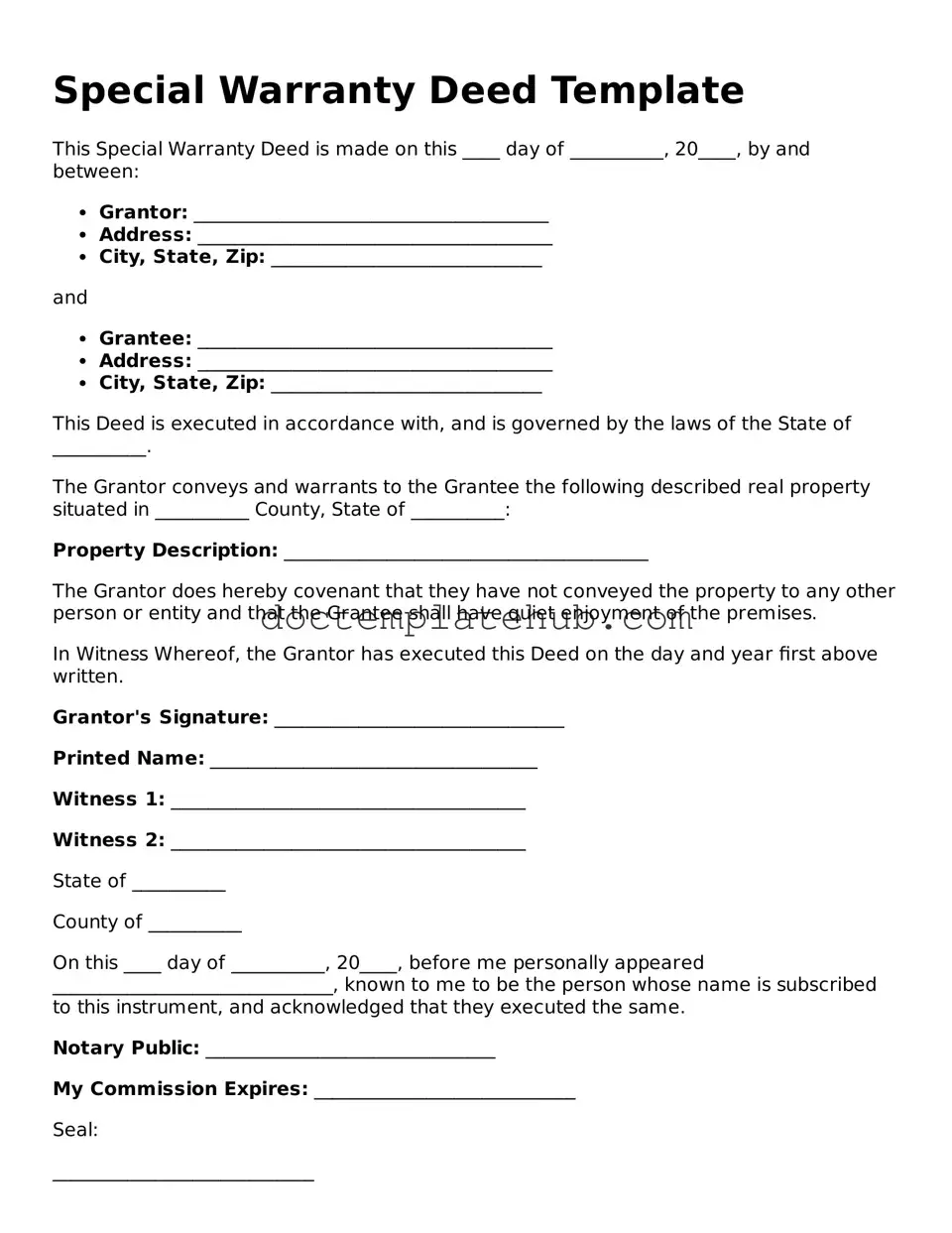

Official Deed Form

The Deed form serves as a crucial legal document in property transactions, ensuring the transfer of ownership from one party to another. It outlines essential details such as the names of the grantor and grantee, the legal description of the property, and any specific terms related to the transfer. This form can vary based on the type of deed being used, such as a warranty deed or a quitclaim deed, each offering different levels of protection and assurances to the parties involved. Additionally, the Deed form typically requires signatures from the parties and may need to be notarized to be legally binding. Understanding the components and implications of the Deed form is vital for anyone involved in real estate transactions, as it formalizes the transfer of property rights and can impact future ownership claims.

Similar forms

A quitclaim deed is similar to a standard deed in that it transfers ownership of property from one party to another. However, it does so without guaranteeing that the property title is clear. This means that if there are any claims or liens against the property, the new owner may inherit those issues. Quitclaim deeds are often used in situations like transferring property between family members or in divorce settlements, where the parties trust each other to handle any title issues that may arise.

A warranty deed provides a higher level of protection than a quitclaim deed. It guarantees that the seller holds clear title to the property and has the right to sell it. If any issues arise with the title after the sale, the buyer can seek compensation from the seller. This document is commonly used in traditional real estate transactions where buyers want assurance that they are receiving a clear and marketable title.

In addition to the various legal documents discussed, it's important to recognize the significance of a Doctors Excuse Note form, which serves as official documentation from a healthcare provider, confirming a patient's medical condition and the necessity for absence from work or school. This note can be essential for ensuring that employees and students receive the appropriate accommodations during their recovery. For those looking for a template, you can visit documentonline.org/blank-doctors-excuse-note/ to find a suitable option.

