Fillable Power of Attorney Template for California State

In California, the Power of Attorney form serves as a crucial tool for individuals seeking to delegate authority to another person, known as an agent or attorney-in-fact, to make decisions on their behalf. This legal document can cover a wide range of responsibilities, from managing financial affairs to making healthcare decisions, depending on the specific powers granted. One of the key features of the California Power of Attorney is its flexibility; individuals can choose to limit the scope of authority, ensuring that the agent can only act within specified boundaries. Additionally, the form allows for both durable and non-durable options, meaning it can remain in effect even if the principal becomes incapacitated or can be set to expire under certain conditions. Proper execution of the form, which includes signatures and, in some cases, notarization, is essential to ensure its validity. Understanding the nuances of this document is vital, as it not only empowers individuals to plan for the future but also provides peace of mind that their wishes will be honored, regardless of unforeseen circumstances.

Similar forms

The California Advance Healthcare Directive is similar to the Power of Attorney form in that it allows individuals to appoint someone to make medical decisions on their behalf. This document combines the functions of a living will and a durable power of attorney for healthcare. It specifies the types of medical treatment one wishes to receive or avoid, ensuring that personal healthcare preferences are honored when one cannot communicate them directly.

The California Conservatorship is another document related to the Power of Attorney. A conservatorship is a legal arrangement where a court appoints an individual to manage the affairs of someone unable to do so due to incapacity. While a Power of Attorney is typically created voluntarily by the principal, a conservatorship is established through a court process, making it more formal and often more restrictive.

The California Living Trust shares similarities with the Power of Attorney in that both documents can help manage a person's assets. A living trust allows individuals to transfer their assets into a trust for management during their lifetime and distribution after death. Unlike a Power of Attorney, which grants authority to act on behalf of another person, a living trust directly holds and manages the assets, potentially avoiding probate.

The California Health Insurance Portability and Accountability Act (HIPAA) Authorization form is also akin to the Power of Attorney. This document allows individuals to designate someone who can access their medical records and information. While a Power of Attorney can grant broad authority, a HIPAA Authorization specifically focuses on the privacy and sharing of health information, ensuring that the designated person can make informed decisions regarding healthcare.

The California Durable Power of Attorney for Finances is a specific type of Power of Attorney that focuses solely on financial matters. This document allows an individual to appoint someone to handle financial transactions, manage bank accounts, and make investment decisions. While it serves a similar purpose to the general Power of Attorney, it is tailored to financial affairs, ensuring that the appointed agent can act on behalf of the principal in all financial matters when necessary.

Other Common State-specific Power of Attorney Templates

Az Form 285 - Can ensure medical treatment preferences are voiced through health care directives.

How to Set Up a Power of Attorney - Can be prepared without an attorney but legal advice is recommended.

More About California Power of Attorney

What is a Power of Attorney in California?

A Power of Attorney (POA) in California is a legal document that allows you to appoint someone else to make decisions on your behalf. This can include financial matters, medical decisions, or other personal affairs. The person you appoint is known as your agent or attorney-in-fact. It's essential to choose someone you trust, as they will have significant authority to act in your name.

What types of Power of Attorney are available in California?

California offers several types of Power of Attorney forms, each serving different purposes. The most common types include General Power of Attorney, which grants broad powers to your agent, and Durable Power of Attorney, which remains effective even if you become incapacitated. There is also a Medical Power of Attorney, specifically for healthcare decisions, and a Limited Power of Attorney, which restricts your agent's authority to specific tasks or situations.

How do I create a Power of Attorney in California?

To create a Power of Attorney in California, you must complete the appropriate form, which can be obtained online or from legal offices. It's crucial to ensure the form is signed and dated by you, the principal. Additionally, your signature must be witnessed by at least one person or notarized to be legally valid. Once completed, keep a copy for your records and provide copies to your agent and any relevant institutions.

Can I revoke a Power of Attorney in California?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that may have relied on the original Power of Attorney. It's advisable to also destroy any copies of the original document to prevent confusion. Always keep a record of the revocation for your files.

Dos and Don'ts

When filling out a California Power of Attorney form, it’s important to be thorough and accurate. Here’s a list of things to keep in mind:

- Do ensure that you understand the powers you are granting. Read the form carefully to know what authority you’re giving to your agent.

- Don’t rush through the process. Take your time to fill out each section completely and correctly.

- Do choose a trustworthy agent. This person will have significant control over your financial or medical decisions.

- Don’t leave any blank spaces. If a section doesn’t apply, write “N/A” to avoid confusion.

- Do sign the form in front of a notary public. This step is crucial for the document’s validity.

- Don’t forget to inform your agent about their responsibilities. Communication is key to ensuring your wishes are respected.

