Fill Your Business Credit Application Form

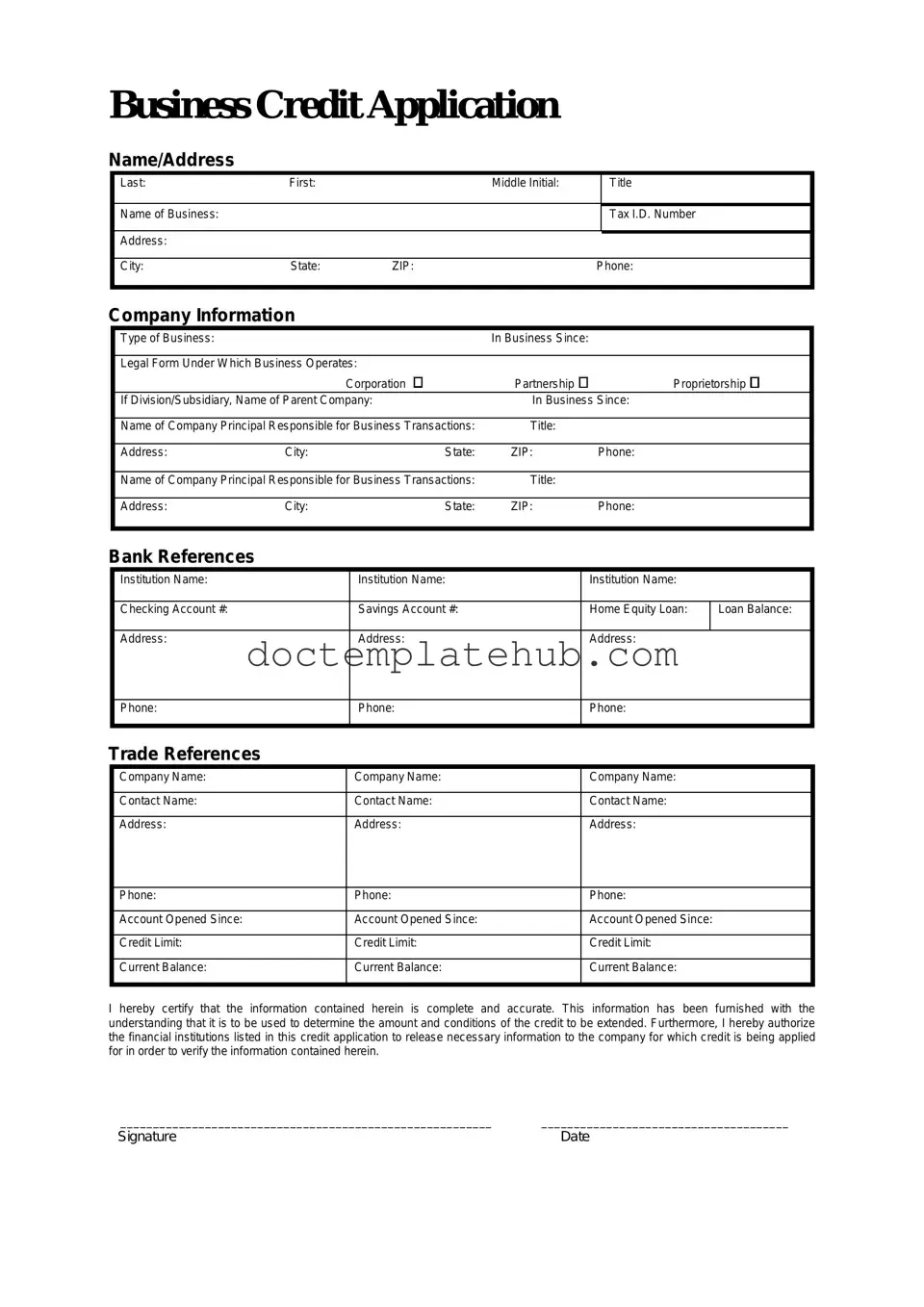

When running a business, establishing credit is a crucial step that can open doors to new opportunities. A Business Credit Application form plays a vital role in this process, serving as the official document that lenders and suppliers use to assess your company's creditworthiness. This form typically requests essential information such as your business name, address, and type of entity, along with details about your ownership structure and financial history. Additionally, it often requires information about your business's annual revenue, number of employees, and banking relationships. Providing accurate and comprehensive information can significantly impact your chances of securing favorable credit terms. Understanding the nuances of this form can help you present your business in the best light, making it easier to build strong financial relationships that support your growth and success.

Similar forms

The Business Credit Application form is similar to the Personal Credit Application form. Both documents serve the purpose of assessing the creditworthiness of an individual or entity. The Personal Credit Application focuses on an individual's financial history, including income, debts, and credit score. In contrast, the Business Credit Application evaluates a business's financial stability, including its revenue, expenses, and overall credit history. Both applications require detailed information to help lenders make informed decisions about extending credit.

Another document that shares similarities is the Loan Application form. Like the Business Credit Application, the Loan Application is designed to gather comprehensive financial information from the applicant. It typically includes sections on income, assets, liabilities, and purpose of the loan. Both documents aim to provide lenders with a clear picture of the applicant’s financial situation, allowing for a thorough risk assessment before approving credit or loans.

The Vendor Credit Application is also akin to the Business Credit Application. Vendors use this document to evaluate a business's creditworthiness before extending credit terms for purchases. Similar to the Business Credit Application, it requires information on the business's financial history and payment practices. This ensures that the vendor can assess the risk of non-payment and determine appropriate credit limits.

The Commercial Lease Application parallels the Business Credit Application in that both forms assess the financial stability of a business seeking to enter a contractual agreement. The Commercial Lease Application requires details about the business’s financial history, credit references, and sometimes personal guarantees from owners. This information helps landlords evaluate the risk of leasing property to the business.

