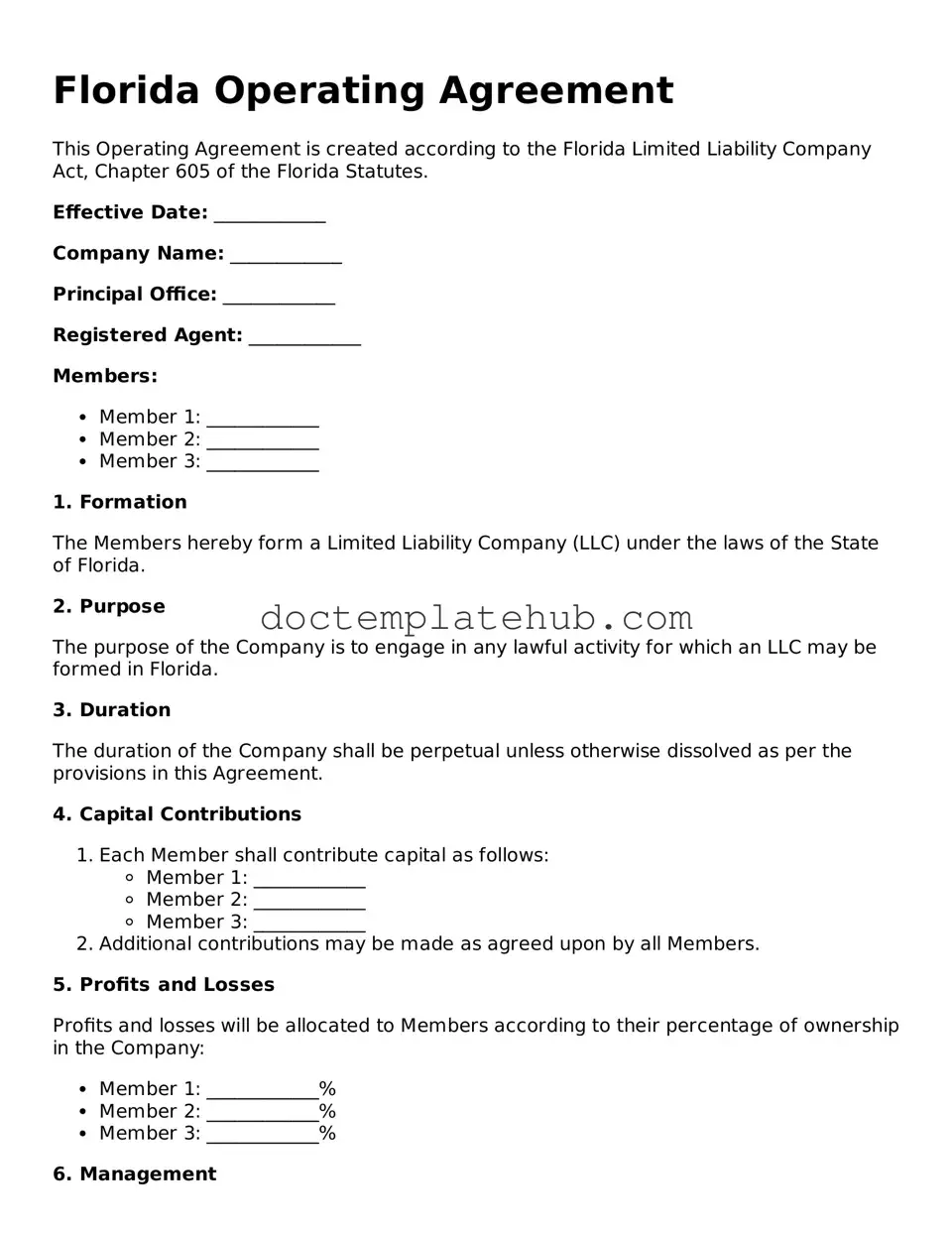

Fillable Operating Agreement Template for Florida State

The Florida Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating in the state. This agreement outlines the internal workings of the LLC, detailing the roles and responsibilities of members, management structures, and procedures for decision-making. It can also address the distribution of profits and losses among members, as well as the process for adding or removing members. By clarifying these key aspects, the Operating Agreement helps prevent misunderstandings and disputes among members. Additionally, while Florida law does not mandate an Operating Agreement for LLCs, having one in place can provide significant legal protections and establish a clear framework for operations. This document can be tailored to meet the specific needs of the business, allowing for flexibility in governance and management. Understanding the importance of this form is essential for anyone looking to start or manage an LLC in Florida.