California Power of Attorney - Usage Steps

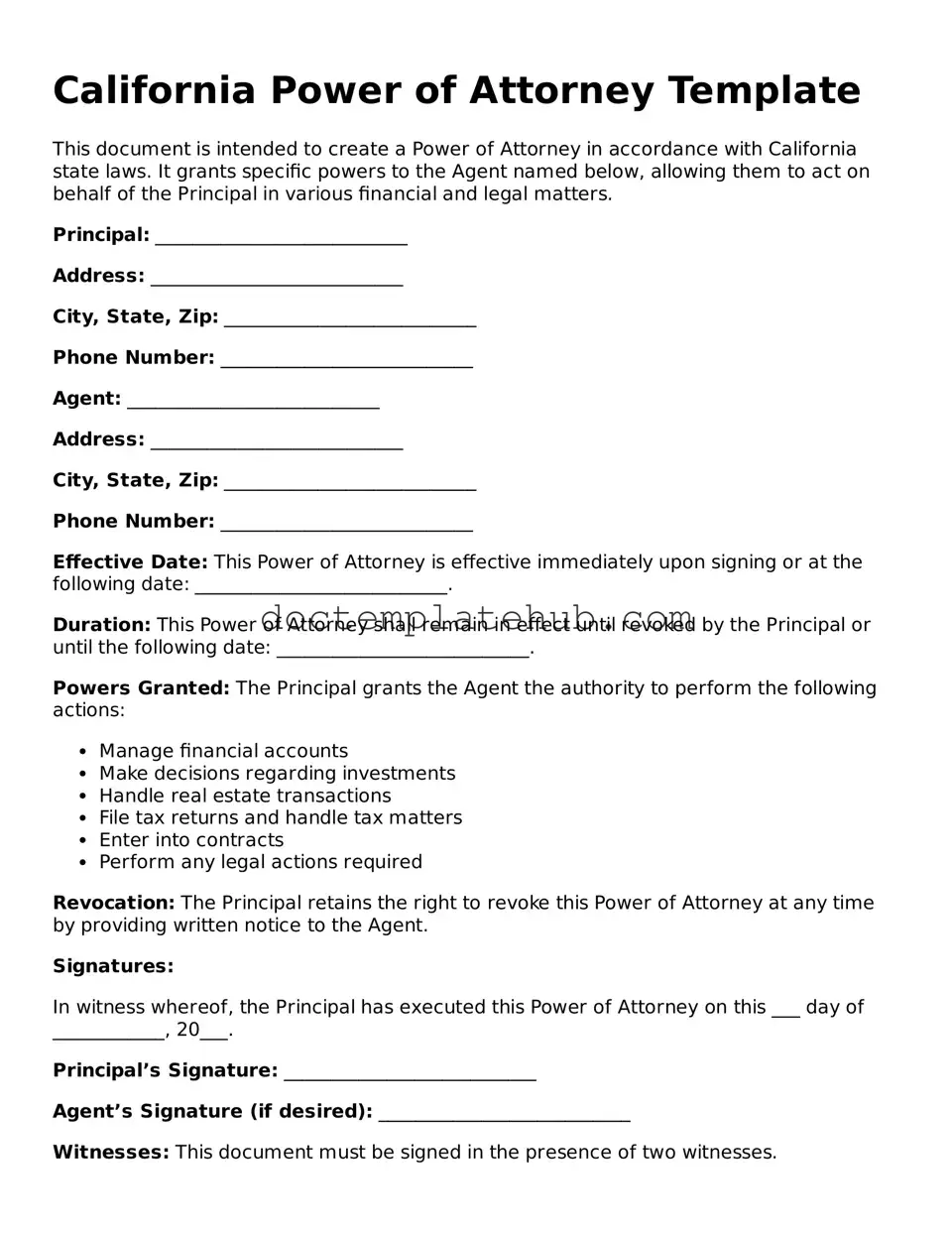

Filling out the California Power of Attorney form is a crucial step in ensuring that your financial and legal matters are managed according to your wishes. After completing the form, it must be signed and notarized to be legally valid. Follow these steps carefully to ensure accuracy and compliance.

- Obtain the California Power of Attorney form. You can download it from the California Secretary of State's website or acquire a physical copy from a legal office.

- Begin with the principal's information. Fill in your full name, address, and date of birth at the top of the form.

- Designate an agent. Provide the name and contact information of the person you are appointing to act on your behalf.

- Specify the powers granted. Clearly outline the financial or legal decisions your agent can make for you. You may choose to grant general powers or specific ones.

- Include any limitations. If there are any restrictions on the powers you are granting, make sure to state them explicitly.

- Sign and date the form. Your signature must be placed at the designated area, and the date of signing should be included.

- Have the document notarized. A notary public must witness your signature to validate the form.

- Distribute copies. Provide copies of the signed and notarized form to your agent, relevant financial institutions, and any other parties involved.