Fill Your Erc Broker Market Analysis Form

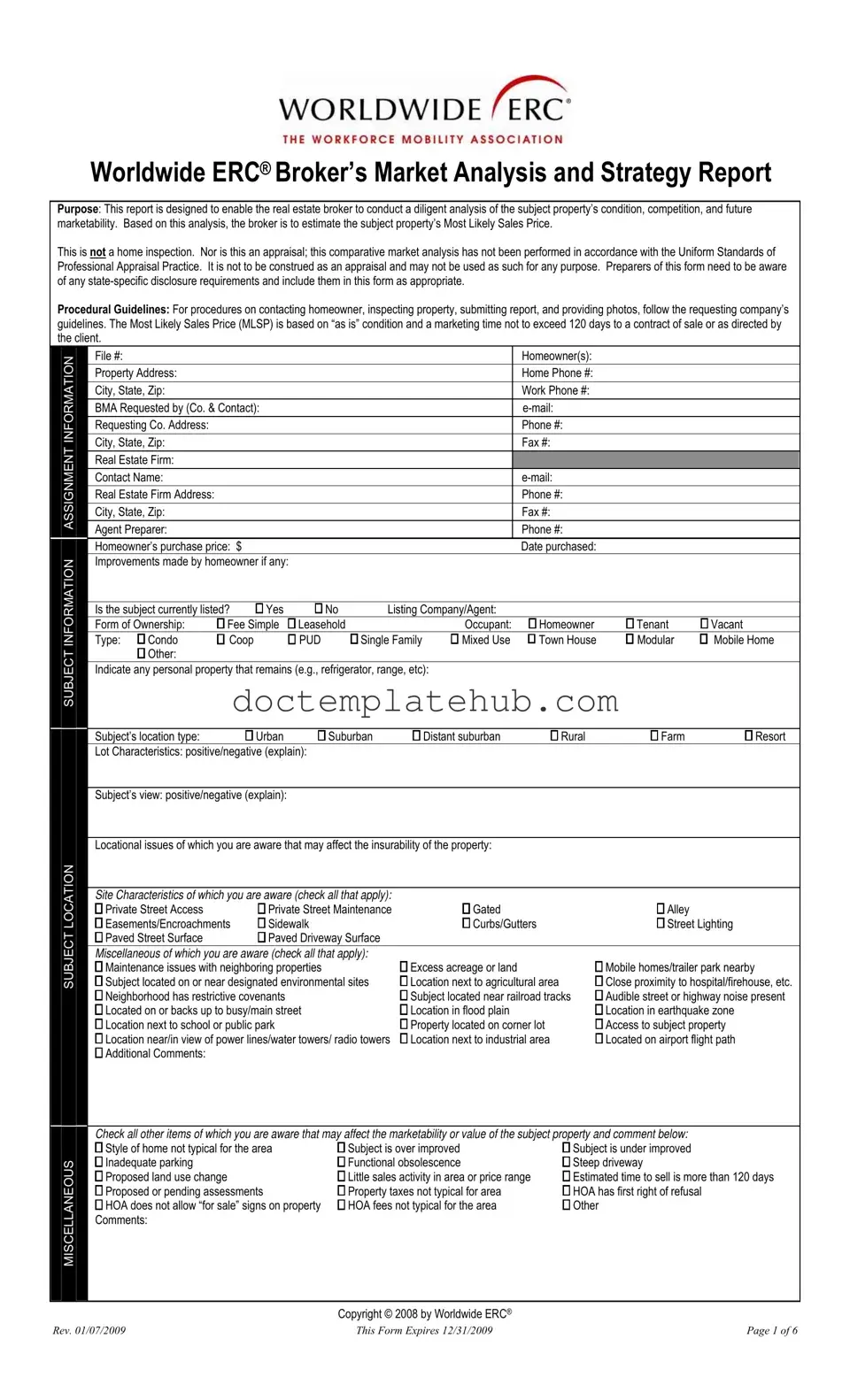

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers, enabling them to thoroughly assess a property's condition, competition, and future marketability. This report is not an appraisal or a home inspection; rather, it focuses on providing a comparative market analysis to estimate the Most Likely Sales Price (MLSP) of the subject property. Brokers must remain aware of state-specific disclosure requirements while completing the form, ensuring compliance with local regulations. The report includes detailed sections for collecting essential information about the property, such as its location, ownership type, and any improvements made by the homeowner. Additionally, it prompts brokers to note the property's condition, including any necessary repairs and improvements, while also considering the impact of the surrounding neighborhood and broader market area on the property’s value. By analyzing competing listings and recent sales, brokers can better understand market trends and recommend appropriate marketing strategies. Ultimately, the Broker’s Market Analysis form equips brokers with the insights needed to guide homeowners through the selling process effectively.

Similar forms

The Comparative Market Analysis (CMA) is a document that closely resembles the ERC Broker Market Analysis form. It serves a similar purpose by evaluating the market conditions and property values in a specific area. Like the ERC form, a CMA analyzes comparable properties, known as "comps," to help estimate the value of a subject property. The CMA typically includes recent sales data, current listings, and market trends, which assists real estate agents in advising clients on pricing strategies. However, while the CMA is often used for residential properties, it can also be applied to commercial real estate, making it a versatile tool in the real estate industry.

The Property Condition Report (PCR) is another document that shares similarities with the ERC Broker Market Analysis form. The PCR focuses primarily on the physical condition of a property, detailing any repairs or improvements needed. While the ERC form emphasizes marketability and pricing, the PCR provides a thorough inspection of the property's structural integrity and compliance with local regulations. Both documents aim to inform stakeholders about the condition and potential value of a property, but the PCR is more technical and specific to the property's physical attributes.

The Appraisal Report is a formal assessment that also aligns with the ERC Broker Market Analysis form. An appraisal is conducted by a licensed appraiser and provides a professional opinion on a property's value based on various factors, including location, condition, and comparable sales. While the ERC form estimates a property's Most Likely Sales Price without being an official appraisal, both documents aim to provide a valuation that can guide buyers and sellers in their real estate decisions. However, an appraisal adheres to strict guidelines and is often required by lenders, while the ERC form serves as a more informal market analysis.

