Official Employee Loan Agreement Form

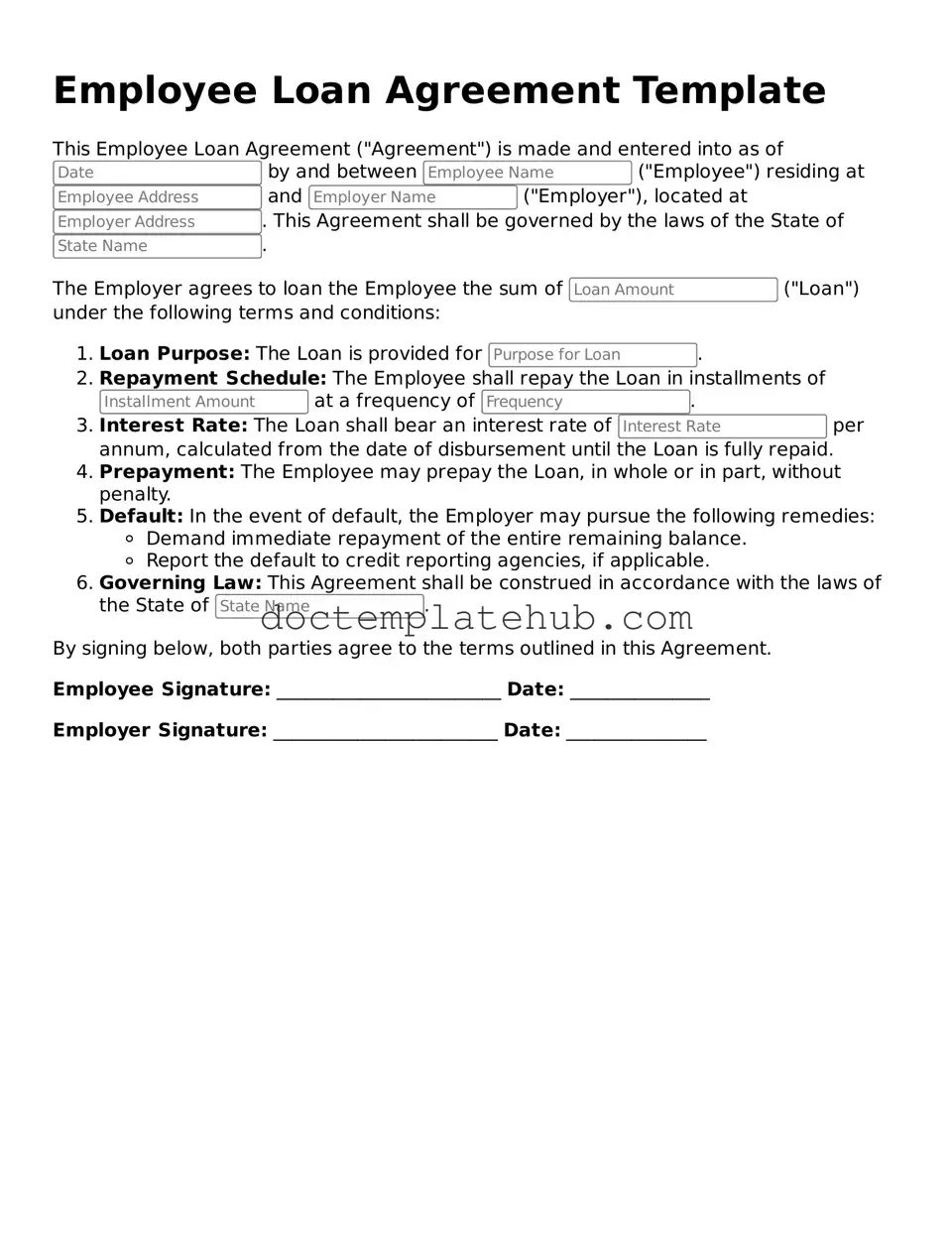

An Employee Loan Agreement form serves as a crucial document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement typically includes key elements such as the loan amount, interest rate, repayment schedule, and any applicable fees. It also specifies the purpose of the loan, ensuring that both parties understand the intended use of the funds. Additionally, the form addresses the consequences of default, detailing the steps the employer may take if the employee fails to meet repayment obligations. By clearly defining the roles and responsibilities of both the employer and the employee, this agreement helps to foster transparency and trust, while also protecting the financial interests of the employer. Understanding the components of this form is essential for both parties to navigate the lending process effectively and to ensure compliance with relevant laws and regulations.

Similar forms

The Employee Loan Agreement form shares similarities with a Personal Loan Agreement. Both documents outline the terms under which one party lends money to another. They specify the loan amount, interest rate, repayment schedule, and consequences for defaulting on the loan. Personal Loan Agreements are typically used between individuals or financial institutions, while Employee Loan Agreements are specifically tailored for employer-employee relationships.

Understanding the nuances of these documents can be greatly enhanced by consulting resources like TopTemplates.info, which provide valuable insights into the structure and terms of various loan agreements, helping both borrowers and lenders navigate their financial commitments with confidence.

A Home Loan Agreement is another document that resembles the Employee Loan Agreement. It serves as a contract between a borrower and a lender for purchasing a home. Like the Employee Loan Agreement, it details the loan amount, interest rate, and repayment terms. However, Home Loan Agreements often involve collateral, typically the property being purchased, whereas Employee Loan Agreements may not require such security.

