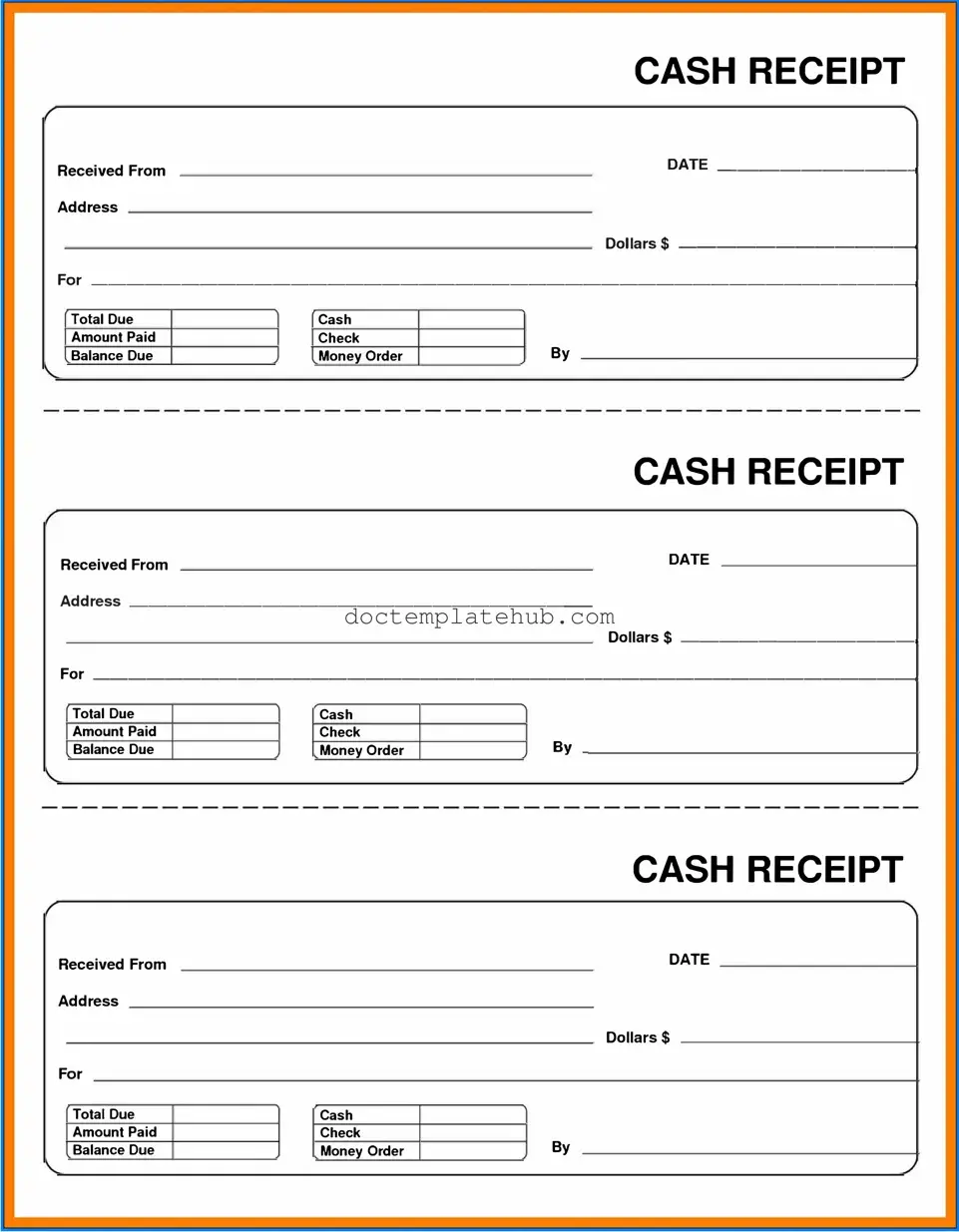

Fill Your Cash Receipt Form

The Cash Receipt form serves as a crucial document in financial transactions, providing a clear record of cash received by a business or organization. This form typically includes essential information such as the date of the transaction, the amount received, the payer's details, and the purpose of the payment. It often features a unique receipt number for tracking and reference purposes. By documenting these transactions, the Cash Receipt form helps maintain accurate financial records and ensures transparency in accounting practices. Additionally, it can serve as proof of payment for both the payer and the recipient, thereby reducing the likelihood of disputes. Proper completion of this form is vital for effective cash management and compliance with financial regulations.

Similar forms

The Cash Receipt form is similar to an Invoice. An invoice is a document that itemizes a transaction between a buyer and a seller. It specifies the goods or services provided, their prices, and the total amount due. Like a cash receipt, an invoice serves as proof of a transaction, but it typically indicates that payment is expected rather than confirming that payment has already been received.

Another document akin to the Cash Receipt form is the Payment Voucher. A payment voucher is used to authorize payment to a vendor or employee. It details the amount owed and the purpose of the payment. While a cash receipt confirms that payment has been made, a payment voucher initiates the payment process, serving as a request for funds to be disbursed.

The Cash Register Tape is also comparable to the Cash Receipt form. This tape is generated by a cash register and provides a summary of sales transactions during a specific period. It includes details such as the total sales amount and the method of payment. Both documents confirm cash transactions, but the cash register tape typically aggregates multiple sales rather than documenting a single transaction.

A Sales Receipt is another document that shares similarities with the Cash Receipt form. A sales receipt is issued to a customer at the point of sale and serves as proof of purchase. It outlines the items purchased, their prices, and the total amount paid. While both documents validate a transaction, a sales receipt may include additional information such as item descriptions and quantities.

