Fillable Transfer-on-Death Deed Template for California State

In California, estate planning can often feel overwhelming, but the Transfer-on-Death Deed (TOD) form offers a straightforward solution for property owners looking to transfer their real estate without the complications of probate. This deed allows individuals to designate one or more beneficiaries who will automatically inherit their property upon their passing, ensuring a smooth transition of ownership. By using a TOD deed, property owners can maintain full control over their assets during their lifetime, as the transfer only takes effect after death. Importantly, the form must be properly executed and recorded to be valid, and it can be revoked or modified at any time before the owner's death. Understanding the nuances of this form can empower individuals to make informed decisions about their estate, providing peace of mind for both themselves and their loved ones.

Similar forms

The California Transfer-on-Death Deed (TOD) form shares similarities with the Last Will and Testament. Both documents allow individuals to express their wishes regarding the distribution of their property after death. A will typically goes through probate, a legal process that can be time-consuming and costly. In contrast, the TOD deed bypasses probate altogether, allowing for a more streamlined transfer of property directly to the designated beneficiary upon the owner’s death. This feature makes the TOD deed an appealing option for those seeking simplicity in estate planning.

Understanding the intricacies of property transfer documents can be pivotal in ensuring the smooth transition of assets. Among these, a Georgia Hold Harmless Agreement can provide vital protection, allowing parties to engage in activities without the fear of liability. For further details, you can visit toptemplates.info, which offers a comprehensive overview of this essential legal document.

Other Common State-specific Transfer-on-Death Deed Templates

Transfer on Death Affidavit - A Transfer-on-Death Deed must be properly signed and recorded with the local government to be effective.

Free Printable Transfer on Death Deed Form Florida - The Transfer-on-Death Deed can be a proactive step in managing one’s estate effectively.

For those considering starting an LLC, understanding the significance of the Operating Agreement is essential. This document not only governs the day-to-day operations and outlines the financial agreements but also serves as a safeguard against potential disputes among members. Although it is not mandated by law in Florida, creating an Operating Agreement can greatly enhance the clarity and stability of your business practices. To better understand its importance and structure, you can learn more about the document.

Transfer on Death Deed Georgia - This deed is often less expensive to implement than other estate planning measures, making it accessible for many individuals.

More About California Transfer-on-Death Deed

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in California to designate a beneficiary who will automatically receive the property upon the owner's death. This deed bypasses the probate process, making the transfer of property simpler and quicker for heirs.

Who can create a Transfer-on-Death Deed?

Any individual who holds title to real property in California can create a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals with a vested interest in the property. However, it’s important to ensure that the deed is executed properly to be valid.

How do I complete a Transfer-on-Death Deed?

