Fillable Last Will and Testament Template for Florida State

In the vibrant state of Florida, individuals often seek to ensure their wishes are honored after their passing, and a Last Will and Testament serves as a crucial tool in this process. This legal document outlines how a person’s assets will be distributed, who will serve as the executor of their estate, and may even include guardianship provisions for minor children. The form is designed to reflect personal intentions clearly, allowing for the appointment of trusted individuals to manage affairs and distribute property according to the deceased's desires. Additionally, Florida law stipulates certain requirements for a valid will, such as the necessity for witnesses and the testator's signature, which must be adhered to in order to avoid complications. Understanding these elements is vital, as it empowers individuals to make informed decisions regarding their estate planning. By taking the time to create a comprehensive Last Will and Testament, residents can navigate the complexities of inheritance and ensure their legacy is preserved according to their wishes.

Similar forms

The Florida Last Will and Testament is similar to a Revocable Living Trust. Both documents allow individuals to dictate how their assets will be distributed after death. A Revocable Living Trust can provide more flexibility, as it allows the creator to modify the trust during their lifetime. Unlike a will, a trust can help avoid probate, making the transfer of assets quicker and often less costly for beneficiaries.

Another document akin to the Last Will and Testament is the Durable Power of Attorney. This document grants authority to someone to make financial decisions on behalf of an individual if they become incapacitated. While a will takes effect after death, a Durable Power of Attorney is effective during the individual's lifetime, ensuring that financial matters can be managed without court intervention.

A Healthcare Proxy is also similar in that it allows individuals to appoint someone to make medical decisions on their behalf if they are unable to do so. Like a will, this document reflects personal wishes regarding health care but focuses specifically on medical decisions rather than asset distribution.

The Living Will is another important document related to end-of-life decisions. It outlines an individual’s preferences regarding medical treatment in situations where they cannot communicate their wishes. While a Last Will and Testament deals with property and asset distribution, a Living Will addresses health care choices, ensuring that one’s medical desires are honored.

The Codicil is a document that amends an existing Last Will and Testament. It allows for changes to be made without drafting an entirely new will. This can include updates to beneficiaries or changes in asset distribution. A Codicil must be executed with the same formalities as a will to be valid, ensuring that the individual's intentions are clear and legally binding.

The Letter of Intent serves as a supplementary document that can accompany a Last Will and Testament. While it is not legally binding, it provides guidance to executors and beneficiaries about the individual's wishes, including funeral arrangements or specific bequests. This document can clarify intentions that may not be explicitly stated in the will.

A Trust Agreement, similar to a Last Will and Testament, also dictates how assets are to be managed and distributed. However, a Trust Agreement can take effect during the creator's lifetime and can help manage assets for minor children or beneficiaries who may not be financially responsible. This document can provide more control over how and when assets are distributed.

A Hold Harmless Agreement form is a legal document used in Utah to protect one party from liability for any injuries or damages incurred by another party during various activities. It essentially shifts the risk of legal claims from one party to another, ensuring that the party hosting or responsible for the activity is not held financially responsible for incidents that occur. This agreement is commonly used in construction, real estate transactions, and special events, which you can learn more about at smarttemplates.net.

The Joint Will is a single will executed by two people, typically spouses, that outlines how their shared assets will be handled upon the death of either party. This document is similar to a Last Will and Testament but is specifically designed for couples who want to ensure that their wishes are aligned and clearly articulated in one document.

The Pour-Over Will is often used in conjunction with a Revocable Living Trust. It ensures that any assets not placed in the trust during the individual's lifetime are transferred to the trust upon death. This document acts as a safety net, ensuring that all assets are managed according to the trust's terms, similar to how a Last Will and Testament directs asset distribution.

Finally, the Guardianship Designation is a document that appoints a guardian for minor children in the event of the parents' death. While a Last Will and Testament can include provisions for guardianship, this designation focuses specifically on the care and custody of children, ensuring that their best interests are prioritized and legally protected.

