Fillable Lady Bird Deed Template for Florida State

The Florida Lady Bird Deed is an important estate planning tool that allows property owners to transfer real estate to their beneficiaries while retaining control during their lifetime. This unique form provides significant benefits, including the ability to avoid probate, protect assets from creditors, and maintain eligibility for government benefits. By using a Lady Bird Deed, property owners can specify how the property will be handled after their passing, ensuring that their wishes are honored. This deed also allows for the retention of the right to sell, use, or modify the property without the need for consent from the beneficiaries. It is particularly advantageous for those looking to simplify the transfer of property and minimize potential disputes among heirs. Understanding the nuances of the Lady Bird Deed is essential for anyone considering this option as part of their estate planning strategy.

Similar forms

The Florida Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights during their lifetime, such as the right to live in and use the property. However, a traditional life estate deed typically requires the property to pass to a specific person upon the owner’s death, while the Lady Bird Deed allows the owner to change the beneficiary at any time. This flexibility can be crucial for individuals who may want to adjust their estate plans as circumstances change.

For those looking to understand property transfers, the Quitclaim Deed process explained can be vital. A Quitclaim Deed serves a specific purpose in the realm of real estate transactions, particularly when ownership interests are being relinquished without any guarantees regarding the title's integrity. This type of deed is frequently used among family members or acquaintances when formal assurances may not be necessary, though complete understanding of the implications is still essential for all parties involved.

Another document that shares similarities with the Lady Bird Deed is the revocable living trust. Like the Lady Bird Deed, a revocable living trust allows property to be transferred to beneficiaries without going through probate, which can save time and costs. However, a trust requires more formalities to set up and maintain. With a Lady Bird Deed, the property owner remains in control and can revoke or change the deed without needing to go through the complexities often associated with a trust.

A transfer-on-death (TOD) deed is also comparable to the Lady Bird Deed. Both documents allow property owners to designate a beneficiary who will receive the property automatically upon their death. The key difference lies in the rights retained during the owner’s lifetime. The Lady Bird Deed permits the owner to retain the right to sell, lease, or mortgage the property, while a TOD deed does not grant such rights, making the Lady Bird Deed a more flexible option for many property owners.

The warranty deed is another document that bears some resemblance to the Lady Bird Deed. A warranty deed transfers ownership of property from one party to another and guarantees that the title is clear of any claims. While a warranty deed does not allow for retained rights during the owner's lifetime, it ensures that the new owner has full ownership and rights to the property. The Lady Bird Deed, on the other hand, allows the original owner to maintain control over the property while still designating a beneficiary.

Lastly, a quitclaim deed can be seen as similar to the Lady Bird Deed in that it transfers interest in a property without warranties. Both deeds are straightforward in their execution and can be used to transfer property quickly. However, a quitclaim deed does not provide the same lifetime rights as a Lady Bird Deed, which allows the original owner to live in the property and make changes to the beneficiary designation. This distinction can be crucial for individuals looking to retain control over their property while planning for the future.

Other Common State-specific Lady Bird Deed Templates

Lady Bird Deed Form Texas - This deed allows for a smooth transfer of property to heirs without the need for court involvement.

When considering the transfer of property through a Texas Quitclaim Deed form, it is crucial to understand its implications, especially since it does not guarantee a clear title. This document can be a convenient option for those within families or for transfers that do not involve full market transactions. For more detailed information and resources regarding this legal form, you can visit smarttemplates.net.

More About Florida Lady Bird Deed

What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an enhanced life estate deed, is a unique type of property deed used in Florida. It allows a property owner to transfer their property to beneficiaries while retaining the right to live on and control the property during their lifetime. This means the owner can sell, mortgage, or change the beneficiaries without needing their consent. Upon the owner's death, the property automatically transfers to the named beneficiaries, avoiding probate, which can simplify the process for heirs.

What are the benefits of using a Lady Bird Deed?

One of the primary benefits of a Lady Bird Deed is that it helps avoid probate, a legal process that can be time-consuming and costly. By using this deed, the property transfers directly to the beneficiaries upon the owner's death, which can save time and money. Additionally, the property owner retains full control and can make changes to the deed at any time. This flexibility allows for adjustments based on changing circumstances or relationships. Furthermore, since the property does not go through probate, it remains private, keeping the details of the estate out of the public record.

Who should consider using a Lady Bird Deed?

Individuals who wish to ensure a smooth transfer of their property to their heirs while retaining control during their lifetime may find a Lady Bird Deed beneficial. It is particularly useful for seniors looking to protect their home from Medicaid claims or for those who want to avoid the complications of probate. However, it’s essential for anyone considering this option to consult with a legal professional to understand the implications fully and ensure it aligns with their estate planning goals.

Are there any drawbacks to using a Lady Bird Deed?

While there are many advantages to a Lady Bird Deed, there are also potential drawbacks. One concern is that if the property owner needs to qualify for Medicaid, the property may still be considered an asset, which could affect eligibility. Additionally, if the owner decides to sell the property or takes out a mortgage, it may complicate the situation for the beneficiaries. Lastly, if the property owner has significant debts, creditors may still be able to make claims against the property after death, which could impact the beneficiaries. It is crucial to weigh these factors and seek professional advice before proceeding.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do provide accurate property information, including the legal description.

