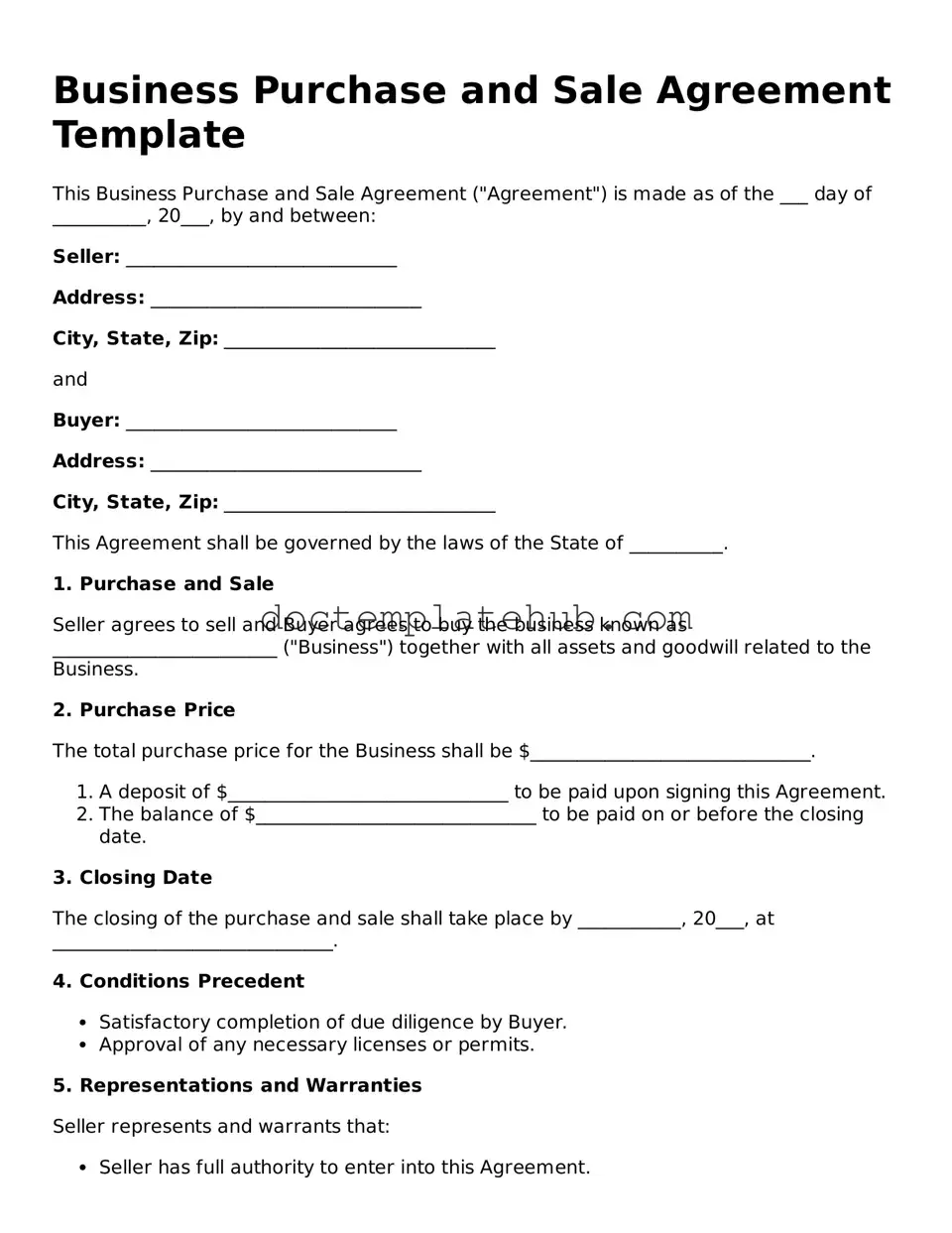

Official Business Purchase and Sale Agreement Form

When considering the purchase or sale of a business, having a comprehensive Business Purchase and Sale Agreement is crucial. This document serves as a roadmap for the transaction, outlining the terms and conditions agreed upon by both the buyer and the seller. Key elements typically included in this agreement are the purchase price, payment terms, and the assets or liabilities being transferred. Additionally, it often addresses representations and warranties, ensuring that both parties are transparent about the business's condition and operations. The agreement may also cover contingencies, such as financing requirements or due diligence processes, which protect both parties during the transaction. By clearly defining the rights and obligations of each party, this form helps minimize misunderstandings and potential disputes, paving the way for a smoother transition of ownership.

Similar forms

The Asset Purchase Agreement is closely related to the Business Purchase and Sale Agreement. This document outlines the terms under which one party agrees to purchase specific assets from another party. Unlike the Business Purchase and Sale Agreement, which may cover the entire business entity, the Asset Purchase Agreement focuses solely on tangible and intangible assets, such as equipment, inventory, and intellectual property. Both documents aim to protect the interests of both buyers and sellers during a transaction.

The Stock Purchase Agreement serves a similar purpose, specifically for transactions involving the sale of a company’s stock. In this agreement, the buyer purchases shares from the seller, thereby acquiring ownership in the company. Like the Business Purchase and Sale Agreement, it includes essential terms such as purchase price, representations, and warranties. However, the Stock Purchase Agreement emphasizes the transfer of ownership through shares rather than the business's operational assets.

A Letter of Intent (LOI) is another document that often precedes a Business Purchase and Sale Agreement. This preliminary document outlines the basic terms and intentions of the parties involved before finalizing the sale. While it is not legally binding, it sets the stage for negotiations and helps clarify the expectations of both parties. The LOI can streamline the process leading to a more formal agreement, ensuring that both sides are aligned on key issues.

