Fillable Deed in Lieu of Foreclosure Template for Florida State

In Florida, the Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows property owners to voluntarily transfer ownership of their home back to the lender in exchange for the cancellation of their mortgage debt. By choosing this option, homeowners can avoid the lengthy and often stressful foreclosure process, which can have lasting impacts on their credit and financial stability. The form outlines essential details, including the identification of the parties involved, a description of the property, and the specific terms of the transfer. It is designed to protect both the homeowner and the lender, ensuring that the transaction is clear and binding. Understanding the implications of this form is vital for anyone considering it as a solution to their financial challenges. The Deed in Lieu of Foreclosure can provide a fresh start, but it is important to approach this decision with careful consideration and awareness of the consequences.

Similar forms

The first document similar to the Florida Deed in Lieu of Foreclosure is the mortgage release. A mortgage release is a legal document that signifies the discharge of a mortgage obligation. When a borrower pays off their mortgage, the lender issues a mortgage release, which clears the title to the property. Both documents serve to transfer ownership and eliminate the borrower's debt, but a mortgage release occurs after the debt is fully paid, while a deed in lieu is a proactive measure taken when a borrower cannot meet their mortgage obligations.

Another comparable document is the short sale agreement. In a short sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Similar to a deed in lieu, a short sale allows the borrower to avoid foreclosure and mitigate the financial impact of default. However, in a short sale, the property is sold to a third party, whereas a deed in lieu transfers ownership directly to the lender without involving other buyers.

The foreclosure process itself is a related document, albeit a more adversarial one. Foreclosure is the legal process by which a lender takes possession of a property when the borrower defaults on their mortgage. While both the deed in lieu and foreclosure result in the lender acquiring the property, the deed in lieu is a voluntary agreement that allows the borrower to relinquish the property without the lengthy and often distressing foreclosure process.

A Hold Harmless Agreement form is essential for individuals engaging in real estate transactions to safeguard against potential liabilities. By clearly delineating responsibilities, parties can proceed with more confidence. This type of agreement is particularly useful when navigating complex situations in property dealings or service provisions. For those looking for templates to construct such agreements, resources like smarttemplates.net can be invaluable in ensuring compliance and clarity.

A quitclaim deed is another document that bears similarities to a deed in lieu of foreclosure. A quitclaim deed transfers any interest the grantor has in a property to the grantee without any warranties. While a deed in lieu conveys ownership to the lender, a quitclaim deed can be used in various situations, such as transferring property between family members. Both documents are straightforward and can expedite the transfer of property, but a deed in lieu specifically addresses mortgage default.

The assignment of mortgage is also relevant. This document allows a lender to transfer their rights under a mortgage to another party. Similar to a deed in lieu, an assignment of mortgage can change the ownership of the debt obligation. However, unlike a deed in lieu, which resolves the borrower's debt through property transfer, an assignment of mortgage merely shifts the lender's rights without necessarily affecting the borrower's obligations.

Lastly, the loan modification agreement shares some characteristics with a deed in lieu. A loan modification alters the terms of an existing mortgage to make it more manageable for the borrower, often preventing foreclosure. Both documents aim to resolve a borrower's financial distress, but a loan modification keeps the borrower in possession of the property while a deed in lieu results in the borrower relinquishing ownership entirely.

Other Common State-specific Deed in Lieu of Foreclosure Templates

Foreclosure Georgia - The deed in lieu of foreclosure is an alternative to short sales and can be less complicated.

If you're looking to streamline your tenant selection process, the Georgia Rental Application provides a key tool for managing potential applicants effectively. Access the form and get started with your tenant vetting by completing the necessary steps through the rental application available here.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It serves as a viable alternative to traditional foreclosure routes and their associated delays.

More About Florida Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is an agreement between a homeowner and their lender, allowing the homeowner to transfer ownership of their property to the lender to avoid foreclosure. This option can be beneficial for homeowners facing financial difficulties, as it can help them escape the lengthy and stressful foreclosure process. By voluntarily giving up their property, homeowners may also be able to protect their credit score and potentially negotiate more favorable terms with their lender regarding any remaining debt.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to consider. First, it can save time and stress. Foreclosure proceedings can take months, while a deed in lieu can often be completed more quickly. Second, it may have a less severe impact on your credit score compared to a foreclosure. Additionally, homeowners may be able to negotiate a cash incentive or relocation assistance from the lender. This can provide some financial relief as they transition to new housing. Lastly, it allows homeowners to avoid the public stigma associated with foreclosure, maintaining a sense of dignity during a challenging time.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential downsides to consider. One major concern is that not all lenders accept a deed in lieu of foreclosure. Homeowners should check with their lender to see if this option is available. Furthermore, if there is a difference between the amount owed on the mortgage and the property's current market value, the lender may still pursue the homeowner for the remaining balance. This is known as a deficiency judgment. Lastly, the homeowner may lose any equity they had built up in the property, which can be a significant financial loss.

How do I initiate a Deed in Lieu of Foreclosure?

The process typically starts with contacting your lender to express your interest in a deed in lieu. It’s essential to gather all relevant financial documents, such as your mortgage statement, proof of income, and any other information the lender may require. After discussing your situation with the lender, they will likely conduct a review to determine if you qualify. If approved, the lender will provide the necessary paperwork to complete the transfer. It’s advisable to consult with a real estate attorney or a housing counselor to ensure you understand the implications and to help you navigate the process smoothly.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid during this process.

- Do: Review the form thoroughly before filling it out.

- Do: Provide accurate and complete information regarding the property.

- Do: Include all necessary signatures from all parties involved.

- Do: Consult with a legal professional if you have questions.

