Fillable Gift Deed Template for California State

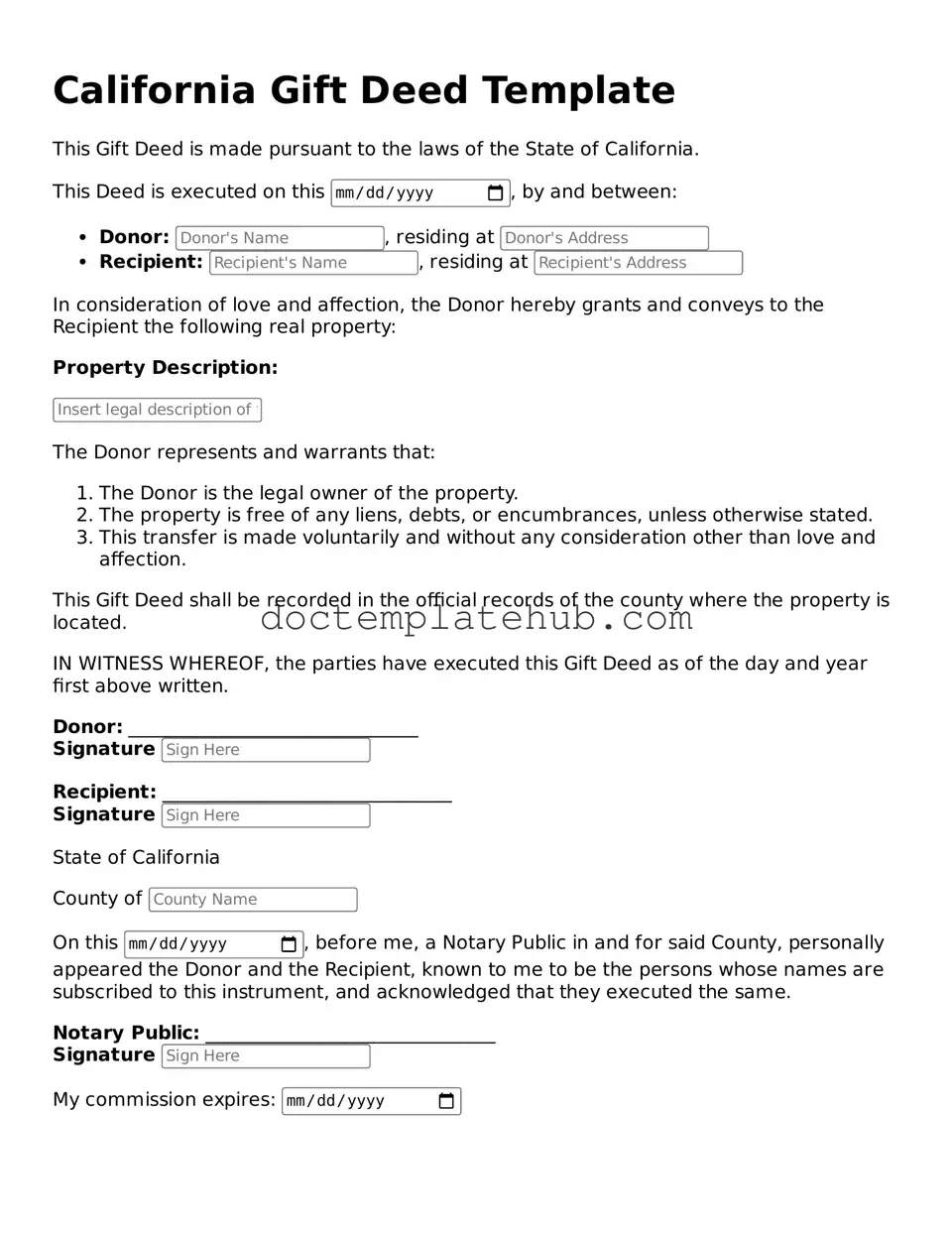

The California Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without the exchange of monetary compensation. This document allows a property owner, often referred to as the donor, to convey ownership to another individual, known as the recipient or donee, while ensuring that the transfer is documented and legally recognized. Essential components of the form include the identification of both parties, a clear description of the property being gifted, and the donor's intent to make a gift. Additionally, the form typically requires the signature of the donor and may necessitate notarization to validate the transaction. Understanding the implications of a gift deed is vital, as it can affect taxes, property rights, and future ownership. By using this form, individuals can facilitate a straightforward transfer of property, fostering goodwill and strengthening personal relationships.

Similar forms

The California Gift Deed form shares similarities with a Quitclaim Deed. Both documents are used to transfer property ownership, but a Quitclaim Deed is typically used to relinquish any claim to the property without guaranteeing that the title is clear. In contrast, a Gift Deed explicitly indicates that the transfer is a gift, often with no exchange of money involved. While a Quitclaim Deed may leave room for potential disputes regarding ownership, a Gift Deed clearly states the donor's intent to give the property without expectation of compensation.

Another document akin to the Gift Deed is the Warranty Deed. This deed also transfers property ownership, but it comes with a guarantee from the seller that the title is clear and free of encumbrances. Unlike a Gift Deed, which does not provide such warranties, a Warranty Deed assures the buyer that they will not face any claims against the property. This added layer of security makes Warranty Deeds more common in sales transactions, while Gift Deeds are specifically designed for transfers without monetary exchange.

The Bargain and Sale Deed is another document that shares characteristics with the Gift Deed. This type of deed implies that the seller has the right to transfer the property but does not guarantee that the title is free from defects. Like a Gift Deed, it facilitates the transfer of ownership; however, it does not explicitly state that the transfer is a gift. Instead, it suggests a sale or exchange, even if no money changes hands, which can create confusion regarding the nature of the transaction.