The use of a General Bill of Sale form can greatly enhance the clarity of transactions involved in business deals and property transfers. By having a documented agreement, buyers and sellers can clearly outline the terms of their transactions, which helps to prevent misunderstandings and disputes down the line. For more information, you can visit https://topformsonline.com/general-bill-of-sale/.

The Non-Disclosure Agreement (NDA) is essential in the context of business transactions. Before sharing sensitive information during negotiations, parties often sign an NDA to protect proprietary information. This document ensures that confidential details about the business, financials, and operations remain secure. While not directly related to the sale itself, it is crucial for safeguarding interests and building trust between the buyer and seller.

The Due Diligence Checklist is a vital tool that complements the Business Purchase and Sale Agreement. This document outlines the information and documents a buyer should review before finalizing the purchase. It includes financial statements, contracts, and legal compliance records. By conducting thorough due diligence, buyers can make informed decisions and mitigate potential risks associated with the acquisition.

The Closing Statement is another key document that is executed at the conclusion of a business sale. It summarizes the financial details of the transaction, including the purchase price and any adjustments made. Both parties review and sign this document to confirm that all terms have been met. The Closing Statement serves as a formal record of the transaction, ensuring clarity and accountability for both the buyer and seller.

The Bill of Sale is a straightforward document that may accompany the Business Purchase and Sale Agreement. It serves as proof of the transfer of ownership of specific assets from the seller to the buyer. This document typically includes a description of the items being sold and the terms of the sale. While the Business Purchase and Sale Agreement covers broader terms, the Bill of Sale provides a concise record of the transaction.

The Employment Agreement can also be relevant during a business sale, particularly when key employees are involved. This document outlines the terms of employment for individuals who will remain with the company after the sale. It includes details such as salary, responsibilities, and benefits. Retaining skilled employees is often critical for the success of a business transition, making this agreement an important consideration.

Finally, the Indemnity Agreement is a protective measure that may be included in a Business Purchase and Sale Agreement. This document outlines the responsibilities of each party concerning potential liabilities arising from the business operations. It ensures that the seller indemnifies the buyer against certain claims or losses that may occur post-sale. This agreement is crucial for minimizing risks and protecting the buyer’s investment in the business.

Common Forms

Printable Simple Storage Agreement - Details the process for resolving disputes between the renter and owner.

For those interested in understanding the nuances of an Investment Letter of Intent, it's important to recognize that such a document not only outlines the terms of potential investments but also reflects a significant step in the investment process. Resources like smarttemplates.net can provide templates that help streamline this crucial phase, ensuring that both parties are aligned before formal agreements are drafted.

Da - Both the giver and receiver should retain copies for their records.

More About Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy a business from another party. This agreement typically includes details such as the purchase price, payment terms, and any conditions that must be met before the sale can be finalized. It serves to protect both the buyer and seller by clearly defining their rights and responsibilities throughout the transaction.

Why is it important to have a Business Purchase and Sale Agreement?

Having a Business Purchase and Sale Agreement is crucial for several reasons. First, it helps prevent misunderstandings between the buyer and seller by clearly stating the expectations of both parties. Second, it provides a legal framework that can be referred to in case of disputes. Lastly, it ensures that all necessary details, such as assets included in the sale and any liabilities being assumed, are documented. This can be invaluable in protecting your investment and ensuring a smooth transition of ownership.

What should be included in the Business Purchase and Sale Agreement?

Key components of a Business Purchase and Sale Agreement typically include the names of the buyer and seller, a detailed description of the business being sold, the purchase price, and payment terms. Additionally, it should outline any contingencies, such as financing or inspections, and specify what assets and liabilities are included in the sale. It’s also wise to include clauses regarding confidentiality and non-compete agreements, if applicable, to protect the interests of both parties.

Can I modify the Business Purchase and Sale Agreement?

Yes, you can modify the Business Purchase and Sale Agreement to fit the specific needs of your transaction. However, any changes should be made carefully and ideally should be agreed upon by both parties. It’s important to ensure that all modifications are documented in writing and signed by both the buyer and seller. This helps maintain clarity and protects both parties in case of any future disputes.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, it is essential to approach the process with care and attention to detail. Here are some important dos and don'ts to consider:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information in each section.

- Do consult with a professional if you have any questions or uncertainties.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

By following these guidelines, you can help ensure that your Business Purchase and Sale Agreement is filled out correctly and effectively represents your interests.

Business Purchase and Sale Agreement - Usage Steps

Once you have the Business Purchase and Sale Agreement form ready, you will need to provide accurate information to ensure a smooth transaction. This process involves several key steps that require attention to detail.

- Identify the Parties: Enter the names and contact information of both the buyer and the seller. Ensure that all details are correct.

- Describe the Business: Provide a clear description of the business being sold, including its name, location, and any relevant identification numbers.

- Specify Purchase Price: Clearly state the total purchase price for the business. Include any terms regarding deposits or payment schedules.

- Outline Assets Included: List all assets that are included in the sale, such as equipment, inventory, or intellectual property.

- Detail Liabilities: Indicate any liabilities that the buyer will assume as part of the sale. This may include debts or obligations related to the business.

- Set Closing Date: Establish a date for the closing of the sale. This is when the transaction will be finalized.

- Include Contingencies: Specify any conditions that must be met before the sale can proceed, such as financing or inspections.

- Signatures: Both parties must sign and date the agreement to make it legally binding. Ensure that all signatures are in the appropriate places.

After completing the form, review it carefully for accuracy. It is advisable to keep a copy for your records and share the final version with all parties involved.