Fill Your Fl Dr 312 Form

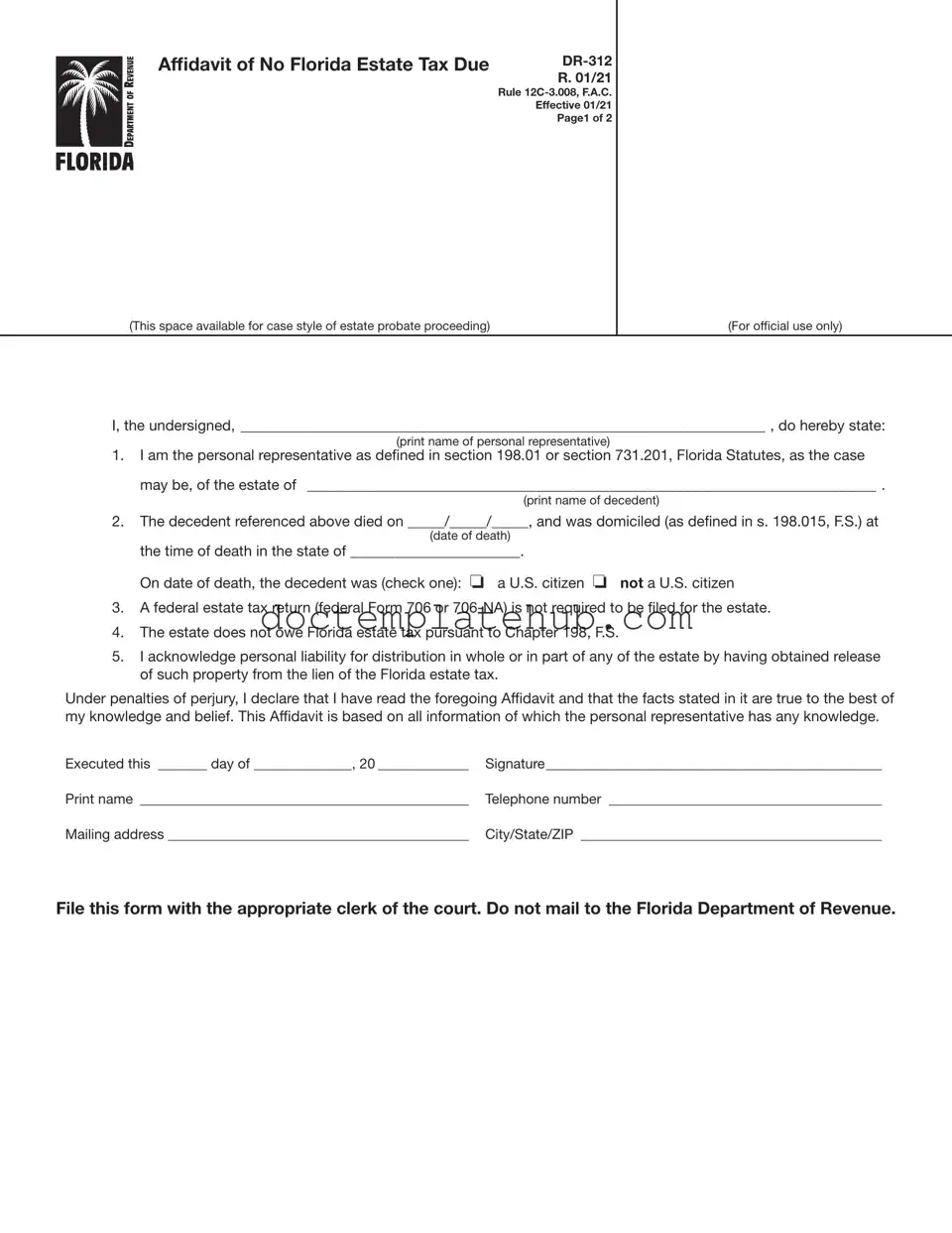

The Florida Form DR-312, officially known as the Affidavit of No Florida Estate Tax Due, plays a crucial role in the estate administration process when no Florida estate tax is owed. This form is primarily used by personal representatives of estates to declare that a federal estate tax return is not required and that the estate does not owe any Florida estate tax under Chapter 198 of the Florida Statutes. It is important to note that the definition of a "personal representative" includes anyone in possession of the decedent's property, making this affidavit applicable to a wider range of individuals involved in estate management. By filing this form with the appropriate clerk of the circuit court, the personal representative can effectively remove the Florida Department of Revenue's estate tax lien, thus facilitating the distribution of the estate. The DR-312 form must be completed accurately, including the decedent's details and the personal representative's acknowledgment of liability for property distribution. Additionally, this form is not applicable for estates that require the filing of federal estate tax returns, such as Form 706 or 706-NA. Understanding the requirements and implications of the DR-312 is essential for anyone involved in the probate process in Florida.

Similar forms

The Affidavit of No Florida Estate Tax Due, or Form DR-312, shares similarities with the Affidavit of Heirship. Both documents serve to clarify the status of an estate, particularly when it comes to the distribution of assets. The Affidavit of Heirship is typically used to establish the heirs of a deceased person without the need for formal probate proceedings. Like Form DR-312, it is a sworn statement that can be filed with the court to facilitate the transfer of property, ensuring that heirs can claim their inheritance without unnecessary delays.

For those seeking guidance on the legalities surrounding childcare decisions, the essential Power of Attorney for a Child document is vital. It allows parents or guardians to delegate decision-making authority to trusted adults when they cannot be present, ensuring that the child's welfare is prioritized during their absence.

Another document akin to Form DR-312 is the Small Estate Affidavit. This form allows heirs to claim assets of a decedent without going through full probate if the estate is below a certain value threshold. Similar to DR-312, the Small Estate Affidavit is a legal declaration made under oath. It simplifies the process for heirs by allowing them to collect the decedent's assets directly, provided they meet the requirements set forth by state law.

