Fill Your Florida Commercial Contract Form

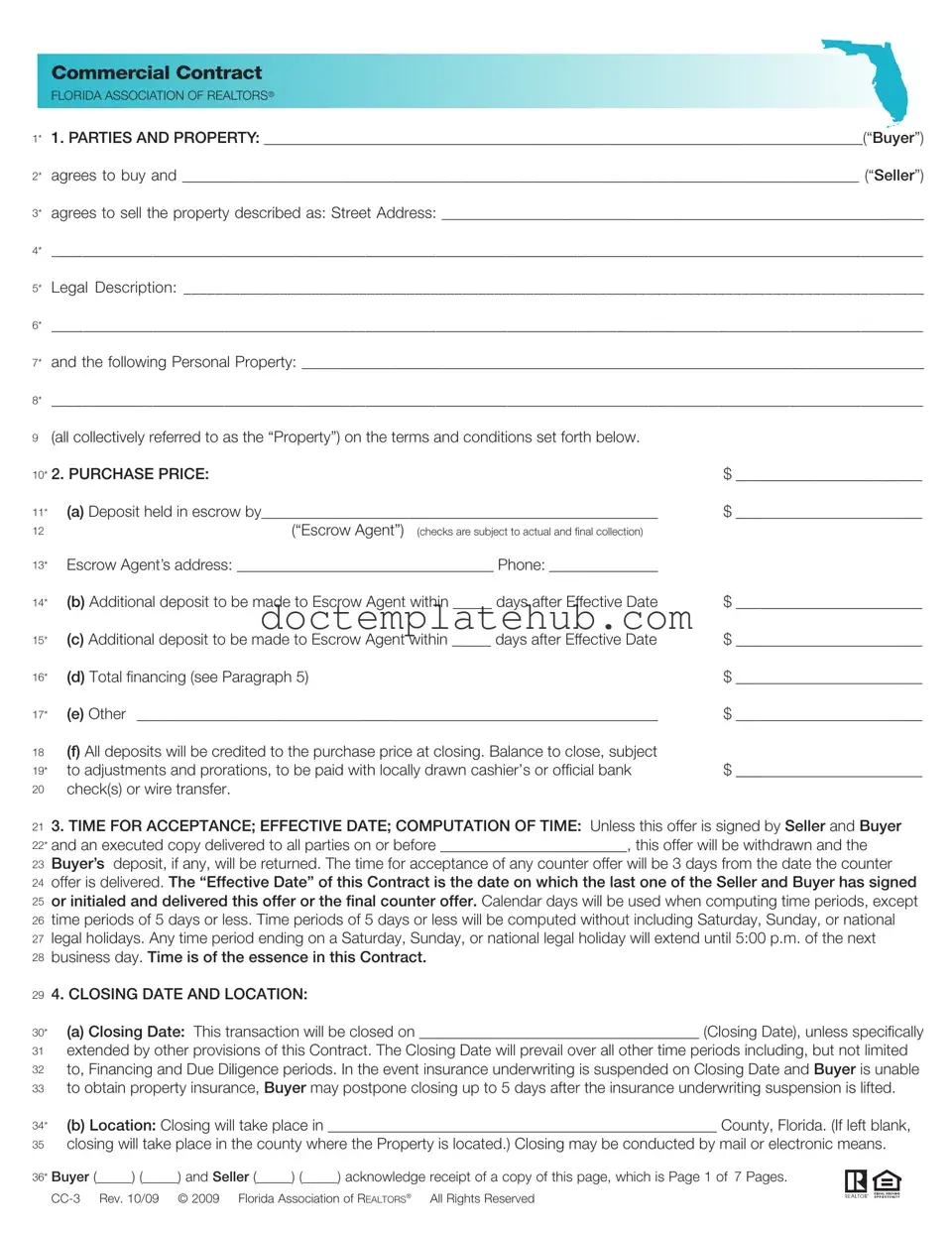

The Florida Commercial Contract form is a vital tool for those engaged in real estate transactions within the state. This form outlines the agreement between a buyer and seller regarding the purchase of commercial property, detailing essential elements such as the parties involved, the property description, and the purchase price. It specifies the timeline for acceptance and closing, ensuring both parties understand their obligations and the conditions under which the sale will proceed. Additionally, the form addresses financing arrangements, including the buyer's responsibility to secure loans and the conditions under which deposits may be returned or retained. The contract also covers title transfer, property condition, and the necessary inspections, providing a framework for due diligence. Furthermore, it includes provisions for handling any defaults, attorney fees, and the risk of loss, ensuring both parties are protected throughout the transaction process. By clearly delineating these aspects, the Florida Commercial Contract form helps facilitate smoother negotiations and transactions, ultimately benefiting all parties involved.

