Fillable Promissory Note Template for California State

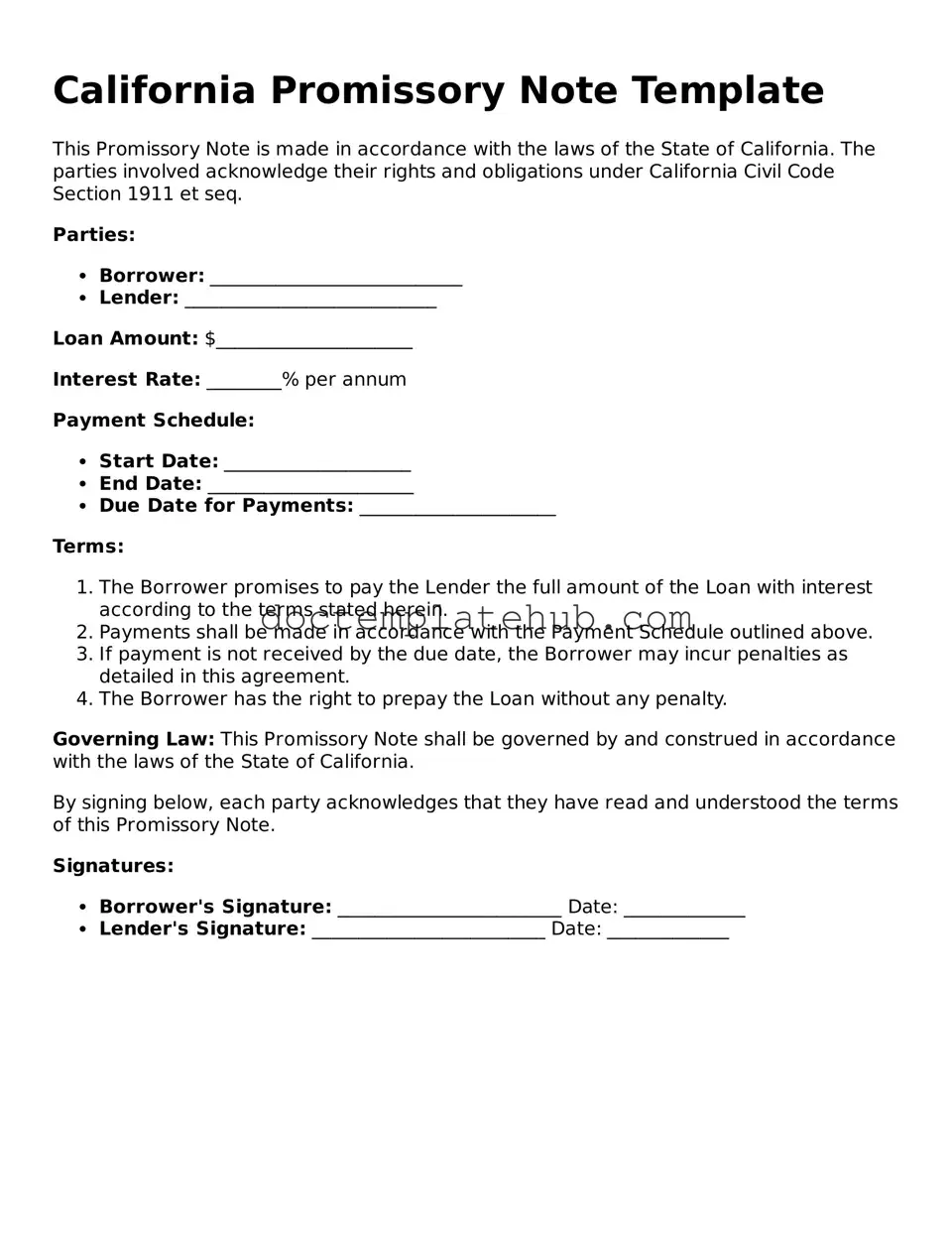

The California Promissory Note form serves as a crucial legal document in financial transactions, particularly when money is borrowed and a formal agreement is needed to outline the terms of repayment. This form is designed to protect both the lender and the borrower by clearly stating the amount borrowed, the interest rate, and the repayment schedule. It typically includes important details such as the due date for payments and any penalties for late payments, ensuring that both parties have a clear understanding of their obligations. Additionally, the form may outline what happens in the event of default, providing a framework for resolution. Understanding the nuances of this document is essential for anyone involved in lending or borrowing, as it not only facilitates trust but also establishes legal recourse if necessary. As financial transactions become increasingly complex, having a well-drafted promissory note can be a vital step in safeguarding one’s financial interests.

Similar forms

A California Promissory Note is similar to a Loan Agreement. Both documents outline the terms of borrowing money, including the amount, interest rate, and repayment schedule. While a promissory note is typically a straightforward promise to pay, a loan agreement often includes more detailed provisions, such as collateral requirements and conditions for default. Both serve to protect the lender's interests and provide a clear framework for the borrower’s obligations.