Understanding the various documents involved in real estate transactions is essential, especially when considering the role of the Straight Bill Of Lading form in shipping logistics, which is crucial for transporting goods efficiently. Just as the CMA provides insights into property value, the Straight Bill Of Lading ensures that shipments are documented clearly and delivered to the appropriate parties, helping to prevent misunderstandings in logistics. For more detailed information, you can refer to https://smarttemplates.net/.

The Listing Agreement is another document that shares characteristics with the ERC Broker Market Analysis form. This agreement outlines the terms under which a real estate agent will represent a seller in the sale of their property. Similar to the ERC form, the Listing Agreement includes details about the property, its condition, and the marketing strategy. Both documents are essential in the real estate transaction process, as they establish expectations and responsibilities for both parties. However, the Listing Agreement is a legally binding contract, whereas the ERC form serves as a preliminary analysis to guide pricing and marketing efforts.

Other PDF Templates

Act of Donation Louisiana Pdf - This form serves as an official record of the donor's intent to transfer ownership.

Having a well-structured Employee Handbook is essential for every organization, as it not only outlines expectations but also empowers employees with knowledge about their rights and responsibilities. By clearly defining the workplace culture and guidelines, this document can help prevent misunderstandings and promote accountability. For those looking for templates to create or update their own handbooks, TopTemplates.info offers valuable resources that can streamline the process.

Contract for Lease - The Landlord may designate other payment methods or locations at their discretion within the lease.

More About Erc Broker Market Analysis

What is the purpose of the ERC Broker Market Analysis form?

The ERC Broker Market Analysis form is designed to assist real estate brokers in conducting a thorough analysis of a property's condition, its competition, and its future marketability. By utilizing this form, brokers can estimate the Most Likely Sales Price (MLSP) for the property in question. It is important to note that this analysis is not a home inspection or an appraisal, and it should not be used as such. The form encourages brokers to be mindful of state-specific disclosure requirements and to incorporate them into their reports as necessary.

