Official Business Bill of Sale Form

When transferring ownership of a business, a Business Bill of Sale form plays a crucial role in ensuring a smooth transaction. This document serves as a legal record that outlines the details of the sale, including the names of the buyer and seller, the business name, and the date of the transaction. It typically includes a description of the assets being sold, such as equipment, inventory, and goodwill, providing clarity for both parties involved. Additionally, the form may specify any warranties or representations made by the seller, protecting the buyer from potential liabilities. By documenting the agreed-upon purchase price, this form helps establish a clear understanding of the financial terms. Overall, the Business Bill of Sale is an essential tool that facilitates the transfer of business ownership while safeguarding the interests of both the buyer and seller.

Similar forms

A Business Bill of Sale is often compared to a standard Bill of Sale, which serves a similar purpose in transferring ownership of personal property. Both documents provide essential details about the transaction, including the names of the buyer and seller, a description of the item being sold, and the purchase price. While a standard Bill of Sale is typically used for personal items like vehicles or furniture, the Business Bill of Sale is specifically tailored for business assets, making it a more formalized document for commercial transactions.

For anyone looking to purchase or sell a motorcycle, understanding the importance of a proper transaction is vital. You can find a useful guide on how to create a comprehensive Motorcycle Bill of Sale by visiting this resource.

The Purchase Agreement is another document that shares similarities with the Business Bill of Sale. A Purchase Agreement outlines the terms and conditions under which a buyer agrees to purchase a business or its assets. Like the Business Bill of Sale, it includes details such as the sale price and the items being sold. However, a Purchase Agreement is generally more comprehensive, often addressing contingencies, warranties, and other legal considerations that may arise during the transaction.

A Business Asset Transfer Agreement is closely related to the Business Bill of Sale, as both documents facilitate the transfer of ownership of business assets. The key difference lies in the scope of the assets involved. While a Business Bill of Sale may focus on specific items, a Business Asset Transfer Agreement can encompass a broader range of assets, including intellectual property, equipment, and inventory. This agreement often includes more detailed descriptions and terms regarding the assets being transferred.

Fill out Common Types of Business Bill of Sale Templates

How to Write Up a Bill of Sale for a Boat - A Boat Bill of Sale provides a clear record of the transaction for both parties.

To ensure all parties have a clear understanding, utilizing a reliable resource like onlinelawdocs.com for obtaining a Florida Bill of Sale form is highly recommended, as it provides the necessary framework for creating this important document during the transfer of ownership.

More About Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. It serves as proof of the transaction and includes details about the business, the parties involved, and the terms of the sale.

What information is typically included in a Business Bill of Sale?

The document usually contains the names and addresses of the seller and buyer, a description of the business or assets being sold, the sale price, and any warranties or representations made by the seller. It may also include terms regarding payment and the date of the transfer.

Is a Business Bill of Sale required by law?

While it is not always legally required to have a Business Bill of Sale, it is highly recommended. Having this document can protect both the buyer and seller by providing a clear record of the transaction and the terms agreed upon.

How does a Business Bill of Sale differ from a purchase agreement?

A Business Bill of Sale is a specific type of document that focuses on the transfer of ownership, while a purchase agreement is broader and may include additional terms such as financing arrangements, contingencies, and obligations of both parties. The Bill of Sale is often a part of the larger purchase agreement.

Do I need a lawyer to create a Business Bill of Sale?

While it is possible to create a Business Bill of Sale without legal assistance, consulting with a lawyer can ensure that the document meets all legal requirements and adequately protects your interests. This is especially important for complex transactions.

Can a Business Bill of Sale be modified after it is signed?

Once a Business Bill of Sale is signed, it is generally considered a binding agreement. However, modifications can be made if both parties agree to the changes. It is advisable to document any amendments in writing and have both parties sign the revised document.

What happens if there is a dispute after the sale?

If a dispute arises after the sale, the Business Bill of Sale can serve as a crucial piece of evidence in resolving the issue. It outlines the terms agreed upon and can help clarify responsibilities and expectations. Legal action may be necessary if the dispute cannot be resolved amicably.

Is there a standard format for a Business Bill of Sale?

There is no universally required format for a Business Bill of Sale, but it should include essential elements like the names of the parties, a description of the business or assets, and the terms of the sale. Templates are available online, but customization may be necessary to fit specific circumstances.

Where should I keep my Business Bill of Sale?

It is important to store the Business Bill of Sale in a safe place, such as a locked file cabinet or a secure digital location. Both parties should retain copies for their records. This ensures that the document is accessible in case it is needed in the future.

Dos and Don'ts

When completing the Business Bill of Sale form, attention to detail is crucial. Here are four important dos and don'ts to consider:

- Do ensure all fields are filled out completely and accurately.

- Do include both the seller's and buyer's full names and contact information.

- Don't leave any sections blank; this can lead to misunderstandings later.

- Don't forget to sign and date the document to validate the transaction.

