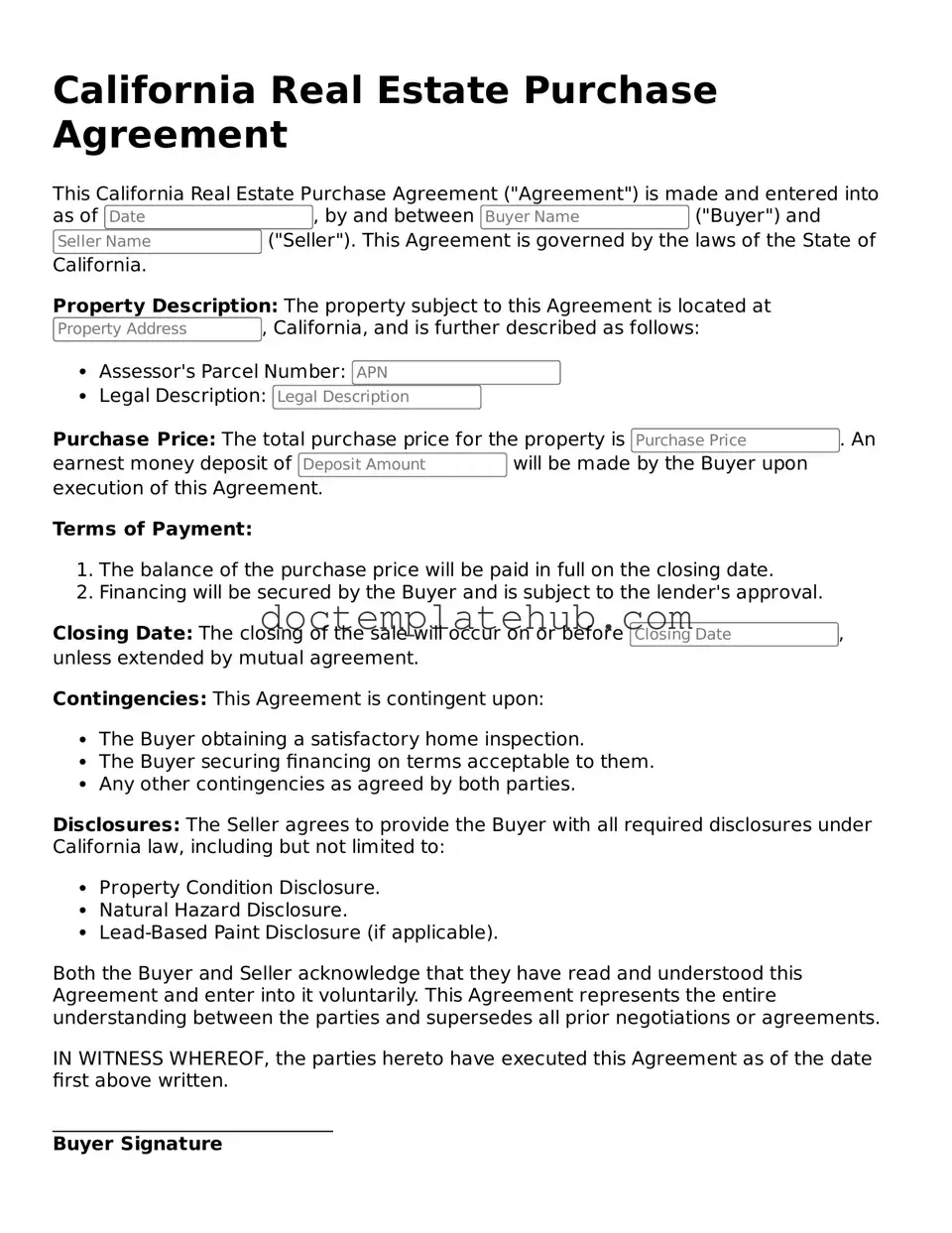

Fillable Real Estate Purchase Agreement Template for California State

The California Real Estate Purchase Agreement (REPA) is a vital document in the real estate transaction process, serving as the foundation for the sale of residential properties. This form outlines the essential terms and conditions agreed upon by the buyer and seller, ensuring that both parties have a clear understanding of their rights and obligations. Key components of the REPA include the purchase price, financing details, and contingencies, which protect the buyer in various scenarios, such as the need for inspections or the securing of a loan. Additionally, the form specifies important dates, including the closing date and any deadlines for contingencies to be met. It also addresses the allocation of costs related to the transaction, such as escrow fees and title insurance. By detailing these elements, the REPA not only facilitates a smoother transaction but also helps to minimize potential disputes, providing both parties with a sense of security and clarity throughout the process.

Similar forms

The California Real Estate Purchase Agreement (REPA) is similar to the Residential Purchase Agreement, which is often used in transactions involving single-family homes. Both documents outline the terms of sale, including the purchase price, financing details, and contingencies. They serve as a binding contract between the buyer and seller, ensuring that both parties understand their obligations. Just like the REPA, the Residential Purchase Agreement includes important clauses regarding disclosures and inspections, protecting both parties' interests during the transaction.

Another document that shares similarities with the REPA is the Commercial Purchase Agreement. While the REPA focuses on residential properties, the Commercial Purchase Agreement is tailored for commercial real estate transactions. Both agreements detail the terms of the sale, including price, payment structure, and any contingencies. They also address due diligence processes, which allow buyers to investigate the property before finalizing the purchase. This helps ensure that both buyers and sellers have a clear understanding of their rights and responsibilities.

