Official Deed of Trust Form

The Deed of Trust form serves as a crucial instrument in real estate transactions, providing a framework for securing a loan through property collateral. This legal document involves three key parties: the borrower, the lender, and a neutral third party known as the trustee. By signing the Deed of Trust, the borrower agrees to transfer the title of the property to the trustee, who holds it on behalf of the lender until the loan is repaid in full. This arrangement offers a layer of protection for the lender, ensuring that they have a claim to the property should the borrower default on their obligations. Additionally, the Deed of Trust outlines specific terms and conditions, including the loan amount, interest rate, and repayment schedule, which all play a vital role in the borrower-lender relationship. Understanding the nuances of this form is essential for anyone involved in property financing, as it delineates the rights and responsibilities of each party, ultimately shaping the course of the transaction.

Similar forms

A mortgage agreement is one of the most similar documents to a Deed of Trust. Both serve as security instruments for a loan, typically used in real estate transactions. In a mortgage, the borrower pledges their property as collateral for the loan. If the borrower defaults, the lender can initiate foreclosure proceedings. While a mortgage involves a direct relationship between the borrower and lender, a Deed of Trust introduces a third party, known as the trustee, who holds the title until the loan is repaid. This distinction can affect the foreclosure process and the rights of the parties involved.

Understanding the various types of property transfer documents is essential for anyone involved in real estate transactions. One such document, the Texas Quitclaim Deed form, provides a straightforward means of transferring interest in property between parties, particularly among family members or acquaintances. For more information on how to create or utilize this document effectively, you can visit smarttemplates.net.

A promissory note is another document closely related to the Deed of Trust. This note outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rates, and repayment terms. While the Deed of Trust secures the loan with the property, the promissory note serves as the borrower's formal commitment. Both documents are often executed together, and the Deed of Trust protects the lender's interests in case the borrower fails to fulfill their obligations outlined in the promissory note.

Lastly, a lease agreement shares similarities with a Deed of Trust, particularly in the context of real estate. A lease agreement allows a tenant to occupy property owned by a landlord in exchange for rent. While a Deed of Trust involves a borrower and lender, both documents outline specific rights and obligations. In a lease, the tenant has the right to use the property, while the landlord retains ownership. Both agreements can lead to legal actions if terms are violated, although the nature of those actions differs based on the relationship between the parties involved.

Fill out Common Types of Deed of Trust Templates

Does California Have a Transfer on Death Deed - Ensure accurate property details are listed in the deed.

When drafting a Quitclaim Deed in Georgia, it is important to consider the details of the transfer, especially if the parties involved have a longstanding relationship. Utilizing a reliable template can simplify the process and ensure all necessary information is included. For a comprehensive option, you can refer to this resource: legalpdfdocs.com/georgia-quitclaim-deed-template, which provides an easy-to-follow structure for your needs.

Corrective Deed California - A Corrective Deed might be required before a refinance or sale.

Printable Quitclaim Deed - This is a simple way to give away a property asset.

More About Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a legal document that secures a loan by using real property as collateral. It involves three parties: the borrower, the lender, and a trustee. The borrower receives the loan, the lender provides the funds, and the trustee holds the title to the property until the loan is paid off. If the borrower defaults, the trustee can sell the property to repay the lender.

How does a Deed of Trust differ from a mortgage?

While both a Deed of Trust and a mortgage serve to secure a loan with real estate, they differ in their structure and process. A mortgage typically involves only two parties—the borrower and the lender. In contrast, a Deed of Trust adds a third party, the trustee. This can simplify the foreclosure process, as the trustee can act more quickly than a court might in a mortgage situation.

Who is the trustee in a Deed of Trust?

The trustee is an impartial third party, often a title company or a bank, who holds the legal title to the property on behalf of the lender. Their role is to ensure that the terms of the Deed of Trust are followed. If the borrower defaults, the trustee has the authority to initiate foreclosure proceedings.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender can instruct the trustee to initiate foreclosure. The trustee will then sell the property at a public auction to recover the outstanding loan amount. This process typically does not require a court proceeding, making it generally faster than a mortgage foreclosure.

Can a Deed of Trust be modified?

Yes, a Deed of Trust can be modified, but this requires agreement from all parties involved. The borrower, lender, and trustee must all consent to any changes. It is essential to document these modifications properly to ensure they are legally enforceable.

Is a Deed of Trust public record?

Yes, a Deed of Trust is typically recorded in the county where the property is located. This makes it a matter of public record, allowing anyone to view the details of the transaction. This transparency helps protect the rights of all parties involved.

What are the benefits of using a Deed of Trust?

Using a Deed of Trust can offer several benefits. It generally provides a quicker foreclosure process compared to traditional mortgages. Additionally, it can create a clear chain of title, which can simplify the transfer of ownership. Borrowers may also find it easier to negotiate terms with lenders due to the involvement of a neutral trustee.

Are there any risks associated with a Deed of Trust?

While Deeds of Trust offer many benefits, there are risks. If the borrower defaults, they could lose their property through a relatively swift foreclosure process. Additionally, if the terms of the Deed of Trust are not clearly understood, borrowers may find themselves in difficult situations. It is crucial to fully understand the terms before signing.

What should I consider before signing a Deed of Trust?

