Fillable Durable Power of Attorney Template for Florida State

In Florida, a Durable Power of Attorney (DPOA) is an essential legal document that allows individuals to appoint someone they trust to make financial and legal decisions on their behalf. This form remains effective even if the person who created it becomes incapacitated, ensuring that their affairs can continue to be managed without interruption. The DPOA can cover a wide range of powers, including handling bank transactions, managing real estate, and making healthcare decisions, depending on how it is drafted. Importantly, the person designated as the agent must act in the best interests of the principal, the individual who created the document. This form can be tailored to fit specific needs, allowing for broad or limited powers, and it must be signed in the presence of a notary public to be valid. Understanding the nuances of the Florida Durable Power of Attorney form is crucial for anyone looking to ensure their financial and legal matters are handled according to their wishes, especially during times of uncertainty.

Similar forms

The Florida Durable Power of Attorney form shares similarities with a Health Care Proxy. Both documents allow individuals to appoint someone to make decisions on their behalf. In the case of a Health Care Proxy, the appointed person makes medical decisions when the individual is unable to do so. Like the Durable Power of Attorney, the Health Care Proxy is designed to ensure that a person's wishes are respected, even when they cannot communicate those wishes directly. This alignment in purpose underscores the importance of having trusted individuals in place to act in one’s best interest in various aspects of life.

Another document akin to the Florida Durable Power of Attorney is the Living Will. While the Durable Power of Attorney focuses on financial and legal decisions, a Living Will specifically addresses medical treatment preferences. It outlines the types of medical interventions a person wishes to receive or decline in the event of a terminal illness or incapacitation. Both documents emphasize the need for clear communication of one’s desires, providing guidance to family members and healthcare providers during critical times.

The Florida Durable Power of Attorney also resembles a Revocable Living Trust. Both instruments allow individuals to manage their assets and designate someone to act on their behalf. A Revocable Living Trust can provide more comprehensive estate planning benefits, as it allows for the management of assets during a person's lifetime and the distribution of those assets after death. Like the Durable Power of Attorney, it is flexible and can be altered as circumstances change. Both documents aim to simplify the management of personal affairs and ensure that an individual’s wishes are honored.

Lastly, the Florida Durable Power of Attorney is similar to a Guardianship document. While a Durable Power of Attorney is created by an individual to designate someone to make decisions on their behalf, a Guardianship is established through a court process when an individual is deemed incapable of making their own decisions. Both serve to protect individuals who may be unable to manage their affairs, but they differ in how they are created and the level of oversight involved. Guardianship often involves more formal procedures and can be more restrictive, whereas a Durable Power of Attorney allows for greater personal autonomy and choice.

Other Common State-specific Durable Power of Attorney Templates

Durable Financial Power of Attorney California - Providing your agent with necessary information and access can improve the effectiveness of their duties.

How to Get Power of Attorney in Ohio for Elderly Parent - The agent is empowered only by the scope defined in the Durable Power of Attorney.

Power of Attorney Georgia Pdf - The form is a critical part of an overall estate plan and helps in avoiding potential complications later.

Durable Power of Attorney Paperwork - This arrangement can vary widely depending on your wishes and the needs of your situation.

More About Florida Durable Power of Attorney

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can still be managed without interruption.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney is important for anyone who wants to ensure their financial and legal affairs are handled according to their wishes if they become unable to make decisions. It provides peace of mind, knowing that a trusted person will manage your affairs in your best interest.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, which may include managing bank accounts, paying bills, handling real estate transactions, and making investment decisions. It is essential to specify the powers you wish to grant clearly to avoid any confusion later on.

Do I need to have a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a Durable Power of Attorney in Florida, consulting one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your intentions, reducing the likelihood of disputes in the future.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you must create a written revocation document and notify your agent and any relevant financial institutions or parties involved. This helps prevent any unauthorized actions by your previous agent.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian to manage your affairs. This process can be lengthy, costly, and may not align with your wishes. Having a Durable Power of Attorney in place can help avoid these complications.

Is a Durable Power of Attorney valid in other states?

A Florida Durable Power of Attorney is generally valid in other states, but it is crucial to check the specific laws of the state where it will be used. Some states may have different requirements or may require additional documentation. It's advisable to consult with a local attorney if you plan to use your Florida document outside the state.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it's important to follow specific guidelines to ensure the document is valid and meets your needs. Here are nine essential do's and don'ts to keep in mind:

- Do clearly identify the principal and the agent. Include full names and addresses to avoid confusion.

- Don't leave any sections blank. Incomplete forms may lead to legal challenges or rejection.

- Do specify the powers granted to the agent. Be clear about what decisions they can make on your behalf.

- Don't use vague language. Specificity helps prevent misunderstandings and misuse of authority.

- Do sign the document in the presence of a notary public. This adds an extra layer of validation.

- Don't forget to date the document. An undated form may be questioned regarding its validity.

- Do keep copies of the signed form in a safe place. Ensure that your agent has access to a copy as well.

