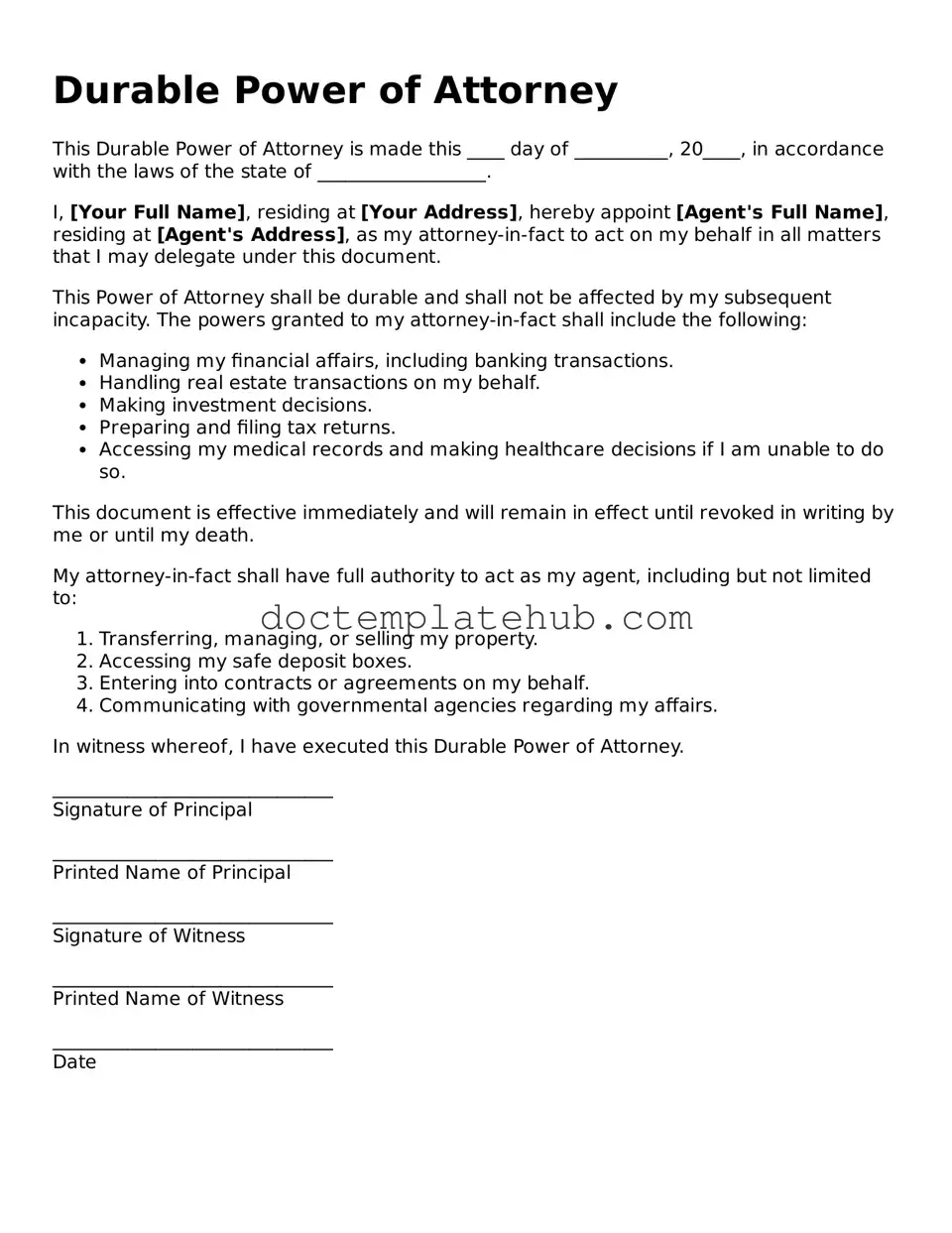

Official Durable Power of Attorney Form

The Durable Power of Attorney (DPOA) is a crucial legal document that empowers an individual, known as the agent or attorney-in-fact, to make decisions on behalf of another person, referred to as the principal. This authority can encompass a wide range of financial and medical decisions, ensuring that the principal's wishes are honored even if they become incapacitated. The DPOA remains effective even after the principal loses the ability to make decisions due to illness or injury, distinguishing it from a standard power of attorney that may become void under such circumstances. It is essential to specify the powers granted to the agent, which can include managing bank accounts, handling real estate transactions, or making healthcare decisions. Additionally, the DPOA can be tailored to fit the principal's unique needs and preferences, allowing for a flexible approach to decision-making. Establishing this document involves careful consideration and often requires the principal to be of sound mind at the time of signing. Understanding the implications and responsibilities associated with a Durable Power of Attorney is vital for both the principal and the agent, as it lays the groundwork for effective management of the principal's affairs during times of vulnerability.

Similar forms

The Durable Power of Attorney (DPOA) is often compared to a standard Power of Attorney (POA). While both documents allow one person to act on behalf of another, the key distinction lies in durability. A standard POA becomes ineffective if the principal becomes incapacitated, whereas a DPOA remains in effect even when the principal is unable to make decisions. This characteristic makes the DPOA particularly valuable for long-term planning, especially for those concerned about future health issues.

A Healthcare Power of Attorney (HPOA) is another document that shares similarities with the DPOA. An HPOA specifically grants authority to an individual to make medical decisions on behalf of someone else. Like the DPOA, it can remain effective even if the principal becomes incapacitated. This ensures that a trusted person can make critical healthcare decisions when the principal is unable to express their wishes, providing peace of mind in medical situations.

