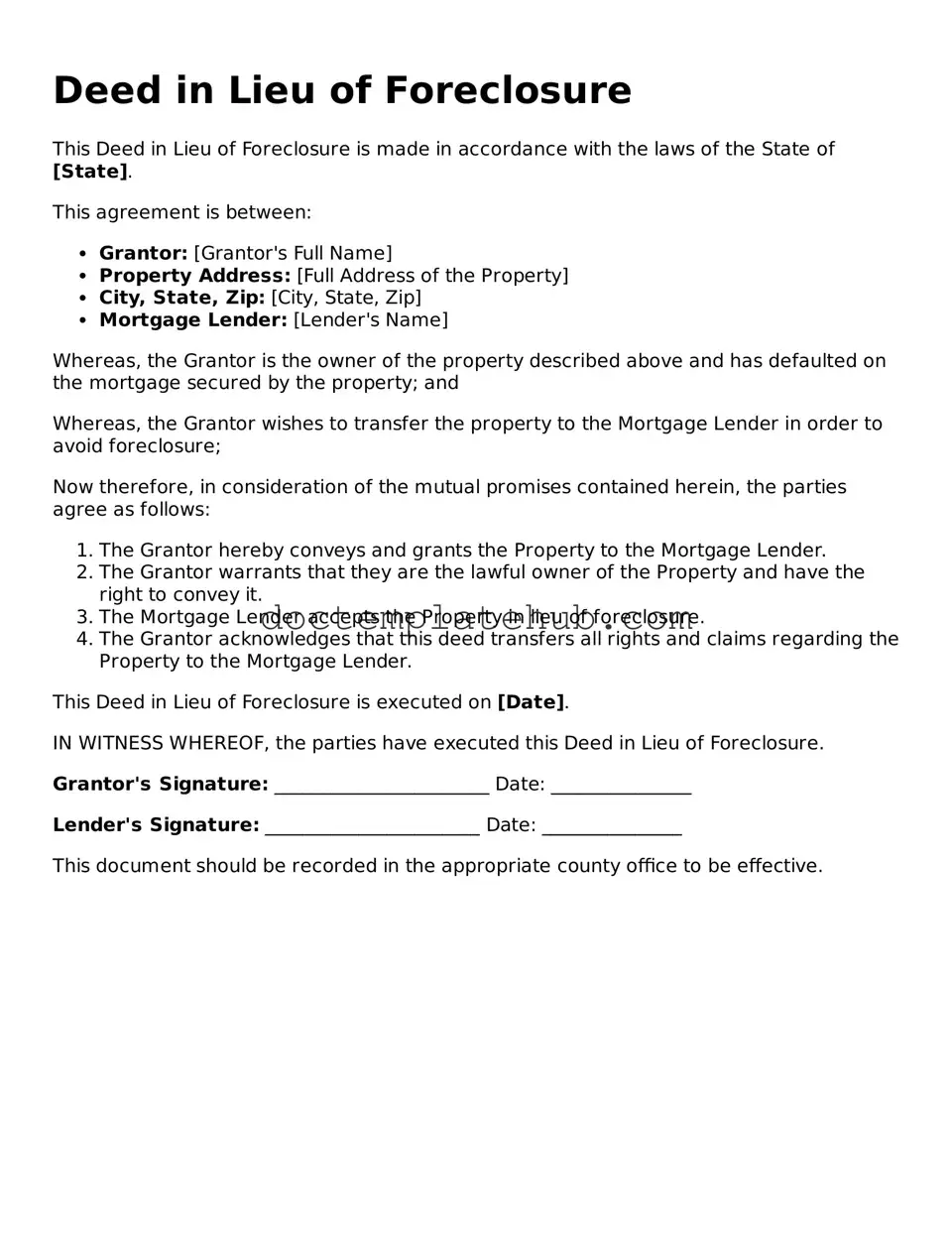

Official Deed in Lieu of Foreclosure Form

Facing financial difficulties can be a daunting experience, especially when it comes to homeownership. Many homeowners find themselves at a crossroads when they can no longer keep up with mortgage payments. In such situations, a Deed in Lieu of Foreclosure can serve as a viable option. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. By choosing this route, individuals can avoid the lengthy and often stressful foreclosure process. The Deed in Lieu of Foreclosure form typically includes essential information such as the property address, details about the mortgage, and the agreement between the homeowner and the lender. It is crucial to understand the implications of this decision, as it can impact credit scores and future homeownership opportunities. However, for many, this option may provide a sense of relief and a fresh start, allowing them to move forward without the burden of an unmanageable mortgage.

Similar forms

The Deed in Lieu of Foreclosure is similar to a Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender's approval. Both documents aim to relieve the homeowner from the burden of an unaffordable mortgage, yet they differ in execution. A short sale involves a sale process, while a deed in lieu transfers ownership directly to the lender without a sale. Both options can help avoid foreclosure and its associated consequences.

In navigating the complexities of financial difficulties, understanding the various options available can be essential for homeowners. For instance, utilizing documents like a Deed in Lieu of Foreclosure can be one strategy to prevent the loss of property. However, homeowners may also find valuable information on additional resources, such as the EDD DE 2501 form, which can be accessed at documentonline.org/blank-edd-de-2501, assisting them in managing their financial situations more effectively.

Another document comparable to the Deed in Lieu of Foreclosure is the Mortgage Release Agreement. This agreement allows the borrower to be released from their mortgage obligations, often in exchange for surrendering the property. Similar to the deed in lieu, the mortgage release can prevent foreclosure. However, the mortgage release may not involve a formal transfer of property ownership, which is a key aspect of the deed in lieu process.