Similar forms

The Florida Commercial Contract form shares similarities with the Residential Purchase Agreement, which is often used for transactions involving residential properties. Both documents outline the essential terms of the sale, such as the parties involved, the property description, and the purchase price. They also detail the financing terms, contingencies, and the closing process. While the Residential Purchase Agreement focuses on homes, the Commercial Contract caters specifically to commercial properties, adjusting the language and terms to suit the unique aspects of commercial real estate transactions.

Another document akin to the Florida Commercial Contract is the Lease Agreement, particularly in commercial contexts. Both agreements establish a legal relationship between parties regarding property use, whether for purchase or lease. They define the responsibilities of the parties, including maintenance obligations, payment terms, and conditions for termination. While a Lease Agreement emphasizes the rental terms and duration of occupancy, the Commercial Contract focuses on the outright sale and transfer of ownership, reflecting the different objectives of leasing versus purchasing property.

In navigating various legal agreements, it’s essential to understand how documents like the Hold Harmless Agreement form can mitigate liability risks for parties involved in transactions or services. This type of agreement, particularly in New York, provides crucial protections by clearly defining responsibilities in order to avoid ambiguities and legal disputes. For those seeking templates for such agreements, resources like smarttemplates.net offer useful tools to ensure that all parties are adequately protected while engaging in business dealings.

The Florida Commercial Contract also resembles the Option to Purchase Agreement, which grants a potential buyer the right to purchase a property at a later date under specified conditions. Both documents outline the purchase price and terms, but the Option to Purchase Agreement typically includes a time frame during which the buyer can decide whether to proceed with the purchase. This flexibility allows buyers to assess the property's value and suitability before committing, whereas the Commercial Contract establishes a definitive sale once signed by both parties.

Lastly, the Florida Commercial Contract is similar to a Joint Venture Agreement in real estate contexts. Both documents involve collaboration between parties for a specific project or investment. They detail contributions, profit-sharing arrangements, and responsibilities. However, the Joint Venture Agreement is more focused on the partnership aspect, often used when two or more parties work together to develop or manage a property. In contrast, the Commercial Contract is primarily concerned with the sale transaction itself, outlining the specifics of the exchange of property ownership.

Other PDF Templates

Bdsm Checklist - Keep a journal to track feelings and insights.

The California Vehicle Purchase Agreement form is a crucial document that outlines the terms and conditions between a buyer and a seller when purchasing a vehicle in California. This agreement ensures both parties are clear on the details of the transaction, from the price to any warranties or conditions. You can access a sample of this form at https://documentonline.org/blank-california-vehicle-purchase-agreement/, which can help make your vehicle purchase smoother and more secure.

Load Calculations - Necessary for the proper sizing of electrical panels and wiring.

More About Florida Commercial Contract

What is the Florida Commercial Contract form?

The Florida Commercial Contract form is a legally binding agreement used in the sale and purchase of commercial properties in Florida. It outlines the responsibilities and obligations of both the buyer and the seller, including details about the property, purchase price, financing, and closing procedures. This form helps ensure that both parties understand the terms of the transaction and protects their interests throughout the process.

Who are the parties involved in the contract?

The contract involves two primary parties: the buyer and the seller. The buyer is the individual or entity agreeing to purchase the property, while the seller is the individual or entity agreeing to sell the property. Both parties must sign the contract for it to be valid. The contract also references an escrow agent, who holds the deposit and ensures that funds are disbursed according to the contract's terms.

What is included in the purchase price section?

The purchase price section details the total amount the buyer agrees to pay for the property. It includes information about deposits held in escrow, additional deposits, and any financing arrangements. All deposits made by the buyer will be credited toward the purchase price at closing. The balance due at closing is also specified, which must be paid via a locally drawn cashier’s check or wire transfer.