The Living Will is closely related to both the DPOA and HPOA, although it serves a slightly different purpose. A Living Will outlines an individual’s preferences regarding medical treatment and end-of-life care. It does not appoint someone to make decisions but rather communicates the principal's wishes in situations where they cannot speak for themselves. Together with an HPOA, a Living Will can provide comprehensive guidance regarding healthcare choices.

The Irrevocable Trust is another estate planning tool that, like a DPOA, can manage assets but in a more permanent manner. Once established, an Irrevocable Trust cannot be changed or dissolved without the consent of the beneficiaries. While a DPOA allows for flexible management of finances, an Irrevocable Trust is more about asset protection and tax benefits, particularly for those concerned about Medicaid eligibility.

The Advance Directive is a broader document that encompasses both a Living Will and a Healthcare Power of Attorney. It allows individuals to express their healthcare preferences and designate someone to make decisions on their behalf. Similar to the DPOA, an Advance Directive is designed to ensure that personal wishes are respected during medical emergencies, providing clarity to healthcare providers and family members.

The Guardianship Agreement can be likened to a DPOA, as both involve the management of another person’s affairs. However, a Guardianship is typically established through a court process and is often used when an individual is unable to manage their own affairs due to incapacity. In contrast, a DPOA is a voluntary arrangement made by the principal, allowing for more control over who is appointed to manage their affairs.

A Financial Power of Attorney is specifically focused on financial matters, granting authority to manage financial transactions and make decisions regarding assets. This document operates similarly to a DPOA but is typically limited to financial issues rather than broader legal or healthcare decisions. It is particularly useful for individuals who want to ensure their financial matters are handled properly in their absence.

Finally, a Medical Proxy is similar to a Healthcare Power of Attorney but is often used interchangeably with it. A Medical Proxy designates someone to make healthcare decisions when the principal is unable to do so. This document emphasizes the importance of having a trusted person who understands the principal’s values and wishes regarding medical treatment, much like the DPOA emphasizes the need for a trusted individual to manage affairs when the principal cannot.

Fill out Common Types of Durable Power of Attorney Templates

How to Write a Notarized Letter for a Vehicle - Allows for the leasing of a vehicle through a designated representative.

Revoking Power of Attorney Form - Understand that revoking power of attorney is your right as the principal.

Real Estate Power of Attorney California - This Power of Attorney can provide peace of mind by ensuring your property is in capable hands.

More About Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf, even if you become incapacitated. This document remains effective even if you are unable to manage your own affairs due to illness or injury.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose anyone you trust to be your agent, such as a family member, friend, or attorney. It is essential to select someone who understands your values and wishes, as they will have significant authority over your financial and legal matters.

What types of decisions can my agent make?

Your agent can handle a wide range of decisions, including managing your finances, paying bills, making investments, and handling real estate transactions. You can specify which powers you want to grant them in the DPOA document.

When does a Durable Power of Attorney go into effect?

A DPOA can take effect immediately upon signing or can be set to activate only under specific circumstances, such as your incapacity. Be clear about your preferences when creating the document to ensure it aligns with your needs.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time, as long as you are mentally competent. To revoke the document, you should notify your agent in writing and destroy any copies of the original DPOA to prevent confusion.

What happens if I do not have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your loved ones may need to go through a lengthy court process to obtain guardianship or conservatorship. This can be costly and time-consuming, making it crucial to have a DPOA in place.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can provide you with valuable guidance. A legal professional can help ensure that your DPOA meets all state requirements and accurately reflects your wishes.

Is a Durable Power of Attorney valid in all states?

Yes, a DPOA is generally recognized across the United States. However, specific laws and requirements may vary by state. It is essential to familiarize yourself with your state’s regulations to ensure your document is valid.

How often should I review my Durable Power of Attorney?

It is advisable to review your DPOA periodically, especially after significant life events such as marriage, divorce, or the birth of a child. Changes in your health or financial situation may also warrant a review to ensure the document continues to reflect your wishes.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's essential to approach the process with care. This document grants someone the authority to make decisions on your behalf, so ensuring accuracy and clarity is vital. Here’s a list of dos and don’ts to keep in mind:

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you are granting to your agent.

- Do ensure the form is signed in front of a notary public, if required by your state.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank; this could lead to misunderstandings.

- Don't appoint someone who may not act in your best interest.

- Don't forget to review and update the document as your circumstances change.

- Don't assume that a verbal agreement will suffice; a written document is essential.

Durable Power of Attorney - Usage Steps

Completing a Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. Follow these steps carefully to fill out the form accurately.

- Begin by entering your full name and address at the top of the form. Make sure this information is current and accurate.

- Identify the person you are appointing as your agent. Provide their full name, address, and relationship to you.

- Clearly state the powers you wish to grant your agent. This may include managing finances, making legal decisions, or handling real estate transactions. Be specific about what you want them to do.

- If there are any limitations to the powers you are granting, outline those limitations clearly. This could include specific tasks your agent cannot perform.

- Decide when the Durable Power of Attorney becomes effective. You can choose for it to take effect immediately or only in the event of your incapacitation.

- Sign and date the form in the designated area. Ensure your signature matches your name as written at the top of the form.

- Have the form witnessed or notarized as required by your state laws. This step is crucial for the form to be legally valid.

- Make copies of the completed form for your records and provide copies to your agent and any relevant institutions.