The Partnership Agreement also bears resemblance to the Business Credit Application, particularly in its focus on financial transparency. While the Partnership Agreement outlines the terms of a business partnership, it often includes financial disclosures that are similar to those found in a credit application. Both documents require detailed financial information to ensure all parties understand the financial commitments involved.

The Business Plan can be compared to the Business Credit Application as both documents provide insight into a business’s operational and financial strategies. A Business Plan outlines the goals, market analysis, and financial projections of a business, while the Business Credit Application focuses on the current financial status. Both are essential for lenders to understand the viability and sustainability of the business.

The Financial Statement is another document similar to the Business Credit Application. Financial Statements provide a snapshot of a business’s financial health, including assets, liabilities, and equity. The Business Credit Application often requires similar financial data to assess creditworthiness. Both documents help lenders evaluate the financial performance and stability of a business.

The Trade Reference form is akin to the Business Credit Application in that it collects information about a business’s payment history and credit behavior. Trade References provide insights into how a business manages its credit obligations, while the Business Credit Application compiles this information along with other financial details. Both documents help lenders gauge the reliability of a business as a borrower.

Lastly, the Credit Report is similar to the Business Credit Application because it provides a comprehensive overview of a business’s credit history. While the Business Credit Application collects information directly from the applicant, the Credit Report compiles data from various sources to present an overall picture of creditworthiness. Both documents are crucial for lenders when making decisions about extending credit.

Other PDF Templates

Western Union Receipt Online - Set up recurring payments for consistent assistance to loved ones.

Wage and Tax Statement - Employees can access digital copies of their W-2s in some cases.

Change Name on Title of Car - It serves as a legal assurance that no further claims can be made on the specified property after payment.

More About Business Credit Application

What is a Business Credit Application form?

