Fill Your Cash Drawer Count Sheet Form

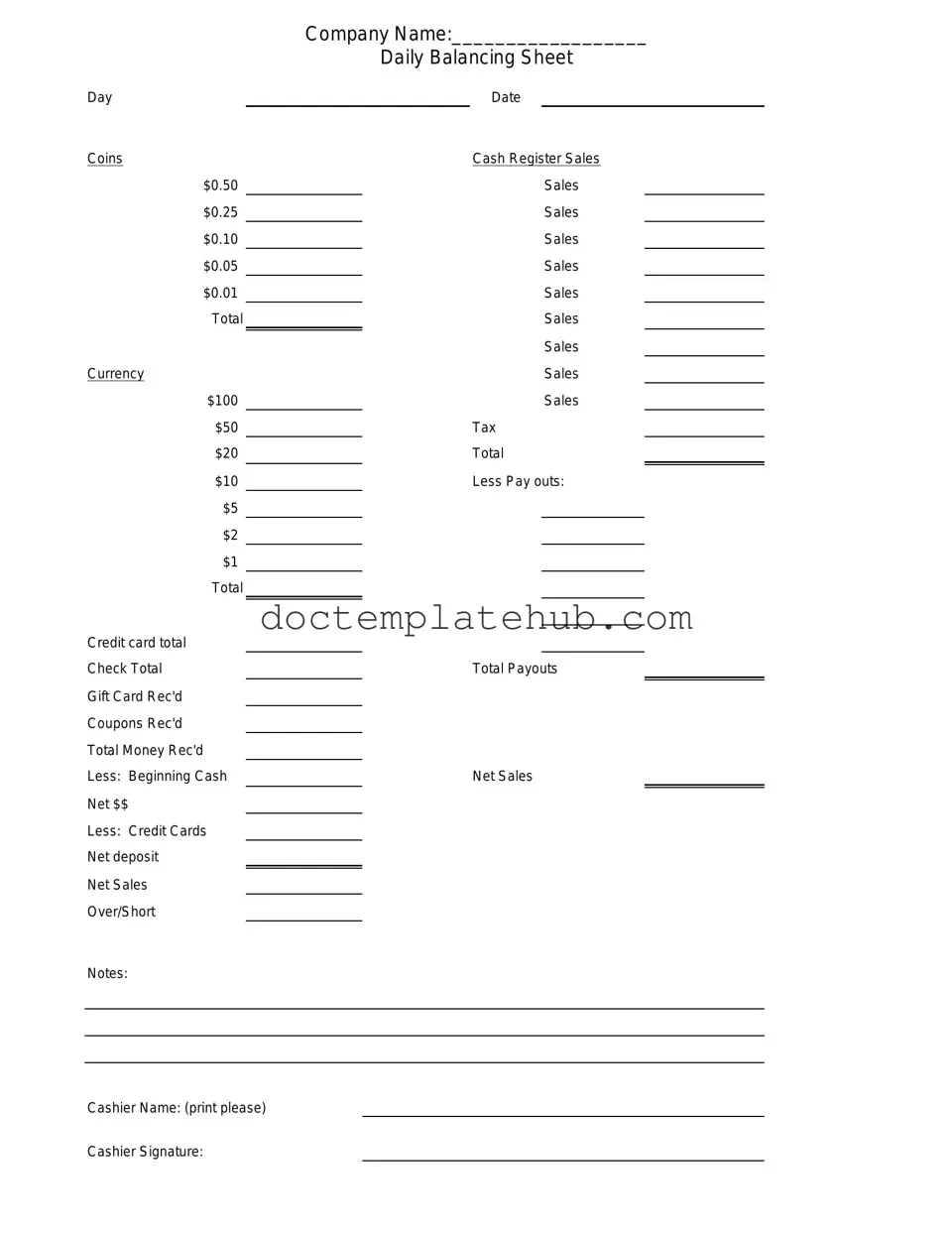

Managing cash in a business can be a daunting task, especially when accuracy and accountability are paramount. One essential tool that helps streamline this process is the Cash Drawer Count Sheet form. This form serves as a vital record for tracking cash transactions, ensuring that every dollar is accounted for at the end of a shift or business day. It typically includes sections for listing the starting cash balance, daily sales, cash received, and cash paid out, allowing for a comprehensive overview of cash flow. By utilizing this form, businesses can easily identify discrepancies, monitor employee performance, and maintain financial integrity. Moreover, it fosters transparency and can be invaluable during audits or financial reviews. Whether you run a small retail shop or a larger enterprise, understanding how to effectively use the Cash Drawer Count Sheet form can enhance your cash management practices and contribute to your overall financial health.

Similar forms

The Cash Register Summary Report is similar to the Cash Drawer Count Sheet in that both documents serve to summarize financial transactions within a specific timeframe. The Cash Register Summary Report typically details total sales, refunds, and payment methods used, providing a snapshot of the day's financial performance. In contrast, the Cash Drawer Count Sheet focuses specifically on the cash present in the drawer at the end of a shift, ensuring that the physical cash matches the recorded sales figures. Both documents are essential for reconciling cash flow and identifying discrepancies.

The Daily Sales Report also shares similarities with the Cash Drawer Count Sheet. This report provides a comprehensive overview of sales activities for a particular day, including total revenue, number of transactions, and average transaction value. While the Cash Drawer Count Sheet emphasizes the cash balance at the end of the day, the Daily Sales Report captures a broader range of sales data. Together, they help businesses assess overall performance and cash management efficiency.

