Fillable Loan Agreement Template for Florida State

When entering into a loan agreement in Florida, understanding the essential components of the Florida Loan Agreement form is crucial for both lenders and borrowers. This document outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It also details the responsibilities of both parties, ensuring clarity on what is expected throughout the duration of the loan. Additionally, the form may include clauses regarding default, prepayment options, and remedies available to the lender in case of non-compliance. By clearly defining these aspects, the Florida Loan Agreement form serves to protect the interests of both parties while fostering transparency and trust in the lending process. Whether you are borrowing money for a personal project or lending to a friend, knowing how to navigate this form can significantly impact the success of your financial arrangement.

Similar forms

The Florida Loan Agreement form shares similarities with the Promissory Note. Both documents outline the terms under which a borrower agrees to repay borrowed funds. A Promissory Note serves as a written promise to pay a specific amount of money at a designated time, often including details such as interest rates and repayment schedules. Like the Loan Agreement, it establishes the legal obligations of the borrower but typically focuses more on the borrower's promise rather than the broader terms of the loan arrangement.

Another document that resembles the Florida Loan Agreement is the Mortgage Agreement. This document secures a loan with real property as collateral. While the Loan Agreement details the terms of the loan, the Mortgage Agreement specifically addresses the rights and responsibilities of both the lender and borrower concerning the property. In essence, the Mortgage Agreement functions as a security instrument, ensuring that the lender can reclaim the loan amount through the sale of the property if the borrower defaults.

The importance of understanding various agreements cannot be overstated for anyone involved in financial transactions. For example, a Hold Harmless Agreement form is essential in Utah, as it protects one party from liability during activities, effectively shifting the risk of legal claims. Those interested in templates for such agreements can find useful resources at smarttemplates.net, which offers fillable templates designed to meet specific legal needs.

The Security Agreement is also akin to the Florida Loan Agreement. This document is used when a borrower pledges personal property as collateral for a loan. It outlines the specific assets that secure the loan and the lender's rights in the event of default. Similar to the Loan Agreement, it establishes the terms of the borrowing relationship but focuses on the collateralized assets rather than the cash loan itself.

A Lease Agreement shares some characteristics with the Florida Loan Agreement, particularly in the context of financing arrangements. In a Lease Agreement, one party (the lessor) allows another party (the lessee) to use an asset in exchange for periodic payments. While the Loan Agreement involves a direct loan of money, a Lease Agreement entails the use of an asset, often with similar terms regarding payment schedules and obligations.

The Credit Agreement is another document that aligns with the Florida Loan Agreement. This document outlines the terms and conditions under which a lender extends credit to a borrower. It often includes stipulations regarding interest rates, repayment terms, and covenants that the borrower must adhere to. Like the Loan Agreement, it serves to formalize the lending relationship, ensuring that both parties understand their rights and responsibilities.

The Forbearance Agreement is similar in that it modifies the terms of an existing loan. When a borrower faces financial difficulties, a Forbearance Agreement allows them to temporarily postpone or reduce payments. This document outlines the new terms and conditions while maintaining the original Loan Agreement's framework. Both agreements aim to provide a solution that benefits both the borrower and the lender during challenging financial times.

Lastly, the Loan Modification Agreement is closely related to the Florida Loan Agreement. This document alters the original terms of an existing loan, such as interest rates or repayment schedules. It is often used when a borrower is unable to meet the original terms due to unforeseen circumstances. Like the Loan Agreement, it formalizes the new terms, ensuring that both parties are aware of and agree to the changes in their financial arrangement.

Other Common State-specific Loan Agreement Templates

Sample Promissory Note California - Defines the process for loan repayment, including maturity date and installments.

Texas Promissory Note Requirements - A written record strengthens the credibility of the loan claim.

In forming a Limited Liability Company (LLC) in Florida, it is essential to consider an Operating Agreement, which serves as a vital framework for delineating operational procedures and financial arrangements among members. While it's not a legal requirement in the state, having a well-structured agreement can facilitate smoother business operations and effective conflict resolution. For those interested in obtaining this important document, the form is available here.

