Fill Your Broker Price Opinion Form

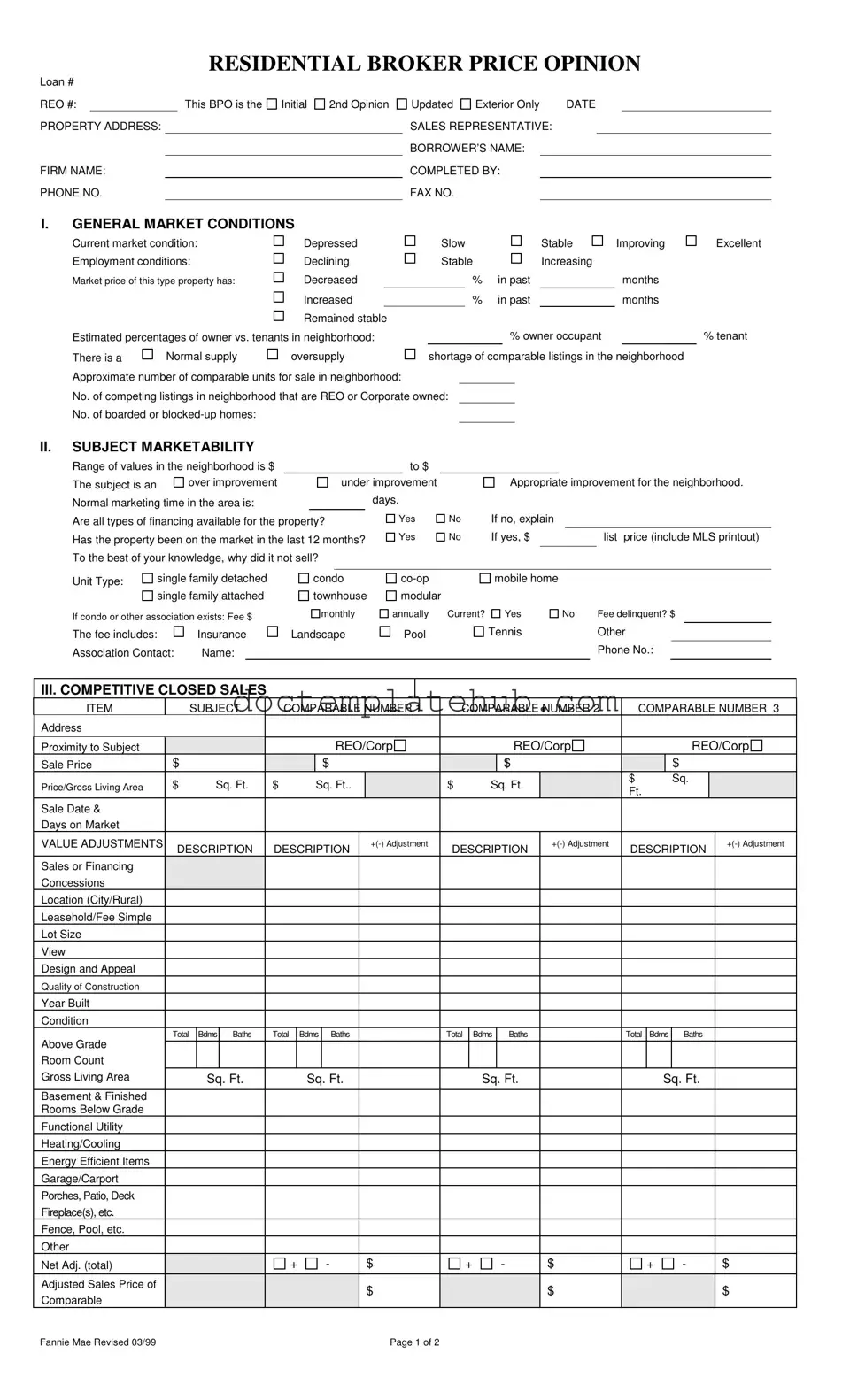

Understanding the Broker Price Opinion (BPO) form is essential for anyone involved in real estate transactions, especially when it comes to evaluating property values. This form serves as a crucial tool for real estate professionals, providing a comprehensive overview of a property’s market value based on various factors. It includes sections that address general market conditions, such as the current state of the housing market and employment trends, as well as the subject property's marketability. The BPO form also requires the identification of comparable properties, allowing for a comparison of sales data, pricing, and other relevant metrics. Additionally, it outlines necessary repairs and improvements that could enhance the property’s appeal, along with a strategic marketing plan tailored to attract potential buyers. By filling out this form, real estate agents can offer informed opinions that reflect current market dynamics, ensuring that sellers and buyers alike have a clear understanding of a property’s worth in today's competitive landscape.