The Loan Modification Agreement also shares similarities with the Deed in Lieu of Foreclosure. This document modifies the terms of an existing mortgage, often to make payments more manageable for the homeowner. While a deed in lieu relinquishes the property to the lender, a loan modification keeps the homeowner in the property by changing the payment structure. Both options aim to provide relief to struggling homeowners but approach the issue from different angles.

A Forbearance Agreement is yet another document that parallels the Deed in Lieu of Foreclosure. This agreement temporarily suspends or reduces mortgage payments for a specified period. Homeowners can avoid foreclosure through forbearance by catching up on payments later. While the deed in lieu transfers ownership to the lender, forbearance allows the homeowner to retain their property, albeit temporarily. Both documents seek to address financial hardship but do so through different mechanisms.

The Bankruptcy Filing is also similar in purpose to the Deed in Lieu of Foreclosure. Filing for bankruptcy can provide an automatic stay on foreclosure proceedings, giving homeowners time to reorganize their debts. While a deed in lieu offers a way to avoid foreclosure by transferring property, bankruptcy can protect the homeowner from losing their home. Both options serve as legal avenues to address overwhelming financial challenges.

Lastly, the Property Settlement Agreement can be likened to the Deed in Lieu of Foreclosure, particularly in divorce situations. This document outlines the division of property between spouses, often including the transfer of real estate. In cases where one spouse cannot afford the mortgage, a deed in lieu may be pursued to relinquish the property to the lender. Both documents aim to resolve ownership issues, but they stem from different circumstances—divorce versus financial hardship.

Fill out Common Types of Deed in Lieu of Foreclosure Templates

Deed of Gift Template - The donor's intent to transfer property must be unequivocal in the Gift Deed.

Does California Have a Transfer on Death Deed - Understand local regulations to ensure compliance with state law.

To facilitate a successful transaction, understanding the requirements for a comprehensive boat bill of sale is crucial. This document not only ensures a smooth transfer of ownership but also serves as a critical proof for both parties involved in the sale. For more information, you can reference the comprehensive boat bill of sale for guidance on necessary details and compliance.

Corrective Deed California - The Corrective Deed must be signed by the original grantors.