Other Common State-specific Last Will and Testament Templates

Online Will Ohio - Plays a key role in ensuring one’s intentions are legally recognized and followed.

To understand the requirements for a legal transfer, it is important to have a clear overview of the Mobile Home Bill of Sale process. This essential document helps to outline responsibilities and expectations effectively. For more information, you can visit the critical guide on Mobile Home Bill of Sale.

Online Will Texas - Direct and clear instructions can help family members navigate grief with fewer issues to address.

Online Will Georgia - Incorporates provisions for the distribution of personal items with sentimental value.

Lawyer to Write a Will - Can incorporate charitable donations as part of the estate distribution.

More About Florida Last Will and Testament

What is a Florida Last Will and Testament?

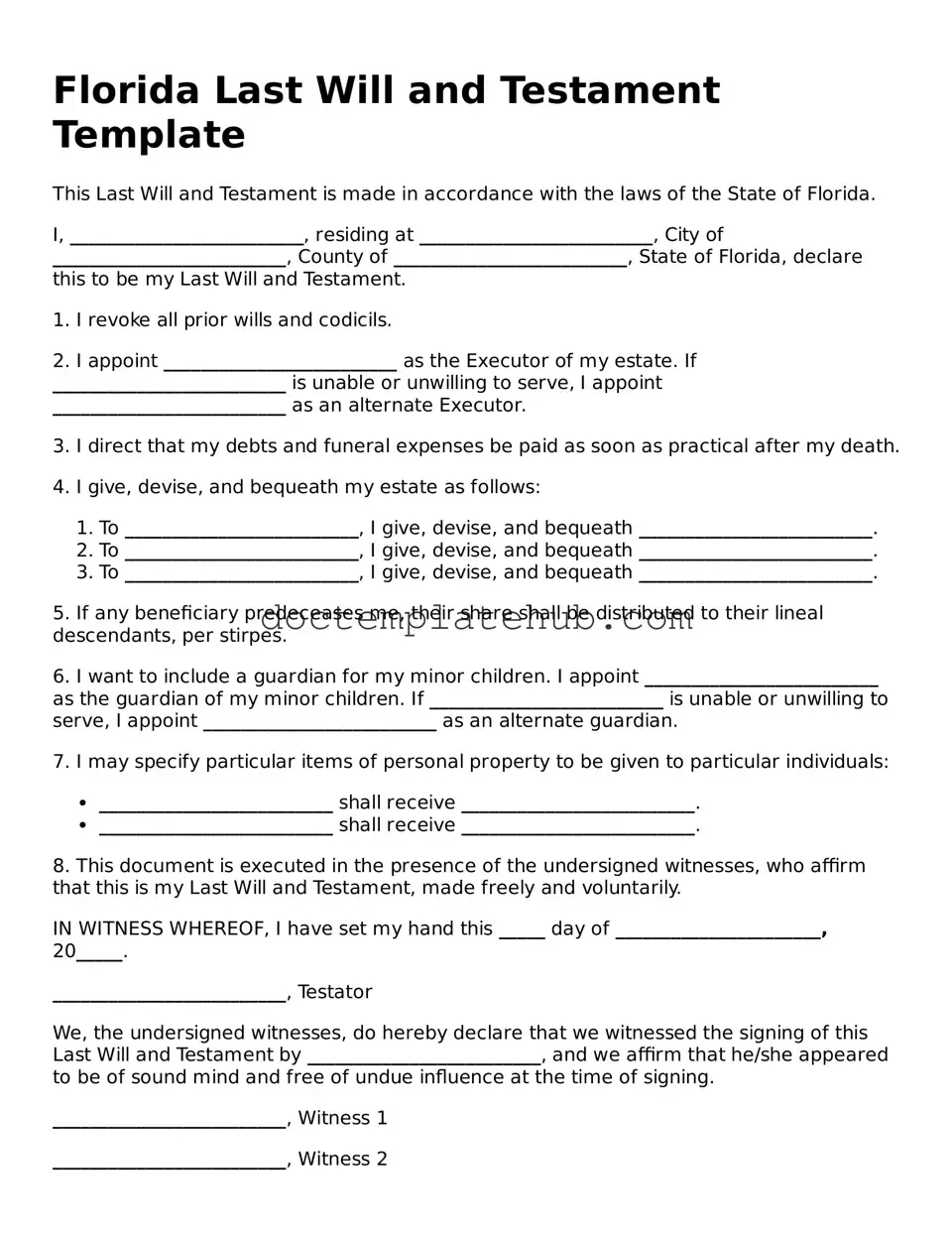

A Florida Last Will and Testament is a legal document that outlines how an individual's assets and property will be distributed after their death. It also allows you to appoint guardians for minor children and specify any funeral arrangements. This document ensures that your wishes are followed and can help avoid disputes among family members.

Who can create a Last Will and Testament in Florida?

In Florida, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means you should understand the nature of your assets and the implications of your decisions. If you meet these criteria, you can legally draft a will to express your final wishes.

What are the requirements for a valid will in Florida?

For a will to be considered valid in Florida, it must be in writing and signed by the testator (the person making the will). Additionally, the signing must be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. To make changes, you can either create a new will that revokes the previous one or add a codicil, which is an amendment to the existing will. It’s important to follow the same legal requirements for signing and witnessing when making these changes.

What happens if I die without a will in Florida?

If you die without a will, your estate will be distributed according to Florida's intestacy laws. This means that your assets will be divided among your relatives based on a predetermined formula, which may not align with your wishes. Having a will allows you to control how your property is distributed and who will manage your estate.

Can I use a template for my Florida Last Will and Testament?

Using a template for your Last Will and Testament is possible, but it’s essential to ensure that the template complies with Florida laws. Many templates are available online, but it’s advisable to review them carefully. If you have complex assets or specific wishes, consulting with a legal professional can help ensure your will is valid and reflects your intentions.