For those interested in property transactions, understanding the Quitclaim Deed process is essential. This document facilitates the transfer of ownership without providing warranty on the title, making it particularly useful in familiar transactions. Properly executing this form helps ensure a clear transfer of property rights.

Another document closely related to the Promissory Note is the Mortgage. A mortgage secures the loan with real property, providing the lender with a legal claim to the property if the borrower defaults. While the promissory note itself is a promise to repay the loan, the mortgage acts as a safety net for the lender, ensuring they can recover their funds through the sale of the property if necessary. Together, these documents create a comprehensive loan structure.

The Security Agreement is also akin to a Promissory Note. This document is used when a borrower offers personal property as collateral for a loan. Like the promissory note, it details the terms of the loan, but it specifically addresses the rights of the lender in relation to the collateral. If the borrower fails to repay, the lender can seize the collateral as outlined in the security agreement, providing an additional layer of protection.

Finally, the Loan Disclosure Statement bears similarities to a Promissory Note. This document provides borrowers with essential information about the loan, including the total cost, terms, and any fees associated with it. While the promissory note is a binding commitment to repay, the loan disclosure statement ensures that borrowers understand their financial obligations upfront, promoting transparency and informed decision-making.

Other Common State-specific Promissory Note Templates

Promissory Note Georgia - Financial institutions often require promissory notes for formal lending processes.

When considering property transfers in Texas, individuals often refer to the Texas Quitclaim Deed form, a crucial legal document that facilitates the transfer of interest in real property without any guarantees regarding the clarity of the title. This form is particularly useful among family members or in situations where properties are conveyed without full market value consideration. For those seeking a straightforward method to transfer ownership rights, yet aware of the risks involved due to an absence of warranties, resources such as smarttemplates.net can provide valuable insights and assistance.

Promissory Note Template Florida Pdf - Facilitates the borrowing process without a bank's involvement.

Texas Promissory Note Form - The note may specify whether payments should be made in installments or as a lump sum.

More About California Promissory Note

What is a California Promissory Note?

A California Promissory Note is a written promise to pay a specified amount of money to a designated party at a specified time or on demand. It serves as a legal document that outlines the terms of a loan or debt agreement between a borrower and a lender. This document can include details such as the interest rate, repayment schedule, and any collateral involved in the transaction.

Who can use a Promissory Note in California?

Anyone can use a Promissory Note in California, provided they are entering into a loan agreement. This includes individuals, businesses, and organizations. It is important for both parties to understand the terms of the note and ensure that it meets legal requirements to be enforceable in court.

What are the key components of a California Promissory Note?

A well-drafted California Promissory Note should include several key components: the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate, repayment terms, and any penalties for late payment. Additionally, it should specify whether the note is secured or unsecured and include any relevant provisions regarding default or acceleration of payment.

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the note must be signed by the borrower. It is advisable for both parties to keep a copy of the signed document for their records. If disputes arise, the note can be used as evidence in court.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best practice to document any modifications in writing and have both parties sign the amended note. This helps to avoid misunderstandings and ensures that all parties are aware of the new terms.

Dos and Don'ts

When filling out the California Promissory Note form, it's important to follow specific guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about both the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Don't leave any required fields blank.

- Don't use vague language; be specific about terms and conditions.

Following these guidelines will help ensure that the Promissory Note is valid and enforceable.

California Promissory Note - Usage Steps

Once you have the California Promissory Note form in front of you, it's time to fill it out accurately. This form is important for outlining the terms of a loan agreement between a borrower and a lender. Follow these steps carefully to ensure all necessary information is included.

- Title the Document: At the top of the form, write "Promissory Note" to clearly identify the purpose of the document.

- Enter the Date: Write the date when the note is being created. This is usually the date you sign the document.

- Identify the Borrower: Fill in the full name and address of the borrower. This is the person or entity receiving the loan.

- Identify the Lender: Write the full name and address of the lender. This is the person or entity providing the loan.

- Loan Amount: Clearly state the amount of money being borrowed. Be sure to write this in both numbers and words for clarity.

- Interest Rate: Specify the interest rate, if applicable. Include whether it is fixed or variable.

- Payment Terms: Outline how and when payments will be made. Include the payment schedule (monthly, bi-weekly, etc.) and the due date for the first payment.

- Maturity Date: Indicate the date when the loan will be fully paid off. This is the final payment date.

- Signatures: Both the borrower and lender must sign the document. Include the date of the signatures.

- Witness or Notary: Depending on your situation, you may need a witness or notary public to sign the document as well.

After completing the form, make sure to keep a copy for your records. It's essential to have a signed agreement that outlines the terms of the loan, as this can help avoid misunderstandings in the future.