The Student Loan Agreement also bears resemblance to the Employee Loan Agreement. This document outlines the terms under which a student borrows money to pay for education-related expenses. Similar to the Employee Loan Agreement, it includes information on the loan amount, interest rates, and repayment schedules. Both agreements aim to facilitate financial support, though the purpose of the loan differs significantly.

A Business Loan Agreement is comparable to the Employee Loan Agreement in that it formalizes the terms of a loan between a lender and a business entity. Both documents specify the loan amount, interest rates, and repayment terms. However, Business Loan Agreements often involve larger sums of money and may include additional clauses regarding the use of funds and financial reporting, which are less common in Employee Loan Agreements.

The Credit Agreement is another document that shares common features with the Employee Loan Agreement. This agreement outlines the terms of a line of credit extended by a lender to a borrower. Similar to the Employee Loan Agreement, it details repayment terms and interest rates. However, Credit Agreements often provide borrowers with flexibility in how much they can borrow at any given time, unlike the fixed amounts typically found in Employee Loan Agreements.

The Lease Agreement can also be compared to the Employee Loan Agreement. While primarily used for renting property, a Lease Agreement outlines the terms under which one party rents property from another. Both documents require clear terms regarding payment schedules and responsibilities. However, Lease Agreements focus on the rental of physical space rather than financial loans, highlighting different types of obligations.

An Installment Loan Agreement is similar to the Employee Loan Agreement in that both involve borrowing a set amount of money that is paid back over time in installments. These agreements detail the payment schedule, interest rates, and any fees associated with late payments. The primary distinction lies in the purpose of the loans, with Installment Loans being used for various personal or business expenses, while Employee Loans are specifically for employees.

The Promissory Note is another document that resembles the Employee Loan Agreement. It serves as a written promise by one party to pay a specified sum to another party under agreed-upon terms. Both documents outline the loan amount, interest rates, and repayment terms. However, a Promissory Note is often less formal and may not include as many detailed provisions as an Employee Loan Agreement.

The Mortgage Agreement is akin to the Employee Loan Agreement in that it involves borrowing money, usually for purchasing real estate. Both documents specify the loan amount, interest rate, and repayment terms. However, Mortgage Agreements typically involve securing the loan with the property itself, which adds a layer of complexity not found in most Employee Loan Agreements.

Lastly, the Debt Settlement Agreement can be compared to the Employee Loan Agreement. This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. While both documents address financial obligations, the Debt Settlement Agreement typically arises from a situation of financial distress, whereas the Employee Loan Agreement is a proactive arrangement intended to assist employees in managing their finances.

More About Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement specifies the loan amount, repayment schedule, interest rates (if applicable), and any other relevant terms to ensure clarity and protect both parties' interests.

Who is eligible to apply for an Employee Loan?

Typically, all full-time employees who meet specific criteria set by the employer may be eligible for an Employee Loan. Eligibility can depend on factors such as length of employment, job performance, and financial need. Employers may also have specific policies regarding loan amounts and repayment terms.

What information is required to complete the form?

To complete the Employee Loan Agreement form, employees usually need to provide personal information such as their name, employee ID, loan amount requested, purpose of the loan, and proposed repayment schedule. Employers may also require financial information to assess the employee's ability to repay the loan.

What are the repayment terms for an Employee Loan?

Repayment terms can vary based on the agreement. Generally, the terms will specify the repayment period, which can range from a few months to several years. The agreement may also outline the frequency of payments (e.g., monthly or bi-weekly) and any interest rates applied to the loan.

Can the loan be forgiven?

Loan forgiveness is not common but may be possible under certain circumstances. Employers may have policies that allow for partial or full forgiveness of the loan if the employee meets specific criteria, such as tenure with the company or achievement of certain performance goals. This should be clearly stated in the agreement.

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan, the agreement will typically outline the consequences. This may include late fees, adjustments to payroll deductions, or legal action. Open communication with the employer is crucial to explore options, such as restructuring the repayment plan.

Is interest charged on Employee Loans?

Interest may be charged on Employee Loans, depending on the employer's policy. If interest is applicable, the agreement will specify the rate and how it is calculated. Employers may choose to offer interest-free loans as an employee benefit, but this is not standard practice.

How can an employee apply for a loan?

To apply for an Employee Loan, employees should follow their employer's established process. This often involves filling out the Employee Loan Agreement form and submitting it to the HR or finance department. Employees should ensure they provide all necessary information to avoid delays in processing their application.

Dos and Don'ts

When filling out the Employee Loan Agreement form, consider the following do's and don'ts to ensure accuracy and compliance.

- Do read the entire form carefully before starting.

- Do provide accurate personal information.

- Do specify the loan amount clearly.

- Do understand the repayment terms.

- Do ask questions if any part of the form is unclear.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand in your responses.

- Don't sign the form without reviewing it thoroughly.

- Don't provide false information.

- Don't forget to keep a copy for your records.

Employee Loan Agreement - Usage Steps

Completing the Employee Loan Agreement form is a straightforward process. This document is essential for formalizing the terms of a loan between an employee and the employer. Follow the steps carefully to ensure all necessary information is included.

- Start by entering the employee's full name at the top of the form.

- Provide the employee's job title and department.

- Fill in the date when the agreement is being completed.

- Specify the total loan amount being requested.

- Outline the purpose of the loan in a brief statement.

- Indicate the repayment schedule, including the start date and frequency of payments.

- Include any interest rate applicable to the loan, if applicable.

- Provide the employee's signature to confirm their agreement to the terms.

- Have a representative from the employer sign the form as well.

- Make a copy of the completed form for both the employee and employer records.