Fillable Durable Power of Attorney Template for California State

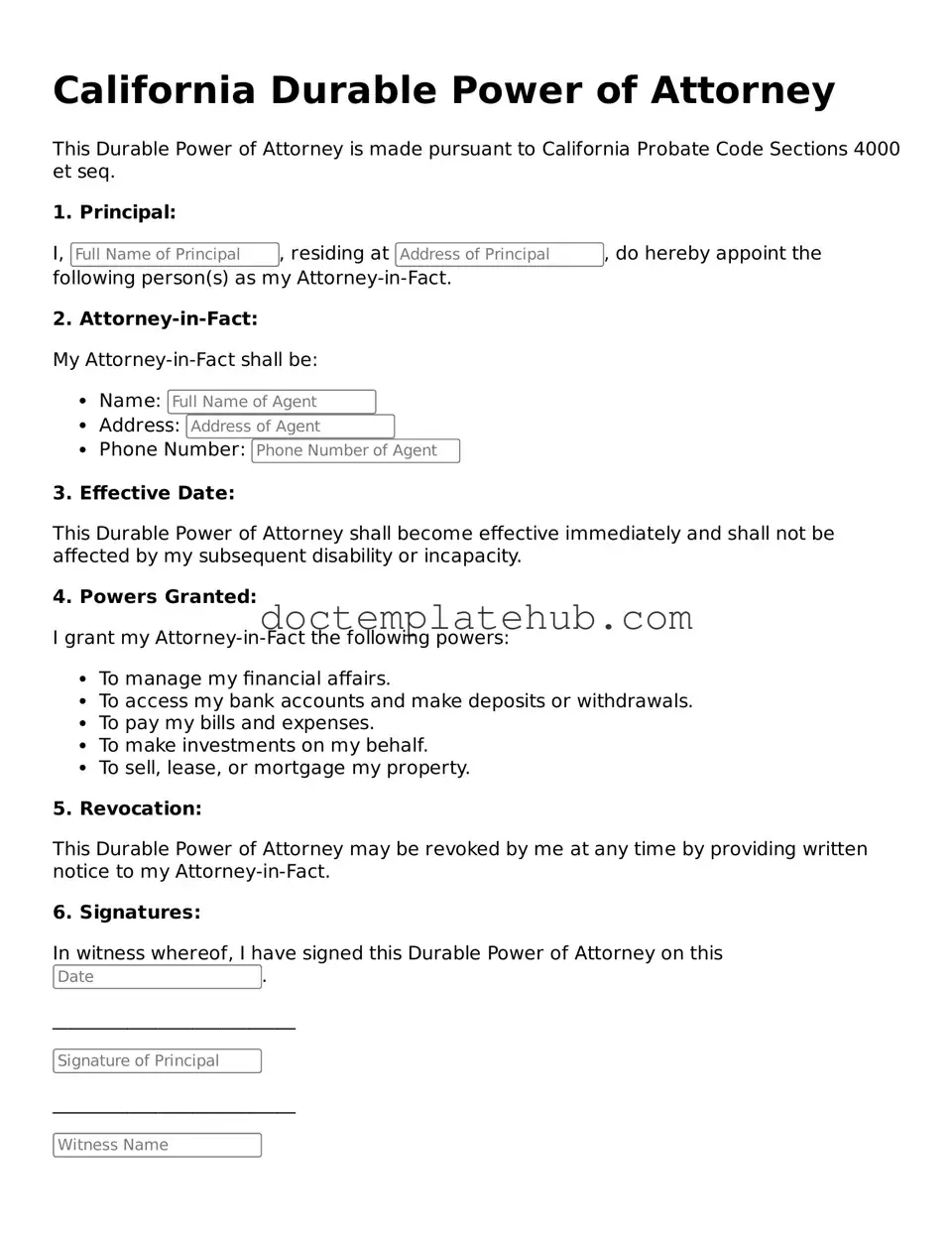

The California Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf in the event they become incapacitated. This form remains effective even if the person who created it loses the ability to make decisions due to illness or injury. Key aspects of the form include the selection of an agent, who is responsible for managing the principal’s affairs, and the specific powers granted to that agent, which can range from handling bank transactions to managing real estate. The form also provides options for the principal to specify any limitations on the agent’s authority, ensuring that their wishes are respected. Importantly, the Durable Power of Attorney can be revoked at any time as long as the principal is still competent, offering flexibility and control over personal affairs. Understanding the nuances of this form is essential for anyone looking to safeguard their financial interests and ensure that their preferences are honored in times of need.

Similar forms

The California Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, referred to as the agent, to make decisions on their behalf. The key distinction lies in the durability aspect; the Durable Power of Attorney remains effective even if the principal becomes incapacitated, whereas the General Power of Attorney typically terminates upon the principal's incapacitation. This makes the Durable Power of Attorney a crucial tool for long-term planning.

Another document that resembles the California Durable Power of Attorney is the Medical Power of Attorney. This specific form grants authority to an agent to make healthcare decisions for the principal when they are unable to do so themselves. Like the Durable Power of Attorney, it is designed to ensure that the principal's wishes are honored, but it focuses solely on medical decisions. Both documents empower an agent, but the Medical Power of Attorney is limited to health-related matters.