Similar forms

The Broker Price Opinion (BPO) form shares similarities with a Comparative Market Analysis (CMA). Both documents help determine a property's value by comparing it to similar properties in the area. A CMA often includes a detailed analysis of recent sales, active listings, and market trends. While a BPO is typically prepared by a real estate broker or agent, a CMA can be created by anyone with access to market data. This makes both tools essential for understanding property values in a specific market.

An Appraisal Report is another document that resembles the BPO. Appraisals are conducted by licensed appraisers and provide an unbiased estimate of a property's value. Like the BPO, an appraisal considers comparable properties, market conditions, and property features. However, appraisals are usually more formal and may follow specific guidelines set by lenders or regulatory bodies. Both documents aim to provide an accurate value, but appraisals often carry more weight in financial transactions.

A Listing Agreement is also similar to a BPO. When a property is listed for sale, the listing agreement outlines the terms between the seller and the real estate agent. This document includes the proposed listing price, which is often influenced by the BPO. Both documents focus on the property's value and marketability, helping sellers understand how to price their homes competitively.

In reviewing the various documentation pertinent to property transactions, understanding the significance of each form is vital, including the New York Power of Attorney, which allows individuals to designate someone to make decisions on their behalf, ensuring that their wishes are respected even when they're unable to assert them. For those interested in preparing this essential document, resources such as smarttemplates.net offer valuable guidance.

The Seller's Disclosure Statement is another related document. While a BPO assesses market value, the Seller's Disclosure provides potential buyers with information about the property's condition and any known issues. Both documents are crucial in the selling process, as they help buyers make informed decisions. Transparency in the Seller's Disclosure can also impact the BPO value if significant issues are disclosed.

A Property Condition Report (PCR) shares similarities with the BPO as well. The PCR focuses on the physical state of the property, detailing necessary repairs and improvements. While the BPO evaluates market value, the PCR helps determine how the property's condition may affect that value. Both documents work together to give a comprehensive view of what a buyer can expect.

A Market Analysis Report (MAR) is another document that aligns with the BPO. The MAR provides insights into broader market trends, including supply and demand dynamics, average days on the market, and price fluctuations. Like the BPO, it helps real estate professionals and clients understand the current market landscape, which can influence pricing strategies and decision-making.

The Lease Agreement can also be compared to the BPO in some aspects. While a lease agreement outlines the terms of renting a property, it often reflects the property's market value based on similar rental properties. Both documents require an understanding of the local market and comparable properties. This helps ensure that the rental price aligns with the current market conditions.

Lastly, a Short Sale Agreement has similarities with the BPO. When a homeowner sells their property for less than what they owe on their mortgage, a short sale agreement is necessary. This document outlines the terms and conditions of the sale. Like the BPO, it requires an assessment of the property's value and market conditions to determine if the short sale is viable. Both documents aim to facilitate a successful transaction, even under challenging circumstances.

Other PDF Templates

What Is a W3 Tax Form - Employers must retain copies of submitted W-3 forms for record-keeping.

To navigate the complexities of estate planning, understanding the role of a Transfer-on-Death Deed for property inheritance is crucial. This legal document facilitates the transfer of real estate directly to beneficiaries without court intervention, ensuring a smoother transition according to your preferences.

What Is Schedule C - A foundational document for mergers and acquisitions discussions.

Western Union Receipt Online - Enjoy user-friendly online options to manage your transfers.

More About Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is a professional assessment of a property's value, typically conducted by a licensed real estate broker or agent. It provides an estimate of the market value based on various factors, including recent sales data, current market conditions, and the property’s characteristics. BPOs are often used by lenders, banks, and investors to make informed decisions about real estate transactions.

When is a BPO needed?

A BPO may be required in several situations, such as when a lender needs to determine the value of a property for a mortgage application, during a foreclosure process, or when assessing the value of a property for sale. Additionally, real estate investors may seek a BPO to evaluate potential investment properties.

What information is included in a BPO form?

The BPO form includes essential details such as the property address, loan number, market conditions, comparable sales, and a marketing strategy. It also outlines necessary repairs, occupancy status, and competitive listings in the area. This comprehensive information helps provide an accurate assessment of the property's value.

