Fill Your California Affidavit of Death of a Trustee Form

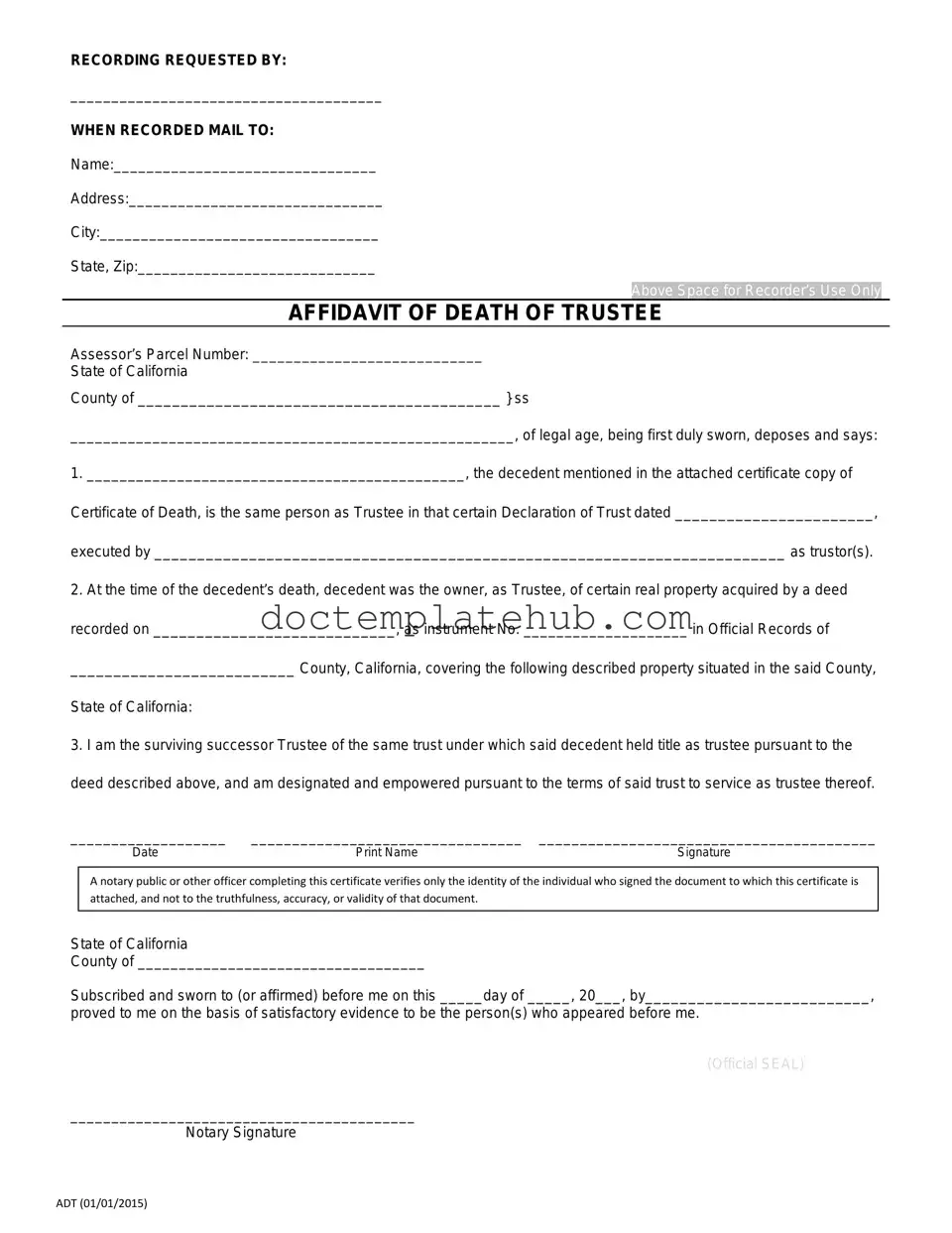

In the realm of estate planning and management, the California Affidavit of Death of a Trustee form plays a crucial role when a trustee passes away. This document serves as an official declaration that confirms the death of a trustee, facilitating the transition of responsibilities and ensuring that the trust can continue to operate smoothly. It is essential for the successor trustee or beneficiaries to complete this form to maintain clarity and legal standing regarding the trust's administration. The affidavit typically requires specific information, including the deceased trustee's name, date of death, and pertinent details about the trust itself. By providing a clear and formal acknowledgment of the trustee's passing, this affidavit helps prevent potential disputes among beneficiaries and ensures that the trust's assets are managed according to the deceased trustee's wishes. Understanding the significance of this form and the process involved in completing it is vital for anyone navigating the complexities of trust management in California.

Similar forms

The California Affidavit of Death of a Trustee form shares similarities with the Affidavit of Death form used in various states. This document serves to officially declare the death of an individual, typically for purposes related to property and estate management. Like the California version, it often requires information about the deceased, including their full name, date of death, and details regarding any assets they may have held. This affidavit is essential for beneficiaries and heirs to establish their rights to the deceased’s estate.

In navigating the complexities of estate management, understanding the various documents involved is essential, including the Power of Attorney form, which grants an individual the authority to act on your behalf. For those in Texas, resources are available to guide you through this process, such as smarttemplates.net/, ensuring that you can establish clear management of your affairs in accordance with your wishes.

