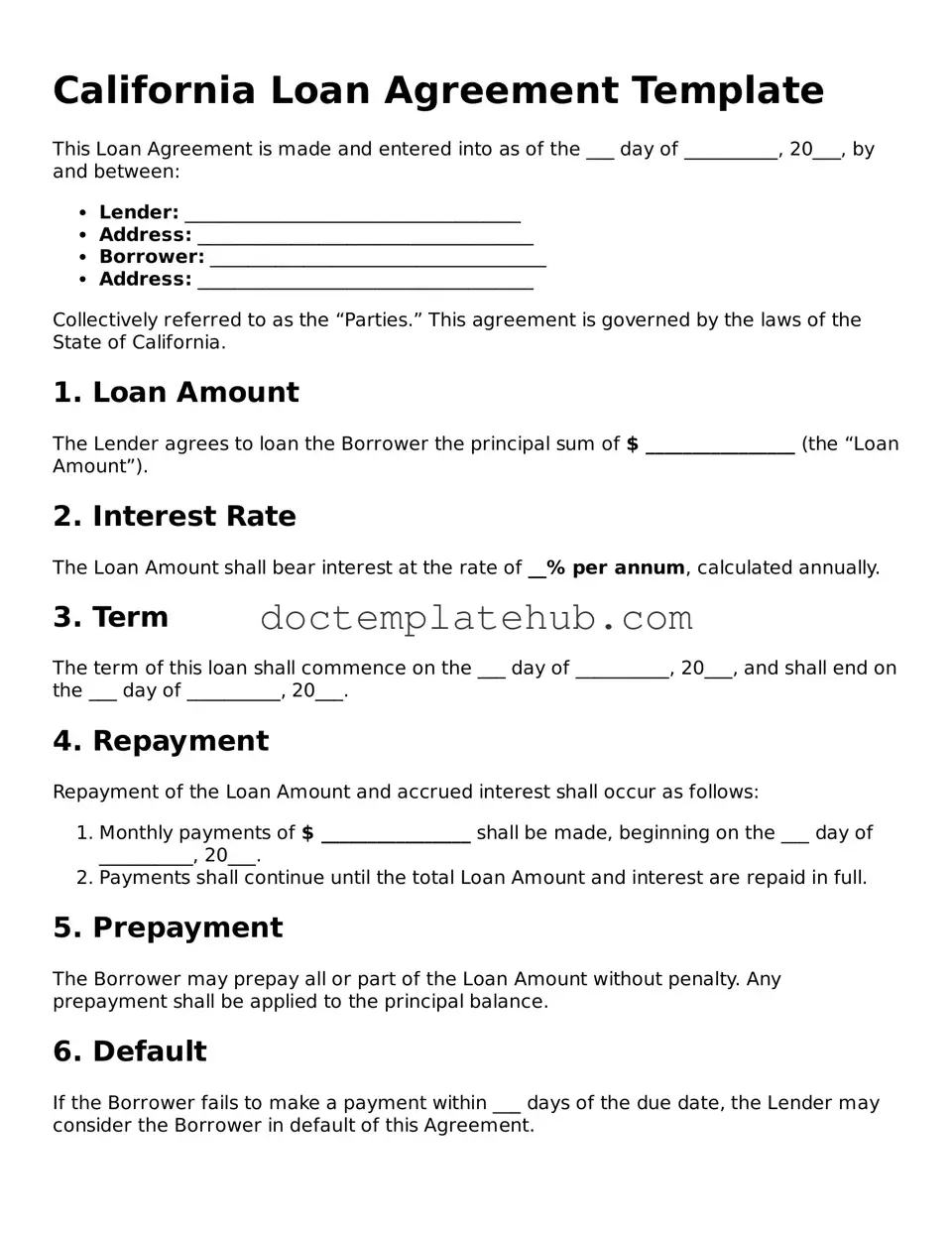

Fillable Loan Agreement Template for California State

The California Loan Agreement form serves as a crucial document in the lending process, providing clarity and protection for both borrowers and lenders. This form outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. It also specifies any collateral involved, which helps secure the loan and provides reassurance to the lender. Additionally, the agreement includes provisions regarding late fees, default conditions, and remedies available to the lender in case of non-payment. By detailing these aspects, the form aims to prevent misunderstandings and disputes, ensuring that both parties are on the same page. Furthermore, the California Loan Agreement adheres to state laws, which adds an extra layer of legal compliance and security. Understanding this form is essential for anyone entering into a lending arrangement in California, as it lays the foundation for a responsible financial relationship.

Similar forms

The California Loan Agreement form shares similarities with the Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a lender at a defined time or on demand. Both documents outline the terms of the loan, including the principal amount, interest rate, and repayment schedule. However, while a Loan Agreement may include more detailed terms and conditions, the Promissory Note focuses primarily on the borrower's commitment to repay the loan. This makes the Promissory Note a simpler, more straightforward document in comparison.

Another document that resembles the California Loan Agreement is the Mortgage Agreement. A Mortgage Agreement secures a loan with real property, allowing the lender to take possession of the property if the borrower defaults. Both agreements detail the obligations of the borrower and lender, including payment terms and consequences for non-payment. However, a Mortgage Agreement specifically addresses the collateral involved, while a Loan Agreement may not always require collateral, depending on the nature of the loan.

The Security Agreement is also similar to the California Loan Agreement. This document is used when a borrower pledges personal property as collateral for a loan. Like the Loan Agreement, it outlines the terms of the loan, including repayment conditions. The primary difference lies in the focus on collateral; a Security Agreement explicitly identifies the property that secures the loan, while a Loan Agreement may not necessarily involve collateral or detail its specifics.