How does a BPO differ from an appraisal?

While both a BPO and an appraisal aim to determine a property's value, they differ in their process and purpose. An appraisal is a more formal and detailed evaluation conducted by a licensed appraiser, often required by lenders for mortgage financing. In contrast, a BPO is typically less formal and quicker to complete, making it suitable for situations where a timely estimate is needed.

Who completes a BPO?

A BPO is completed by a licensed real estate broker or agent who has expertise in the local market. These professionals analyze market trends, comparable properties, and other relevant data to provide an accurate assessment of the property's value.

What factors influence the value determined in a BPO?

Several factors can influence the value determined in a BPO, including the condition of the property, location, recent sales of comparable properties, and current market trends. The BPO also considers the economic environment, such as employment rates and housing supply and demand.

How long does it take to complete a BPO?

The time required to complete a BPO can vary depending on the complexity of the property and the availability of data. Generally, a BPO can be completed within a few days to a week, making it a relatively quick process compared to a formal appraisal.

Can a BPO be used for legal purposes?

While a BPO can provide valuable insights into a property's value, it may not be considered legally binding like an appraisal. However, it can still be used as a supporting document in legal matters, such as disputes over property value or during foreclosure proceedings.

How often should a BPO be updated?

It is advisable to update a BPO regularly, especially in fluctuating markets. If the property has not sold within a specified timeframe or if significant changes occur in the market or property condition, a new BPO may be necessary to ensure an accurate valuation.

What should I do if I disagree with a BPO?

If you disagree with a BPO, you can request a second opinion or provide additional information that may affect the property's value. Engaging another qualified real estate professional to conduct a separate BPO or appraisal may also be beneficial in resolving discrepancies.

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, attention to detail is crucial. Here are five key actions to take and avoid:

- Do: Provide accurate property details, including the address, loan number, and REO number.

- Do: Assess the current market conditions thoroughly, including employment trends and comparable listings.

- Do: Clearly indicate the subject property's marketability and any necessary repairs.

- Do: Include specific comments regarding the property's condition and any unique features that may affect its value.

- Do: Ensure all financial information, such as list prices and adjustments, is clearly documented.

- Don't: Skip over sections; every part of the form is important for an accurate assessment.

- Don't: Provide vague or incomplete explanations for why a property did not sell.

- Don't: Ignore the significance of comparable sales; they are essential for establishing value.

- Don't: Forget to check for outstanding fees or conditions that could impact the property's marketability.

- Don't: Submit the form without double-checking for errors or omissions.

Broker Price Opinion - Usage Steps

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. This process will help in assessing the value of a property based on various market factors and comparable sales. Follow these steps to ensure that you complete the form accurately.

- Start by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, PHONE NO., and FAX NO..

- Indicate whether this BPO is an Initial, 2nd Opinion, Updated, or Exterior Only.

- Provide the DATE and the name of the SALES REPRESENTATIVE.

- Enter the BORROWER’S NAME and the name of the person COMPLETED BY.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions. Select from options like Depressed, Stable, or Increasing.

- Estimate the percentage of owner-occupants in the neighborhood and indicate the supply of comparable listings.

- In the SUBJECT MARKETABILITY section, provide the range of values and whether the property is an over or under improvement.

- Indicate the normal marketing time and whether all types of financing are available for the property. If not, explain why.

- Note if the property has been on the market in the last 12 months and include the list price if applicable.

- Specify the Unit Type and any association fees, including details about the association.

- In the COMPETITIVE CLOSED SALES section, list comparable properties with their addresses, sale prices, and other relevant details.

- Make value adjustments for each comparable property based on factors like location, condition, and amenities.

- Fill in the MARKETING STRATEGY section by selecting between As-is or Minimal Lender Required Repairs.

- Document the occupancy status of the property and identify the most likely buyer.

- Itemize all necessary repairs and check those that are recommended for successful marketing.

- In the COMPETITIVE LISTINGS section, provide details for other comparable properties currently on the market.

- Calculate the Market Value and suggested list price based on the information gathered.

- Finally, include any COMMENTS regarding positives, negatives, or special concerns about the property.

- Sign and date the form to finalize your assessment.

Once the form is completed, it can be submitted to the relevant parties for review. This thorough documentation will support the valuation process and assist in making informed decisions regarding the property in question.