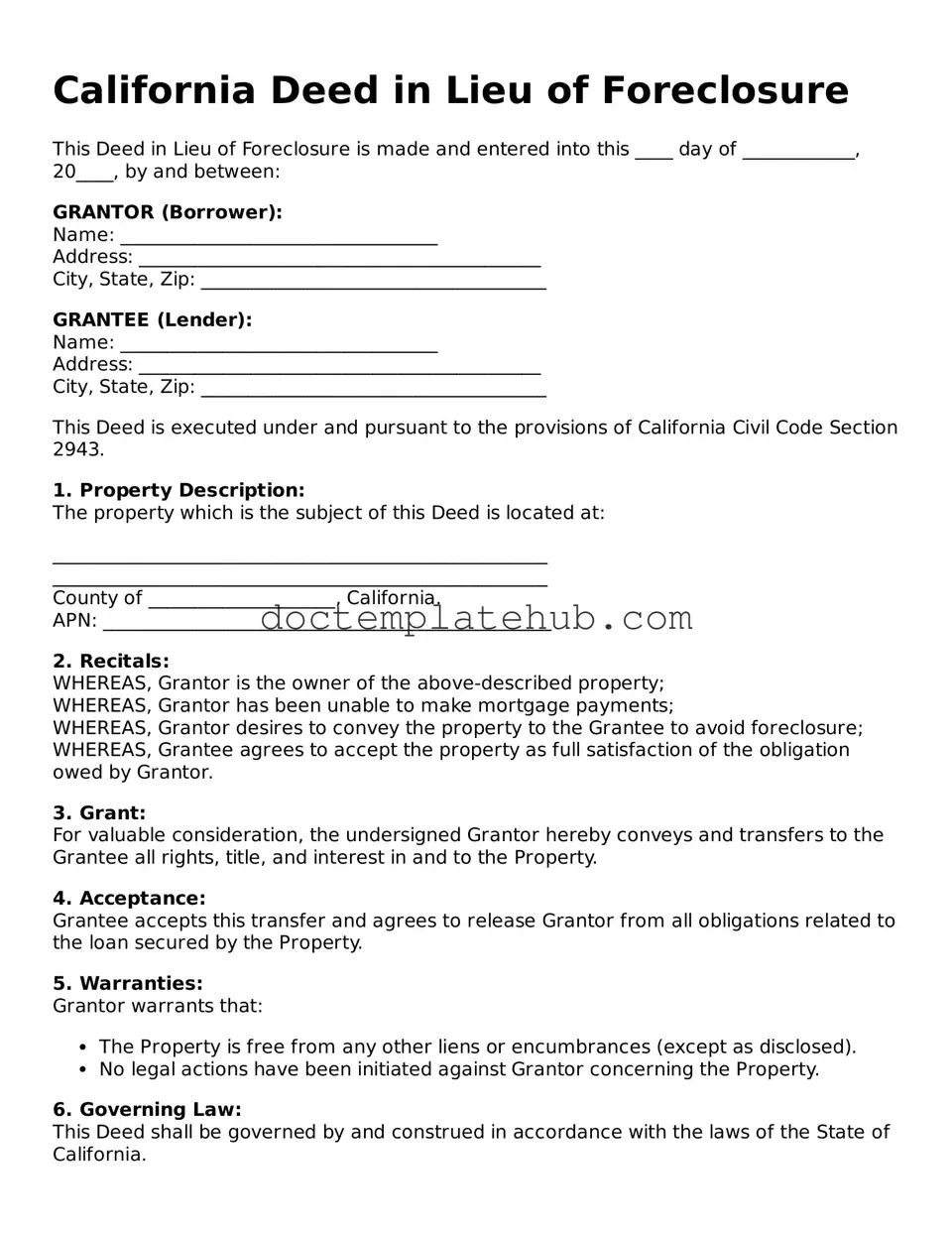

Fillable Deed in Lieu of Foreclosure Template for California State

In the landscape of real estate transactions, particularly for homeowners facing financial difficulties, the California Deed in Lieu of Foreclosure form emerges as a significant tool. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often distressing process of foreclosure. By executing this form, the homeowner can potentially mitigate the negative impact on their credit score and expedite the resolution of their mortgage obligations. Key aspects of the form include the necessity for clear communication between the homeowner and the lender, the requirement for the lender's acceptance, and the implications for any remaining debt after the transfer. Understanding the nuances of this process is crucial for those seeking to navigate the complexities of property ownership and financial distress in California.

Similar forms

The California Deed in Lieu of Foreclosure is similar to a Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender's approval. This process helps the homeowner avoid foreclosure and allows the lender to recover some of their losses. Both options aim to provide a less damaging alternative to foreclosure, but while a short sale involves selling the property, a deed in lieu transfers ownership directly to the lender without a sale. This can simplify the process for both parties involved.

Another document that shares similarities is the Loan Modification Agreement. This agreement allows a borrower to change the terms of their existing mortgage to make payments more manageable. Like a deed in lieu, a loan modification seeks to prevent foreclosure by keeping the homeowner in their property. The key difference lies in the outcome; a loan modification keeps the homeowner in their home, while a deed in lieu results in the homeowner relinquishing ownership. Both documents require lender approval and aim to find a solution that benefits both the borrower and the lender.