Georgia Promissory Note Template - The duration of the loan or repayment period is clearly stated.

More About Florida Loan Agreement

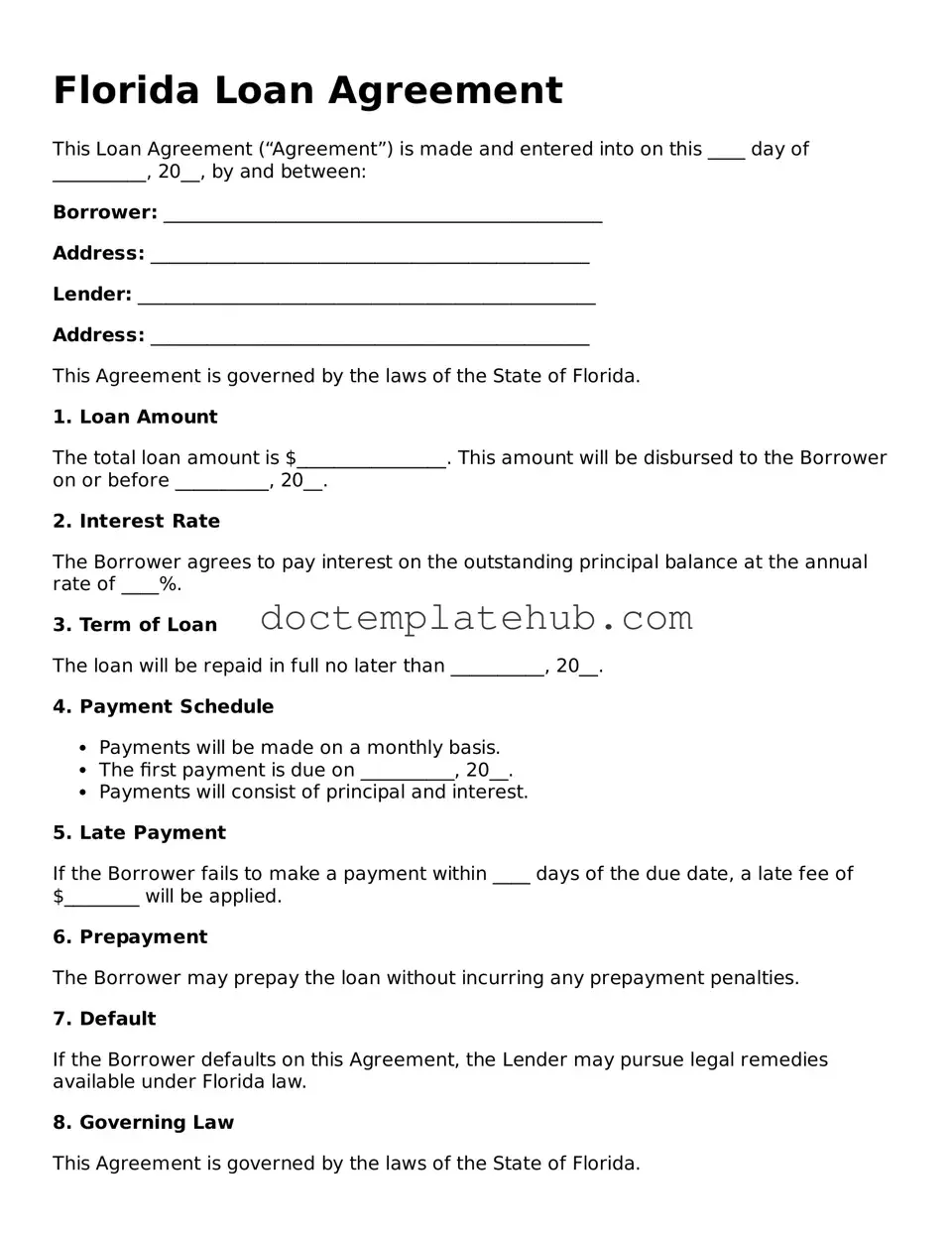

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. It specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This agreement serves to protect both parties and ensure clarity regarding the loan terms.

