Fill Your Cg 20 10 07 04 Liability Endorsement Form

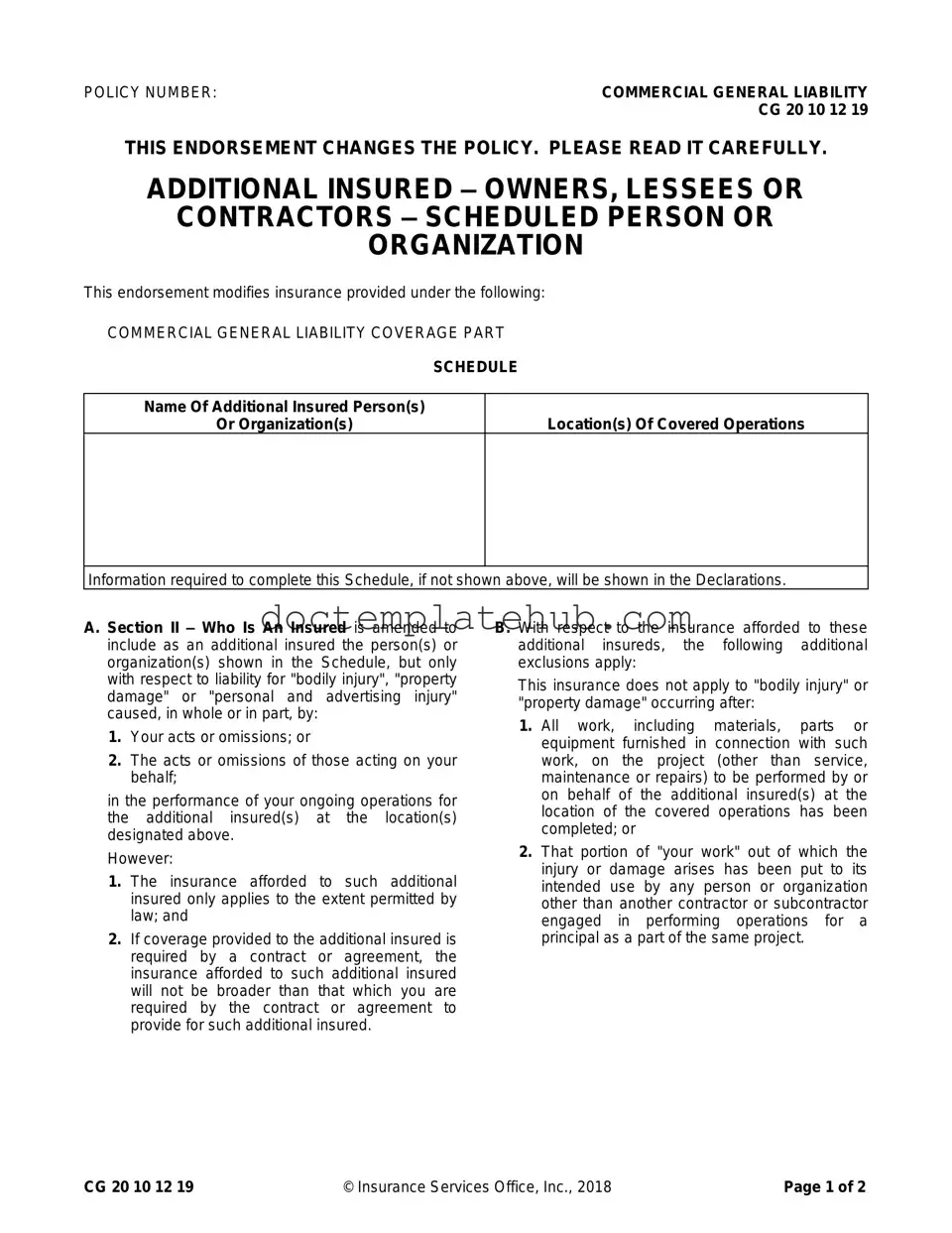

The CG 20 10 07 04 Liability Endorsement form is a crucial document for businesses seeking to extend their liability coverage to additional insured parties, such as owners, lessees, or contractors. This endorsement modifies the existing Commercial General Liability policy, ensuring that specific individuals or organizations listed in a schedule receive protection against claims related to bodily injury, property damage, or personal and advertising injury. Coverage is granted only for incidents arising from the acts or omissions of the primary insured or those acting on their behalf during ongoing operations at designated locations. However, it is important to note that the insurance offered to these additional insureds is limited to what is required by contract and does not exceed the policy’s overall limits. Additionally, the endorsement specifies exclusions, particularly concerning injuries or damages that occur after the completion of work or when the work has been put to its intended use by parties other than the contractor. Understanding these key elements is essential for businesses to ensure compliance and adequate coverage when engaging in contractual relationships.

Similar forms

The CG 20 10 07 04 Liability Endorsement form is similar to the Additional Insured Endorsement (CG 20 10) in that both documents extend liability coverage to additional parties involved in a project. The CG 20 10 specifically allows for coverage of additional insureds based on a contractual agreement, ensuring that those parties are protected against liabilities arising from the named insured's operations. This form typically includes a list of the additional insureds and details about the scope of coverage, similar to the CG 20 10 07 04, which specifies the conditions under which the additional insureds are covered.

Another document that shares similarities is the Completed Operations Coverage Endorsement. This endorsement provides coverage for liability arising from work completed by the insured. Like the CG 20 10 07 04, it emphasizes that the coverage is applicable only under certain conditions, such as when the work has been completed and the liability arises from that work. Both documents outline the limitations of coverage, ensuring that the insured understands the extent of their responsibilities and the protections afforded to additional parties.

For individuals looking to secure a rental property, completing a thorough rental application is vital. This is especially important for understanding the requirements within the real estate market. For a comprehensive guide on filling out this necessary paperwork, refer to the detailed Rental Application instructions available online.