Before signing a Deed of Trust, carefully review the terms and conditions. Understand your obligations, including payment schedules and penalties for late payments. It may also be wise to consult with a legal professional to ensure that you fully grasp the implications of the document.

Can a Deed of Trust be used for any type of property?

A Deed of Trust can be used for various types of real estate, including residential homes, commercial properties, and land. However, specific requirements may vary by state and lender. Always check local laws and lender policies to ensure compliance.

Dos and Don'ts

When filling out the Deed of Trust form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are four things to do and four things to avoid:

- Do ensure all names are spelled correctly.

- Do provide complete and accurate property descriptions.

- Do review the form for any missing signatures or dates.

- Do consult a legal professional if you have questions.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations that may cause confusion.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to ensure accuracy.

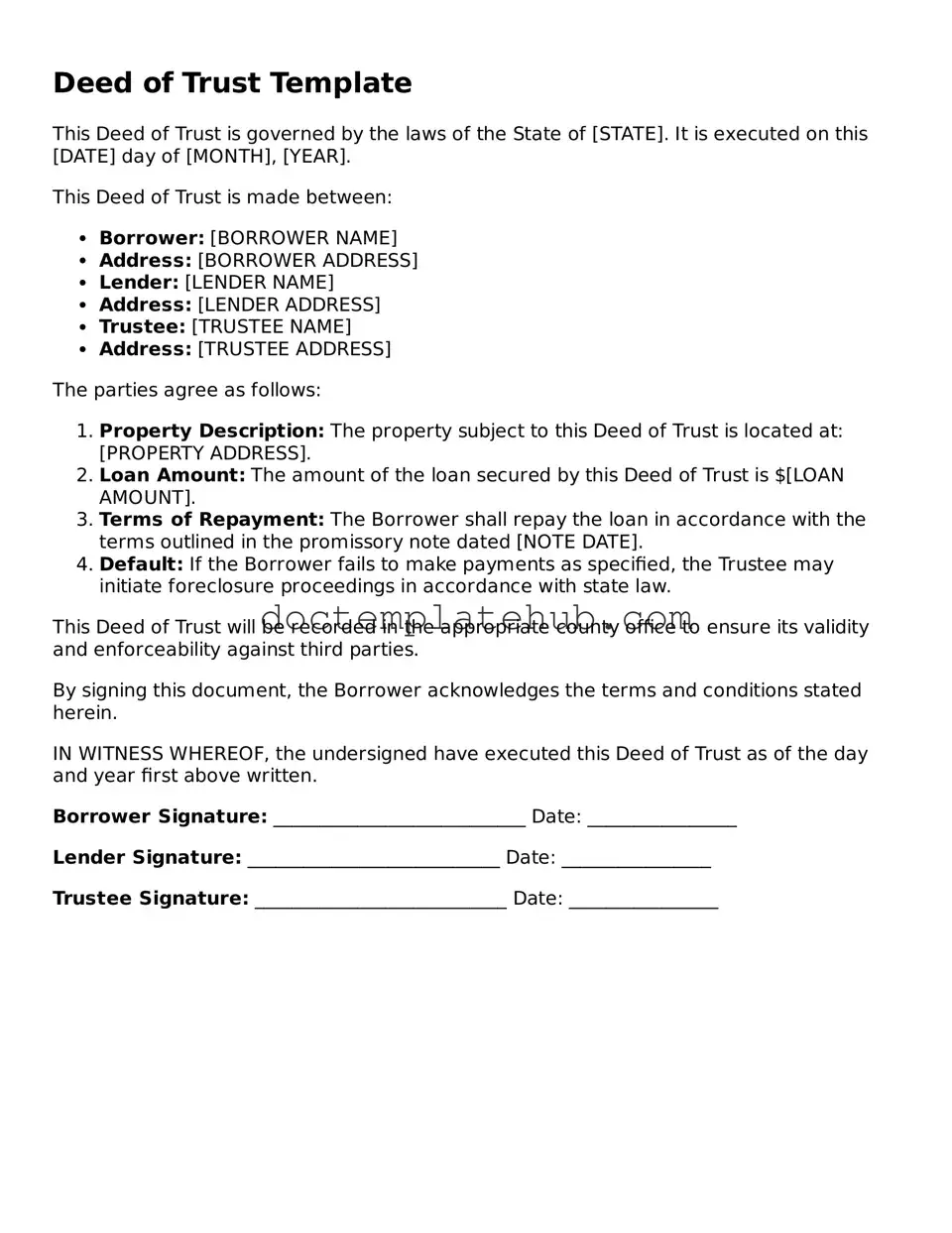

Deed of Trust - Usage Steps

Filling out a Deed of Trust form is an important step in securing a loan for a property. Once completed, this form will need to be signed and notarized before being recorded with the appropriate county office.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Write the name of the borrower(s) and the lender.

- Provide the property description. Include the address and legal description of the property.

- Specify the loan amount. Write the total amount being borrowed.

- State the terms of the loan. Include interest rates and repayment terms.

- Indicate if there are any additional agreements. Mention any other conditions tied to the loan.

- Include the signature lines. Ensure all parties sign the document.

- Have the document notarized. A notary public must witness the signatures.

- Submit the completed form to the county recorder's office. Ensure you have copies for your records.