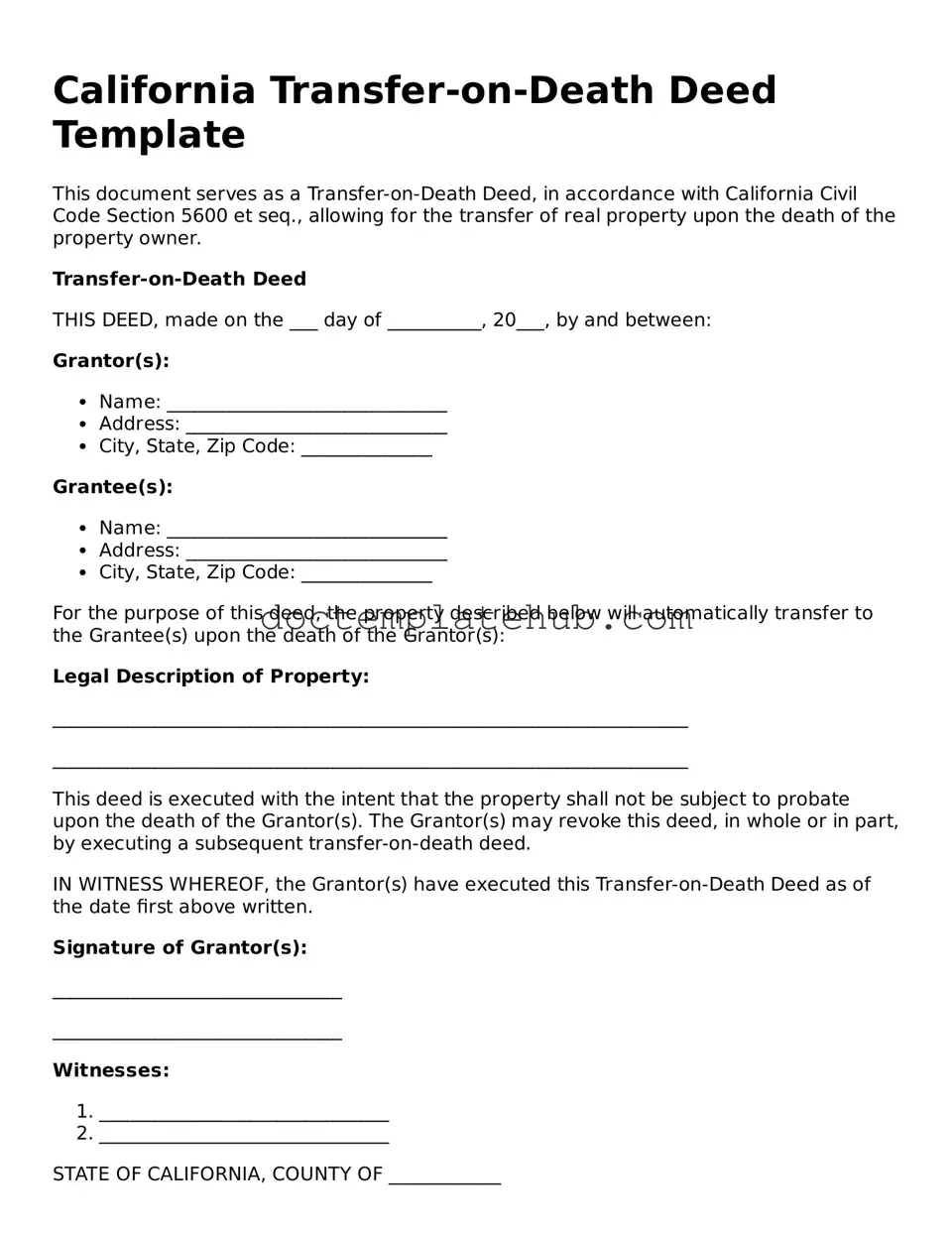

To complete a Transfer-on-Death Deed, you need to fill out the form with specific information, including the property owner’s details, a legal description of the property, and the name of the beneficiary. After filling out the form, it must be signed and notarized before being recorded with the county recorder's office where the property is located.

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can change or revoke the deed at any time before their death. To revoke the deed, the owner must execute a new deed that explicitly states the revocation and file it with the county recorder's office.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed will not automatically transfer the property to the beneficiary's heirs. Instead, the property will be distributed according to the owner’s estate plan or California intestacy laws if there is no plan in place.

Can I name multiple beneficiaries in a Transfer-on-Death Deed?

Yes, you can name multiple beneficiaries in a Transfer-on-Death Deed. When doing so, it’s essential to specify how the property will be divided among them. You can designate shares, or you may choose to have the property transferred to all beneficiaries equally.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, the beneficiary may face property taxes upon transfer. It’s advisable to consult with a tax professional to understand the specific implications based on individual circumstances.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can be used for most types of real property, including residential homes and commercial properties. However, it cannot be used for personal property like vehicles or bank accounts. For those types of assets, different estate planning tools may be necessary.

How does a Transfer-on-Death Deed affect the property owner during their lifetime?

During the owner’s lifetime, a Transfer-on-Death Deed does not affect their rights to the property. The owner retains full control and can sell, lease, or mortgage the property as they wish. The deed only takes effect upon the owner's death.

Where can I obtain a Transfer-on-Death Deed form?

Transfer-on-Death Deed forms can be obtained from various sources, including online legal form providers, county recorder's offices, or estate planning attorneys. It’s important to ensure that the form complies with California law to ensure its validity.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it’s crucial to ensure accuracy and compliance with state laws. Here are five essential do's and don'ts to guide you through the process:

- Do ensure that the property description is complete and accurate.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the form in the presence of a notary public.

- Do record the deed with the county recorder’s office promptly.

- Do keep a copy of the recorded deed for your records.

- Don't forget to check for any local requirements that may apply.

- Don't use vague language when describing the property.

- Don't leave any fields blank; all required information must be filled in.

- Don't attempt to alter the form after it has been signed and notarized.

- Don't delay in recording the deed, as it may affect its validity.

California Transfer-on-Death Deed - Usage Steps

After you have gathered all necessary information, you can begin filling out the California Transfer-on-Death Deed form. This process involves providing specific details about the property and the beneficiaries. Follow the steps below to ensure that the form is completed correctly.

- Start by entering the name of the property owner(s) at the top of the form. Include the full legal names as they appear on the title.

- Next, provide the address of the property. This should include the street address, city, state, and ZIP code.

- Describe the property in detail. Include the legal description, which can usually be found on the property deed. This may include the parcel number or lot number.

- Identify the beneficiary or beneficiaries. List their full names and addresses. If there are multiple beneficiaries, make sure to specify how the property will be divided among them.

- Include a statement indicating that the transfer is to occur upon the death of the property owner(s). This is typically a standard phrase provided in the form.

- Sign and date the form. All property owners must sign the document. If there are multiple owners, each must provide their signature.

- Have the form notarized. A notary public must witness the signatures to ensure the document is legally binding.

- Finally, file the completed deed with the county recorder's office where the property is located. Ensure that you keep a copy for your records.