Fillable Deed Template for Florida State

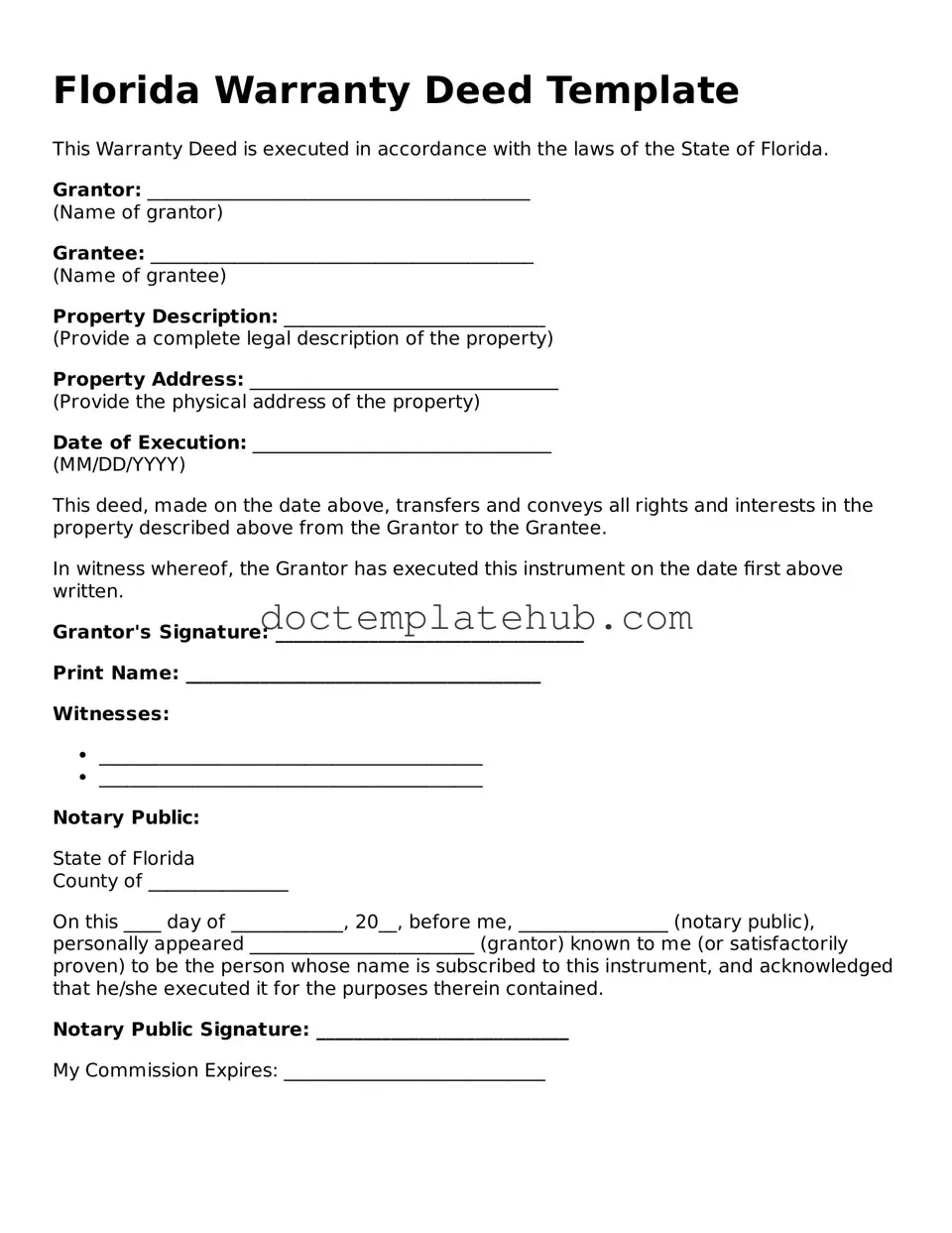

In Florida, the deed form serves as a crucial document in real estate transactions, facilitating the transfer of property ownership from one party to another. It outlines essential details, such as the names of the grantor (the seller) and grantee (the buyer), the legal description of the property, and any specific terms or conditions associated with the transfer. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes and offering varying levels of protection for the parties involved. Additionally, the deed must be signed, notarized, and recorded with the county clerk to ensure its validity and to provide public notice of the ownership change. Understanding the components and requirements of the Florida deed form is vital for anyone looking to buy or sell property in the state, as it not only safeguards the interests of both parties but also ensures compliance with local laws and regulations.

Similar forms

The Warranty Deed is a document that provides a guarantee from the seller (grantor) to the buyer (grantee) that the property title is clear of any claims. It ensures that the seller has the legal right to transfer ownership and that the property is free from liens or encumbrances. Like the Florida Deed form, it is used in property transactions and requires signatures from both parties to be valid. This type of deed offers the highest level of protection to the buyer, which is similar to the assurances provided in a Florida Deed.

The USCIS I-589 form is a critical document for individuals seeking asylum or protection from persecution in their home countries. It serves as the primary application for individuals who wish to apply for asylum in the United States, offering a path to safety and security for those fleeing danger. Completing this form is the first step towards potentially obtaining asylum and starting a new chapter in life within the safety of the U.S. For more information, you can visit smarttemplates.net/.

A Quitclaim Deed is another document that transfers ownership of property but does not guarantee that the title is clear. It simply transfers whatever interest the grantor has in the property to the grantee. While the Florida Deed form may offer warranties about the title, the Quitclaim Deed does not provide such assurances. However, both documents are used to facilitate the transfer of property ownership and require the parties' signatures to be legally binding.

