Fill Your Citibank Direct Deposit Form

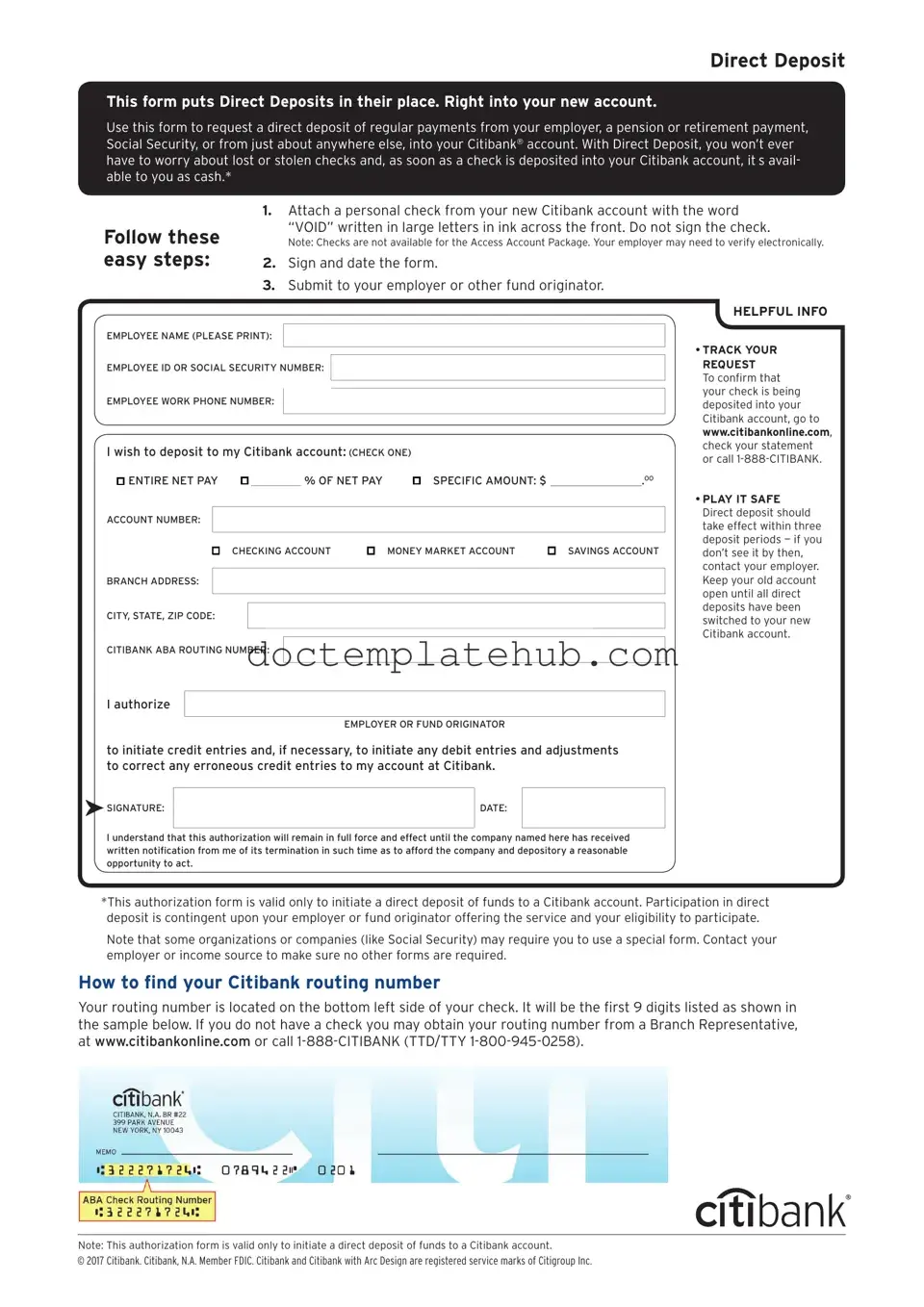

The Citibank Direct Deposit form is an essential document for individuals looking to streamline their banking experience by allowing automatic deposits into their accounts. This form is designed to facilitate the transfer of funds directly from an employer or other sources, such as government benefits, into a Citibank account. Key components of the form include the account holder's personal information, such as name, address, and Social Security number, which helps ensure accurate processing. Additionally, the form requires details about the bank account, including the account number and routing number, to direct the funds correctly. By completing this form, users can enjoy the convenience of having their paychecks or other payments deposited automatically, eliminating the need for manual deposits and reducing the risk of lost checks. Understanding how to fill out this form correctly is crucial for a smooth setup and uninterrupted access to funds.

Similar forms

The Citibank Direct Deposit form is similar to the W-4 form, which employees use to inform their employer about their tax withholding preferences. Both documents require personal information, such as your name, address, and Social Security number. While the W-4 focuses on tax deductions, the Direct Deposit form centers on how and where your paycheck will be deposited. Both forms are essential for ensuring that employees receive their earnings correctly and efficiently, highlighting the importance of accurate information in payroll processing.

Another document akin to the Citibank Direct Deposit form is the ACH Authorization form. This document allows individuals to authorize electronic payments and transfers from their bank accounts. Like the Direct Deposit form, the ACH Authorization form requires bank account details, including the account number and routing number. Both forms facilitate smooth electronic transactions, ensuring that funds are transferred securely and promptly. The primary difference lies in the ACH form's broader application, which can include various types of payments beyond just payroll deposits.