More About Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process in which a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish their mortgage obligations while the lender takes possession of the property. It can be a beneficial alternative for those facing financial difficulties, as it may help preserve the homeowner's credit score compared to a foreclosure. Additionally, it can expedite the resolution of the mortgage default situation.

How does the process work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will typically require the homeowner to provide financial information to assess their eligibility. If both parties agree to the terms, the homeowner will sign the Deed, transferring ownership of the property to the lender. It is essential to ensure that the property is free of any liens or other encumbrances, as these may complicate the transfer. After the Deed is executed, the lender will typically release the homeowner from the mortgage obligation.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to pursuing a Deed in Lieu of Foreclosure. First, it can provide a quicker resolution to the homeowner's financial difficulties. This option may also allow the homeowner to avoid the lengthy and often stressful foreclosure process. Additionally, a Deed in Lieu may have a less severe impact on the homeowner's credit score compared to a foreclosure. Lastly, some lenders may offer relocation assistance or other incentives to homeowners who choose this option, making the transition smoother.

Are there any drawbacks to consider?

While a Deed in Lieu of Foreclosure has its benefits, there are potential drawbacks to consider. Homeowners may face tax implications, as the IRS may treat the forgiven mortgage debt as taxable income. Furthermore, not all lenders accept Deeds in Lieu, and some may require homeowners to explore other options first. Homeowners should also be aware that a Deed in Lieu does not guarantee a release from all liabilities associated with the property, particularly if there are second mortgages or other liens in place.

Can a homeowner still pursue a Deed in Lieu if they have already started the foreclosure process?

In many cases, homeowners who have already begun the foreclosure process can still pursue a Deed in Lieu of Foreclosure. However, this will depend on the lender's policies and the specific circumstances of the case. It is advisable for homeowners to contact their lender as soon as possible to discuss their options. Engaging with the lender early in the process can help facilitate a smoother transition and potentially halt the foreclosure proceedings.

What should a homeowner do before signing a Deed in Lieu of Foreclosure?

Before signing a Deed in Lieu of Foreclosure, homeowners should take several important steps. First, they should seek legal advice to fully understand the implications of the transfer. Consulting a financial advisor can also provide insight into potential tax consequences. Homeowners should ensure that they have explored all available alternatives, such as loan modifications or short sales, before committing to this option. Finally, reviewing the terms of the Deed carefully is crucial to ensure that all conditions are understood and acceptable.

Dos and Don'ts

When filling out a Deed in Lieu of Foreclosure form, it is essential to approach the process with care. This document can have significant implications for your financial future and property ownership. Below are some important guidelines to consider.

- Do ensure accuracy: Double-check all information entered on the form. Incorrect details can lead to delays or complications.

- Do seek legal advice: Consult with a legal professional who can provide guidance tailored to your specific situation. This step can help you understand your rights and obligations.

- Don’t rush the process: Take your time to understand each section of the form. Hasty decisions may result in unintended consequences.

- Don’t ignore potential tax implications: Be aware that transferring your property through a deed in lieu of foreclosure may have tax consequences. It is wise to discuss this with a tax advisor.

By following these guidelines, you can navigate the process more confidently and make informed decisions regarding your property and financial well-being.

Deed in Lieu of Foreclosure - Usage Steps

After completing the Deed in Lieu of Foreclosure form, the next steps involve submitting the document to your lender and ensuring all parties involved are informed of the transaction. Be prepared for follow-up communications and potential negotiations regarding any outstanding obligations.

- Obtain the Deed in Lieu of Foreclosure form from your lender or a reliable legal source.

- Read the form carefully to understand all required fields.

- Fill in your name and contact information as the borrower in the designated areas.

- Provide the lender’s name and contact information in the appropriate section.

- Include the property address that is subject to the deed.

- Clearly state the date on which you are signing the document.

- Sign the form in the designated signature area. Ensure your signature matches the name provided.

- Have the form notarized if required by your lender or state law.

- Make copies of the completed form for your records.

- Submit the original form to your lender along with any additional documents they may require.