- Don't assume that all agents have the same authority. Clarify if the agent has limited or broad powers.

- Do review the form periodically. Changes in your circumstances may require updates to the document.

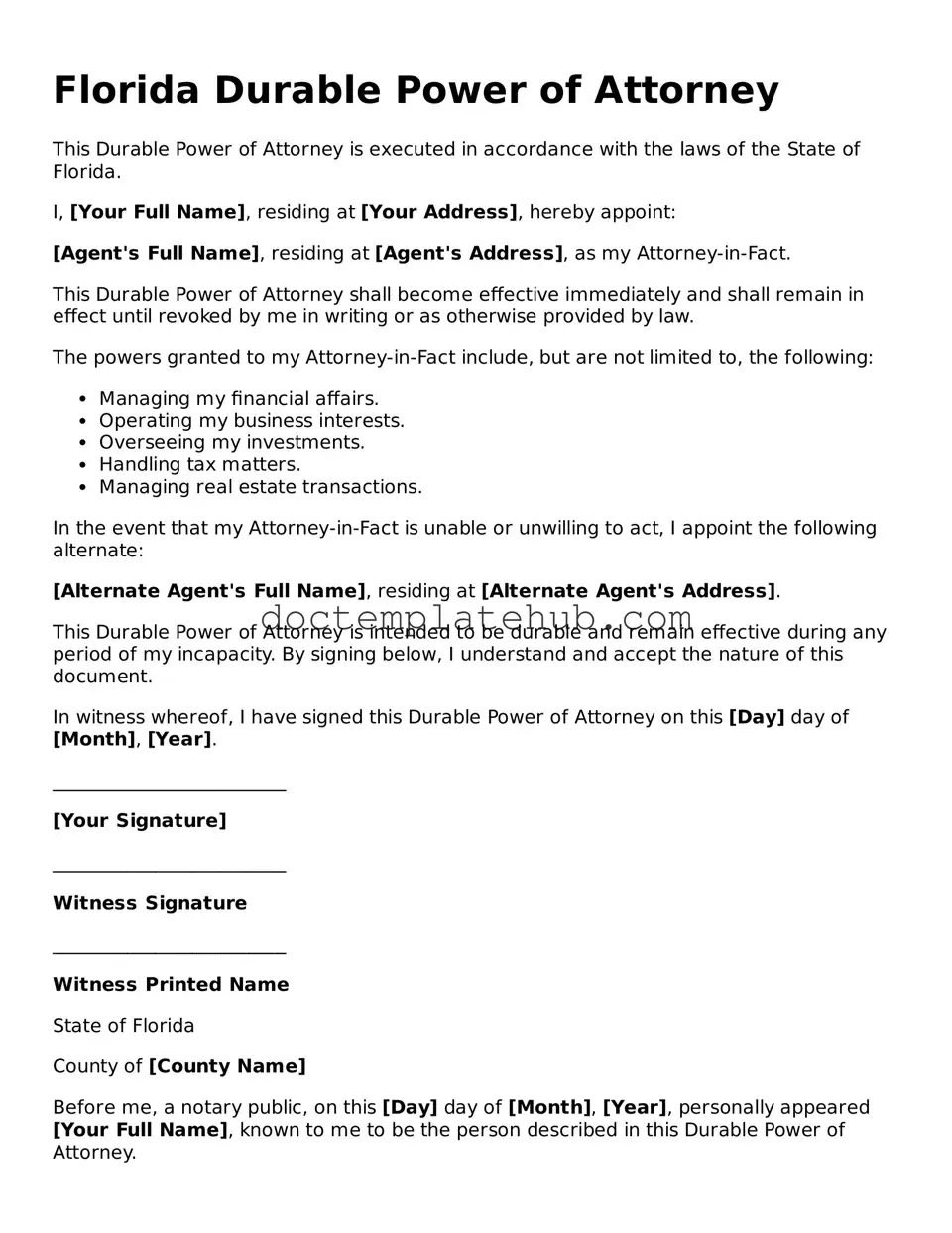

Florida Durable Power of Attorney - Usage Steps

Filling out the Florida Durable Power of Attorney form is an important step in designating someone to handle your financial and legal matters. Once you have completed the form, you will need to sign it in front of a notary public and ensure that your chosen agent is aware of their responsibilities.

- Obtain the Florida Durable Power of Attorney form. You can find it online or at legal supply stores.

- Read through the entire form carefully to understand the sections you need to fill out.

- In the first section, provide your full name and address as the principal (the person granting authority).

- Next, enter the name and address of the agent (the person you are designating to act on your behalf).

- If you want to designate an alternate agent, fill in their name and address in the appropriate section.

- Specify the powers you wish to grant to your agent. This may include managing finances, handling real estate transactions, or making healthcare decisions.

- Sign and date the form in the designated area. This must be done in front of a notary public.

- Ensure that the notary public completes their section, including their signature and seal.

- Make copies of the completed form for your records and provide a copy to your agent.