Fill Your Auto Insurance Card Form

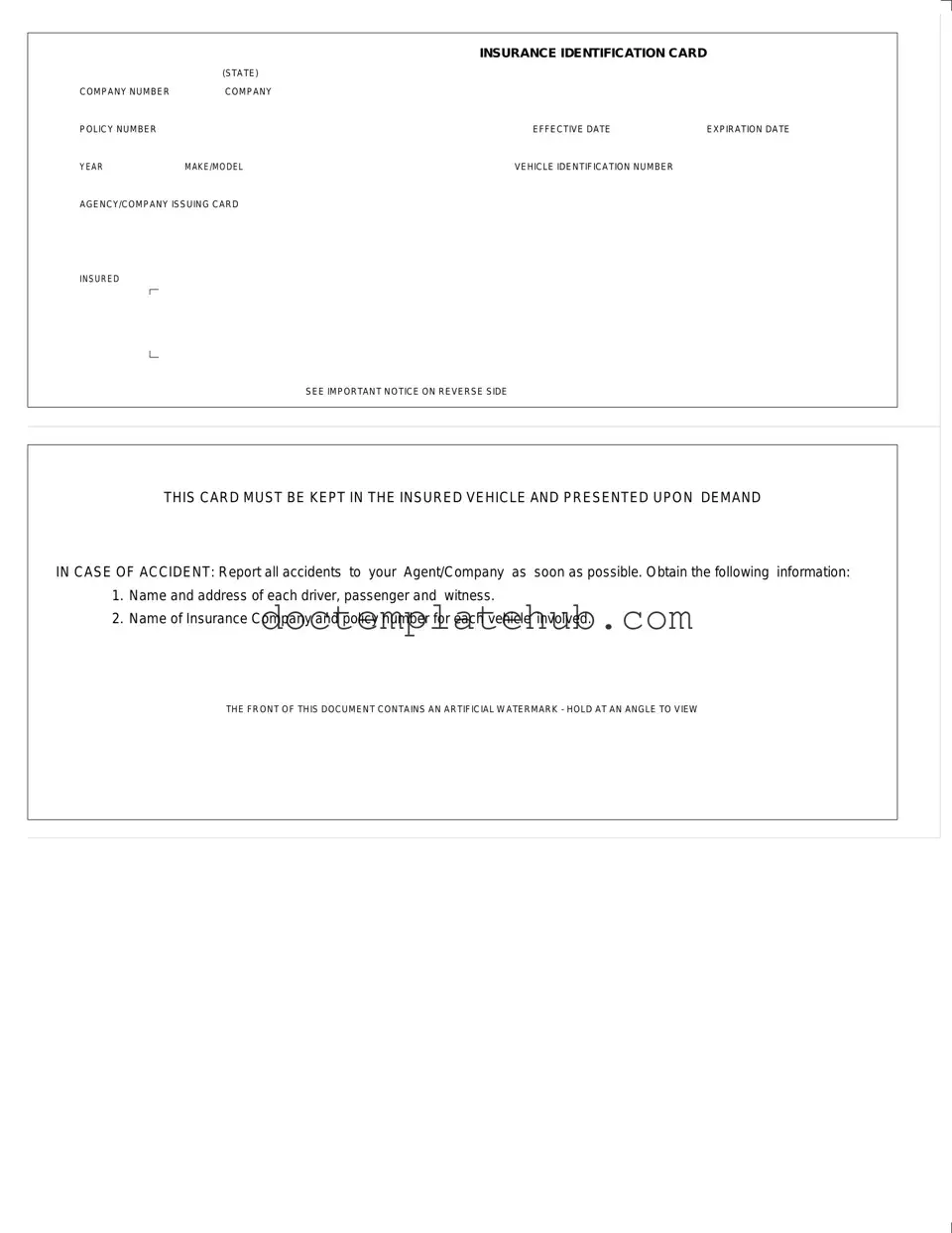

The Auto Insurance Card is a crucial document for vehicle owners, serving as proof of insurance coverage while on the road. This card includes essential information such as the insurance company’s identification number, the policy number, and the effective and expiration dates of the coverage. Additionally, it provides details about the insured vehicle, including the year, make, model, and vehicle identification number (VIN). The card is issued by the insurance agency or company and must be kept in the insured vehicle at all times. In the event of an accident, it is imperative that the card is presented upon demand. Furthermore, the card contains an important notice that emphasizes the necessity of reporting all accidents to the insurance agent or company promptly. Collecting information from all parties involved, including names and addresses of drivers, passengers, and witnesses, is also advised. Notably, the front of the card features an artificial watermark, which can be viewed by holding the card at an angle, adding an extra layer of security to this vital document.

Similar forms

The Auto Insurance Card is similar to a Vehicle Registration Document. Both documents serve as proof of ownership and compliance with state regulations. While the Auto Insurance Card verifies that a vehicle is insured, the Vehicle Registration Document confirms that the vehicle is registered with the state. Drivers must carry both documents in their vehicles to demonstrate legal compliance during traffic stops or accidents. The Vehicle Registration Document typically includes the owner’s name, vehicle identification number, and registration expiration date, similar to how the Auto Insurance Card lists the policy details and effective dates.

Another document akin to the Auto Insurance Card is the Proof of Insurance Certificate. This certificate is often provided by the insurance company and serves as a temporary or permanent proof of coverage. Like the Auto Insurance Card, it contains essential information such as the policy number, the insured vehicle's details, and the coverage period. While the Auto Insurance Card is usually required to be kept in the vehicle, the Proof of Insurance Certificate can be presented digitally or in print, depending on state laws.

