Fillable Motor Vehicle Bill of Sale Template for California State

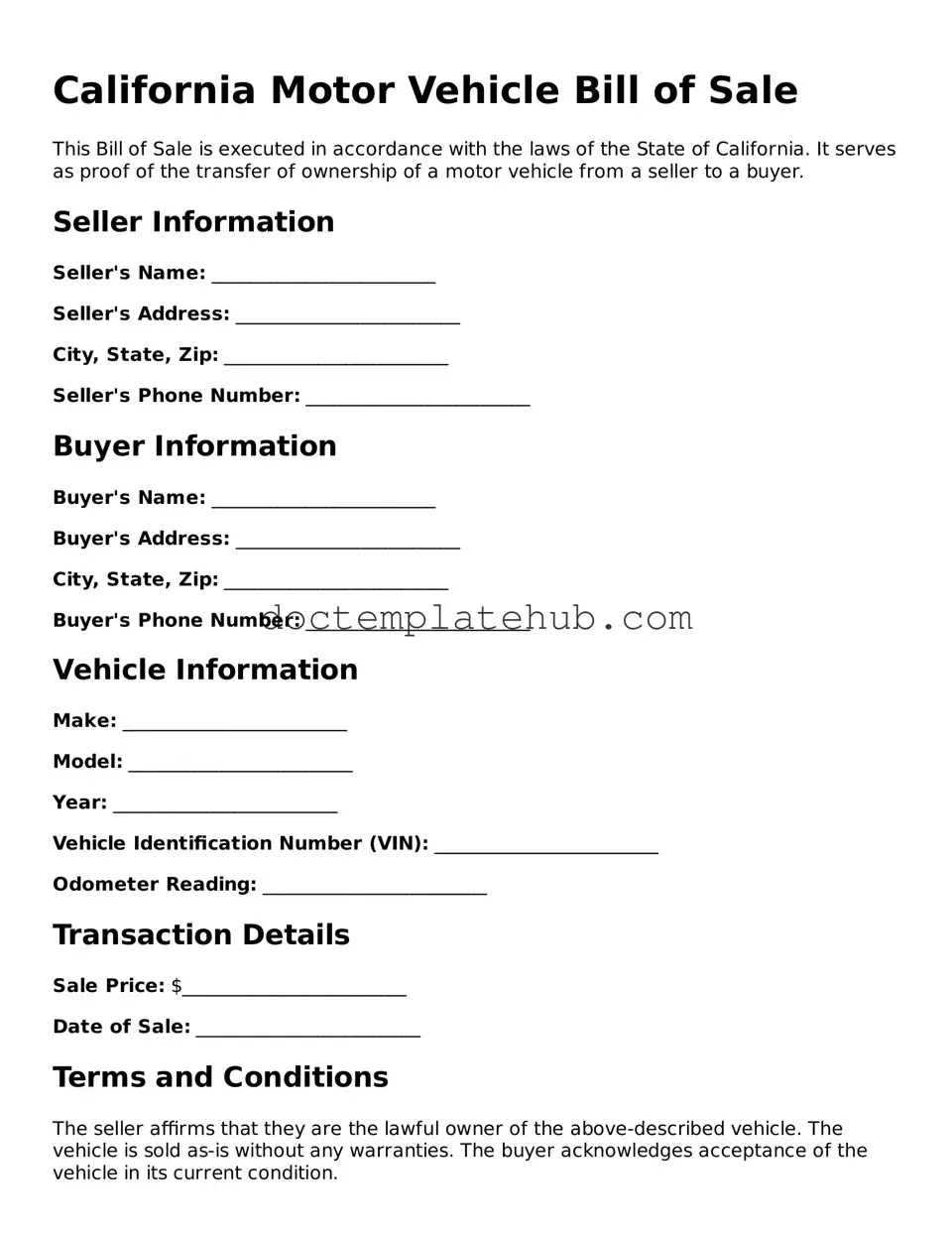

The California Motor Vehicle Bill of Sale form serves as a crucial document in the process of buying or selling a vehicle within the state. This form captures essential details about the transaction, including the names and addresses of both the seller and the buyer, the vehicle's identification number (VIN), make, model, and year. Additionally, it records the sale price and the date of the transaction, providing a clear record for both parties. This document not only helps in transferring ownership but also serves as proof of the sale for future reference. It is important to ensure that all information is accurate and complete to avoid any potential disputes. Understanding the significance of this form can facilitate a smoother transaction and ensure compliance with California's vehicle registration requirements.

Similar forms

The California Vehicle Registration Application serves a similar purpose as the Bill of Sale by documenting the transfer of ownership for a vehicle. Both forms require information about the buyer and seller, including names and addresses. They also capture details about the vehicle itself, such as the make, model, and Vehicle Identification Number (VIN). While the Bill of Sale primarily acts as proof of the transaction, the Vehicle Registration Application is essential for updating the state's records to reflect the new owner.

The Vehicle Title Transfer form is another document that shares similarities with the Bill of Sale. This form is crucial when ownership of a vehicle changes hands. Like the Bill of Sale, it contains essential details about the vehicle and the parties involved. However, the Title Transfer form is specifically designed to officially transfer the title from the seller to the buyer, ensuring that the new owner is legally recognized as the vehicle's owner by the state.