The Special Warranty Deed is similar to the Warranty Deed but with a key difference: it only guarantees that the grantor has not caused any title issues during their ownership. This means that while the seller provides some assurances, they are limited to the time they owned the property. Like the Florida Deed form, it is often used in real estate transactions and requires the proper execution to be valid.

An Executor’s Deed is used when a property is transferred as part of a deceased person's estate. This document allows the executor of the estate to convey the property to heirs or beneficiaries. Similar to the Florida Deed form, it serves as a legal instrument for transferring ownership, although it is specific to estate matters and may not provide the same level of title assurance as a Warranty Deed.

A Bargain and Sale Deed is a document that implies the seller has the right to sell the property but does not guarantee that the title is free of claims. This type of deed is often used in transactions involving foreclosures or tax sales. Like the Florida Deed form, it facilitates the transfer of property ownership but offers less protection regarding the title's condition.

The Grant Deed is similar to a Warranty Deed in that it guarantees the seller has not sold the property to anyone else and that the title is free from encumbrances made during their ownership. However, it does not provide as extensive a guarantee as a Warranty Deed. Both documents serve the purpose of transferring property ownership and require proper execution to be legally effective.

A Deed of Trust is a document used in real estate transactions that involves three parties: the borrower, the lender, and a trustee. This document secures a loan with the property as collateral. While it serves a different function than the Florida Deed form, both documents are essential in property transactions. They both require signatures and serve as legal instruments to establish ownership or interest in real estate.

Other Common State-specific Deed Templates

Ohio Deed - A deed form is a legal document that conveys property ownership from one party to another.

What Does Property Deed Look Like - The signing of the deed should take place in a formal setting to ensure its legitimacy.

In Florida, while not mandatory, it is highly recommended for LLCs to have an Operating Agreement, as it establishes clear guidelines for governance and financial management. This document can significantly mitigate potential disputes among members by detailing the responsibilities and rights of each member. To make the process easier, click here to get the document that will assist you in drafting a comprehensive agreement tailored to your business needs.

Quit Claim Deed Ga - In contrast, a quitclaim deed transfers only the interest the grantor has in the property, without warranties.

Legal House Deed Document - Can also provide tax benefits when transferring property.

More About Florida Deed

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and the terms of the transfer. It is essential for ensuring that the transfer is recognized legally and is recorded with the appropriate county office to provide public notice of the change in ownership.

What types of Deeds are available in Florida?

Florida offers several types of Deeds, each serving different purposes. The most common types include Warranty Deeds, which guarantee that the seller has clear title to the property; Quitclaim Deeds, which transfer any interest the seller may have without guaranteeing clear title; and Special Purpose Deeds, such as Personal Representative Deeds and Trustee Deeds. Each type has its specific use cases and implications for the buyer and seller.

How do I complete a Florida Deed form?

To complete a Florida Deed form, you will need to gather specific information, including the names and addresses of the grantor (seller) and grantee (buyer), a legal description of the property, and any applicable consideration (the purchase price or other value exchanged). It is crucial to ensure that all information is accurate and that the form is signed in the presence of a notary public. After completing the form, it should be filed with the county clerk’s office where the property is located.

Is notarization required for a Florida Deed?

Yes, notarization is required for a Florida Deed. The signatures of the parties involved must be notarized to ensure the authenticity of the document. This step helps prevent fraud and confirms that the individuals signing the Deed are doing so willingly and with an understanding of the transaction. Without notarization, the Deed may not be accepted for recording by the county clerk.

What happens after a Florida Deed is recorded?

Once a Florida Deed is recorded with the county clerk’s office, it becomes a matter of public record. This means that anyone can access the information regarding the property transfer. Recording the Deed protects the buyer’s ownership rights and provides notice to third parties about the change in ownership. It is advisable for the buyer to obtain a copy of the recorded Deed for their records, as it serves as proof of ownership.

Dos and Don'ts

When filling out a Florida Deed form, it's essential to approach the process with care. Here’s a list of things to consider, both what to do and what to avoid.

- Do ensure that all parties involved in the transaction are correctly identified.

- Do provide a clear and accurate description of the property being transferred.

- Do include the date of the transaction.

- Do have the deed signed in the presence of a notary public.

- Do check for any specific requirements based on the type of deed you are using.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Don't use legal jargon or complicated language; clarity is key.

- Don't forget to include any necessary additional documentation, such as prior deeds.

- Don't overlook the importance of accuracy; even small errors can complicate matters.

- Don't neglect to file the deed with the appropriate county office after completion.

By following these guidelines, you can help ensure that the process of filling out the Florida Deed form is smooth and effective.

Florida Deed - Usage Steps

Filling out a Florida Deed form is an important step in transferring property ownership. Once completed, the form will need to be signed, notarized, and filed with the appropriate county office to ensure the transfer is legally recognized. Here’s how to fill out the form correctly.

- Start with the **Grantor** section. Enter the name(s) of the current owner(s) who is transferring the property.

- Next, fill in the **Grantee** section. This is where you’ll write the name(s) of the person(s) receiving the property.

- Provide the **property description**. This should include the legal description of the property, which can typically be found on the current deed or through a property appraisal.

- Indicate the **consideration** amount. This is the price or value being exchanged for the property. If it’s a gift, you can write "love and affection" or a similar phrase.

- Complete the **date** section. Write the date when the deed is being executed.

- Sign the deed. The grantor(s) must sign the form in the presence of a notary public.

- Have the deed notarized. The notary will verify the identities of the signers and affix their seal.

- Finally, file the completed deed with the county clerk’s office in the county where the property is located. Be sure to keep a copy for your records.