The Deposit Slip is also related to the Cash Receipt form. A deposit slip is used to record the amount of cash or checks being deposited into a bank account. It provides a summary of the funds being deposited. While a cash receipt confirms that a payment has been received, a deposit slip documents the transfer of those funds into a financial institution.

Similarly, a Credit Note can be compared to the Cash Receipt form. A credit note is issued to acknowledge a return or overpayment. It serves as a record that money has been credited back to a customer. Both documents reflect financial transactions, but a credit note indicates a reversal or adjustment rather than a completed sale.

The Acknowledgment of Payment is another document that resembles the Cash Receipt form. This acknowledgment is often issued by a service provider or vendor to confirm that a payment has been received. It serves as a formal recognition of the transaction, much like a cash receipt, but may not include detailed transaction information.

In addition, the Remittance Advice is similar to the Cash Receipt form. A remittance advice is typically sent by a customer to a supplier along with payment. It provides information about the payment being made, such as invoice numbers and amounts. While a cash receipt confirms payment has been received, the remittance advice communicates payment details to the recipient.

The Purchase Order Confirmation can also be likened to the Cash Receipt form. This document is issued by a seller to confirm receipt of a purchase order from a buyer. It details the items ordered and the agreed-upon prices. While the cash receipt confirms payment, the purchase order confirmation verifies the agreement of terms before the transaction is completed.

For individuals looking to navigate the complexities of the I-134 form, resources like smarttemplates.net can provide valuable assistance in understanding the requirements and ensuring compliance with USCIS regulations.

Lastly, the Expense Report shares some similarities with the Cash Receipt form. An expense report is used by employees to document and request reimbursement for business-related expenses. It includes details of expenditures and the amounts spent. While a cash receipt serves as proof of payment, an expense report summarizes costs incurred, often requiring additional documentation for reimbursement.

Other PDF Templates

1098 Form - The due date for the next payment is clearly highlighted in the information.

The Employee Handbook form serves as an essential document that outlines a company's policies, procedures, and expectations for its employees. It provides guidance on various topics, including workplace behavior, benefits, and compliance with workplace laws. For a detailed example, you can refer to the handbook available at https://documentonline.org/blank-employee-handbook. Having a comprehensive and clear handbook can help both employees and employers understand their rights and responsibilities within the organization.

Da Form 31 - Stay informed about the rules surrounding the DA 31 to maximize your leave.

More About Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for transactions, providing both the payer and the payee with a record of the amount received, the date of the transaction, and the purpose of the payment. This form is essential for maintaining accurate financial records.

Who should use a Cash Receipt form?

Any individual or organization that receives cash payments should use a Cash Receipt form. This includes businesses, non-profits, and freelancers. By using this form, parties can ensure transparency and accountability in their financial dealings.

What information is typically included on a Cash Receipt form?

A Cash Receipt form usually includes the following information: the date of the transaction, the name of the payer, the amount received, the purpose of the payment, and the signature of the person receiving the cash. Additional details, such as the method of payment (e.g., cash, check), may also be included.

Why is it important to keep a copy of the Cash Receipt form?

Keeping a copy of the Cash Receipt form is crucial for record-keeping and accounting purposes. It helps in tracking income, verifying transactions during audits, and resolving any disputes that may arise regarding payments. Both the payer and the payee should retain their copies for future reference.

Can a Cash Receipt form be used for electronic payments?

While a Cash Receipt form is primarily designed for cash transactions, it can also be adapted for electronic payments. In such cases, the form should indicate the method of payment, such as credit card or bank transfer, along with relevant transaction details to maintain accurate records.

Is there a specific format for a Cash Receipt form?

There is no universally mandated format for a Cash Receipt form. However, it should clearly present the necessary information in a structured manner. Organizations may choose to create their own templates or use standardized forms available online, ensuring all essential details are included.

How can I ensure that my Cash Receipt form is legally valid?

To ensure the legal validity of a Cash Receipt form, it should be completed accurately and signed by both the payer and the receiver. Including specific details about the transaction and maintaining copies for both parties also contributes to its validity. Consulting with a financial advisor or accountant can provide additional guidance.

What should I do if I lose my Cash Receipt form?

If a Cash Receipt form is lost, it is advisable to recreate the form with as much detail as possible. This includes the date of the transaction, the amount, and the purpose of the payment. If possible, obtain confirmation from the payer regarding the transaction. Keeping thorough records can help prevent issues related to lost documentation in the future.

Dos and Don'ts

When filling out a Cash Receipt form, it is essential to ensure accuracy and completeness. Here are some important dos and don’ts to consider:

- Do double-check all amounts entered to avoid errors.

- Do include the date of the transaction for proper record-keeping.

- Do provide a clear description of the payment to avoid confusion later.

- Do keep a copy of the completed form for your records.

- Do sign the form to validate the transaction.

- Don’t leave any fields blank; all sections must be filled out completely.

- Don’t use correction fluid to alter information; it can lead to misunderstandings.

- Don’t forget to verify the payment method, whether cash, check, or electronic transfer.

- Don’t rush through the process; take your time to ensure accuracy.

- Don’t ignore any specific instructions provided with the form.

Cash Receipt - Usage Steps

After obtaining the Cash Receipt form, you will need to complete it accurately to ensure proper documentation of the transaction. This process involves gathering necessary information and filling out specific fields on the form. Follow the steps below to complete the form correctly.

- Begin by entering the date of the transaction in the designated field.

- Provide the name of the individual or organization making the payment.

- Fill in the address of the payer, including street, city, state, and zip code.

- Specify the amount of cash received, ensuring to use the correct currency format.

- Indicate the purpose of the payment in the appropriate section.

- Sign the form to validate the transaction.

- Review all the entered information for accuracy before submission.