A grant deed is another type of property transfer document that is similar to a warranty deed. It conveys ownership and includes a promise that the property has not been sold to anyone else and that there are no undisclosed encumbrances. While it doesn’t offer the same level of protection as a warranty deed, it does provide some assurance to the buyer regarding the title's status.

An easement agreement is another document related to property rights. It grants one party the right to use a portion of another party's property for a specific purpose, such as access to a road or utility installation. Like a deed, it must be properly executed and recorded to be enforceable. Both documents establish rights and responsibilities concerning property use.

A title transfer form is directly related to the process of transferring property ownership. This document is often used in conjunction with a deed to officially record the change in ownership with the local government. While the deed serves as the legal instrument of transfer, the title transfer form provides the necessary details for the property records, ensuring that ownership is clear and publicly documented.

A bill of sale is similar in function to a deed, but it is used for the transfer of personal property rather than real estate. This document outlines the sale of items such as vehicles, equipment, or furniture. It provides proof of the transaction and includes details about the items being sold, the sale price, and the parties involved. Both documents serve as legal proof of ownership transfer.

A mortgage agreement, while primarily a loan document, is similar to a deed in that it involves property rights. When a property is mortgaged, the deed remains with the property, but the mortgage agreement gives the lender a claim against the property until the loan is repaid. Both documents are crucial in real estate transactions, as they outline the rights and responsibilities of the parties involved.

A trust deed is used in some states as a means of securing a loan with real property. It involves three parties: the borrower, the lender, and a trustee who holds the title until the loan is paid off. Similar to a mortgage, it provides a way to secure financing while also transferring property rights. Both documents serve to protect the lender's interest in the property.

Finally, a property settlement agreement is often used during divorce proceedings. It outlines how marital property, including real estate, will be divided between spouses. While it does not transfer property rights like a deed, it is similar in that it defines ownership and rights to property. Both documents are essential in clarifying and formalizing property ownership and obligations in legal contexts.

Common Forms

How to Sell Limited Edition Art Prints - Helpful for insurance purposes after purchase.

Utilizing a comprehensive Profit and Loss (P&L) form is crucial for assessing a company's financial standing, and resources available at smarttemplates.net can greatly aid in creating accurate and effective documents. This financial tool empowers businesses to track their earnings and expenditures, ultimately supporting better financial decision-making and strategic planning.

How to Add Money to Netspend Card - Keep records of all communications regarding your dispute for future reference.

More About Deed

What is a Deed form?

A Deed form is a legal document that conveys a property interest from one party to another. It serves as proof of ownership and outlines the rights and responsibilities associated with the property. Deeds can be used for various types of property, including real estate and personal property. They must be executed according to state laws to be valid, which often includes signing the document in the presence of a notary public.

What are the different types of Deed forms?

There are several types of Deed forms, each serving a specific purpose. The most common types include Warranty Deeds, which provide a guarantee that the grantor holds clear title to the property; Quitclaim Deeds, which transfer whatever interest the grantor may have without any guarantees; and Special Purpose Deeds, such as Executor's Deeds or Trustee's Deeds, used in specific circumstances like estate management. Understanding the differences is crucial for ensuring that the right type of deed is used for a particular transaction.

Do I need a lawyer to prepare a Deed form?

How do I record a Deed form?

To record a Deed form, you must submit it to the appropriate local government office, typically the county recorder or clerk's office, where the property is located. The recording process involves filling out a form, paying a fee, and providing the original Deed along with any required attachments. Once recorded, the deed becomes part of the public record, which helps establish your ownership and protects your rights to the property.

Dos and Don'ts

When filling out a Deed form, attention to detail is crucial. Here are ten important guidelines to follow, divided into things you should do and things you should avoid.

Things You Should Do:

- Read the instructions carefully before starting.

- Use clear and legible handwriting or type the information.

- Provide accurate and complete information to avoid delays.

- Include all required signatures from all parties involved.

- Double-check for any spelling errors or omissions.

Things You Shouldn't Do:

- Do not leave any fields blank unless specifically instructed.

- Avoid using abbreviations that may cause confusion.

- Do not rush through the process; take your time to ensure accuracy.

- Refrain from making alterations or corrections without proper procedures.

- Do not submit the form without reviewing it one last time.

Deed - Usage Steps

After you have gathered all necessary information and documents, you will be ready to fill out the Deed form. This form is crucial for transferring property ownership. Take your time and ensure that all details are accurate to avoid any issues down the line.

- Begin by entering the full names of the parties involved in the transaction. This includes both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Next, provide the complete address of the property being transferred. This should include the street address, city, state, and zip code.

- Indicate the legal description of the property. This may require referencing previous deeds or property records to ensure accuracy.

- Fill in the date of the transfer. This is the date when the ownership will officially change hands.

- Include any necessary consideration amount. This is the value exchanged for the property, which can be a dollar amount or a statement indicating that the transfer is a gift.

- Sign the form in the designated area. Make sure that the signature matches the name listed as the grantor.

- Have the form notarized. A notary public will verify your identity and witness the signing of the document.

- Once completed, make copies of the signed and notarized Deed form for your records.

- Finally, file the original Deed form with the appropriate county office to make the transfer official.