How should a broker prepare to fill out the ERC Broker Market Analysis form?

Before filling out the form, brokers should gather all relevant information regarding the subject property, including its location, condition, and any improvements made by the homeowner. It is essential to follow the procedural guidelines set by the requesting company for contacting homeowners, inspecting the property, and submitting the report. Additionally, brokers should be prepared to document any factors that may affect the property’s marketability, such as neighborhood characteristics and local market conditions.

What factors are considered when estimating the Most Likely Sales Price (MLSP)?

The estimation of the Most Likely Sales Price (MLSP) is based on the property's current condition, referred to as "as is," and assumes a marketing time of no more than 120 days to secure a contract of sale. Factors influencing this estimate include the property’s location, the condition of the home, the surrounding neighborhood, and the current market trends. Brokers are encouraged to consider recent comparable sales and active listings to support their price estimation.

What are some common issues that may affect the insurability of a property?

Several issues can impact the insurability of a property. These may include structural problems, environmental concerns, or the presence of easements and encroachments. Additionally, factors such as proximity to industrial areas, flood zones, or noise from nearby highways can also pose challenges. Brokers should be diligent in identifying and documenting any such issues, as they can significantly influence both the marketability and value of the property.

What should brokers keep in mind regarding state-specific disclosure requirements?

It is crucial for brokers to be aware of and comply with any state-specific disclosure requirements when filling out the ERC Broker Market Analysis form. Each state may have its own regulations regarding what must be disclosed to potential buyers. Brokers should ensure that they include all necessary disclosures in their reports to avoid legal complications and to provide a transparent assessment of the property. This diligence not only protects the broker but also serves the best interests of the homeowner and potential buyers.

Dos and Don'ts

When filling out the ERC Broker Market Analysis form, keep the following guidelines in mind:

- Do: Carefully read each section and ensure all required fields are completed accurately.

- Do: Include any state-specific disclosure requirements that may apply to the property.

- Do: Use clear and concise language when providing comments or descriptions of the property.

- Do: Follow the requesting company’s guidelines for contacting homeowners and submitting reports.

- Don't: Assume that your analysis is an appraisal; it should not be used as such.

- Don't: Leave any sections blank if they are applicable; incomplete forms can lead to delays.

- Don't: Provide personal opinions without supporting data; stick to observable facts and figures.

- Don't: Forget to include any necessary photos that support your analysis of the property.

Erc Broker Market Analysis - Usage Steps

After gathering all necessary information, you will proceed to fill out the ERC Broker Market Analysis form. This form helps in assessing the property’s condition, competition, and future marketability, ultimately leading to an estimated sales price.

- File Information: Enter the file number, homeowner(s) names, property address, and phone numbers for both home and work.

- BMA Requestor: Fill in the name of the requesting company and contact person, including their email and address.

- Real Estate Firm: Provide the name of the real estate firm, contact name, email, and address.

- Agent Preparer: Include the name and phone number of the agent preparing the report.

- Property Details: Document the homeowner’s purchase price, date of purchase, and any improvements made to the property.

- Current Listing Status: Indicate if the property is currently listed and provide details about the listing agent or company.

- Property Type: Specify the form of ownership and occupancy status (homeowner, tenant, or vacant).

- Location Type: Select the type of location (urban, suburban, rural, etc.) and describe any positive or negative characteristics.

- Site Characteristics: Check all applicable site features that may affect the property, such as street access and easements.

- Miscellaneous Issues: Note any additional issues that could impact the property’s marketability or value.

- Property Condition: Assess the property condition and check any relevant boxes regarding decor, construction status, or damage.

- Recommended Repairs: List any recommended repairs and estimated costs for both interior and exterior items.

- Inspections: Identify required inspections and any issues affecting insurability.

- Financing Options: Describe the most probable financing means and any potential issues that may arise.

- Neighborhood Analysis: Define the subject neighborhood and summarize market conditions, including property values and days on market.

- Competing Listings: Gather information on comparable listings and document their details.

- Comparable Sales: Record details of comparable sales, including prices and conditions.