The Affidavit of No Contest is also comparable to Form DR-312 in that it is a sworn statement regarding the intentions and wishes of the decedent. This document is often used in the context of wills to discourage beneficiaries from contesting the will. Like the DR-312, it serves as a protective measure, ensuring that the estate is settled according to the decedent's wishes without unnecessary legal challenges.

The Certificate of No Tax Due is another document that resembles the DR-312 form. This certificate is issued by tax authorities to confirm that no estate taxes are owed. Similar to the DR-312, it serves as proof for the personal representative that the estate is free from tax liabilities, allowing for the smooth distribution of assets to beneficiaries.

The Affidavit of Personal Representative also shares characteristics with Form DR-312. This affidavit is used to establish the authority of the personal representative to act on behalf of the estate. Like DR-312, it is a sworn statement that provides necessary information about the decedent and the personal representative, facilitating the administration of the estate and ensuring that all actions taken are legally recognized.

The Will itself can be seen as similar to Form DR-312 in that both documents address the distribution of a decedent's assets. While the Will outlines the decedent's wishes regarding their property, Form DR-312 confirms that no estate tax is due, which can expedite the process of executing those wishes. Both documents play essential roles in the estate administration process, ensuring clarity and compliance with legal requirements.

The Affidavit of Debt is another document that bears resemblance to Form DR-312. This affidavit is used to affirm that debts of the decedent have been settled or are not applicable. Like the DR-312, it serves to protect the personal representative from future claims, ensuring that the estate can be distributed without the worry of outstanding debts affecting the beneficiaries.

Lastly, the Notice of Administration is similar to Form DR-312 in that it is part of the probate process. This notice informs interested parties about the initiation of probate proceedings. While DR-312 addresses tax liabilities, the Notice of Administration ensures that all parties are aware of the estate's status and any actions being taken, promoting transparency in the probate process.

Other PDF Templates

Cadet Command Regulations - It includes sections for students to list their academic school and credit hours.

For those looking to create a comprehensive legal framework, utilizing a Hold Harmless Agreement form can be crucial; resources like smarttemplates.net provide templates that simplify the process and ensure necessary clauses are adequately addressed, thereby enhancing the security and understanding between parties involved.

What Is a W3 Tax Form - A digital signature is allowed when filing electronically.