The Credit Agreement is another document that bears resemblance to the California Loan Agreement. A Credit Agreement outlines the terms under which a borrower can access credit from a lender. Both documents specify the amount of money being borrowed, interest rates, and repayment terms. However, Credit Agreements are often used for revolving credit lines, such as credit cards, whereas Loan Agreements typically pertain to fixed loans with a set repayment schedule.

A Loan Modification Agreement is akin to the California Loan Agreement in that it outlines changes to the original loan terms. This document is created when a borrower and lender agree to modify the existing loan conditions, such as interest rates or repayment schedules. Both agreements require mutual consent and detail the obligations of both parties. However, a Loan Modification Agreement specifically addresses alterations to existing terms rather than establishing a new loan.

The Installment Agreement is another document that shares characteristics with the California Loan Agreement. This type of agreement details a loan that will be repaid in regular, scheduled payments over time. Both documents outline the payment structure, including the total amount borrowed, interest rates, and repayment timeline. The key distinction is that an Installment Agreement is often used for consumer loans, such as car loans, while a Loan Agreement can cover a broader range of borrowing scenarios.

For those seeking to establish legal representation for financial decisions, understanding a Texas Durable Power of Attorney form is essential, as it allows a designated individual to act on another's behalf even in cases of incapacity. This critical document ensures the chosen representative adheres to the individual's financial wishes, providing peace of mind and clarity. Resources such as smarttemplates.net can be invaluable in accessing the necessary forms and guidance on this important aspect of legal preparation.

The Lease Agreement can also be compared to the California Loan Agreement, particularly in situations where a lease involves a loan for purchasing equipment or property. Both documents stipulate the terms of repayment and the obligations of the parties involved. However, a Lease Agreement typically involves the rental of property or equipment, while a Loan Agreement focuses on the borrowing of funds, making the purpose of each document distinct.

The Personal Loan Agreement is similar to the California Loan Agreement in that it governs loans made between individuals. It outlines the terms of the loan, including the amount borrowed, interest rate, and repayment plan. While both documents serve to protect the interests of the lender and borrower, a Personal Loan Agreement is often less formal and may not require the same level of detail as a standard Loan Agreement.

The Business Loan Agreement is another document that closely resembles the California Loan Agreement. This type of agreement is specifically designed for loans taken out by businesses. Both documents outline the terms of the loan, including repayment schedules and interest rates. However, Business Loan Agreements often include additional terms related to the operation of the business and may require more extensive financial disclosures from the borrower.

Finally, the Line of Credit Agreement shares similarities with the California Loan Agreement, particularly in how it establishes borrowing terms. A Line of Credit Agreement allows borrowers to access funds up to a specified limit, with interest only charged on the amount drawn. Both documents detail the terms of borrowing and repayment, but a Line of Credit Agreement is designed for flexible borrowing, while a Loan Agreement typically involves a fixed amount and repayment schedule.

Other Common State-specific Loan Agreement Templates

Georgia Promissory Note Template - Borrowers should receive a copy of the signed agreement for their records.

To facilitate the transfer of ownership smoothly, it is crucial to use the proper documentation, such as a reliable boat sale agreement. This ensures that all parties are protected and informed; for guidance on filling out the necessary Boat Bill of Sale requirements, please refer to the link.

More About California Loan Agreement

What is a California Loan Agreement?

A California Loan Agreement is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities throughout the loan period.

What information should be included in a California Loan Agreement?

Essential details in a California Loan Agreement include the names and contact information of both the lender and borrower, the principal amount of the loan, the interest rate, and the repayment terms. Additionally, it is important to specify any fees, penalties for late payments, and the consequences of default. Including a section on dispute resolution can also be beneficial, as it outlines how any disagreements will be handled.

Is it necessary to have a lawyer review the Loan Agreement?

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is crucial to document any modifications in writing and have both parties sign the amended agreement. This ensures that the new terms are clear and legally enforceable. Verbal agreements or informal changes may lead to misunderstandings and potential legal issues down the line.

Dos and Don'ts

When filling out the California Loan Agreement form, it is essential to be careful and thorough. Below are some important do's and don'ts to keep in mind:

- Do read the entire form carefully before you begin filling it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all figures and calculations to ensure they are correct.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use white-out or erase any mistakes; instead, cross out errors neatly and initial them.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to check for any additional documents that may need to be submitted with the form.

California Loan Agreement - Usage Steps

Completing the California Loan Agreement form is a straightforward process. By following these steps, you can ensure that all necessary information is accurately provided. This will help facilitate the loan agreement between the parties involved.

- Begin by clearly stating the date at the top of the form. This should reflect the day you are filling out the agreement.

- Next, fill in the names and addresses of both the borrower and the lender. Ensure that all information is correct and up to date.

- Specify the loan amount in both numerical and written form. This helps to avoid any misunderstandings regarding the total amount being borrowed.

- Indicate the interest rate being charged on the loan. This should be expressed as a percentage.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, bi-weekly) and the total duration of the loan.

- Include any fees associated with the loan, such as origination fees or late payment penalties. Clearly outline these costs.

- Both parties should sign and date the agreement at the bottom of the form. This signifies that both the borrower and lender agree to the terms outlined.

- Make copies of the signed agreement for both parties. This ensures that each party has a record of the terms of the loan.

Once the form is filled out and signed, both parties should keep their copies in a safe place. This document serves as a formal record of the loan agreement and can be referenced if any questions arise in the future.