Who can use a Florida Loan Agreement form?

Any individual or entity that intends to lend or borrow money in Florida can use this form. This includes personal loans between friends or family, business loans, and loans from financial institutions. It is essential for both parties to understand the terms and conditions outlined in the agreement.

What information is required in the form?

The Florida Loan Agreement form typically requires the following information: names and addresses of both the lender and borrower, the loan amount, interest rate, repayment schedule, due dates, and any collateral securing the loan. Additionally, it may include provisions for late payments and default conditions.

Is a Florida Loan Agreement legally binding?

Yes, once signed by both parties, a Florida Loan Agreement is legally binding. This means that both the lender and borrower are obligated to adhere to the terms set forth in the document. Failure to comply may result in legal consequences, including potential lawsuits.

Do I need a lawyer to create a Florida Loan Agreement?

While it is not legally required to have a lawyer draft a Florida Loan Agreement, it is advisable to seek legal assistance, especially for larger loans or complex agreements. A lawyer can ensure that the agreement complies with Florida laws and adequately protects your interests.

Can the terms of a Florida Loan Agreement be modified?

Yes, the terms of a Florida Loan Agreement can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the revised agreement to avoid misunderstandings in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender may take legal action to recover the owed amount. This can include filing a lawsuit or, if collateral is involved, seizing the collateral as outlined in the agreement. The specific actions available to the lender will depend on the terms of the agreement and Florida law.

Are there any restrictions on interest rates in Florida?

Florida law does impose some restrictions on interest rates, particularly for consumer loans. The maximum allowable interest rate can vary based on the type of loan and the amount borrowed. It is essential to ensure that the interest rate specified in the agreement complies with state regulations to avoid legal issues.

Can a Florida Loan Agreement be used for business loans?

Yes, a Florida Loan Agreement can be used for business loans. The form can be customized to reflect the specific terms and conditions relevant to business transactions. It is crucial for both parties to clearly outline the purpose of the loan and any associated risks.

Where can I obtain a Florida Loan Agreement form?

A Florida Loan Agreement form can be obtained from various sources, including online legal document services, financial institutions, or legal professionals. It is important to ensure that the form is up-to-date and compliant with Florida laws before use.

Dos and Don'ts

When filling out the Florida Loan Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays or issues.

- Do double-check all figures and calculations for accuracy.

- Do sign and date the form in the appropriate sections.

- Don't leave any required fields blank; incomplete forms can be rejected.

- Don't use abbreviations or shorthand that may confuse the reader.

Florida Loan Agreement - Usage Steps

Completing the Florida Loan Agreement form is an important step in formalizing a loan between parties. Ensuring that every detail is accurately filled out will help protect the interests of both the lender and the borrower. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date on which the agreement is being made.

- Identify the parties involved. Clearly write the full legal names of both the lender and the borrower in the designated sections.

- Provide the addresses for both parties. This includes the street address, city, state, and zip code.

- Specify the loan amount. Write the total dollar amount being borrowed in both numerical and written form to avoid any confusion.

- Indicate the interest rate. Clearly state the percentage of interest that will be charged on the loan.

- Outline the repayment terms. This includes the payment schedule (monthly, bi-weekly, etc.), the due date for payments, and the total duration of the loan.

- Include any late fees or penalties. Specify the amount that will be charged if a payment is missed or late.

- Detail any collateral if applicable. If the loan is secured by collateral, describe the items and their value.

- Provide spaces for signatures. Both parties must sign and date the agreement to make it legally binding.

- Finally, ensure all sections are filled out completely and accurately before submitting the form. Review it one last time for any errors or omissions.