What is the significance of the closing date?

The closing date is the date on which the transaction is finalized, and ownership of the property is transferred from the seller to the buyer. The contract specifies that the closing will occur on a predetermined date unless extended by other provisions within the contract. It is crucial because it sets a timeline for the completion of all obligations, including financing and due diligence periods.

What happens if the buyer cannot obtain financing?

If the buyer is unable to secure financing despite making a good faith effort, they have the option to cancel the contract. The buyer must notify the seller within a specified time frame, either waiving the financing contingency or choosing to cancel the contract. If neither action is taken, the seller may cancel the contract, and the buyer's deposit will be returned if the financing contingency is not waived.

What is the due diligence period?

The due diligence period is a specified timeframe during which the buyer can conduct inspections and assessments of the property. This allows the buyer to evaluate whether the property meets their needs and intended use. The buyer must provide written notice to the seller regarding their acceptance or rejection of the property before the due diligence period expires. Failure to do so will result in the buyer accepting the property in its current "as is" condition.

How are title issues handled in the contract?

The contract outlines the seller's obligation to provide marketable title to the property, free of liens and encumbrances, except for those disclosed. The buyer is granted a specific period to review the title evidence and report any defects. If defects are found, the seller is given a chance to cure them within a designated timeframe. If the seller cannot cure the defects, the buyer has the option to either terminate the contract or accept the title as is.

What are the consequences of defaulting on the contract?

In the event of a default, the contract specifies different outcomes based on which party is at fault. If the seller defaults, the buyer may receive a refund of their deposit or seek specific performance to enforce the contract. Conversely, if the buyer defaults, the seller may retain the buyer's deposit as liquidated damages or seek specific performance. These provisions help clarify the repercussions of failing to fulfill the contract's terms.

Dos and Don'ts

When filling out the Florida Commercial Contract form, it's crucial to pay attention to several important dos and don’ts. Here’s a concise list to guide you through the process:

- Do ensure all parties are clearly identified, including full names and addresses.

- Do provide a complete legal description of the property to avoid any ambiguity.

- Do specify the purchase price and all related deposits accurately.

- Do adhere to the timeframes outlined for acceptance and counteroffers to avoid complications.

- Do maintain clear communication with all parties involved, especially regarding financing and inspections.

- Don't leave any sections blank unless specifically indicated; incomplete forms can lead to misunderstandings.

- Don't overlook the importance of the due diligence period; use this time to assess the property thoroughly.

- Don't ignore the need for proper documentation, such as title insurance and any required disclosures.

- Don't assume verbal agreements are sufficient; all modifications must be documented in writing.

By following these guidelines, you can help ensure a smoother transaction and mitigate potential disputes. Always prioritize clarity and communication throughout the process.

Florida Commercial Contract - Usage Steps

Completing the Florida Commercial Contract form is an important step in the process of buying or selling commercial property. The following steps will guide you through filling out the form accurately and completely. Make sure to have all necessary information on hand before you begin.

- Identify the Parties and Property: Fill in the names of the Buyer and Seller, along with the property’s street address and legal description.

- Specify the Purchase Price: Enter the total purchase price and any deposits held in escrow, along with the Escrow Agent's details.

- Set the Time for Acceptance: Indicate the deadline for the Seller and Buyer to sign and return the contract.

- Determine the Closing Date and Location: Fill in the closing date and the county in Florida where the closing will occur.

- Complete the Third Party Financing section: Specify the financing terms, including the percentage of the purchase price and interest rates.

- Outline the Title details: Indicate how the Seller will convey title and any conditions related to the title.

- Describe the Property Condition: Choose whether the Buyer accepts the property “as is” or if a due diligence period will be used.

- Clarify the Operation of Property During Contract Period: State how the Seller will operate the property until closing.

- Detail the Closing Procedure: Specify the possession details and who will cover the associated costs.

- Fill in the Escrow Agent information: Provide details about the escrow agent who will manage the deposits.

- Include any necessary Notices: Make sure to specify how notices will be communicated between parties.

- Finalize the Signatures: Ensure that both Buyer and Seller sign and date the contract at the end of the form.

Once you have completed the form, review it carefully to ensure all information is accurate. After that, the next step is to share the signed contract with all parties involved, including the Escrow Agent, to move forward with the transaction.