Similar forms

The Florida Operating Agreement is akin to the Partnership Agreement, which outlines the terms and conditions under which two or more individuals operate a business together. Like the Operating Agreement, the Partnership Agreement specifies each partner's roles, responsibilities, and profit-sharing arrangements. Both documents aim to prevent misunderstandings by clearly defining the operational framework and expectations among partners, ensuring a smoother collaboration and reducing potential conflicts.

Another similar document is the Limited Liability Company (LLC) Agreement. This document serves a similar purpose as the Operating Agreement but is specifically tailored for LLCs. It details the ownership structure, management responsibilities, and distribution of profits among members. Both agreements provide essential guidelines that help maintain order within the business structure, protecting the interests of all parties involved.

The Corporate Bylaws are also comparable to the Florida Operating Agreement. While the Operating Agreement governs LLCs, Corporate Bylaws apply to corporations. They outline the rules for managing the corporation, including the roles of officers and directors, voting procedures, and meeting protocols. Both documents serve to establish a clear governance framework, ensuring that all members understand their rights and obligations.

The Shareholders' Agreement shares similarities with the Operating Agreement as well. This document is used in corporations to regulate the relationship between shareholders. It often includes provisions about the transfer of shares, voting rights, and how disputes will be resolved. Like the Operating Agreement, it aims to protect the interests of the parties involved and provide clarity on how the business will be run.

The Joint Venture Agreement also resembles the Florida Operating Agreement. This document outlines the terms of a temporary partnership between two or more parties for a specific project or business endeavor. It details contributions, profit-sharing, and responsibilities, much like the Operating Agreement does for LLC members. Both agreements help establish a clear understanding of each party's role and expectations, minimizing the potential for disputes.

The Non-Disclosure Agreement (NDA) can be seen as related, albeit in a different context. While the Operating Agreement focuses on operational and management issues, an NDA protects sensitive information shared between parties. Both documents create a framework for trust and confidentiality, allowing parties to engage in business without fear of exposing proprietary information.

For those navigating the process of buying or selling a mobile home, understanding the significance of a well-drafted document is vital. You can find a useful resource for this purpose by exploring the "guidelines for preparing a Mobile Home Bill of Sale" that ensure both parties are protected throughout the transaction. Visit guidelines for preparing a Mobile Home Bill of Sale for more information.

The Employment Agreement is another document that shares some similarities with the Operating Agreement. This contract outlines the terms of employment for individuals working within a business, detailing responsibilities, compensation, and termination conditions. Both documents establish clear expectations and obligations, ensuring that all parties understand their roles within the business structure.

The Franchise Agreement is comparable as well, particularly in how it governs the relationship between a franchisor and franchisee. This document includes terms related to branding, operational procedures, and fees. Like the Operating Agreement, it aims to create a structured relationship that benefits both parties, ensuring compliance with established guidelines and minimizing potential conflicts.

Lastly, the Memorandum of Understanding (MOU) shares some similarities with the Florida Operating Agreement. An MOU outlines an agreement between parties before a formal contract is established. While it may not be legally binding, it clarifies intentions and expectations. Both documents serve to foster understanding and cooperation among parties, paving the way for a successful partnership.

Other Common State-specific Operating Agreement Templates

Operating Agreement Llc Arizona Template - This document details the roles and responsibilities of members in an LLC.

Does California Require an Operating Agreement for an Llc - It may outline dispute resolution procedures to resolve conflicts efficiently.