The Business Credit Application form is a document that businesses complete to request credit from suppliers or lenders. This form typically collects essential information about the business, including its legal structure, financial history, and creditworthiness. By filling out this application, a business seeks to establish a credit line that can help manage cash flow and facilitate purchases without immediate payment.

Why is the Business Credit Application important?

This application serves several critical purposes. First, it helps lenders or suppliers assess the risk associated with extending credit. They will review the information provided to determine whether the business is likely to repay its debts. Additionally, it establishes a formal record of the business’s request for credit, which can be useful for future reference and accountability.

What information do I need to provide on the form?

Typically, you will need to provide details such as your business name, address, and contact information. Financial information, including annual revenue and existing debts, is also required. Furthermore, personal information about the business owner(s), such as Social Security numbers and personal credit history, may be necessary to evaluate the application comprehensively.

How long does it take to process the Business Credit Application?

The processing time can vary significantly depending on the lender or supplier. Generally, it can take anywhere from a few hours to several days. Factors influencing this timeline include the complexity of the application, the responsiveness of the applicant, and the lender’s internal processes. It’s advisable to follow up after submitting the application to ensure it is being processed in a timely manner.

What happens if my application is denied?

If your application is denied, you will typically receive a notification explaining the reasons for the decision. Common reasons for denial include insufficient credit history, low credit scores, or inadequate financial information. Understanding these reasons can help you address any issues and improve your chances of approval in the future. You may also have the option to appeal the decision or apply again after making necessary adjustments.

Can I apply for business credit without a personal guarantee?

In many cases, lenders will require a personal guarantee, especially for new or small businesses without an established credit history. A personal guarantee means that the business owner agrees to be personally responsible for the debt if the business fails to repay it. However, some lenders may offer credit options that do not require a personal guarantee, particularly for businesses with strong financials and a solid credit history.

Is there a fee associated with submitting the Business Credit Application?

Most lenders and suppliers do not charge a fee for submitting a Business Credit Application. However, it’s important to read the terms and conditions carefully. Some lenders may have specific requirements or fees associated with processing the application or setting up a credit account. Clarifying these details upfront can prevent unexpected costs down the line.

Dos and Don'ts

When filling out a Business Credit Application form, it’s crucial to approach the task with care. Here’s a list of things to do and avoid to ensure your application stands out for the right reasons.

- Do: Provide accurate and complete information. Double-check all entries to minimize errors.

- Do: Use clear and concise language. Avoid jargon that may confuse the reader.

- Do: Include all required documentation. This may include financial statements, tax returns, and business licenses.

- Do: Be honest about your business’s financial situation. Transparency builds trust.

- Do: Review the application before submission. A fresh set of eyes can catch mistakes you might have missed.

- Don't: Leave any fields blank. If a question doesn’t apply, write “N/A” instead.

- Don't: Provide misleading information. This can lead to denial of credit or future legal issues.

- Don't: Rush through the application. Taking your time can prevent costly mistakes.

- Don't: Ignore the fine print. Terms and conditions are important and should be understood fully.

- Don't: Submit the application without a cover letter. A brief introduction can set the tone for your request.

Business Credit Application - Usage Steps

After obtaining the Business Credit Application form, you will need to complete it accurately to ensure a smooth review process. This form will collect essential information about your business, helping lenders assess your creditworthiness. Follow these steps carefully to fill out the form correctly.

- Start by entering your business name in the designated field.

- Provide your business address, including street, city, state, and ZIP code.

- Fill in the contact information, including a phone number and email address.

- Indicate the type of business entity (e.g., sole proprietorship, partnership, corporation).

- Enter your business's federal tax identification number (EIN) if applicable.

- List the names and titles of all owners or principal officers.

- Provide the date your business was established.

- Detail your business's annual revenue and number of employees.

- Include the purpose for requesting credit and the amount needed.

- Sign and date the application to certify the information is accurate.

Once you have completed the form, review it for accuracy. Ensure all required fields are filled out, and make a copy for your records before submitting it to the lender.