- Do include the names of all grantors and grantees clearly.

- Do check for any existing liens or encumbrances on the property.

- Do ensure that the form is signed in front of a notary public.

- Do record the deed with the county clerk's office promptly.

- Don't leave any fields blank; fill out all required sections.

- Don't use outdated forms; always use the most current version.

- Don't forget to review the form for errors before submission.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

Florida Lady Bird Deed - Usage Steps

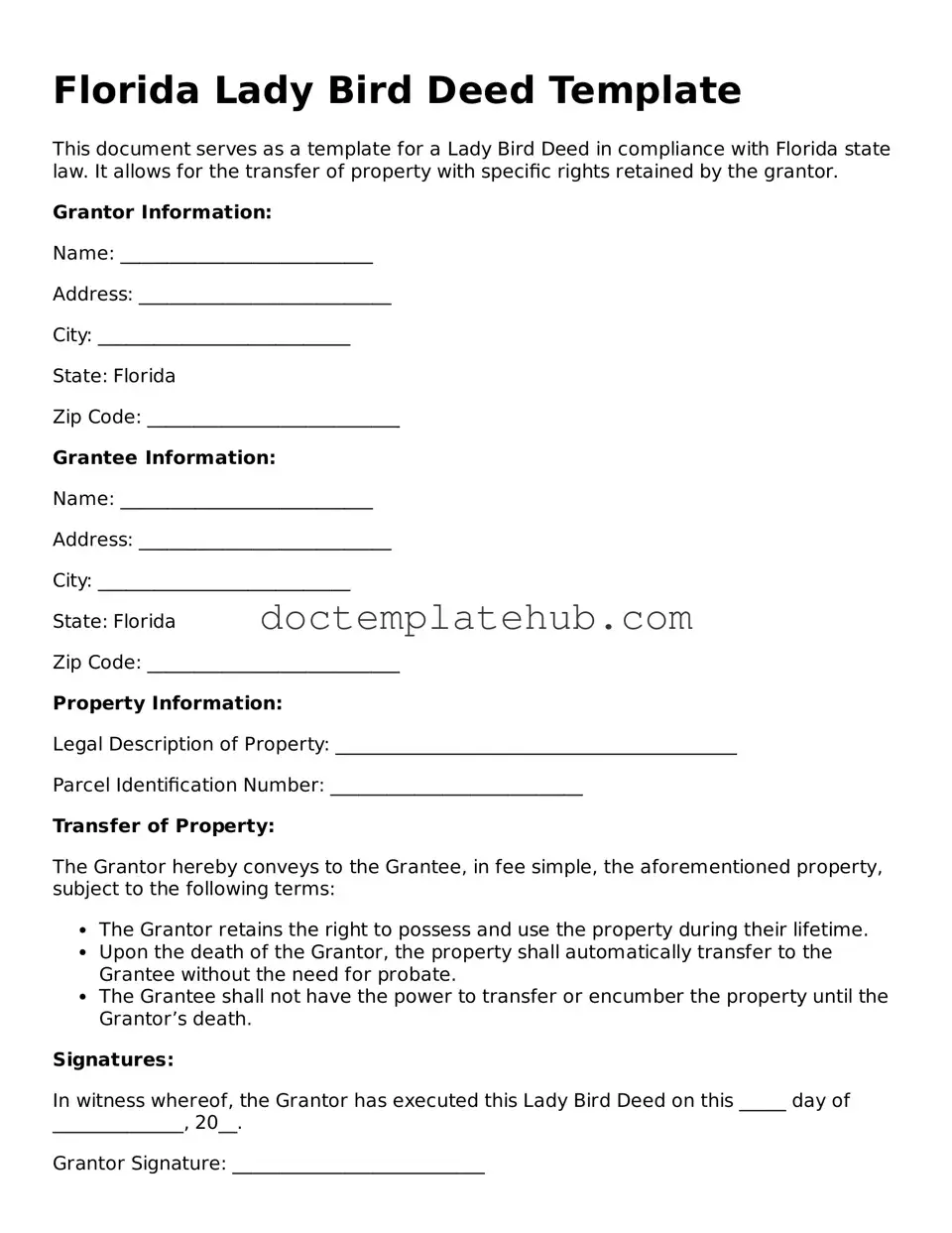

Filling out the Florida Lady Bird Deed form requires attention to detail and accuracy. After completing the form, it will need to be signed and notarized before being submitted to the appropriate county office for recording.

- Obtain the Florida Lady Bird Deed form from a reliable source, such as a legal website or local government office.

- Fill in the names of the grantor(s), who are the current property owners. Ensure that the names are spelled correctly and match the titles on the property deed.

- Provide the names of the grantee(s), who will receive the property. Again, check for accuracy in spelling and title.

- Clearly describe the property being transferred. Include the address and legal description, which can typically be found on the current deed.

- Indicate any conditions or limitations, if applicable. This section may include details about retaining the right to live in the property for the grantor's lifetime.

- Sign the form in the presence of a notary public. The notary will verify the identity of the signers and witness the signing.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county clerk's office where the property is located for recording.