The Payroll Authorization form is also similar to the Citibank Direct Deposit form. This document is used by employers to gather information from employees regarding how they wish to receive their wages. It may include options for direct deposit, check, or other payment methods. Both forms serve the same purpose: to ensure that employees receive their pay in a manner that suits their needs. The Payroll Authorization form may also include additional options for bonuses or reimbursements, making it slightly more comprehensive than the Direct Deposit form.

The Bank Account Verification form shares similarities with the Citibank Direct Deposit form, as both require confirmation of bank account details. This document is often used by employers or financial institutions to verify that the provided account information is accurate and valid. While the Direct Deposit form focuses on setting up deposits, the Bank Account Verification form emphasizes ensuring the integrity of the account information provided. Both are crucial in preventing errors in financial transactions, thereby protecting both the employee and the employer.

When it comes to transferring ownership of a mobile home, utilizing a thorough Mobile Home Bill of Sale document is essential. This form outlines key transaction details, ensuring clarity and accountability between the buyer and seller, while safeguarding both parties during the process.

Lastly, the Vendor Payment Authorization form is another document that resembles the Citibank Direct Deposit form. This form is utilized by businesses to authorize payments to vendors or service providers through direct deposit. Similar to the Direct Deposit form, it requires bank account information and may include specific instructions on payment amounts and schedules. Both forms aim to streamline payment processes, ensuring that funds are transferred efficiently and securely. The Vendor Payment Authorization form is more focused on business transactions, whereas the Direct Deposit form is tailored for employee payroll.

Other PDF Templates

Living Will Downloadable 5 Wishes Printable Version - Five Wishes responds to both emotional and physical aspects of medical care.

To ensure a smooth property transfer process, it is essential to understand the implications of a Quitclaim Deed. This type of deed allows the current owner to relinquish their claim to a property without the certainty of the title being clear. For those looking to navigate this straightforward but important legal procedure, you can access a Quitclaim Deed form that simplifies the process and provides the necessary documentation needed for the transaction.

Dd 1750 - Authorization for any component shortages can be noted on the form.

I9 - The I-9 form helps prevent unauthorized employment in the United States.

More About Citibank Direct Deposit

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows you to authorize your employer or other payers to deposit your paycheck or other payments directly into your Citibank account. This process is convenient and often faster than receiving a paper check.

How do I obtain the Citibank Direct Deposit form?

You can easily obtain the Citibank Direct Deposit form by visiting the Citibank website or by contacting your local Citibank branch. Many employers also provide this form as part of their onboarding process, so be sure to check with your HR department as well.

What information do I need to fill out the form?

To complete the form, you will need to provide your personal information, including your name, address, and Social Security number. Additionally, you'll need your Citibank account number and the bank's routing number. This information ensures that your funds are deposited correctly.

Is there a fee for using direct deposit with Citibank?

No, there is typically no fee for using direct deposit with Citibank. In fact, many banks encourage direct deposit as it reduces the costs associated with processing paper checks. However, always check with Citibank for the most current fee schedule.

How long does it take for direct deposits to process?

Direct deposits usually process quickly. Most employers initiate payroll on a specific schedule, and funds are typically available in your account on the same day they are deposited. However, the timing can vary based on your employer’s payroll processing schedule.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. To do so, simply fill out a new Citibank Direct Deposit form with your updated information and submit it to your employer or payer. It’s a good idea to allow some time for the changes to take effect.

What should I do if my direct deposit doesn’t show up?

If your direct deposit does not appear in your account as expected, first check with your employer to confirm that the payment was processed. If it was processed, contact Citibank customer service for assistance. They can help you track down the issue.

Can I use direct deposit for multiple accounts?

Yes, you can set up direct deposit for multiple accounts. However, you will need to fill out a separate Citibank Direct Deposit form for each account. Just make sure to specify how much money should go to each account if you are splitting your deposits.

Is my direct deposit information secure?

Yes, Citibank takes security very seriously. When you fill out the Direct Deposit form, your personal and banking information is protected through various security measures. Always ensure you are using secure channels when submitting sensitive information.

What happens if I close my Citibank account?

If you close your Citibank account, any direct deposits will no longer be processed. It's essential to update your direct deposit information with your employer or payer to avoid any disruptions in receiving your funds. Consider providing them with your new banking details as soon as possible.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it’s essential to ensure accuracy and completeness. Here are some important do's and don'ts to keep in mind:

- Do double-check your account number to avoid any errors.

- Do provide the correct routing number for your bank.

- Do ensure your name matches the name on your bank account.

- Do sign and date the form where indicated.

- Don't leave any required fields blank.

- Don't use a temporary account number; always use your permanent account details.

- Don't submit the form without reviewing it for mistakes.

- Don't forget to notify your employer of any changes to your banking information.

- Don't assume that the form will be processed immediately; allow time for it to take effect.

Citibank Direct Deposit - Usage Steps

Filling out the Citibank Direct Deposit form is an important step in ensuring that your funds are deposited directly into your account. Once completed, the form will need to be submitted to your employer or the organization responsible for your payments. Follow these steps carefully to ensure accuracy.

- Obtain the Citibank Direct Deposit form from your employer or download it from the Citibank website.

- Fill in your personal information at the top of the form. This typically includes your name, address, and Social Security number.

- Locate the section for account information. Here, you will need to provide your Citibank account number and the routing number for your bank. Ensure that these numbers are entered correctly.

- Indicate the type of account you are using for direct deposit. You will usually have the option to choose between a checking or savings account.

- Review the details you have entered for accuracy. Double-check your account and routing numbers to avoid any issues.

- Sign and date the form at the bottom. This confirms that you authorize the direct deposit.

- Submit the completed form to your employer or the organization that processes your payments.