Another document that is similar is the Affidavit of Heirship. This form is commonly used to identify the rightful heirs of a deceased person, especially when there is no will. It includes information about the deceased and the relationships of the heirs to the deceased. Like the Affidavit of Death of a Trustee, it must be signed under oath, often in the presence of a notary, to ensure its validity and authenticity. This document aids in transferring property titles and settling the estate according to state laws.

The Certificate of Death is also akin to the Affidavit of Death of a Trustee. This official document is issued by a government authority and confirms the individual’s death. While it serves as a legal proof of death, it does not address the management of the deceased's assets directly. However, it is often required alongside the affidavit to facilitate the transfer of property and ensure that all legal processes are followed correctly. Both documents work together to establish the necessary legal framework for handling the deceased's estate.

The Last Will and Testament is another document that bears resemblance to the California Affidavit of Death of a Trustee. This legal document outlines how a person wishes their assets to be distributed after their death. While the affidavit deals specifically with the death of a trustee and the management of trust assets, the will serves a broader purpose in estate planning. Both documents are crucial in the probate process and often require the involvement of a court to validate their contents and enforce the deceased's wishes.

Lastly, the Trust Certification is similar in that it provides evidence of the existence of a trust and the authority of the trustee. This document outlines the terms of the trust and confirms who the current trustee is, as well as any changes that may have occurred due to the death of a trustee. Like the Affidavit of Death of a Trustee, it helps to clarify the management of assets and ensures that the trust is administered according to the deceased’s wishes. Both documents play significant roles in maintaining clarity and legal standing in estate management.

Other PDF Templates

Tst Meaning - Results must be read within 48-72 hours after the test is placed.

In addition to its fundamental role, the Employee Handbook can also provide valuable resources for navigating workplace scenarios, and you can find useful templates and examples at TopTemplates.info, which can aid in creating a comprehensive guide tailored to your company's unique needs.

Free Job Application Template - Ensure all requested documents are submitted with the application.

More About California Affidavit of Death of a Trustee

What is the California Affidavit of Death of a Trustee?

The California Affidavit of Death of a Trustee is a legal document used to confirm the death of a trustee in a trust. This form helps to clarify the status of the trust and allows for the proper administration of the trust assets following the trustee's passing.

Who can file the Affidavit of Death of a Trustee?

Typically, the remaining trustee, a successor trustee, or a beneficiary of the trust can file the affidavit. It is important that the person filing has a vested interest in the trust or its assets.

What information is required to complete the affidavit?

The affidavit requires specific information, including the name of the deceased trustee, the date of their death, and details about the trust itself. You will also need to provide a certified copy of the trustee’s death certificate.

Is the Affidavit of Death of a Trustee necessary?

Yes, this affidavit is often necessary to transfer control of the trust assets to a new trustee or to manage the trust according to its terms. It provides legal proof of the trustee's death and helps to avoid disputes among beneficiaries.

Where should the affidavit be filed?

The affidavit should be filed with the county recorder's office in the county where the trust property is located. This ensures that the change in trusteeship is officially recorded and recognized.

Are there any fees associated with filing the affidavit?

Yes, there may be fees associated with filing the affidavit. These fees vary by county, so it’s advisable to check with the local county recorder’s office for the exact amount.

What happens after the affidavit is filed?

Once the affidavit is filed, it becomes part of the public record. The new trustee can then take over the management of the trust assets. This may include distributing assets to beneficiaries or managing investments according to the trust’s terms.

Can the affidavit be contested?

Yes, beneficiaries or interested parties can contest the affidavit if they believe it is inaccurate or if there are disputes regarding the trust. It’s important to resolve any conflicts early to avoid complications in the administration of the trust.

Do I need a lawyer to file the affidavit?

While it is not legally required to have a lawyer to file the affidavit, consulting with one can be beneficial. A lawyer can help ensure that the document is completed correctly and that all necessary steps are taken to manage the trust effectively.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it’s essential to approach the task with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that you have the correct form for the affidavit. Using the right document is crucial for proper processing.

- Do provide accurate and complete information about the deceased trustee. This includes their full name, date of death, and any relevant details.

- Do sign the affidavit in front of a notary public. A notarized signature adds legitimacy to the document.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Don't leave any sections blank. Incomplete forms may lead to delays or rejection.

- Don't forget to check for any specific requirements from the court or local jurisdiction. Each area may have unique guidelines.

- Don't rush through the process. Take your time to review the form thoroughly before submission.

California Affidavit of Death of a Trustee - Usage Steps

After completing the California Affidavit of Death of a Trustee form, the next step involves filing the document with the appropriate court or agency. This is crucial for ensuring that the death of the trustee is officially recognized and that the trust can be administered according to the deceased's wishes.

- Begin by downloading the California Affidavit of Death of a Trustee form from a reliable source or obtain a physical copy from the court.

- At the top of the form, enter the name of the deceased trustee in the designated space.

- Provide the date of death of the trustee. This information is typically found on the death certificate.

- Fill in the name of the trust as it appears in the trust documents.

- Include the date the trust was created. This date can be found in the trust document itself.

- List the names and addresses of the current trustees who are still living. Ensure that all contact information is accurate.

- Sign the form in the designated area. The signature should be that of a surviving trustee or an individual authorized to act on behalf of the trust.

- Have the signature notarized. A notary public will need to witness the signing and provide their seal.

- Make copies of the completed and notarized form for your records and for any other interested parties.

- File the original form with the appropriate court or agency, along with any required filing fees.