The Primary and Non-Contributory Endorsement is also comparable. This endorsement establishes that the insurance policy is primary in relation to any other insurance that may be available to the additional insured. This is similar to the CG 20 10 07 04 in that it clarifies the hierarchy of coverage, ensuring that the additional insured’s claims will be covered first by the primary policy. It highlights the importance of contractual obligations in determining how coverage is applied, much like the restrictions outlined in the CG 20 10 07 04 form.

The Waiver of Subrogation Endorsement is another document that aligns with the CG 20 10 07 04. This endorsement prevents the insurer from seeking recovery from a third party that may have contributed to a loss. It is similar in that both documents are often tied to contractual agreements and aim to protect additional insureds by limiting the insurer's ability to pursue claims against them. This fosters a collaborative environment among contractors and additional insureds, which is critical in many construction and service-related agreements.

Finally, the Liability Coverage Extension Endorsement offers additional coverage options that can be added to a general liability policy. This endorsement is akin to the CG 20 10 07 04 in that it can modify the existing coverage to include more parties or broaden the scope of protection. Both documents require careful attention to the terms and conditions laid out, ensuring that all parties understand their coverage limits and responsibilities. The focus on contractual obligations in both endorsements serves to protect the interests of all involved parties.

Other PDF Templates

How to Make Self Employed Pay Stubs - This form provides a clear record of payments made to an independent contractor.

When considering the sponsorship of a foreign national, it is essential to understand the significance of the USCIS I-134 form. By filling out this form, sponsors assert their commitment to support the visitor financially and ensure they will not require public assistance during their time in the U.S. For more information and resources regarding the I-134 form, you can visit smarttemplates.net.

Broward County Animal Care and Adoption - Each vaccination is documented to maintain accurate health records.

More About Cg 20 10 07 04 Liability Endorsement

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form serves to add specific individuals or organizations as additional insureds under a Commercial General Liability policy. This endorsement ensures that these additional insureds are covered for certain liabilities that may arise from the actions of the policyholder or those acting on their behalf during ongoing operations.

