Fillable Articles of Incorporation Template for Florida State

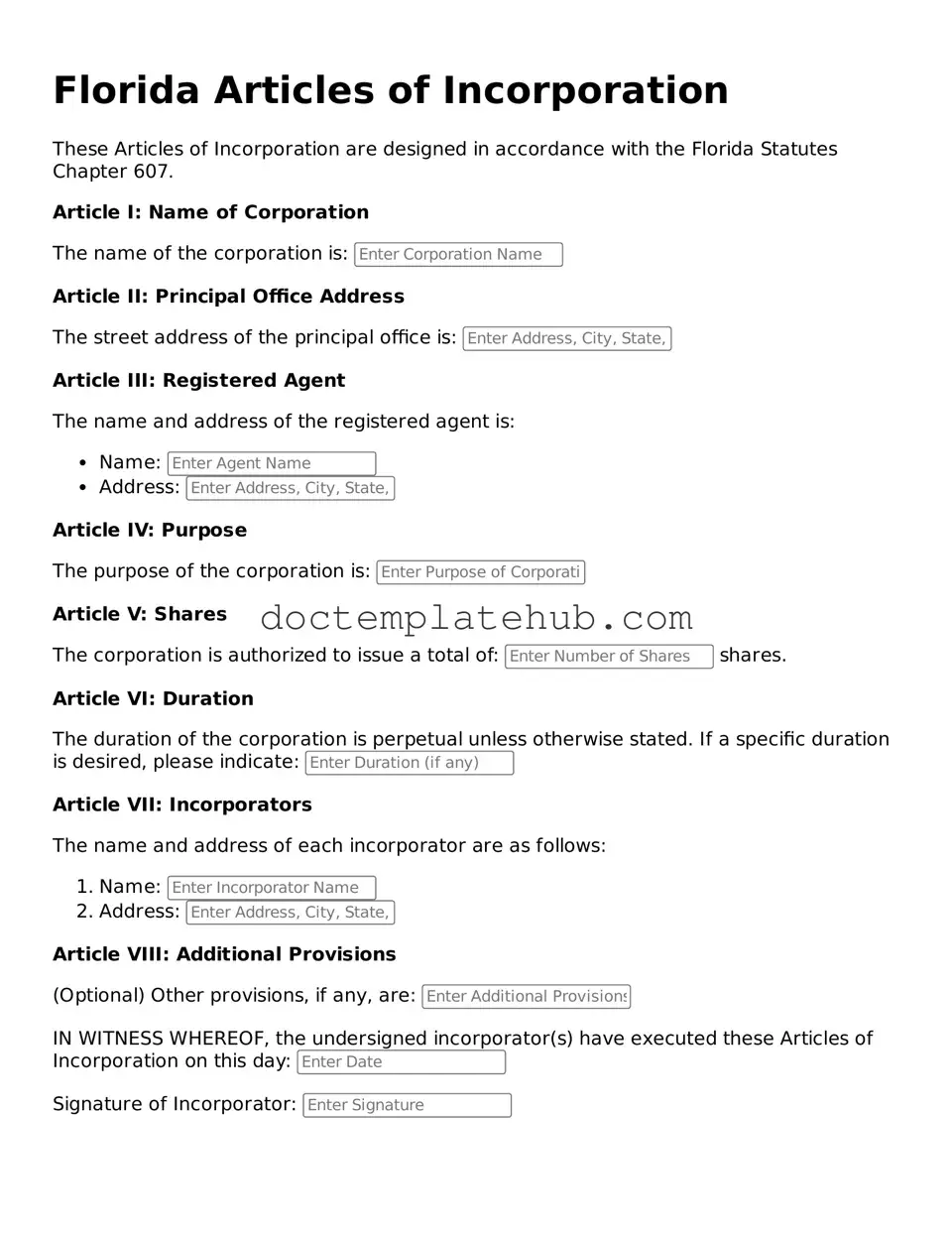

When starting a business in Florida, one of the essential steps is filing the Articles of Incorporation. This document serves as the foundation for your corporation, laying out key details that define its structure and purpose. The form requires specific information, including the corporation's name, which must be unique and not already in use by another entity in the state. Additionally, it calls for the designation of a registered agent—an individual or business responsible for receiving legal documents on behalf of the corporation. The Articles also need to specify the number of shares the corporation is authorized to issue, along with the names and addresses of the initial directors. By completing this form accurately, you not only comply with state requirements but also establish a legal identity for your business, paving the way for future growth and success. Understanding each component of the Articles of Incorporation is crucial, as it can affect your business operations and legal standing in Florida.

Similar forms

The Articles of Incorporation is a foundational document for establishing a corporation, and it shares similarities with several other important documents in the business world. One such document is the Certificate of Incorporation. Often used interchangeably with Articles of Incorporation, this certificate serves the same purpose: to formally create a corporation in the eyes of the state. Both documents outline essential details such as the corporation’s name, purpose, and registered agent, making them crucial for legal recognition and compliance.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation lay the groundwork for the corporation's existence, the Bylaws provide the internal rules and regulations that govern its operations. They detail how the corporation will be managed, the responsibilities of its officers, and the procedures for holding meetings. Together, these documents ensure that a corporation not only exists legally but also functions smoothly and effectively.