In light of various financial challenges that homeowners may face, it's essential to explore legal options that help protect vital interests and assets. For those dealing with sensitive information about their financial situations, using a Michigan Non-disclosure Agreement can safeguard proprietary details shared with advisors or lenders. This form, which can be found at smarttemplates.net, serves as a crucial tool in maintaining confidentiality, ensuring that essential data remains protected while navigating complex financial agreements.

The Forebearance Agreement also bears resemblance to the Deed in Lieu of Foreclosure. This document allows a borrower to temporarily pause or reduce their mortgage payments due to financial hardship. The goal is to provide relief and prevent foreclosure while the borrower gets back on their feet. In contrast, a deed in lieu involves giving up the property altogether. While both options are designed to help borrowers avoid the negative consequences of foreclosure, they cater to different situations and outcomes.

Lastly, the Bankruptcy Filing is another document that can relate to the Deed in Lieu of Foreclosure. Filing for bankruptcy can help individuals reorganize their debts or liquidate assets to pay off creditors. In some cases, homeowners may choose to file for bankruptcy to prevent foreclosure. However, unlike a deed in lieu, which transfers property ownership to the lender, bankruptcy can lead to various outcomes, including keeping the home or losing it through the bankruptcy process. Both documents serve as tools to address financial distress, but they operate under different legal frameworks and implications.

Other Common State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Mortgage - Homeowners may consider this option when they cannot afford their mortgage payments and want to avoid foreclosure.

The California Trailer Bill of Sale form is a vital legal document that not only records the sale and transfer of ownership of a trailer in California but also serves as a reference for those involved in the transaction. For anyone looking to ensure a smooth process, understanding this form can be crucial, and additional details can be found at https://documentonline.org/blank-california-trailer-bill-of-sale/.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - In this arrangement, homeownership is relinquished willingly to address mortgage issues.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Consideration should also be given to how this decision fits into long-term financial planning.

Foreclosure Georgia - It's vital to disclose any liens or other encumbrances before proceeding with the deed.

More About California Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to walk away from the mortgage without the lengthy and often stressful foreclosure process. It can also help protect the homeowner's credit score compared to a foreclosure. However, the lender must agree to this arrangement, as they are not obligated to accept it.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider. First, it can save time and money. The foreclosure process can be lengthy and costly for both parties. By opting for a Deed in Lieu, the homeowner can expedite the process. Second, it may have a less severe impact on the homeowner's credit score compared to a foreclosure. Lastly, it can provide the homeowner with a fresh start, as they can avoid the stigma associated with foreclosure.

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify, the homeowner must typically be experiencing financial hardship. This could include job loss, medical expenses, or other significant financial challenges. Additionally, the homeowner must be current on their mortgage payments or at least not significantly behind. The lender will also require a thorough review of the homeowner's financial situation and may request documentation to support the claim of hardship.

How does the process work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner’s financial situation and property details. If approved, both parties will sign the necessary paperwork to transfer ownership of the property. The lender may also require the homeowner to vacate the property by a certain date. It’s important to ensure that all terms are clearly understood before signing any documents.

Will I still owe money after a Deed in Lieu of Foreclosure?

In some cases, the homeowner may still owe money after the deed is transferred. This is known as a deficiency. Whether a deficiency exists depends on the terms of the mortgage and state laws. California has specific laws regarding deficiencies, and in many cases, lenders cannot pursue the homeowner for the remaining balance if the property was their primary residence. However, it’s crucial to discuss this with the lender to understand potential liabilities fully.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate the terms. This may include asking for a waiver of any deficiency or discussing the timeline for vacating the property. It's advisable to approach negotiations with a clear understanding of your needs and to communicate openly with the lender. Having legal representation can also help ensure that your interests are protected during this process.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is important to approach the process with care. Here are some essential dos and don'ts to consider:

- Do read the entire form thoroughly before starting.

- Do ensure that all information is accurate and complete.

- Do consult with a legal professional if you have any questions.

- Do keep copies of all documents for your records.

- Do sign the form in the presence of a notary public.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't submit the form without ensuring all required signatures are present.

- Don't forget to check for any additional documents that may be needed.

By following these guidelines, you can help ensure that your Deed in Lieu of Foreclosure form is filled out correctly and submitted without issues.

California Deed in Lieu of Foreclosure - Usage Steps

After completing the California Deed in Lieu of Foreclosure form, the next steps involve submitting the form to the appropriate parties and ensuring that all necessary documentation is in order. This process is essential for transferring property ownership and addressing any outstanding mortgage obligations.

- Begin by downloading the California Deed in Lieu of Foreclosure form from a reliable source or the official California government website.

- Fill in the Grantor's name, which is typically the current property owner. Ensure that the name matches the name on the property title.

- Provide the Grantee's name, usually the lender or financial institution that holds the mortgage.

- Include the property address. This should be the complete address of the property that is being conveyed.

- Write down the legal description of the property. This can often be found on the property deed or title. It describes the property boundaries and specifics.

- State the date of the transfer. This is the date when the deed will take effect.

- Sign the form in the designated area. The signature should be that of the Grantor, and it may need to be notarized.

- Provide any additional required information, such as the names and addresses of any witnesses, if applicable.

- Review the completed form for accuracy. Double-check all names, addresses, and legal descriptions.

- Make copies of the completed form for your records before submitting it.

- Submit the form to the lender and follow any additional instructions they may have for processing the deed.