Understanding the importance of a Small Estate Affidavit form is crucial for managing the legal aspects of a deceased person's estate efficiently. This document allows for a streamlined process that can save time and reduce the complexities involved in settling an estate without lengthy probate procedures.

The Bank Deposit Slip is another document that parallels the Cash Drawer Count Sheet. A Bank Deposit Slip is used to record the details of cash and checks being deposited into a bank account. Like the Cash Drawer Count Sheet, it ensures accuracy in financial reporting. Both documents require meticulous attention to detail, as they help prevent errors in accounting and maintain financial integrity. Each serves as a tool for tracking cash flow and safeguarding against potential discrepancies.

The Petty Cash Log is also akin to the Cash Drawer Count Sheet. This log tracks small, incidental expenses that a business incurs, detailing each transaction and the remaining balance in the petty cash fund. While the Cash Drawer Count Sheet focuses on cash at the end of a shift, the Petty Cash Log provides ongoing oversight of cash used for minor expenditures. Both documents are vital for maintaining accurate financial records and ensuring that all cash transactions are accounted for.

Lastly, the Sales Receipt serves a similar function to the Cash Drawer Count Sheet by documenting individual transactions. Each sales receipt records the details of a sale, including items purchased, prices, and payment method. This documentation is crucial for both the customer and the business, as it provides proof of purchase and aids in tracking sales. While the Cash Drawer Count Sheet aggregates this information at the end of a shift, the Sales Receipt captures the details of each transaction, ensuring that all sales are accurately recorded and reconciled.

Other PDF Templates

Chikfila - Foster an inclusive environment where everyone feels welcome.

Rochdale Village Income Requirements - Enjoy community events and social activities organized by Rochdale Village residents.

Filing the USCIS I-589 form is essential for those who have experienced persecution or fear returning to their home country, and it is important to understand the resources available for filling it out correctly. For assistance and templates to help navigate this process, individuals can visit smarttemplates.net, which offers valuable tools for applicants.

Progressive Supplement Request - Review repairs needed to keep your vehicle running smoothly.

More About Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

The Cash Drawer Count Sheet is a tool used by businesses to track the cash in their cash drawers at the end of a shift or business day. It helps ensure that the amount of cash on hand matches the sales recorded, allowing for accurate financial reporting and identifying any discrepancies.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for maintaining financial integrity. It helps prevent theft and errors by providing a clear record of cash transactions. Regularly counting cash and documenting it can also help identify trends in sales and cash flow, aiding in better business decisions.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, start by recording the date and your name or the name of the person responsible for the cash drawer. Next, count the cash in each denomination (bills and coins) and write down the amounts in the designated sections. Finally, total the amounts and compare them to the expected cash based on sales records.

What should I do if the cash counted does not match the expected amount?

If the cash counted does not match the expected amount, it’s important to investigate the discrepancy. Double-check your counts and review sales records for any errors. If you still find a difference, report it to your supervisor or manager for further action. Documenting any discrepancies is essential for accountability.

How often should I complete a Cash Drawer Count Sheet?

Ideally, a Cash Drawer Count Sheet should be completed at the end of every shift or business day. This frequency helps maintain accurate records and allows for immediate identification of any issues. Some businesses may choose to do additional counts during the day, especially in high-traffic environments.

Can I use a digital version of the Cash Drawer Count Sheet?

Yes, many businesses are moving towards digital solutions for cash management. Digital Cash Drawer Count Sheets can offer advantages such as easier data storage, automatic calculations, and enhanced reporting features. However, ensure that any digital system you use is secure and compliant with financial regulations.

What happens if I lose a Cash Drawer Count Sheet?

If a Cash Drawer Count Sheet is lost, it’s important to recreate the information as best as possible. Review sales records, and if necessary, conduct a new cash count. Document the loss and any actions taken to recreate the information. This record-keeping is essential for maintaining transparency and accountability.

Is there a standard format for a Cash Drawer Count Sheet?

While there is no universally mandated format, many Cash Drawer Count Sheets include sections for the date, employee name, cash denominations, total cash counted, and a space for notes. Businesses can customize their sheets to fit their specific needs, but it’s important to ensure that all necessary information is captured for accurate record-keeping.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it's essential to ensure accuracy and clarity. Here are some important dos and don'ts to consider:

- Do double-check your cash totals before submitting the form.

- Do use clear and legible handwriting to avoid misunderstandings.

- Do ensure that all required fields are filled out completely.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed otherwise.

- Don't use correction fluid or tape; if you make a mistake, simply cross it out and write the correct information.

- Don't forget to sign and date the form where required.

- Don't rush through the process; take your time to ensure everything is accurate.

Cash Drawer Count Sheet - Usage Steps

After gathering all necessary cash and receipts, you are ready to fill out the Cash Drawer Count Sheet form. This form will help you document the cash in the drawer accurately. Follow these steps to ensure everything is recorded properly.

- Begin by writing the date at the top of the form.

- Enter your name or the name of the person responsible for the cash drawer.

- Count the cash in the drawer. Separate bills by denomination for easier counting.

- Record the total amount of each denomination in the designated spaces on the form.

- Add up the total cash amount and write it in the total cash field.

- If applicable, note any discrepancies between the expected cash amount and what you counted.

- Sign and date the form to confirm the count is accurate.

Once you have completed the form, it should be submitted to the appropriate supervisor or manager for review. This ensures that all cash handling procedures are followed correctly.