of Incorporation - Usage Steps

Once you have the Articles of Incorporation form, it’s important to fill it out accurately. This form is essential for officially establishing your corporation. After completing the form, you will need to submit it to the appropriate state agency along with any required fees.

- Begin by entering the name of your corporation. Ensure it complies with your state’s naming rules.

- Provide the principal office address. This is where official correspondence will be sent.

- List the purpose of your corporation. Be clear and concise about what your business will do.

- Indicate the duration of your corporation. Most corporations are set up to exist indefinitely unless stated otherwise.

- Fill in the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Include the number of shares your corporation is authorized to issue, along with the par value of those shares.

- Provide the names and addresses of the incorporators. These individuals are responsible for setting up the corporation.

- Sign and date the form. Ensure that all incorporators have signed if required by your state.