The Living Will is also similar to the California Durable Power of Attorney, as both documents address the principal's wishes in situations where they cannot communicate their preferences. A Living Will outlines specific healthcare wishes, particularly regarding end-of-life care, while the Durable Power of Attorney allows an agent to make broader decisions, including financial and legal matters. Together, they create a comprehensive approach to managing one's affairs in times of incapacity.

The Healthcare Proxy is another document akin to the California Durable Power of Attorney. This form appoints an individual to make healthcare decisions on behalf of the principal. While it is similar to the Medical Power of Attorney, the Healthcare Proxy often includes the authority to make decisions about life-sustaining treatment. Both documents ensure that someone trusted acts in the principal's best interests when they cannot advocate for themselves.

Lastly, the Revocable Living Trust shares common ground with the California Durable Power of Attorney. Both documents allow for the management of an individual's assets and decision-making in the event of incapacity. A Revocable Living Trust can facilitate the transfer of assets without going through probate, while the Durable Power of Attorney allows an agent to manage financial matters directly. Together, they provide a robust framework for financial and estate planning, ensuring that a person's wishes are respected and carried out effectively.

Other Common State-specific Durable Power of Attorney Templates

How to Get a Power of Attorney in Arizona - This document is vital for individuals who want to ensure their affairs are in trusted hands if needed.

Power of Attorney Florida - This simple form can save time and heartache during a critical phase of life.

Power of Attorney Georgia Pdf - A Durable Power of Attorney can be set up to take effect immediately or only upon your incapacitation.

More About California Durable Power of Attorney

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It is an important tool for managing financial and legal affairs when the principal is unable to do so themselves.

What decisions can an agent make under a Durable Power of Attorney?

The agent can make a variety of decisions, including managing bank accounts, signing checks, handling real estate transactions, and making investment decisions. The scope of authority can be broad or limited based on the principal's preferences. It is crucial to clearly outline the powers granted to the agent in the document.

How does one create a Durable Power of Attorney in California?

To create a Durable Power of Attorney in California, the principal must complete a specific form that complies with state laws. This form should include the principal’s name, the agent’s name, and the powers granted to the agent. The document must be signed by the principal and, in some cases, witnessed or notarized. It is advisable to consult with a legal professional to ensure that the form meets all legal requirements.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. The principal must provide a written notice of revocation to the agent and any institutions or individuals that were relying on the original document. It is important to formally revoke the document to avoid any confusion or misuse of authority.

What happens if the agent is unable or unwilling to serve?

If the designated agent is unable or unwilling to serve, the Durable Power of Attorney may name an alternate agent. If no alternate agent is specified, the principal may need to appoint a new agent through a new Durable Power of Attorney form. In some cases, it may be necessary to seek court intervention to appoint a conservator if no agent is available.

Is a Durable Power of Attorney valid in other states?

A California Durable Power of Attorney is generally valid in other states, but it is advisable to check the specific laws of the state in question. Some states may have different requirements or forms. To ensure that the document is recognized and enforceable, it may be beneficial to consult with an attorney in the state where the agent will be acting.

What are the risks of granting someone a Durable Power of Attorney?

Granting someone a Durable Power of Attorney comes with inherent risks, as the agent has significant authority over the principal's financial and legal matters. If the agent acts unethically or against the principal's wishes, it can lead to financial loss or legal complications. Therefore, it is crucial to choose a trustworthy individual and to clearly outline the powers granted in the document to mitigate potential risks.

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it’s important to be careful and thorough. Here’s a list of things to do and avoid:

- Do clearly identify yourself and the agent you are appointing.

- Do specify the powers you are granting to your agent.

- Do sign the document in front of a notary public.

- Do keep a copy of the completed form for your records.

- Do discuss your wishes with your agent before completing the form.

- Don't leave any sections blank unless instructed.

- Don't use ambiguous language that could lead to confusion.

- Don't forget to date the document when you sign it.

- Don't assume your agent knows your wishes without discussing them.

- Don't overlook the need for witnesses if required in your situation.

California Durable Power of Attorney - Usage Steps

Filling out the California Durable Power of Attorney form is an important step in ensuring your financial and medical decisions are handled according to your wishes. Once completed, the form must be signed and may need to be notarized or witnessed, depending on your specific situation. Follow these steps to fill out the form correctly.

- Obtain the California Durable Power of Attorney form. You can find it online or at legal supply stores.

- Read the instructions carefully. Familiarize yourself with the sections of the form to understand what information is required.

- Fill in your name and address in the designated area. This identifies you as the principal.

- Designate an agent by writing their name and address. This person will have the authority to act on your behalf.

- Decide if you want to name an alternate agent. If your first choice cannot serve, the alternate will step in.

- Specify the powers you are granting to your agent. You can choose general powers or limit them to specific tasks.

- Indicate when the powers become effective. You may want them to start immediately or only if you become incapacitated.

- Sign and date the form. Ensure you do this in front of a notary public or witnesses if required.

- Make copies of the completed form. Keep one for your records and provide copies to your agent and any relevant institutions.