Fillable Power of Attorney Template for Florida State

In Florida, a Power of Attorney (POA) form serves as a vital legal document that grants someone the authority to make decisions on your behalf, particularly when you are unable to do so. This form can cover a wide range of powers, from managing financial matters to making healthcare decisions. It is essential to understand that there are different types of POAs, including durable, medical, and limited, each designed for specific situations and needs. A durable Power of Attorney remains effective even if you become incapacitated, while a medical Power of Attorney specifically focuses on healthcare decisions. The person you designate as your agent must act in your best interests, and you can specify the extent of their authority. Properly completing and executing the form is crucial to ensure it is legally binding. Additionally, understanding the implications of this document can help you avoid potential conflicts and ensure your wishes are honored when it matters most.

Similar forms

The Florida Power of Attorney form is similar to a Living Will, which allows individuals to express their wishes regarding medical treatment in case they become incapacitated. Both documents ensure that a person's preferences are honored when they cannot communicate them directly. While a Power of Attorney designates someone to make decisions on behalf of the individual, a Living Will specifically outlines the types of medical interventions the individual does or does not want, focusing primarily on end-of-life care.

A Health Care Proxy is another document akin to the Power of Attorney. It appoints someone to make healthcare decisions on behalf of the individual when they are unable to do so. Like the Power of Attorney, it empowers a trusted person to act in the best interest of the individual. However, the Health Care Proxy is specifically limited to medical decisions, whereas the Power of Attorney can cover a broader range of financial and legal matters.

Other Common State-specific Power of Attorney Templates

How to Set Up a Power of Attorney - Facilitates communication with financial institutions on the principal's behalf.

Georgia Power of Attorney Form 2023 - Healthcare decisions can be made by your agent during incapacity.

Az Form 285 - Provides peace of mind that someone trusted can act in your best interests.

Power of Attorney Form Ohio Free - Family dynamics can play a significant role in selecting a suitable agent.

More About Florida Power of Attorney

What is a Power of Attorney in Florida?

A Power of Attorney (POA) in Florida is a legal document that allows one person to act on behalf of another person. This arrangement can be useful for managing financial matters, making healthcare decisions, or handling other legal affairs when the principal is unable to do so themselves.

Who can create a Power of Attorney in Florida?

Any adult who is mentally competent can create a Power of Attorney in Florida. The person creating the document is referred to as the "principal," and they can designate someone they trust, known as the "agent" or "attorney-in-fact," to act on their behalf.

What types of Power of Attorney are available in Florida?

Florida recognizes several types of Power of Attorney. The most common are the durable Power of Attorney, which remains effective even if the principal becomes incapacitated, and the healthcare Power of Attorney, which specifically allows the agent to make medical decisions for the principal. There are also limited and general Powers of Attorney that specify the scope of authority granted.

How do I create a Power of Attorney in Florida?