The Accident Report Form is also comparable to the Auto Insurance Card, as both documents are crucial in the event of an accident. The Accident Report Form is filled out by drivers involved in a collision and includes details such as the names of all parties, vehicle information, and insurance details. Just like the Auto Insurance Card, this form helps facilitate communication between insurance companies and assists in claims processing. Both documents emphasize the importance of gathering information immediately after an incident.

Next, the Driver’s License shares similarities with the Auto Insurance Card in that both are essential documents for operating a vehicle legally. The Driver’s License verifies that an individual is authorized to drive, while the Auto Insurance Card confirms that the vehicle is insured. Both documents must be presented during traffic stops or when requested by law enforcement. They are often required to be kept in the vehicle to ensure compliance with state laws.

The Title Document is another important paper that resembles the Auto Insurance Card. The Title serves as legal proof of ownership of a vehicle, while the Auto Insurance Card proves that the vehicle is insured. Both documents contain critical information such as the vehicle identification number and the owner's details. When buying or selling a vehicle, both the Title and the Auto Insurance Card are essential for ensuring a smooth transaction and legal compliance.

In Alabama, understanding the legal documents involved in property transactions is crucial, especially when it comes to transferring ownership. One of the primary documents used for this purpose is the Quitclaim Deed form, which allows for the transfer of real estate without any warranties or guarantees about the title's validity, making it essential for parties looking to convey property ownership in a straightforward manner.

In addition, the Registration Renewal Notice is similar to the Auto Insurance Card, as both require timely attention from vehicle owners. The Registration Renewal Notice reminds owners to renew their vehicle registration, while the Auto Insurance Card must be updated when the insurance policy changes. Both documents serve as reminders of the ongoing responsibilities of vehicle ownership and help avoid penalties for non-compliance.

The Rental Car Agreement is also comparable to the Auto Insurance Card, particularly when renting a vehicle. This agreement outlines the terms of the rental, including insurance coverage options. Like the Auto Insurance Card, it contains vital information about the vehicle and the rental company. It is essential to review this document to ensure adequate coverage during the rental period, similar to how one would check the Auto Insurance Card for current policy details.

Lastly, the Certificate of Financial Responsibility is akin to the Auto Insurance Card, especially in states that require proof of financial responsibility. This certificate demonstrates that a driver can cover costs related to accidents or damages. While the Auto Insurance Card provides proof of insurance, the Certificate of Financial Responsibility may be required in situations where a driver has had their insurance lapse or has been involved in multiple accidents. Both documents are crucial for ensuring that drivers meet legal requirements and can handle financial obligations related to vehicle operation.

Other PDF Templates

Get License Online - Organ and tissue donation can be selected as part of the application process.

In addition to outlining the obligations of confidentiality, the Utah Non-disclosure Agreement form can be easily accessed and customized through various online platforms, such as smarttemplates.net, making it a practical choice for those looking to ensure their sensitive information is protected.

International Driver License Aaa - The Aaa International Driving Permit Application ensures that applicants meet safety and legal requirements internationally.

Irs Transcripts - Any prior year minimum tax credits that might apply are also included in the summary.

More About Auto Insurance Card

What information is included on the Auto Insurance Card?

The Auto Insurance Card contains essential details such as the insurance identification card number, company number, policy number, effective date, and expiration date. Additionally, it lists the year, make, and model of the insured vehicle, along with the vehicle identification number (VIN). The agency or company issuing the card is also identified. This information is crucial for verifying coverage in the event of an accident.

Why is it important to keep the Auto Insurance Card in the vehicle?

Keeping the Auto Insurance Card in the vehicle is vital because it serves as proof of insurance. In case of an accident, law enforcement or other parties involved may request to see this card. Not having it readily available can lead to complications, including fines or penalties. Therefore, having it on hand ensures compliance with state laws and helps facilitate the claims process.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card. It’s important to obtain a new card as soon as possible to ensure you have proof of insurance when driving. Most companies can provide a digital version as well, which can be stored on your smartphone for convenience.

What steps should I take if I'm involved in an accident?

In the event of an accident, first, ensure everyone's safety. Then, report the accident to your insurance agent or company as soon as possible. Gather important information, including the names and addresses of all drivers, passengers, and witnesses involved. Also, note the insurance company names and policy numbers for each vehicle. This information will be essential for processing your claim effectively.

Dos and Don'ts

When filling out the Auto Insurance Card form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure all information is accurate and complete. Double-check your entries for any typos or missing details.

- Do keep a copy of the filled form for your records. This can be helpful in case of any discrepancies later.

- Don't leave any fields blank. If a particular section does not apply, write "N/A" instead of skipping it.

- Don't ignore the important notice on the reverse side. It contains valuable instructions regarding what to do in case of an accident.

By following these guidelines, you can ensure that your Auto Insurance Card form is filled out correctly and efficiently.

Auto Insurance Card - Usage Steps

After gathering your necessary information, you are ready to fill out the Auto Insurance Card form. This card is essential for proving your insurance coverage while driving. Follow these steps carefully to ensure all details are accurate.

- Locate the INSURANCE IDENTIFICATION CARD (STATE) section at the top of the form.

- Fill in the COMPANY NUMBER provided by your insurance company.

- Enter your COMPANY POLICY NUMBER in the designated space.

- Write the EFFECTIVE DATE of your policy.

- Indicate the EXPIRATION DATE of your policy.

- Provide the YEAR, MAKE/MODEL, and VEHICLE IDENTIFICATION NUMBER (VIN) of your vehicle.

- Fill in the name of the AGENCY/COMPANY ISSUING CARD.

- Review all entered information for accuracy.

- Keep the card in your vehicle as required.