The Odometer Disclosure Statement is closely related to the Bill of Sale, particularly for used vehicles. This document is required to confirm the mileage of the vehicle at the time of sale. Both forms aim to protect buyers from potential fraud by ensuring that the odometer reading is accurate. While the Bill of Sale serves as a record of the transaction, the Odometer Disclosure Statement specifically addresses the vehicle's mileage, which is a critical factor in its value.

The Vehicle Emission Compliance Certificate is another document that may accompany the Bill of Sale. This certificate verifies that the vehicle meets California's emission standards. While the Bill of Sale confirms the sale itself, the Emission Compliance Certificate ensures that the vehicle can legally be registered in California. Both documents work together to facilitate a smooth transfer of ownership while complying with state regulations.

The Power of Attorney for Vehicle Transactions can also be compared to the Bill of Sale. This document allows one party to act on behalf of another in the sale or transfer of a vehicle. While the Bill of Sale serves as proof of the transaction, the Power of Attorney grants the necessary authority for the transaction to take place. This is particularly useful in situations where the seller cannot be present to complete the sale.

The Application for Duplicate Title is similar in that it relates to the ownership of a vehicle. If a title is lost or damaged, this application allows the owner to request a duplicate. While the Bill of Sale documents the transfer of ownership, the Application for Duplicate Title ensures that the new owner can obtain a valid title to the vehicle, which is essential for registration and legal recognition.

Finally, the Vehicle Insurance Policy is relevant in the context of vehicle ownership transfer. While the Bill of Sale confirms the sale, an insurance policy is necessary for the new owner to legally operate the vehicle. Both documents are integral to vehicle ownership, with the Bill of Sale serving as proof of purchase and the insurance policy providing coverage against potential liabilities.

Other Common State-specific Motor Vehicle Bill of Sale Templates

Az Dmv Bill of Sale - Buyers may use the Bill of Sale to prove ownership if the title is lost or missing.

Texas Motor Vehicle Bill of Sale - Specifies the sale price and payment method.

More About California Motor Vehicle Bill of Sale

What is a California Motor Vehicle Bill of Sale?

A California Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a motor vehicle from one party to another. This form serves as proof of the sale and includes important details such as the vehicle's identification number (VIN), make, model, year, and the names and addresses of both the buyer and seller. It is an essential document for both parties to protect their rights and ensure a smooth transaction.

Is a Bill of Sale required in California?

While a Bill of Sale is not legally required in California for the transfer of vehicle ownership, it is highly recommended. This document provides a clear record of the transaction, which can be beneficial in case of disputes or for tax purposes. Additionally, when registering the vehicle with the Department of Motor Vehicles (DMV), having a Bill of Sale can simplify the process.

What information is needed to complete the Bill of Sale?

To complete a California Motor Vehicle Bill of Sale, several key pieces of information are necessary. This includes the date of the sale, the purchase price, the VIN, the make, model, and year of the vehicle. Both the seller and buyer must provide their names, addresses, and signatures. If applicable, any liens on the vehicle should also be disclosed.

Can I use a generic Bill of Sale form?

Yes, you can use a generic Bill of Sale form in California. However, it is advisable to use a form specifically designed for motor vehicles to ensure that all relevant details are included. A specific form can help prevent potential issues during the registration process with the DMV.

What do I need to do after completing the Bill of Sale?

After completing the Bill of Sale, the seller should provide a copy to the buyer. The buyer must then take the signed Bill of Sale to the DMV along with other required documents, such as the title of the vehicle and proof of insurance, to complete the registration process. The seller should also keep a copy for their records.

How does a Bill of Sale affect taxes?

The Bill of Sale plays a crucial role in determining the sales tax owed on the vehicle purchase. In California, the buyer is responsible for paying sales tax based on the purchase price stated in the Bill of Sale. Accurate reporting of the sale price can help ensure compliance with tax regulations.

What if the vehicle has a lien?

If the vehicle has an outstanding lien, it is essential to address this before completing the sale. The seller should disclose any liens on the Bill of Sale. The lienholder may need to be involved in the transaction to ensure that the lien is satisfied and that the title can be transferred to the buyer without complications.

Dos and Don'ts

When filling out the California Motor Vehicle Bill of Sale form, it’s important to get it right. Here are some guidelines to follow:

- Do provide accurate information about the vehicle, including make, model, year, and VIN.

- Do include the purchase price and date of sale clearly.

- Do ensure both the buyer and seller sign the document.

- Do keep a copy of the completed form for your records.

- Do check for any specific local requirements that may apply.

- Don't leave any fields blank; fill in all required information.

- Don't use white-out or make alterations to the form after signing.

- Don't forget to date the document at the time of signing.

- Don't misrepresent the condition of the vehicle.

- Don't ignore the importance of having witnesses if required.

California Motor Vehicle Bill of Sale - Usage Steps

After completing the California Motor Vehicle Bill of Sale form, the next steps involve ensuring that all parties have copies for their records. This form serves as proof of the transaction and should be kept in a safe place. Make sure to follow these steps carefully to fill out the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Fill in the name and address of the seller. This information should be clear and complete.

- Next, provide the name and address of the buyer. Ensure that this is accurate to avoid any issues later.

- In the designated section, write down the vehicle's details, including the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the vehicle. This should reflect the agreed-upon amount between the buyer and seller.

- Both the seller and buyer should sign and date the form. This confirms that both parties agree to the terms outlined.

- Make copies of the completed form for both the buyer and seller. Retain these copies for future reference.