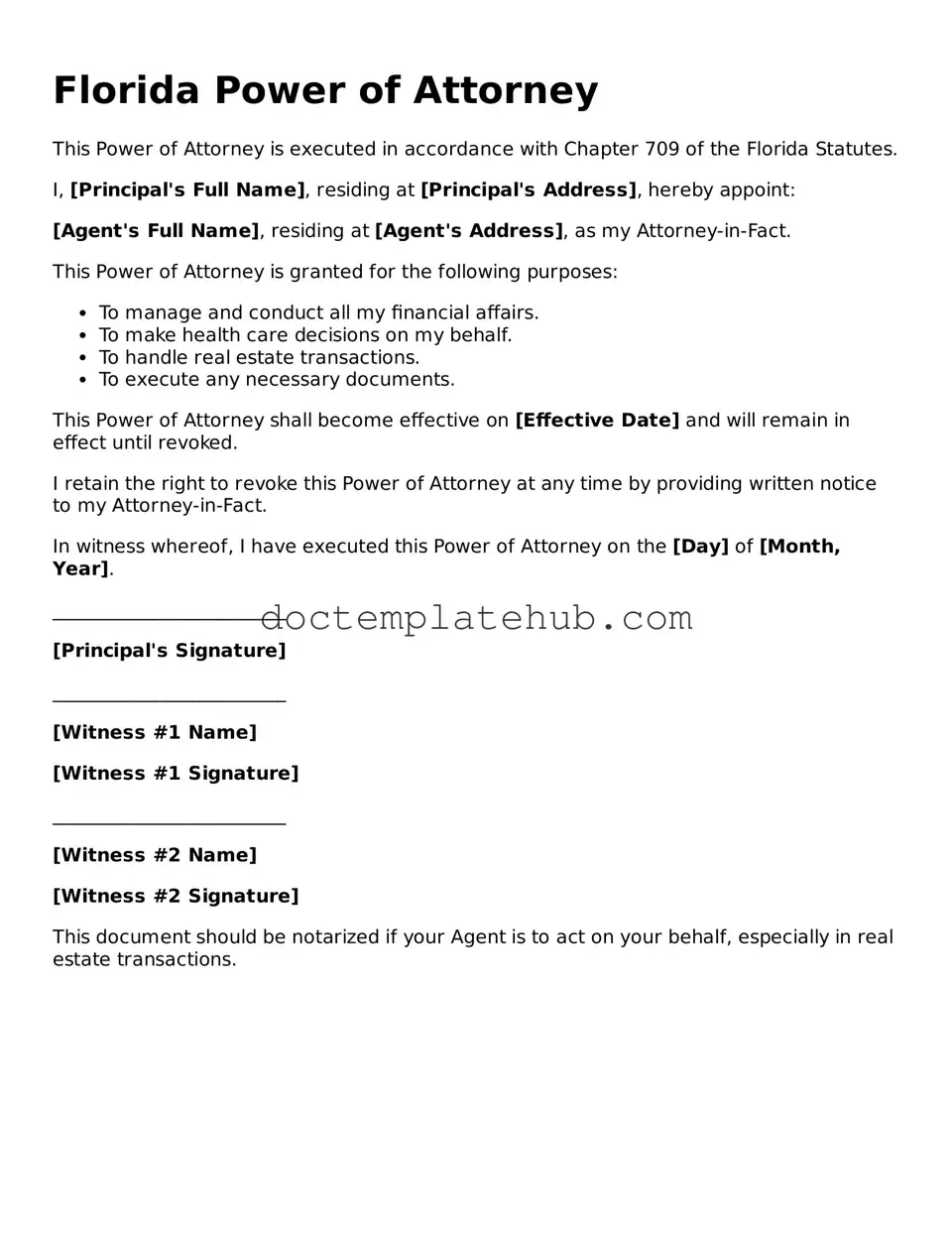

To create a Power of Attorney in Florida, you must complete a written document that clearly states your intentions. It should identify the principal and the agent, outline the powers granted, and be signed by the principal in the presence of a notary public and two witnesses. This ensures the document is legally valid and recognized by institutions.

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney in Florida at any time as long as you are mentally competent. To do so, you should create a written revocation document, notify your agent, and, if possible, inform any institutions or individuals who may have relied on the original Power of Attorney.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a durable Power of Attorney remains in effect, allowing the agent to continue making decisions. If the Power of Attorney is not durable, it will terminate upon the principal's incapacity. Therefore, it is essential to specify that the document is durable if you want it to remain valid under such circumstances.

Are there any limitations to the powers granted in a Power of Attorney?

Yes, the powers granted can be limited based on the principal's wishes. The principal can specify which actions the agent can take, such as managing bank accounts or making healthcare decisions. It’s crucial to outline these limitations clearly in the document to avoid any confusion.

Do I need an attorney to create a Power of Attorney in Florida?

While it is not legally required to have an attorney to create a Power of Attorney in Florida, consulting with one can be beneficial. An attorney can help ensure that the document complies with state laws and accurately reflects your wishes, reducing the risk of future disputes.

Can a Power of Attorney be used for business matters?

Yes, a Power of Attorney can be used for business matters in Florida. The principal can grant the agent authority to handle business transactions, sign contracts, and manage financial affairs. This can be particularly helpful for business owners who need someone to act on their behalf when they are unavailable.

Dos and Don'ts

When filling out a Power of Attorney form in Florida, it's essential to approach the task with care. Here are some important dos and don'ts to consider:

- Do ensure that you understand the powers you are granting. Familiarize yourself with the specific authority you are giving to your agent.

- Do choose a trustworthy agent. This person will be making significant decisions on your behalf, so select someone you can rely on.

- Do clearly specify the duration of the Power of Attorney. Indicate whether it is effective immediately, upon a certain event, or for a specific period.

- Do consult with a legal professional if you have any doubts. Getting expert advice can help you avoid potential pitfalls.

- Don't leave blank spaces on the form. Every section should be completed to prevent misunderstandings or misuse.

- Don't choose an agent who may have conflicting interests. This can lead to complications and may not serve your best interests.

- Don't neglect to sign the document in the presence of a notary. A notarized signature is often required for the form to be valid.

- Don't forget to provide copies to your agent and any relevant institutions. This ensures that your wishes are known and can be acted upon when necessary.

Florida Power of Attorney - Usage Steps

After obtaining the Florida Power of Attorney form, it is important to fill it out accurately to ensure it meets legal requirements. The following steps outline how to complete the form properly.

- Obtain the Form: Download the Florida Power of Attorney form from a reliable source or acquire a physical copy from a legal office.

- Read Instructions: Review any accompanying instructions to understand the requirements and sections of the form.

- Identify the Principal: Fill in the name and address of the person granting the power of attorney (the principal).

- Designate the Agent: Enter the name and address of the individual who will act on behalf of the principal (the agent).

- Specify Powers: Clearly outline the powers being granted to the agent. This may include financial, legal, or medical decisions.

- Set Effective Date: Indicate when the power of attorney will become effective. This can be immediate or upon a specific event.

- Include Additional Provisions: If desired, add any special instructions or limitations regarding the agent's authority.

- Sign the Form: The principal must sign the form in the presence of a notary public. This step is crucial for validation.

- Notarization: The notary public will complete their section, confirming the identity of the principal and witnessing the signature.

- Distribute Copies: Provide copies of the completed and notarized form to the agent, any relevant institutions, and keep one for personal records.