How can I ensure my will is properly executed?

To ensure your will is properly executed, follow these steps: sign the document in front of two witnesses, who should also sign the will. Keep the original will in a safe place, and inform your executor and loved ones about its location. Consider filing your will with the local probate court for added security. Regularly review and update your will as necessary to reflect any changes in your life circumstances.

What is the role of an executor in a Florida will?

The executor is the person you appoint to manage your estate after your death. This individual is responsible for carrying out your wishes as outlined in your will, including settling debts, distributing assets, and handling any necessary legal processes. Choosing a trustworthy and organized executor is crucial, as they will play a significant role in ensuring your estate is handled according to your instructions.

Dos and Don'ts

When filling out the Florida Last Will and Testament form, it is important to follow certain guidelines to ensure that your will is valid and accurately reflects your wishes. Here is a list of things you should and shouldn't do:

- Do clearly state your full name and address at the beginning of the document.

- Do specify that the document is your Last Will and Testament.

- Do name an executor who will manage your estate after your passing.

- Do sign the document in the presence of at least two witnesses.

- Don't use vague language when describing your assets or beneficiaries.

- Don't forget to date the document when you sign it.

By adhering to these guidelines, you can help ensure that your Last Will and Testament is properly executed and legally binding in Florida.

Florida Last Will and Testament - Usage Steps

After obtaining the Florida Last Will and Testament form, you will need to complete it carefully. This document is important for outlining your wishes regarding the distribution of your assets and appointing an executor. Follow these steps to fill out the form accurately.

- Begin by writing your full name at the top of the form.

- Provide your address, including city, state, and zip code.

- State your date of birth.

- Declare that you are of sound mind and not under duress.

- List your beneficiaries. Include their full names and relationships to you.

- Specify how you want your assets distributed among your beneficiaries.

- Choose an executor. Write their full name and contact information.

- Include alternate executors if desired.

- Sign and date the form in the presence of two witnesses.

- Have your witnesses sign and date the form as well.

Once you have completed the form, keep it in a safe place and inform your executor and family members of its location. This ensures that your wishes will be honored when the time comes.