The Lease Agreement also bears resemblance to the REPA, albeit for different purposes. While the REPA facilitates the sale of property, a Lease Agreement governs the rental of a property. Both documents specify terms such as duration, payment amounts, and responsibilities of each party. They also include provisions for what happens if either party breaches the agreement. In this way, both documents aim to protect the interests of the involved parties, ensuring clarity and accountability in property transactions.

When establishing a Texas-based limited liability company (LLC), it is essential to complete and file the Operating Agreement form. This document not only delineates the operating procedures and financial decisions but also clearly defines the roles of each member within the company. For those looking for reliable templates or guidance in drafting such agreements, resources like smarttemplates.net can provide valuable assistance.

Lastly, the Option to Purchase Agreement is another document similar to the REPA. This agreement gives a buyer the right, but not the obligation, to purchase a property at a later date. Like the REPA, it outlines the purchase price and any conditions that must be met for the sale to occur. The Option to Purchase Agreement also includes timelines and other critical details that help both parties understand their commitments. This document serves as a valuable tool for buyers who may want to secure a property while they finalize their financial or personal arrangements.

Other Common State-specific Real Estate Purchase Agreement Templates

Generic Home Purchase Agreement - Can prevent misunderstandings by clearly spelling out terms.

Real Estate Contract Template - Clarifies the rights of each party if the agreement is breached.

For those looking to streamline their lending process, the New York Promissory Note form is an invaluable resource, outlining crucial terms and conditions for repayment. Accessing this form will help you understand your obligations and rights as a borrower or lender, making it easier to establish clear financial agreements. For more information, explore this comprehensive guide on the Promissory Note requirements.

Georgia Purchase and Sale Agreement 2023 - The form can specify which items are included in the sale, like appliances.

Arizona Purchase Contract - This agreement serves as evidence of intent to purchase the property.

More About California Real Estate Purchase Agreement

What is a California Real Estate Purchase Agreement?

A California Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties sign it, detailing the price, property description, and other essential terms of the sale.

What information is included in the agreement?

The agreement typically includes the names of the buyer and seller, the property address, the purchase price, and the closing date. It may also contain contingencies, such as financing, inspections, and disclosures, which must be met for the sale to proceed. Other important details, like earnest money deposits and any included fixtures or appliances, are also addressed.

Do I need a lawyer to complete the agreement?

What happens if one party does not fulfill their obligations?

If either the buyer or seller fails to meet their obligations under the agreement, the other party may have the right to take legal action. This could involve seeking damages or enforcing the contract. It's crucial to understand your rights and responsibilities to avoid any potential disputes.

Can the agreement be modified after it's signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability.

What is an earnest money deposit?

An earnest money deposit is a sum of money that the buyer provides to show their serious intent to purchase the property. This deposit is typically held in escrow and applied toward the purchase price at closing. If the buyer backs out without a valid reason, the seller may keep the deposit as compensation.

What are contingencies in a real estate purchase agreement?

Contingencies are specific conditions that must be met for the sale to proceed. Common contingencies include financing approval, home inspections, and the sale of the buyer's current home. If a contingency is not met, the buyer can usually withdraw from the agreement without penalty.

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it's crucial to approach the task with care and attention to detail. Here are some important dos and don'ts to keep in mind:

- Do read the entire form thoroughly before starting. Understanding all sections is essential.

- Do provide accurate and complete information. Any errors can lead to complications later.

- Do consult with a real estate agent or attorney if you have questions. Their expertise can be invaluable.

- Do ensure all parties involved sign the agreement. This includes both the buyer and the seller.

- Don't rush through the form. Taking your time helps avoid mistakes.

- Don't leave any sections blank unless instructed. Every part of the form serves a purpose.

- Don't ignore deadlines. Timeliness is key in real estate transactions.

- Don't forget to keep a copy of the completed agreement for your records. Documentation is important.

California Real Estate Purchase Agreement - Usage Steps

Filling out the California Real Estate Purchase Agreement form is an important step in the home buying process. Completing this form accurately ensures that both the buyer and seller understand their rights and obligations. After filling out the form, it will need to be signed by both parties and may require additional documentation to finalize the transaction.

- Obtain the Form: Start by downloading the California Real Estate Purchase Agreement form from a reliable source or request a copy from your real estate agent.

- Fill in Buyer Information: Enter the full legal names of all buyers, along with their contact information. Ensure that this information is accurate.

- Fill in Seller Information: Similarly, provide the full legal names of all sellers and their contact information.

- Property Details: Include the property address, legal description, and any relevant details about the property being sold.

- Purchase Price: Clearly state the agreed-upon purchase price for the property. Be specific and include the currency.

- Deposit Information: Indicate the amount of the deposit and the timeline for when it will be paid. This shows the seller that the buyer is serious.

- Financing Terms: Specify whether the purchase will be financed and include details about the type of financing (e.g., conventional loan, FHA loan).

- Contingencies: List any contingencies that must be met for the sale to proceed, such as home inspections or financing approval.

- Closing Date: Enter the proposed closing date, which is when the sale will be finalized and ownership transferred.

- Signatures: Ensure that both parties sign and date the agreement. This makes the document legally binding.