In some cases, a Revocable Living Trust can resemble a Gift Deed in the context of property transfer. When property is placed into a revocable trust, the trustor retains control during their lifetime and can distribute assets to beneficiaries upon death. While a Gift Deed transfers property outright, a trust allows for more control over how and when the property is distributed. Both documents aim to facilitate the transfer of property, but the trust offers a more flexible approach to managing assets.

The Transfer on Death Deed (TOD) is similar in that it allows property to be transferred upon the death of the owner. This document, like a Gift Deed, does not require the beneficiary to pay for the property during the owner's lifetime. However, a TOD deed is specifically designed to avoid probate, making it a popular choice for estate planning. In contrast, a Gift Deed is effective immediately upon signing and recording, which can lead to different tax implications and ownership rights.

The Chick-fil-A job application form is a fundamental document used by individuals seeking employment at the popular fast-food chain. This form collects essential information about applicants, including their work history and availability. Completing it accurately is the first step toward joining a team known for its commitment to customer service and community involvement. For those interested in applying, the application can be found at https://documentonline.org/blank-chick-fil-a-job-application.

Another related document is the Special Warranty Deed. This deed provides a limited warranty on the title, meaning the seller only guarantees that they have not caused any title issues during their ownership. While it is similar to a Warranty Deed, which offers a broader guarantee, a Special Warranty Deed can still be used to transfer property, albeit with less assurance. A Gift Deed, on the other hand, does not involve any warranties, focusing solely on the intent to gift the property.

Lastly, a Deed of Trust can also bear resemblance to a Gift Deed, particularly in the context of property transfer. A Deed of Trust is used primarily in real estate transactions to secure a loan, where the borrower conveys legal title to a trustee until the loan is paid off. While it serves a different purpose than a Gift Deed, both documents involve the transfer of property rights. The key difference lies in the intent and conditions surrounding the transfer, with the Gift Deed focusing on gifting without any financial obligation.

Other Common State-specific Gift Deed Templates

What Is a Gift Deed in Texas - The form serves as proof that the property was a gift and not a sale.

The process of applying for asylum can be daunting, but understanding the importance of the USCIS I-589 form is essential for those in need of safety. This form is the gateway for individuals fleeing persecution, allowing them to seek protection in the United States. Resources such as smarttemplates.net can provide valuable assistance in navigating this crucial application, helping applicants to fill out the form accurately and effectively as they embark on their journey towards a safer future.

More About California Gift Deed

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer property ownership from one person to another without any exchange of money. This type of deed is typically used when a property owner wishes to give their property as a gift to a family member or friend. The gift deed must be signed by the donor (the person giving the gift) and should be recorded with the county recorder's office to make the transfer official. It is important to ensure that the deed complies with California laws to avoid any future disputes.

What are the requirements for a valid Gift Deed in California?

To create a valid Gift Deed in California, certain requirements must be met. First, the deed must clearly identify the donor and the recipient. It should also describe the property being transferred in detail. The donor must sign the deed in front of a notary public. Additionally, the deed should include a statement indicating that the transfer is a gift, not a sale. Once completed, the deed must be filed with the local county recorder's office to be legally recognized.

Are there tax implications when using a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. The donor may be subject to gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. However, many individuals do not end up paying gift tax due to the lifetime exemption amount. The recipient may also face property tax reassessment depending on the value of the property and local laws. It is advisable to consult a tax professional to understand the specific implications based on individual circumstances.

Can a Gift Deed be revoked or changed?

A Gift Deed is generally irrevocable once it has been executed and recorded. However, there are limited circumstances under which a donor may be able to revoke the gift, such as if the gift was made under duress or if the donor was not of sound mind at the time of the transfer. If changes are necessary, the donor may need to create a new legal document or deed to address the situation. Consulting with a legal professional is recommended for guidance in these cases.

What should I do if I want to create a Gift Deed?

If you wish to create a Gift Deed, start by gathering all necessary information about the property and the parties involved. It may be helpful to consult with a legal professional to ensure that the deed complies with all legal requirements. After drafting the deed, both the donor and a notary public must sign it. Finally, file the completed deed with the county recorder's office to finalize the transfer of ownership. Proper documentation and recording are essential to protect both parties' interests.

Dos and Don'ts

When filling out the California Gift Deed form, it's essential to approach the process with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that the property description is accurate and complete.

- Do include the full names of both the giver and the recipient.

- Do sign the deed in front of a notary public to ensure its validity.

- Do check for any local regulations that might affect the gift transfer.

- Don't leave any sections of the form blank; this can lead to delays or rejections.

- Don't forget to include the date of the gift.

- Don't assume that the gift deed is the only document needed; consider other legal implications.

- Don't rush the process; take your time to review all information for accuracy.

California Gift Deed - Usage Steps

After obtaining the California Gift Deed form, you will need to fill it out accurately to ensure a smooth transfer of property. Follow these steps to complete the form correctly.

- Gather Required Information: Collect details about the property being gifted, including the legal description, address, and parcel number.

- Identify the Grantor: Write the full name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the full name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a clear description of the property. This should include the type of property (e.g., residential, commercial) and any relevant details.

- State the Gift: Clearly indicate that the property is being given as a gift without any compensation.

- Sign the Form: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name provided.

- Notarization: Have the notary public complete their section of the form, verifying the grantor's identity and signature.

- Record the Deed: Take the completed and notarized Gift Deed to the county recorder's office where the property is located. This step is crucial for making the gift official.