Business Bill of Sale - Usage Steps

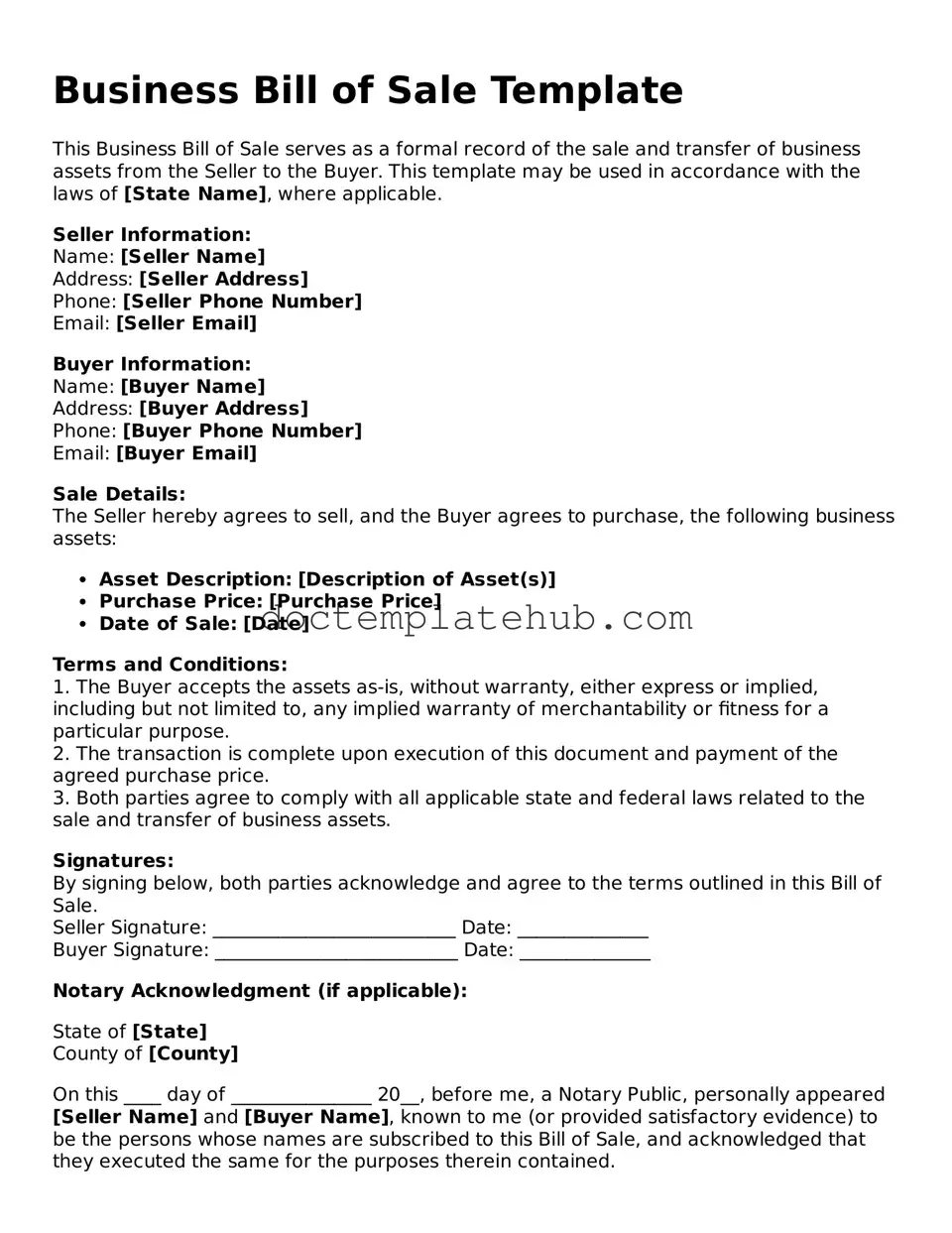

Filling out a Business Bill of Sale form is an important step in transferring ownership of a business. This document helps ensure that both parties are clear about the terms of the sale. Follow these steps to complete the form accurately.

- Obtain the Form: Start by downloading or printing the Business Bill of Sale form from a reliable source.

- Seller Information: Fill in the seller's name, address, and contact information. Ensure all details are correct.

- Buyer Information: Provide the buyer's name, address, and contact information in the designated section.

- Business Details: Enter the name of the business being sold, along with any relevant identification numbers, such as a tax ID.

- Sale Price: Clearly state the agreed sale price for the business. Make sure this amount is accurate and agreed upon by both parties.

- Payment Terms: Describe the payment method and any specific terms related to the payment, such as installments or deposits.

- Signatures: Both the seller and buyer must sign and date the form. This signifies agreement to the terms outlined in the document.

- Witness or Notary: If required, have a witness or notary public sign the document to add an extra layer of validation.

After completing the form, keep copies for both the seller and buyer. This ensures that both parties have a record of the transaction. It's a good practice to store the original document in a safe place.