To create a comprehensive legal safeguard, utilizing a Hold Harmless Agreement is essential, as it clearly delineates the responsibilities and liabilities of the parties involved. In Utah, this form not only protects against unforeseen claims but also establishes a mutual understanding of risk management, which can be particularly crucial in high-stakes situations such as construction projects and public events. For more resources on how to properly draft and fill out these agreements, visit smarttemplates.net.

What Does an Operating Agreement Look Like for an Llc - It may define the term of the LLC’s existence, indicating whether it is perpetual.

State Filing Fee for Llc in Texas - The agreement can specify any restrictions on members’ actions.

More About Florida Operating Agreement

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. It serves as an internal guideline for the LLC, detailing how the business will be run, the roles of members, and how profits and losses will be distributed. While not required by law, having an Operating Agreement is highly recommended to prevent disputes among members and to clarify expectations.

Is an Operating Agreement required in Florida?

No, Florida does not legally require LLCs to have an Operating Agreement. However, it is beneficial to create one. An Operating Agreement can help protect your personal assets, provide clarity on business operations, and establish rules that govern the relationship between members. Without it, your LLC will be subject to default state laws, which may not align with your business goals.

Who should draft the Operating Agreement?

What should be included in the Operating Agreement?

An Operating Agreement should cover several key areas, including the business name, purpose, and principal office address. It should outline the management structure, detailing whether the LLC is member-managed or manager-managed. Additionally, it should specify how profits and losses will be allocated, the process for adding new members, and procedures for handling disputes. Including provisions for dissolution of the LLC is also important.

Can the Operating Agreement be changed after it is created?

Yes, the Operating Agreement can be amended. Changes may be necessary as the business evolves or as members' circumstances change. To make amendments, the process should be outlined in the original Operating Agreement. Typically, this involves obtaining the consent of all members or a specified percentage of members, depending on what was agreed upon initially.

How does an Operating Agreement affect personal liability?

Having an Operating Agreement can help reinforce the limited liability status of the LLC. This means that members' personal assets are generally protected from the debts and liabilities of the business. If an Operating Agreement is not in place, or if it is poorly drafted, there is a risk that a court could disregard the LLC's limited liability protection, potentially exposing members to personal liability.

Where can I find a template for a Florida Operating Agreement?

Templates for Florida Operating Agreements can be found online through various legal websites and resources. Many state-specific legal aid organizations also provide sample agreements. However, while templates can serve as a helpful starting point, it is important to customize the document to fit your specific business needs. Consulting with a legal professional can ensure that all necessary provisions are included and that the agreement complies with Florida law.

Dos and Don'ts

When filling out the Florida Operating Agreement form, it's important to approach the task with care and attention to detail. Here are some essential dos and don'ts to keep in mind:

- Do ensure all member names and addresses are accurately listed.

- Do clearly outline the roles and responsibilities of each member.

- Do include provisions for profit and loss distribution.

- Do review the document thoroughly before signing.

- Don't leave any sections blank; incomplete forms can lead to complications.

- Don't use vague language; be specific to avoid misunderstandings.

- Don't forget to include the effective date of the agreement.

- Don't rush through the process; take your time to ensure accuracy.

Florida Operating Agreement - Usage Steps

Filling out the Florida Operating Agreement form is a straightforward process that helps establish the structure and rules for your business. Once you have completed the form, you can proceed with other important steps in setting up your business.

- Begin by downloading the Florida Operating Agreement form from a reliable source.

- Read through the entire form carefully to understand what information is required.

- Fill in the name of your Limited Liability Company (LLC) at the top of the form.

- Provide the principal address of the LLC. This is where official documents will be sent.

- List the names and addresses of all members involved in the LLC.

- Indicate the percentage of ownership for each member. This shows how profits and losses will be shared.

- Detail the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Outline the voting rights of each member. This determines how decisions will be made within the LLC.

- Include any additional provisions that are relevant to your LLC, such as rules for adding new members or handling disputes.

- Review the completed form for accuracy. Ensure that all information is correct and complete.

- Sign and date the form. All members should sign to indicate their agreement.

- Make copies of the signed agreement for your records and for each member involved.