The Operating Agreement is similar to the Articles of Incorporation but is specifically designed for Limited Liability Companies (LLCs). This document outlines the ownership structure and operational guidelines of the LLC, much like how the Articles define the corporation's structure. Both documents are essential for legal formation and help protect the interests of the owners, ensuring clarity in roles and responsibilities.

The Partnership Agreement also bears resemblance to the Articles of Incorporation, particularly in its role in defining the structure of a business entity. While the Articles establish a corporation, the Partnership Agreement outlines the relationship between partners in a partnership. It includes details about profit sharing, decision-making processes, and the roles of each partner, promoting transparency and cooperation among the partners.

In addition, the Certificate of Good Standing can be likened to the Articles of Incorporation. This document verifies that a corporation has been legally formed and is compliant with state regulations. While the Articles initiate the formation process, the Certificate of Good Standing serves as proof that the corporation is in good standing with the state, often required for conducting business or applying for loans.

The Statement of Information is another document similar to the Articles of Incorporation. It provides updated information about a corporation's key details, such as its address and officers. While the Articles are filed at the inception of the corporation, the Statement of Information is typically required periodically to ensure that the state has current information about the corporation’s operations and management.

The Business License is also related, albeit in a different context. While the Articles of Incorporation establish a corporation legally, the Business License grants permission to operate within a specific jurisdiction. Both documents are essential for compliance; however, the Business License is more focused on local regulations, while the Articles pertain to state-level incorporation.

Lastly, the Tax Identification Number (TIN) application aligns with the Articles of Incorporation in the sense that both are necessary for a corporation to operate legally. The Articles provide the legal foundation, while the TIN is required for tax purposes. This number is essential for opening bank accounts, hiring employees, and fulfilling tax obligations, making it a vital component of a corporation’s operational framework.

Other Common State-specific Articles of Incorporation Templates

Georgia Secretary of State Forms - It lists the names and addresses of the initial directors.

Texas Llc Annual Fees - Certain tax-related privileges may be linked to how the Articles are structured.

More About Florida Articles of Incorporation

What is the Florida Articles of Incorporation form?

The Florida Articles of Incorporation form is a legal document that establishes a corporation in the state of Florida. It outlines essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form is a crucial step in creating a corporation in Florida.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Florida must file the Articles of Incorporation. This includes individuals or groups who want to operate as a for-profit or non-profit corporation. It is essential for ensuring that your business is recognized as a legal entity by the state.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the corporation's name, the principal office address, the registered agent's name and address, the purpose of the corporation, and details about the shares. Additionally, the names and addresses of the incorporators must be included. Make sure all information is accurate to avoid delays in processing.

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Florida Division of Corporations website or by mailing a paper form to the appropriate office. If filing online, you will need to create an account. For paper filings, ensure that you include the correct filing fee and send it to the designated address.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Florida varies based on the type of corporation you are forming. As of now, the fee for a for-profit corporation is typically around $70, while a non-profit corporation may have a lower fee. Always check the Florida Division of Corporations website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online submissions are processed faster, often within a few business days. Paper filings may take longer, sometimes up to several weeks. If you need expedited service, there are options available for an additional fee.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are approved, your corporation is officially recognized by the state. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After that, you should focus on obtaining any necessary business licenses and permits, setting up a corporate bank account, and establishing internal governance documents.

Dos and Don'ts

When filling out the Florida Articles of Incorporation form, it’s important to follow certain guidelines to ensure your application is successful. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information about your business name and address.

- Do include the names and addresses of all initial directors.

- Do specify the purpose of your corporation clearly.

- Do double-check for any spelling or formatting errors before submission.

- Don't use a name that is already taken or too similar to another registered business.

- Don't forget to include your registered agent's information.

- Don't leave any required sections blank; all parts must be completed.

- Don't submit the form without the necessary filing fee.

Florida Articles of Incorporation - Usage Steps

Once you have gathered the necessary information, you can begin filling out the Florida Articles of Incorporation form. This document is essential for establishing your corporation and will require specific details about your business. Follow these steps to ensure you complete the form accurately.

- Obtain the Form: Download the Florida Articles of Incorporation form from the Florida Division of Corporations website or request a hard copy.

- Business Name: Write the name of your corporation. Ensure it complies with Florida naming requirements, including the use of “Corporation,” “Incorporated,” or an abbreviation.

- Principal Office Address: Provide the complete address of the corporation's principal office. This should include the street address, city, state, and zip code.

- Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation. Include the agent's name and address.

- Incorporators: List the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Purpose of the Corporation: Briefly describe the purpose of your corporation. This can be a general statement about the business activities you plan to conduct.

- Stock Information: If your corporation will issue stock, specify the number of shares and their par value. If it will not issue stock, indicate that as well.

- Effective Date: If you want the incorporation to take effect on a specific date, fill that in. Otherwise, it will become effective upon filing.

- Signature: The form must be signed by the incorporators. Ensure that all signatures are included before submission.

- Filing Fee: Prepare the payment for the filing fee. Check the current fee amount on the Florida Division of Corporations website.

After completing the form, review all entries for accuracy. Once verified, you can submit the Articles of Incorporation by mail or online, depending on your preference. Keep a copy for your records, as you will need it for future reference.