More About Fl Dr 312

What is the FL DR 312 form?

The FL DR 312 form, officially known as the Affidavit of No Florida Estate Tax Due, is a document used by personal representatives of estates in Florida. It certifies that the estate does not owe any Florida estate tax and that a federal estate tax return is not required. This form helps to clear any tax liens associated with the estate, allowing for the proper distribution of assets.

Who needs to file the FL DR 312 form?

Personal representatives of estates that are not subject to Florida estate tax and do not require a federal estate tax return should file the FL DR 312 form. This includes individuals in actual or constructive possession of the decedent's property. If the estate meets these criteria, the form is essential for confirming the estate's nonliability for taxes.

Where should the FL DR 312 form be filed?

The FL DR 312 form must be filed with the clerk of the circuit court in the county or counties where the decedent owned property. It is important to note that this form should not be sent to the Florida Department of Revenue. Proper filing ensures that the affidavit is recorded in the public records, which is crucial for the estate's administration.

When is the FL DR 312 form used?

This form is used when an estate is not subject to Florida estate tax under Chapter 198 of the Florida Statutes and when a federal estate tax return (Form 706 or 706-NA) is not required. If the estate exceeds the federal thresholds for filing these forms, the FL DR 312 cannot be used. It is essential to determine the estate's tax obligations before filing.

What information is required on the FL DR 312 form?

The form requires several pieces of information, including the name of the personal representative, the name of the decedent, the date of death, and the decedent's domicile at the time of death. Additionally, the personal representative must indicate whether the decedent was a U.S. citizen and provide their contact information. This information is crucial for the validity of the affidavit.

What happens if the FL DR 312 form is not filed?

If the FL DR 312 form is not filed, the estate may remain subject to a Florida estate tax lien, which can complicate the distribution of assets. Without this affidavit, beneficiaries may face delays or difficulties in accessing their inheritance. Filing the form helps to ensure a smoother transition of assets and clears any potential tax obligations.

How can I get help with the FL DR 312 form?

If you have questions or need assistance with the FL DR 312 form, you can contact Taxpayer Services at the Florida Department of Revenue at 850-488-6800. They are available Monday through Friday, excluding holidays. Additionally, resources, forms, and tutorials are available on the Department's website, which can provide further guidance.

Dos and Don'ts

When filling out the FL DR 312 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do print clearly to avoid any misunderstandings.

- Do ensure that all required fields are completed, including names and dates.

- Do check the box that applies to the decedent's citizenship status.

- Do file the form with the appropriate clerk of the court in the correct county.

- Do read the entire affidavit to confirm all information is accurate before signing.

- Don't mail the form to the Florida Department of Revenue; it must be filed in person.

- Don't write or mark in the designated space for the clerk of the court.

- Don't submit this form if a federal estate tax return is required.

- Don't forget to include the case style if an administration proceeding is pending.

- Don't overlook the need for personal liability acknowledgment when distributing estate property.

By adhering to these guidelines, the process of completing the FL DR 312 form will be smoother and more efficient.

Fl Dr 312 - Usage Steps

Completing the FL DR 312 form is an important step in managing an estate that is not subject to Florida estate tax. After filling out the form, it must be filed with the appropriate clerk of the court in the county where the decedent owned property. This ensures that the estate is recognized as not owing any Florida estate tax, which is crucial for the distribution of the estate's assets.

- Begin by entering the case style of the estate probate proceeding in the designated space at the top of the form.

- In the first blank line, print the name of the personal representative responsible for the estate.

- In the second blank line, print the name of the decedent whose estate is being represented.

- Enter the date of death of the decedent in the format of month/day/year.

- Specify the state where the decedent was domiciled at the time of death in the next blank space.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return is not required to be filed by checking the corresponding box.

- Affirm that the estate does not owe Florida estate tax by checking the relevant box.

- Sign the form to acknowledge personal liability for the distribution of the estate's property.

- Print your name beneath your signature.

- Provide your telephone number in the designated space.

- Fill out your mailing address, including city, state, and ZIP code.

- Once completed, file the form with the appropriate clerk of the court. Do not mail it to the Florida Department of Revenue.