- Do: Keep copies of the completed form for your records.

- Don't: Leave any fields blank unless specified.

- Don't: Use outdated versions of the form.

- Don't: Forget to notarize the document as required.

- Don't: Rush through the process; take your time to ensure accuracy.

- Don't: Submit the form without verifying all details are correct.

Florida Deed in Lieu of Foreclosure - Usage Steps

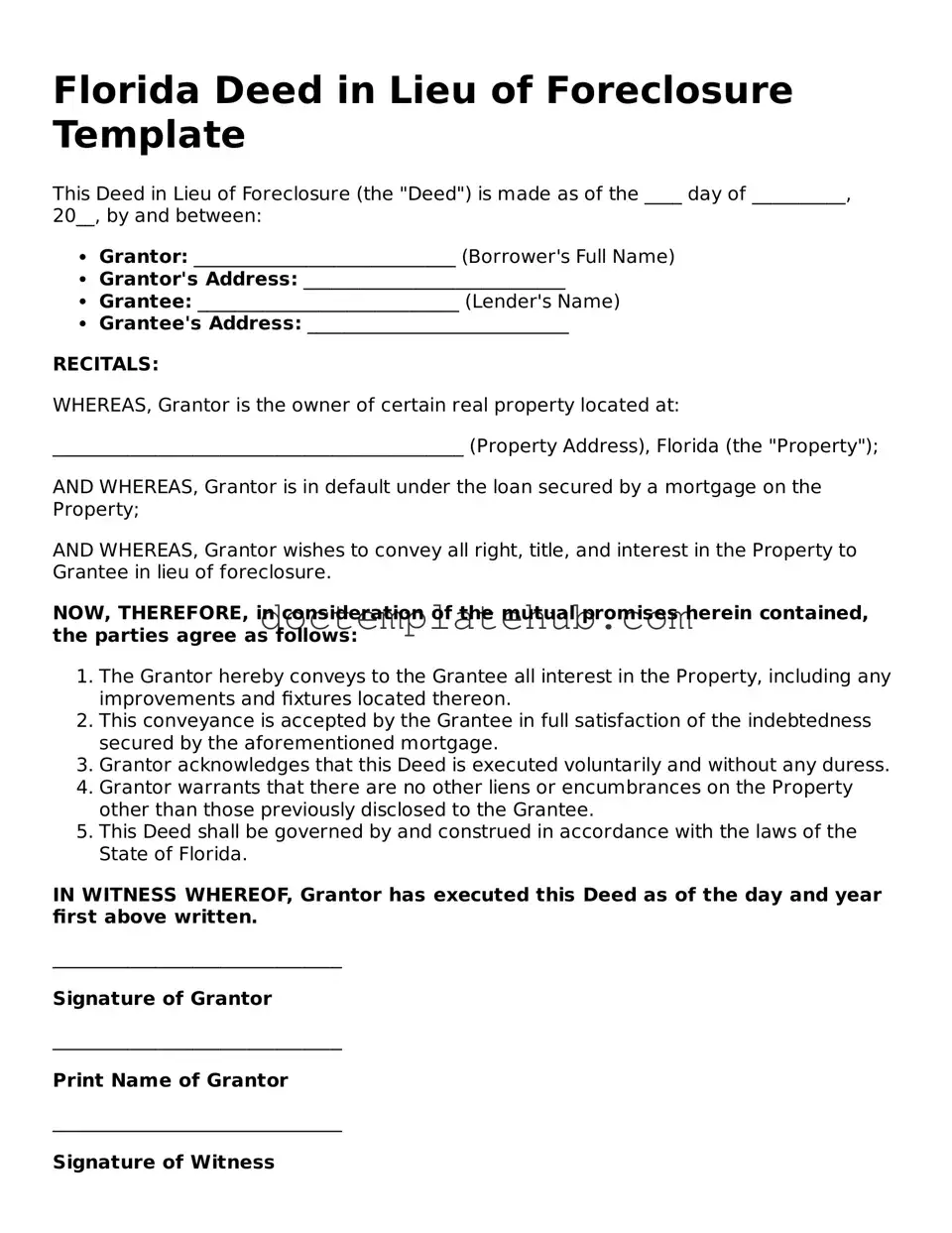

Once you have decided to proceed with a Deed in Lieu of Foreclosure, it’s important to fill out the form accurately. This form will allow you to transfer ownership of your property back to the lender, which can help you avoid the lengthy foreclosure process. Follow these steps to complete the form properly.

- Obtain the Form: Start by downloading the Florida Deed in Lieu of Foreclosure form from a reliable legal forms website or your lender's website.

- Property Information: Fill in the property address, including the city, county, and zip code. Ensure this information matches what is on your mortgage documents.

- Grantor Information: Enter your full name as the current owner of the property. If there are multiple owners, include all names as they appear on the title.

- Grantee Information: Indicate the name of the lender or financial institution receiving the property. This is typically the same entity that holds your mortgage.

- Consideration Clause: Write "For no consideration" or "For the sum of $1" to indicate that you are not receiving any payment in exchange for the deed.

- Sign the Document: Sign the form in the designated area. Make sure to date your signature. If there are multiple owners, all must sign.

- Notarization: Take the completed form to a notary public. They will witness your signature and provide their seal, which is required for the document to be valid.

- Submit the Form: Send the notarized deed to your lender. Keep a copy for your records. Confirm with your lender that they have received it and inquire about any further steps.

After submitting the form, your lender will review it and process the deed transfer. This may take some time, so be patient. You should receive confirmation once the transfer is complete, and it’s advisable to check with your lender for any additional documentation or follow-up actions needed on your part.