Who can be listed as an additional insured on this endorsement?

The endorsement allows for any person or organization to be named as an additional insured, provided they are specified in the Schedule section of the form. This typically includes owners, lessees, or contractors involved in a project related to the policyholder’s operations.

What types of liabilities are covered for additional insureds?

Additional insureds are covered for liabilities related to bodily injury, property damage, or personal and advertising injury. However, this coverage only applies if the injury or damage is caused, in whole or in part, by the acts or omissions of the policyholder or their representatives during the performance of ongoing operations for the additional insured.

Are there any limitations on the coverage for additional insureds?

Yes, there are limitations. The coverage for additional insureds is only effective to the extent permitted by law. Additionally, if the coverage is required by a contract, it cannot be broader than what the policyholder is obligated to provide under that contract.

What exclusions apply to the coverage for additional insureds?

The endorsement specifies that coverage does not apply to bodily injury or property damage occurring after all work related to the project has been completed. This includes materials, parts, or equipment furnished in connection with that work. Coverage also ceases if the portion of the work that caused the injury has been put to its intended use by anyone other than another contractor or subcontractor involved in the same project.

How does the endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance. If coverage for an additional insured is required by a contract, the maximum amount the insurer will pay is either the amount specified in the contract or the applicable limits of insurance, whichever is less.

What happens if the work is completed?

If all work on the project is completed, the coverage for additional insureds ceases. This means that any claims related to bodily injury or property damage that arise after completion will not be covered under this endorsement.

Can the additional insureds be held liable for damages?

Yes, additional insureds can still be held liable for damages. However, this endorsement provides them with coverage for liabilities that arise from the actions of the policyholder or their representatives. It is important to note that the endorsement does not absolve additional insureds from their own negligence.

Is it necessary to have this endorsement?

Whether or not to have this endorsement depends on the specific requirements of contracts or agreements related to a project. Many contracts stipulate that additional insured coverage is necessary to protect the interests of the owners or contractors involved.

How can one ensure compliance with the endorsement’s requirements?

To ensure compliance, policyholders should carefully review any contracts or agreements that require additional insured coverage. It is also advisable to consult with an insurance professional to confirm that the coverage aligns with legal requirements and contractual obligations.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, there are important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do ensure that the policy number is correctly entered at the top of the form.

- Do list all additional insured persons or organizations clearly in the designated section.

- Do provide accurate locations of covered operations to avoid any confusion later.

- Do read the endorsement carefully to understand the coverage limits and exclusions.

- Don't leave any sections blank; all fields should be completed to ensure validity.

- Don't provide information that contradicts your existing contract or agreement.

Cg 20 10 07 04 Liability Endorsement - Usage Steps

Completing the CG 20 10 07 04 Liability Endorsement form is a crucial step in ensuring that the necessary parties are covered under your insurance policy. Following these steps carefully will help you fill out the form correctly and avoid potential delays in coverage. Ensure that all information is accurate and complete, as this will facilitate a smoother process.

- Locate the Policy Number: Find your Commercial General Liability policy number, which is typically listed on your insurance documents.

- Fill in the Policy Number: Write the policy number in the designated space at the top of the form.

- Identify Additional Insured: In the section titled "Name Of Additional Insured Person(s) Or Organization(s)," enter the names of the individuals or organizations that need to be added as additional insureds.

- Specify Locations: Provide the "Location(s) Of Covered Operations" where the additional insureds will be operating. This should include specific addresses or descriptions of the locations.

- Review Information: Double-check the information entered to ensure accuracy. Any errors could affect coverage.

- Sign and Date: Sign and date the form to confirm that the information is correct and that you are submitting it with the intent to modify your policy.

- Submit the Form: Send the completed form to your insurance provider as instructed, either by mail or electronically, as per their submission guidelines.